Get the free persons under 18 to make a Will)

Get, Create, Make and Sign persons under 18 to

Editing persons under 18 to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out persons under 18 to

How to fill out persons under 18 to

Who needs persons under 18 to?

Persons Under 18 to Form: A Comprehensive Guide to Creating Legal Entities as a Minor

Understanding the context of forming a legal entity under 18

Navigating the world of business or legal matters as a minor can seem daunting, yet it can open doors to opportunities that cultivate skills and independence. Understanding the legal backdrop is crucial for anyone under 18 who aims to engage in forming a legal entity, which can range from starting a business to establishing a trust. The need for legal structures varies; it could stem from entrepreneurship aspirations or safeguarding assets through legal frameworks.

The types of entities that minors can form, however, can be quite limited. Here’s a brief overview of common legal structures available: solo proprietorships, partnerships, and non-profit organizations—each with unique legal mandates and developmental opportunities.

In essence, grasping the importance of legal awareness equips young individuals with the knowledge to step forward confidently in their pursuits.

Steps to forming an entity as a minor

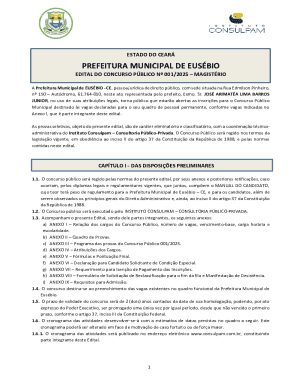

The journey of forming a legal entity begins with a clear understanding of one’s eligibility and the best type of formation based on personal aspirations. Different states and countries have various minimum age requirements for forming legal entities; therefore, it’s critical to research local laws. Some jurisdictions allow minors as young as 16 or 17 to form certain types of businesses, while others may impose stricter age requirements. Evaluating the type of entity one wishes to form based on personal goals—whether it's a small business, a partnership, or a non-profit organization—is the next step.

Involving guardians or legal representatives becomes vital as minors embark on this process. Parents and guardians play a significant role in not only offering wisdom and support but ensuring that all legal and logistical requirements are met. Their involvement is generally crucial, especially when signing contracts, registering businesses, or navigating legal hurdles.

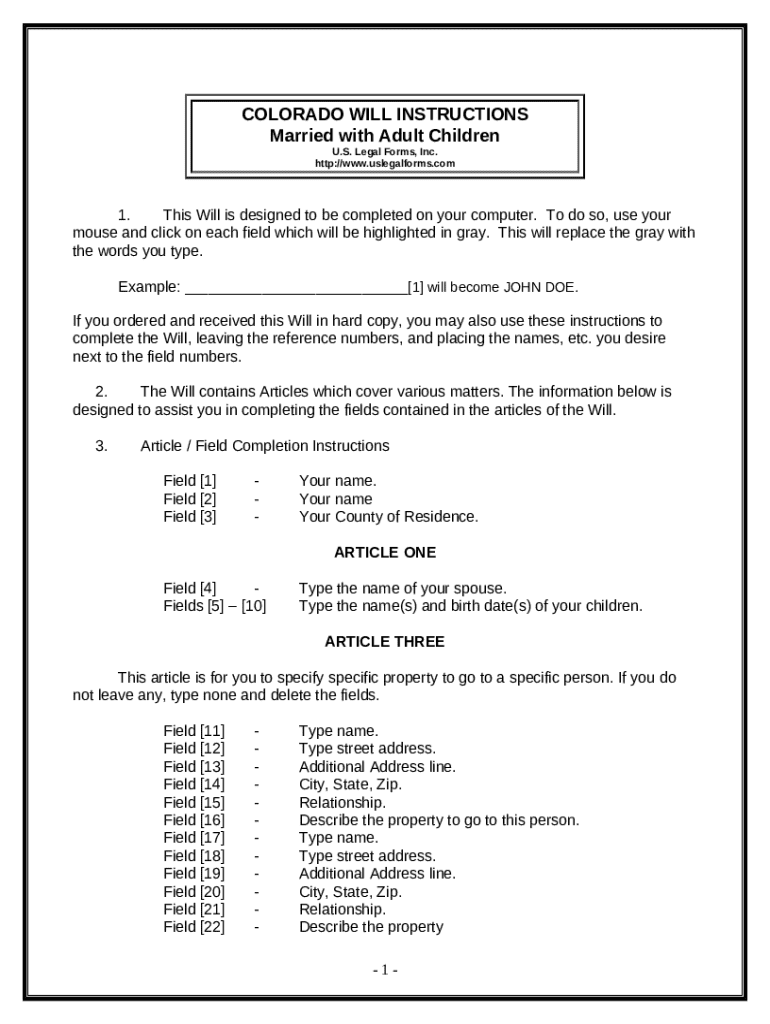

Documentation required for formation

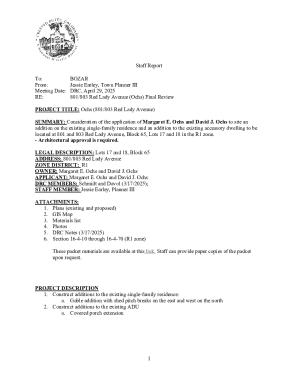

One of the first steps in forming a legal entity involves gathering the necessary documentation. Identification is typically the cornerstone of the process. Minors usually need to present identification documents such as their birth certificate or a state-issued ID to validate their identities. Many states also require proof of residence, which may involve providing a utility bill or lease agreement confirming where the minor resides.

Moreover, depending on the type of entity being formed, additional forms may be required. For instance, business licenses need to be secured in some jurisdictions, while non-profit organizations may necessitate specific registration forms that comply with local regulations.

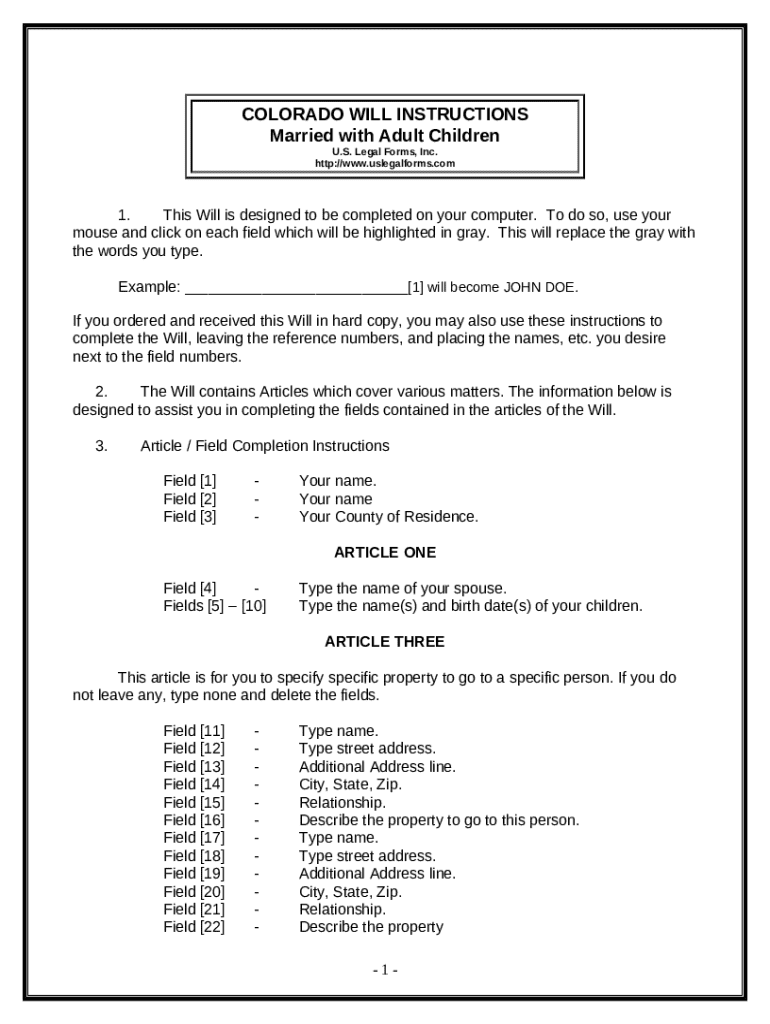

Detailed instructions for filling out common forms

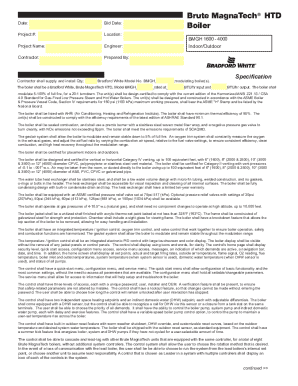

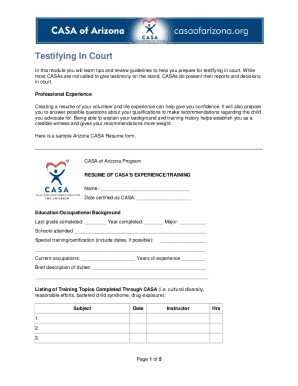

When it comes to filling out forms, clarity and accuracy are paramount. For business formation, a basic business registration template will usually include sections for the entity name, business address, and the applicant’s details. For non-profit incorporation, one can find templates provided by state agencies that detail the mission statement, beneficiaries, and structure.

Once the appropriate documents are available, completing them entails a systematic approach: reading the instructions carefully, filling in all designated areas, and double-checking for accuracy. Minors must be mindful to approach the forms with the understanding of any restrictions that apply due to their age, ensuring to involve a guardian where needed.

Managing and maintaining formed entities

After successfully forming a legal entity, maintaining compliance is essential. Most entities encounter annual compliance requirements, which can include submitting specific documents or fees to the relevant authorities to keep the entity in good standing. Minors need to be aware of ongoing responsibilities such as filing annual reports, renewing licenses, or adhering to any regulatory requirements that allow their business or non-profit to operate smoothly.

In addition to compliance, understanding basic financial management is crucial for minors running a business. Tips for effective financial management include opening a designated bank account to separate personal and business finances, keeping detailed financial records, and budgeting effectively. Best practices dictate that minors seek formal guidance when managing business finances, as this can set a solid foundation for future financial responsibility.

Challenges and considerations for minors

Minors aspiring to form a legal entity often face a range of challenges. Among these, navigating legal hurdles stands out, particularly when it comes to entering contracts or obtaining necessary permits. Many companies require co-signers or guardians to validate business agreements or loans, directly impacting the autonomy of the minor. Understanding these limitations can help prepare aspiring young entrepreneurs for the challenges they may face.

To overcome these challenges, education and support networks play a vital role. Engaging in mentorship opportunities can provide minors with the tools they need to navigate the complexities involved in forming and maintaining a business. Additionally, various organizations and online platforms are dedicated to supporting young entrepreneurs through workshops and resources that focus on developing legal literacy and business acumen.

Alternative paths to consider

For some minors, partnering with adults may be a more strategic approach than forming a business entity independently. Such partnerships can be structured in various ways, typically involving a legal agreement delineating responsibilities and profit-sharing. Adults may provide essential guidance and resources, enhancing the minor's practical experience while serving to mitigate legal and financial risks.

Another option is utilizing a proxy or legal representation for specific activities. This may involve hiring an attorney or legal expert to manage paperwork or negotiations on behalf of the minor. While this can streamline certain processes, it’s crucial to weigh the pros and cons. Engaging proxy representation usually incurs costs and may limit the minor's direct involvement and learning opportunities.

Resources for minors to explore further

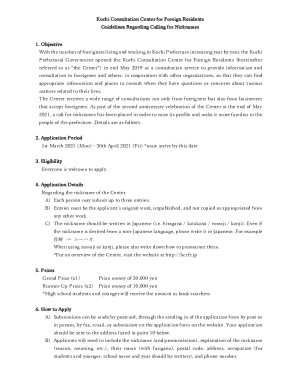

For minors looking to explore their options further, countless resources are available. Government websites often provide valuable information regarding the legal requirements for forming a business, such as the necessary documentation and processes. Understanding welfare arrangements can also help protect minors and their legal standings while pursuing entrepreneurial interests, particularly when it intersects with visa conditions for education under programs like the Subclass 590 in Australia.

Investigating online courses or workshops can deepen knowledge and provide practical skills critical for engaging in the business landscape.

Conclusion: empowering young aspirants

Many inspiring stories showcase young entrepreneurs who successfully managed to form their legal entities, navigate challenges, and create opportunities. Their journeys remind us of the importance of persistence, adaptability, and the seeking of assistance when needed. For minors, the path to becoming a successful entrepreneur hinges not only on the foundational knowledge of how to form an entity but also the support systems available to them.

Utilizing platforms like pdfFiller can significantly streamline the process of managing documents related to forming a legal entity. With its features allowing for seamless editing, eSigning, and collaboration, pdfFiller empowers users with the tools necessary to focus on their goals rather than become bogged down in paperwork. For any young person looking to take their first entrepreneurial steps, leveraging such resources makes the journey ahead much more manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the persons under 18 to electronically in Chrome?

Can I edit persons under 18 to on an iOS device?

Can I edit persons under 18 to on an Android device?

What is persons under 18 to?

Who is required to file persons under 18 to?

How to fill out persons under 18 to?

What is the purpose of persons under 18 to?

What information must be reported on persons under 18 to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.