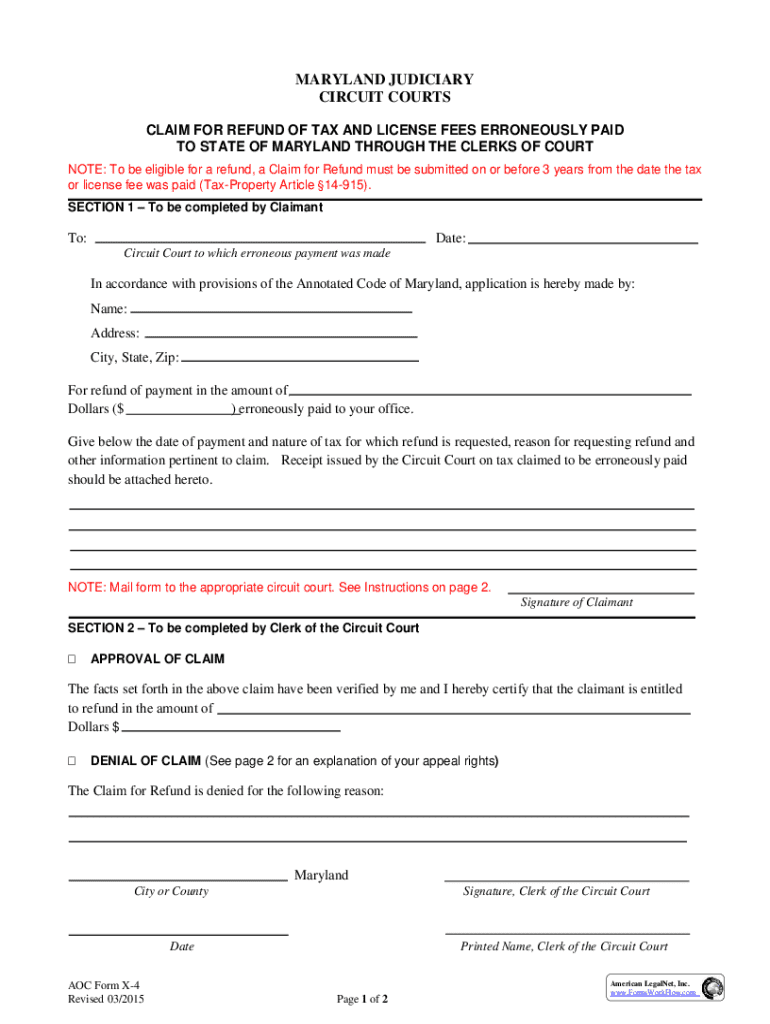

Get the free Claim for Refund of Tax and License Fees Erroneously ...

Get, Create, Make and Sign claim for refund of

Editing claim for refund of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claim for refund of

How to fill out claim for refund of

Who needs claim for refund of?

Claim for Refund of Form: A Comprehensive Guide

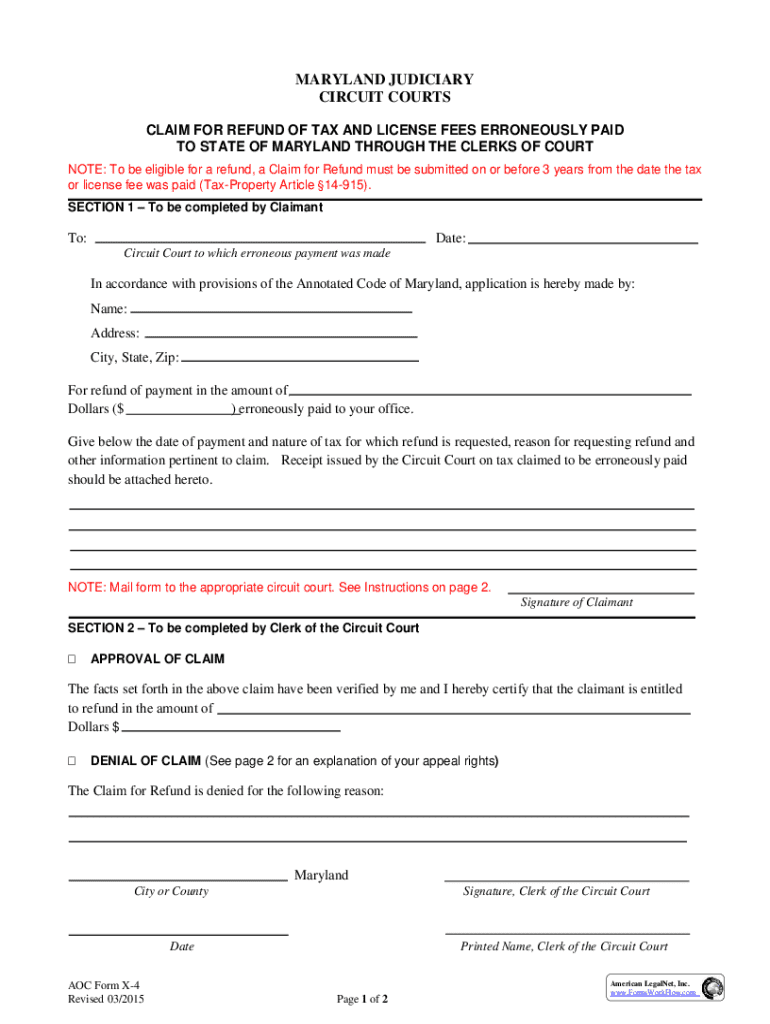

Understanding refund claims

A refund claim is a formal request made by individuals or entities to recover amounts previously paid for goods, services, or taxes. Its purpose is to ensure that customers receive their rightful refunds when they face issues such as product returns, service dissatisfaction, or overpayment of taxes. Common scenarios for filing a refund claim include requesting a refund for an incorrect tax payment, a canceled flight, or returning a product that did not meet expectations.

In many cases, the claims process is necessitated by errors or unsatisfactory experiences. For taxpayers, refund claims often relate to discrepancies in reported income or deductions on tax returns that resulted in overpayment. Understanding the nuances of these claims is essential, as it allows individuals to navigate the refund process efficiently.

Types of refund forms

Refund forms can be categorized into domestic and international types, which address different jurisdictions and regulations. Domestic refund forms pertain to requests made within a country, such as state tax refunds, while international forms may include customs duty refunds for imported goods or services. Specific forms are designated for various refund claims, so it’s vital to select the correct one based on the circumstances.

Key differences in requirements often stem from eligibility criteria. For example, tax refund claims may require documentation proving overpayment, whereas product refunds may necessitate proof of purchase and possibly, reasons for dissatisfaction. Understanding these requirements upfront can expedite the refund process, helping you avoid unnecessary delays.

Step-by-step guide to claiming a refund

The process of claiming a refund can seem daunting, but breaking it down into manageable steps simplifies it significantly. Step one involves identifying the correct form needed for your specific claim. Websites like pdfFiller offer a variety of forms that can be customized to suit your needs, ensuring you select the right document.

Step two is all about filling out the refund form accurately. Focus on critical sections such as personal information and reasons for the refund. It’s crucial to provide thorough explanations to avoid claims being denied due to lack of information. Remember to double-check for accuracy; even small errors can lead to processing delays.

Step three involves submitting your refund claim. You can typically submit forms online, via mail, or in-person at customer service offices. If you're submitting your claim online through a platform like pdfFiller, follow the straightforward submission guidelines provided. When mailing, ensure you send it to the correct address and consider using certified mail for tracking purposes.

Tracking your refund claim

Monitoring the status of your refund claim is essential after submission. Many online platforms, such as pdfFiller, provide tracking tools that allow you to check the progress of your claim conveniently from any device. Regularly checking your claim's status can give you peace of mind and help you manage expectations.

In the event of delays, it’s advisable to reach out to the relevant customer service office for assistance. Having your claim reference number handy can expedite the inquiry process and lead to quicker resolutions of any issues that may have arisen.

Frequently asked questions (FAQs)

Refund claims often come with a set of common queries. For instance, how long does a refund take to process? The answer can vary significantly based on the type of refund and the issuing entity. Tax refunds may take weeks, while product refunds are often quicker, depending on the retailer’s policies.

What should you do if your claim is denied? First, review the reasons for the denial and ensure you have all the necessary documentation. If you believe the denial was unjust, you can often appeal the decision or resubmit your claim with additional evidence. Additionally, it's worth noting that while many companies do not charge fees for refund claims, reviewing the specific terms and conditions is essential.

Tips for successfully managing refund claims

To navigate the refund claim process successfully, several best practices can enhance your experience. First, keep all relevant documentation organized, including receipts and correspondence regarding the claim. An organized filing system helps avoid confusion and supports your case if complications arise.

Following up on your claim is another critical step. Many refunds require proactive engagement from the claimant, so check in regularly to ensure your claim is moving forward. Utilizing tools from pdfFiller can simplify this; you can edit, sign, and save your documents all in one place, which is incredibly advantageous for managing multiple claims.

Troubleshooting common issues

Encountering issues during the refund claim process is not unusual. Common reasons for claim denials include incomplete information, missing documentation, or filing the wrong form. Resolving these issues may require revisiting your original submission, identifying any discrepancies, and reapplying with corrected information.

Additionally, if you face payment issues or rejections, ensure that the payment details provided are correct and up-to-date. Always monitor your account for any unusual activity, which may indicate potential scams, such as text message scams that can compromise sensitive banking information.

Benefits of using pdfFiller for refund claims

pdfFiller stands out as a cloud-based document management solution that enhances the refund claiming process. With its seamless editing and eSigning capabilities, users can modify refund forms in real-time, ensuring accuracy and compliance with the requirements. The platform supports collaboration, making it an ideal choice for teams handling multiple claims.

Accessing documents from anywhere also adds an extra layer of convenience, allowing you to manage your claims on the go. This accessibility is particularly advantageous when working within tight deadlines, as it empowers you to edit and submit your forms promptly.

Final thoughts on the refund claim process

The refund claim process, while potentially overwhelming, can be managed effectively with the right tools and knowledge. Staying organized and informed gives you the upper hand in ensuring your claims are processed without delay. By utilizing pdfFiller, you not only streamline the process but also enhance your ability to navigate refunds with confidence.

Empowering yourself through informed decisions and proactive engagement sets you up for success. Remember, the more familiar you are with the tools and processes, the easier it will be to handle any refund claim that comes your way.

Interactive tools and resources

To further assist you with your refund claims, pdfFiller offers access to numerous templates and examples designed for quick and efficient filing. Users can find pre-filled form templates, allowing for rapid adjustments to fit specific needs without starting from scratch.

Additionally, interactive tools are available to guide users through the editing process, ensuring that every claim is completed correctly. Make use of these resources to enhance your refund claiming experience and streamline your journey toward retrieving your funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my claim for refund of in Gmail?

How can I send claim for refund of to be eSigned by others?

How do I edit claim for refund of online?

What is claim for refund of?

Who is required to file claim for refund of?

How to fill out claim for refund of?

What is the purpose of claim for refund of?

What information must be reported on claim for refund of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.