Get the free 5 great credit application email templates to copy & paste

Get, Create, Make and Sign 5 great credit application

Editing 5 great credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 5 great credit application

How to fill out 5 great credit application

Who needs 5 great credit application?

5 Great Credit Application Forms

Understanding credit application forms

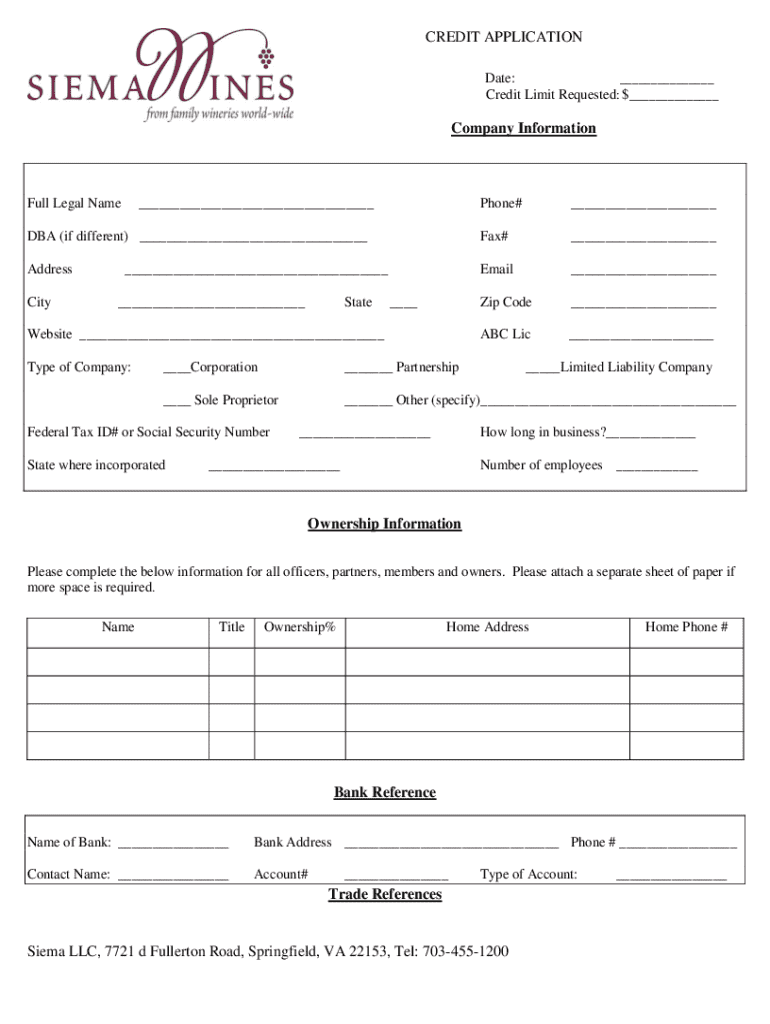

A credit application form serves as a formal document through which individuals or businesses request credit or a loan from lenders. This document is pivotal in the credit assessment process, enabling lenders to evaluate the creditworthiness of applicants by collecting essential information regarding their financial history and current financial standing.

Understanding the different types of credit applications is important, as it allows you to choose the appropriate form tailored to your needs. Personal credit applications are geared towards individuals seeking loans for personal expenses, while business credit applications cater to companies looking for funding to expand or manage operational costs. Selecting the right form ensures that all pertinent information is included, allowing for a more efficient review process.

Essential components of an effective credit application form

Effective credit application forms require specific key information, such as personal identifiers, income details, outstanding debts, and purpose of the loan. For businesses, additional factors like business structure, revenue streams, and existing debts must be disclosed. Financial institutions need these details to gauge risk and determine eligibility.

Legal considerations are crucial when creating or filling out a credit application. Compliance with the Equal Credit Opportunity Act (ECOA) ensures that all applicants are treated fairly, and lenders cannot discriminate based on race, color, religion, or national origin. Additionally, applicants must be mindful of privacy concerns, ensuring their data is protected according to relevant laws.

The five great credit application forms

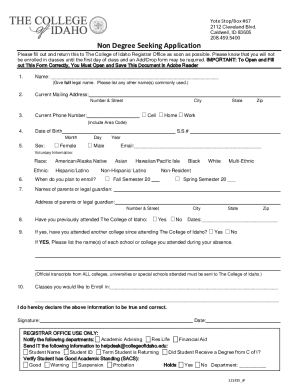

1. **Standard personal credit application** - This universally used form captures critical personal financial details necessary for assessing eligibility for loans or credit cards. It typically includes information about income, existing debt, and personal liabilities. Users can easily download this form from platforms like pdfFiller, which also offers interactive features for completing the form online.

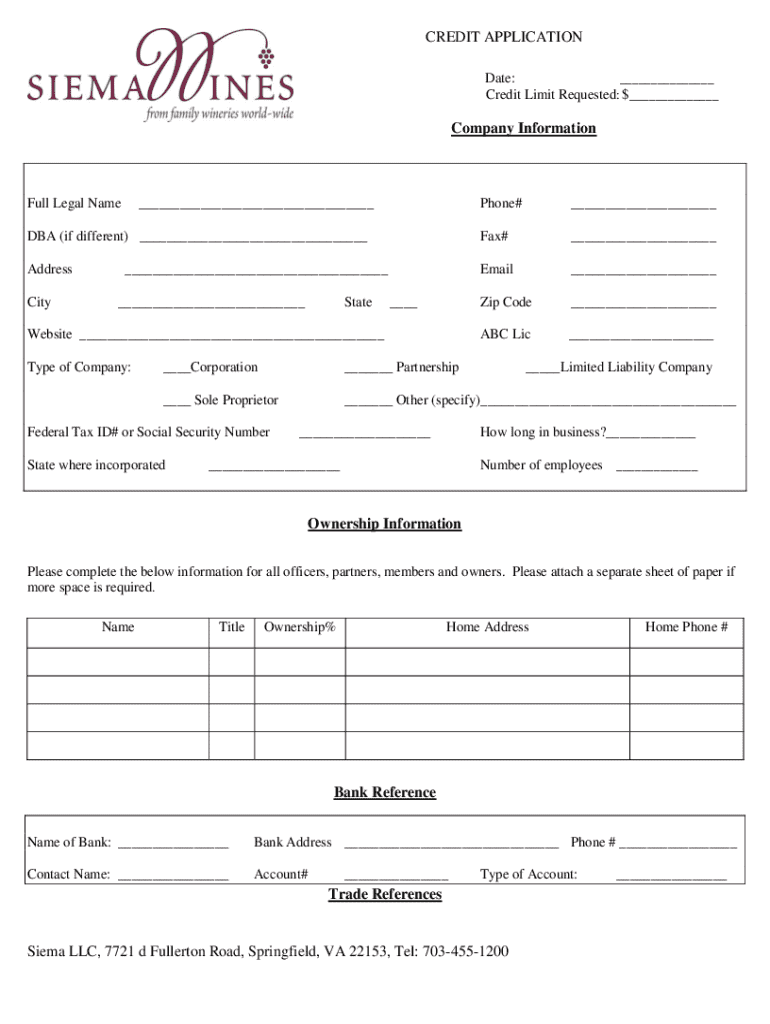

2. **Business credit application** - Tailored for business owners, this application form differs significantly from personal applications by incorporating elements relevant to businesses, such as business structure, tax ID, and financial statements. Customization options on pdfFiller allow users to adapt the form to reflect their unique business information.

3. **Joint credit application** - In situations where multiple parties seek credit together, such as spouses or business partners, a joint credit application can be advantageous. This form necessitates comprehensive financial data from all parties, ensuring lenders can assess combined creditworthiness effectively, promoting transparency in shared responsibilities.

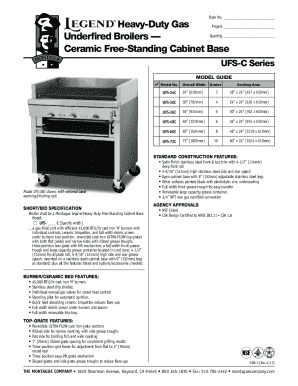

4. **Retail credit application** - Designed specifically for retail services, this form gathers basic personal details to facilitate the immediate approval process for in-store purchases. Key features often simplify customer experience, ensuring that personal information is captured swiftly and securely.

5. **Multi-purpose credit application** - Versatile and useful in various contexts, this form can be employed across different types of loans or credit opportunities, providing a standardized approach. It is particularly beneficial for institutions that offer multiple credit products, easing the application process for customers by consolidating their requests.

How to fill out your credit application form effectively

Completing a credit application form may seem daunting, but following a step-by-step guide can simplify the process significantly. Begin by gathering your financial documents, including proof of income, identification, and any previous credit reports. Next, start filling the form meticulously, ensuring that each section is completed with accurate and updated information.

When filling out the form, common mistakes to avoid include providing incomplete information or neglecting to sign where required. Additionally, ensure that you attach all necessary documentation as specified; missing elements can delay the approval process or result in outright rejection of your application.

Editing and customizing your credit application forms

Utilizing pdfFiller's features for document management allows you to edit and customize your credit application forms seamlessly. You can modify text, add annotations, and even create branded versions for your business. Customizing forms ensures that they reflect your organization’s identity while preserving essential legal and financial components.

Additionally, pdfFiller’s cloud storage capabilities mean you can access your forms from any device at any time. Version control features will help you maintain document history, enabling you to track changes and revert to earlier drafts if necessary. This flexibility is beneficial, especially when collaborating with teams.

eSigning credit application forms

The importance of electronic signatures cannot be understated in the credit industry. eSignatures are legally valid and streamline the signing process, making it easier for applicants to complete their forms. By leveraging pdfFiller’s eSigning capabilities, users can sign documents directly online without the need for physical paperwork, thus enhancing efficiency.

For teams, collaboration features allow multiple signatories to engage with a single document effortlessly. This functionality can effectively manage the signing process, ensuring that all necessary parties can review and approve the application in a timely manner.

Managing your credit applications post-submission

After submitting your credit application, monitoring its status is crucial to understanding the next steps. pdfFiller provides tools that help applicants track their submitted forms, minimizing the uncertainty that often accompanies waiting for credit decisions.

Once a decision is rendered, knowing how to respond is equally vital. Having templates ready for follow-up communication can streamline this process. Whether your application is approved or denied, being able to understand your rights and the subsequent steps allows you to be proactive in managing your financial future.

Additional tips for a successful credit application experience

To increase your chances of a successful credit application experience, it's essential to prepare adequately. Understanding what lenders look for, such as credit history, income stability, and overall financial health, can significantly strengthen your application. Ensure that you present accurate, complete, and honest information throughout the process.

Additionally, leveraging technology can facilitate quicker access to your forms and financial information. With pdfFiller's mobile capabilities, you can retrieve your forms quickly whenever needed, allowing you to remain responsive to lenders and their requests.

Conclusion: Transforming your credit application process

Utilizing pdfFiller's suite of tools can revolutionize your experience with credit application forms. The platform's ability to streamline document creation, editing, eSigning, and storage empowers individuals and teams to manage their credit queries efficiently.

Embracing technology not only makes the application process smoother but also demystifies lending procedures, helping applicants navigate the complexities of credit with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 5 great credit application directly from Gmail?

Can I create an electronic signature for signing my 5 great credit application in Gmail?

How do I fill out 5 great credit application using my mobile device?

What is 5 great credit application?

Who is required to file 5 great credit application?

How to fill out 5 great credit application?

What is the purpose of 5 great credit application?

What information must be reported on 5 great credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.