Get the free 0000950170-23-005578. Form 10-K filed on 2023-03-01 for the period ending 2022-12-31

Get, Create, Make and Sign 0000950170-23-005578 form 10-k filed

How to edit 0000950170-23-005578 form 10-k filed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 0000950170-23-005578 form 10-k filed

How to fill out 0000950170-23-005578 form 10-k filed

Who needs 0000950170-23-005578 form 10-k filed?

Exploring 0000950170-23-005578 Form 10-K Filed Form

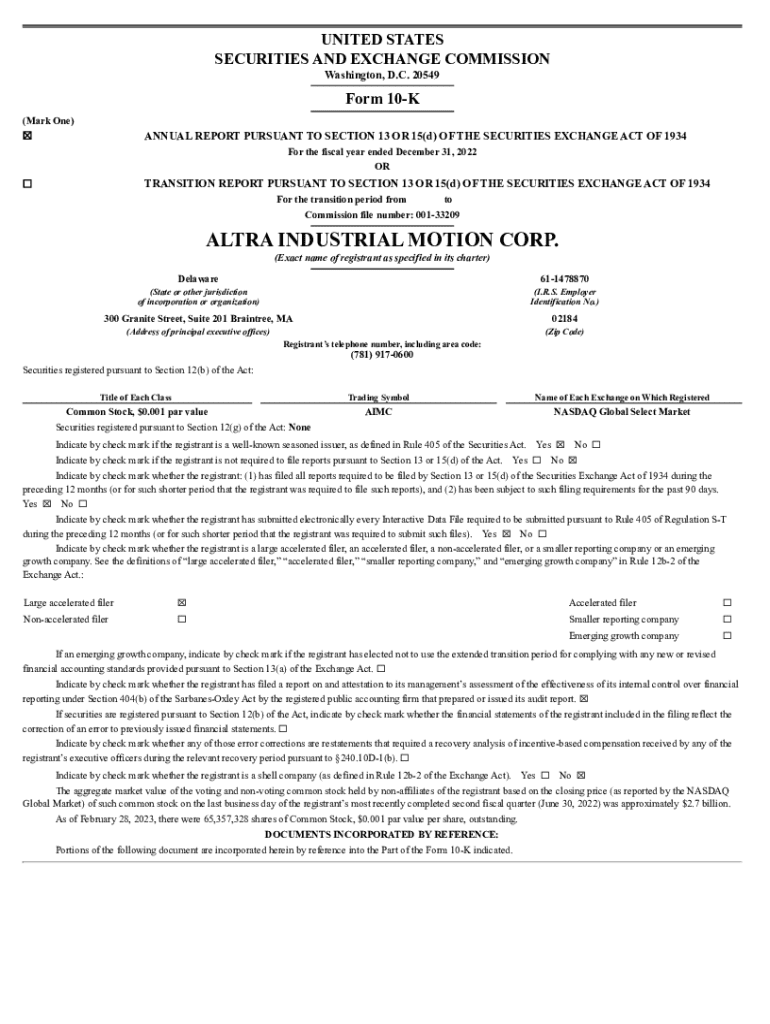

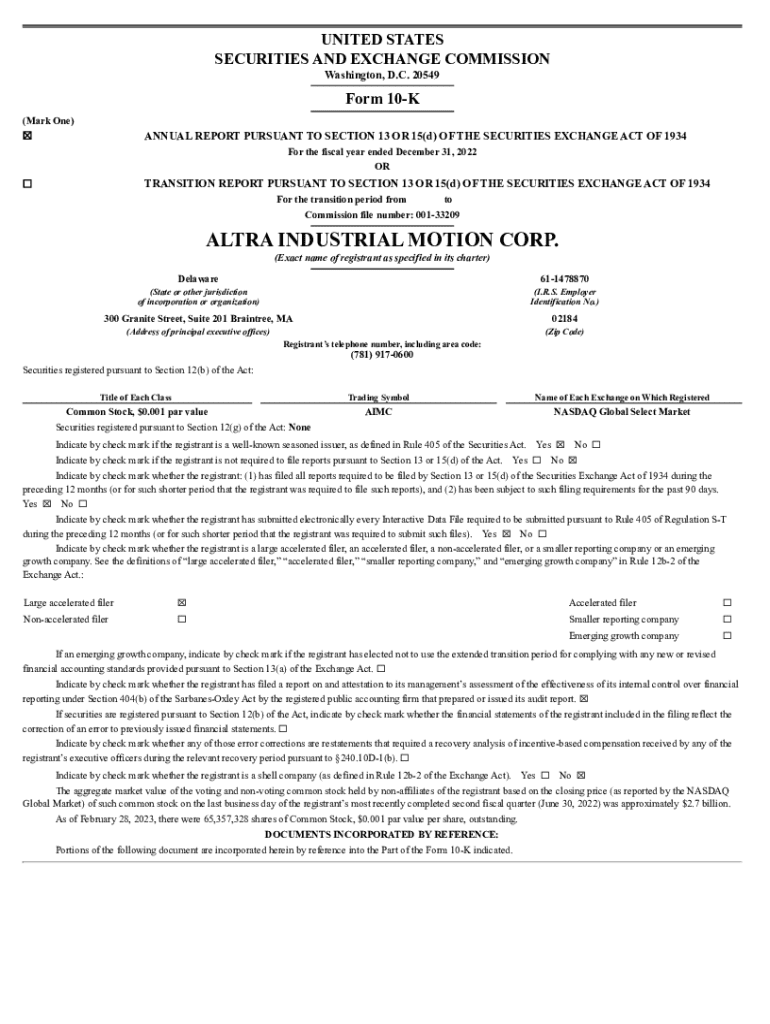

Understanding Form 10-K

Form 10-K is an essential annual report mandated by the U.S. Securities and Exchange Commission (SEC) for publicly-traded companies. This comprehensive document provides a thorough overview of a company’s financial performance, operational insights, and future outlook, aiding investors and regulatory bodies in evaluating the organization’s stability and growth prospects.

The importance of Form 10-K extends beyond mere compliance; it serves as a trustworthy source of information for stakeholders. Investors depend on its contents to make informed decisions regarding shareholder investment and future company direction. Moreover, regulatory authorities utilize it to ensure companies adhere to the requirements set forth in the Delaware General Corporation Law.

Detailed breakdown of filing process

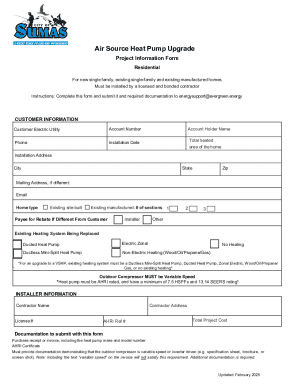

Preparing the Form 10-K involves meticulous planning and data collection. Organizations must first gather vital financial data and disclosures in compliance with SEC guidelines specific to the 10-K form. Understanding these requirements helps streamline the preparation process and ensures that essential information is not overlooked.

The actual filing process typically involves converting your document into PDF format. This involves using specific software tools to ensure consistency and compliance with SEC filing norms. Attention to detail during this phase is crucial, as inaccuracies can lead to regulatory scrutiny or delays in the filing process.

Essential elements to highlight in 10-K filing

When reviewing your 10-K, highlighting year-over-year changes is essential. Investors often look for key metrics such as sales growth, net sales, and EBITDA margin improvements when assessing a company’s performance over the fiscal year. Visualizing these changes through graphs or charts can greatly enhance the document's comprehensibility and present the data in a more engaging manner.

Corporate governance disclosures are key in establishing a company’s credibility and integrity. Ensure that the report highlights important governance practices and complies with all regulations. Furthermore, summarizing the key risk factors, such as potential merger agreements or changes in market dynamics, can assist shareholders in making educated predictions about future performance.

Utilizing pdfFiller for 10-K filings

Leveraging pdfFiller can dramatically ease the 10-K filing process. This platform offers a variety of features tailored to enhance the experience of creating, editing, and managing important documents. For instance, interactive tools allow users to edit PDF files directly in the browser, enabling quick modifications without the need for complicated software.

Additionally, pdfFiller's collaborative features provide teams with the ability to work concurrently on documents, facilitating streamlined reviews and edits. This ensures that all input is captured and incorporated efficiently, which is particularly useful when multiple stakeholders are involved in the 10-K preparation process.

Analyzing financial exhibits

One of the crucial aspects of Form 10-K is the inclusion of financial statements. The balance sheet, income statement, and cash flow statement each have specific requirements that must be met to comply with SEC regulations. Accurate reporting here is vital, as it reflects the financial health of the company and provides a basis for evaluating share performance.

Moreover, identifying eventualities and changes in control within the company is necessary. Documenting these occurrences helps shareholders understand how potential shifts might affect their investments. Ensuring clarity in financial exhibits builds trust with investors and demonstrates the company's commitment to transparency.

FAQs and common challenges

Navigating regulatory conditions around Form 10-K can present challenges, especially for those unfamiliar with the intricacies involved. Common questions include how to ensure compliance with SEC requirements and how to effectively present financial results. Addressing these questions upfront can save time and prevent headaches later in the filing process.

Technical issues during filing, such as format discrepancies or system downtime, are also regular hurdles. To mitigate these issues, it’s beneficial to prepare ahead of time and maintain clear communications with technical teams. Always have a contingency plan for submitting the filing to the SEC to avoid missing deadlines.

Staying updated with SEC filings

Monitoring new filings relevant to your company or industry sector is crucial for staying ahead. Various tools and platforms are available that allow you to effortlessly track new SEC filings, ensuring you do not miss important updates or changes. Setting up alerts can provide notifications on critical record changes, keeping your investment approach proactive.

Utilizing financial news outlets and dedicated SEC tracking services can further enhance your ability to stay informed about potential impacts on share values or operational stability due to newly released reports. Establishing a routine to review this information can significantly influence effective investment decision-making.

Conclusion or next steps

After filing the 0000950170-23-005578 Form 10-K, companies should evaluate their feedback loop and ensure they plan for continuous improvement in subsequent filings. This includes assessing how well the current filing meets stakeholders' needs and any areas needing clarification or expansion in future reports.

Ongoing education regarding SEC requirements and regulations is essential for companies aiming to enhance their reporting standards. Working with platforms like pdfFiller can streamline future filings, ensuring a smooth and compliant process while encouraging transparency and accountability in business dealings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 0000950170-23-005578 form 10-k filed?

How do I fill out 0000950170-23-005578 form 10-k filed using my mobile device?

How do I edit 0000950170-23-005578 form 10-k filed on an Android device?

What is 0000950170-23-005578 form 10-k filed?

Who is required to file 0000950170-23-005578 form 10-k filed?

How to fill out 0000950170-23-005578 form 10-k filed?

What is the purpose of 0000950170-23-005578 form 10-k filed?

What information must be reported on 0000950170-23-005578 form 10-k filed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.