Get the free What is an Escrow Account Agreement? (Key Terms + ...

Get, Create, Make and Sign what is an escrow

How to edit what is an escrow online

Uncompromising security for your PDF editing and eSignature needs

How to fill out what is an escrow

How to fill out what is an escrow

Who needs what is an escrow?

What is an escrow form? A comprehensive guide

Understanding the escrow concept

Escrow is a critical financial arrangement used to ensure secure transactions. Essentially, it’s a safeguard for both parties involved in a transaction. In layman's terms, escrow functions as a neutral third party that holds funds or assets until all terms of the agreement are fulfilled, ensuring that everyone adheres to the contractual obligations. This system significantly reduces potential risks, making it indispensable in various transactions.

What is an escrow form?

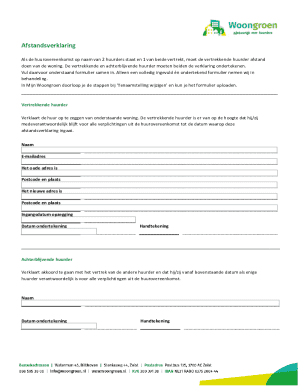

An escrow form is a pivotal document in the escrow process that outlines the specific terms and conditions agreed upon by the involved parties. The primary purpose of this form is to formally initiate the escrow agreement, setting the stage for the transaction's execution. By detailing the responsibilities of the parties and the conditions under which the escrow agent will release funds or assets, this form creates clarity and legal accountability.

The escrow form generally includes essential elements such as the names of the parties involved, the specific terms of the agreement, and the timeline for fulfilling these conditions. The presence of this document significantly reduces misunderstandings and disputes, instilling trust among the parties.

The role of escrow forms in transactions

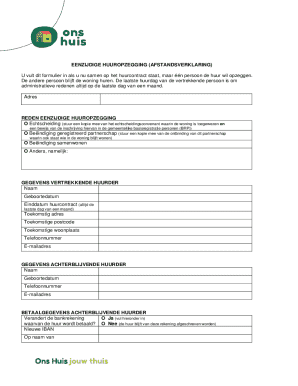

Escrow forms serve crucial roles in various types of transactions, such as real estate, business agreements, and online transactions. In real estate, for instance, the escrow form is vital when purchasing a property. It guarantees that buyer funds are securely held until all legal obligations are met, allowing for a smooth transfer of ownership. A well-drafted escrow form protects both buyers and sellers by ensuring a transparent and fair process.

In the context of business transactions, such as mergers and acquisitions, escrow forms play a significant role in managing larger asset transfers. They help protect the interests of all parties by holding funds until all terms are satisfied, mitigating risks associated with complex agreements. Lastly, in online transactions, escrow forms enhance security in digital payments and services, providing users with peace of mind that their funds are safe until the service or product is delivered.

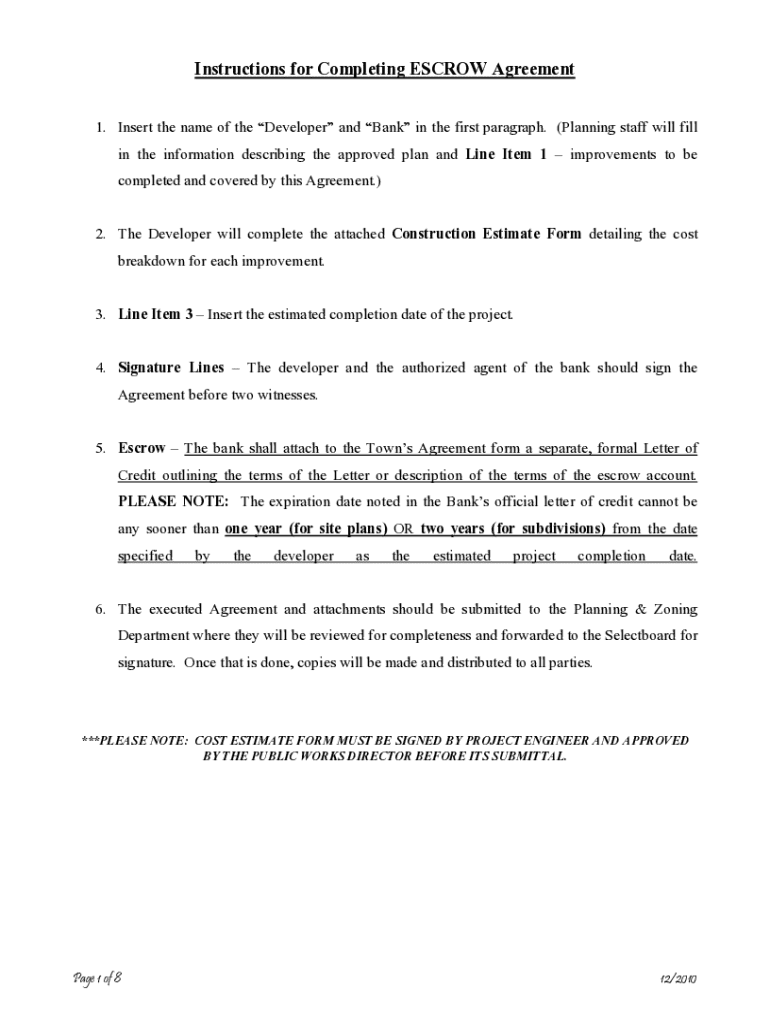

How to complete an escrow form

Completing an escrow form accurately is crucial for ensuring a smooth transaction. Here's a step-by-step guide to help you through the process.

Common mistakes to avoid when filling out an escrow form

Filling out an escrow form can be straightforward, but certain pitfalls can lead to delays or disputes. Paying attention to detail is essential. One common mistake is providing incomplete information, which can create uncertainty and hinder the process. Always ensure you have all required information before starting.

Another frequent error involves incorrect signatures. Each party must sign the form as specified; otherwise, the form could be deemed invalid, jeopardizing the transaction. Furthermore, misunderstanding terms related to the escrow agreement can lead to confusion. Familiarizing yourself with key terms and definitions is crucial for a successful transaction.

Benefits of using escrow forms

Utilizing escrow forms in transactions comes with numerous benefits, enhancing overall trust and security. Firstly, escrow forms bolster security by acting as a neutral third-party safeguard, ensuring that funds or assets are only released when both parties meet their obligations. This instills confidence between buyers and sellers, knowing that their interests are protected.

Moreover, escrow forms lay down clear terms of the agreement, defining roles and responsibilities, which helps prevent misunderstandings. Additionally, the use of an escrow agreement mitigates risks for both parties by reducing the chances of fraud and ensuring that all conditions are met before the exchange is finalized.

Managing escrow after submission

Once you've submitted the escrow form, it’s essential to monitor the escrow process actively. Staying informed can help you track progress and be aware of any outstanding requirements. Most escrow agents provide tools and updates to facilitate communication, so take advantage of these resources to stay aligned with your transaction.

Communication with your escrow agent is vital throughout this process. Establish a channel for questions and updates, ensuring you receive timely information about any developments. This proactive approach not only keeps you informed but also fosters a strong working relationship, ensuring a smoother transaction.

Additional tools and resources

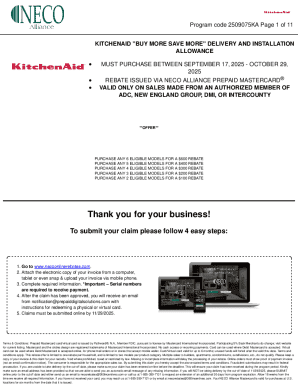

To further streamline your experience with escrow forms, tools such as pdfFiller provide interactive features for editing, signing, and managing your documents. pdfFiller accommodates users seeking accessible, cloud-based solutions to handle their form needs seamlessly. Whether you need to customize your escrow form or track the progress of your transaction, pdfFiller offers the capabilities to enhance your workflow.

Additionally, utilizing templates available on pdfFiller can save time and effort when drafting your escrow forms. Pre-made templates are useful for various situations, ensuring you incorporate the necessary terms and conditions without missing critical information.

Frequently asked questions (FAQs)

Addressing common concerns is essential for understanding escrow forms better. One frequent question is, 'What happens if there is a dispute?' In such cases, escrow agents typically follow specified procedures to mediate and resolve any issues based on the terms agreed upon in the escrow form.

Another common inquiry is regarding the duration of the escrow process. The timeline can vary based on the complexity of the transaction and the responsiveness of the involved parties. Lastly, some users wonder if they can make changes after submission. While adjustments may be possible, it is usually advisable to discuss any modifications with the escrow agent to ensure compliance with the agreement terms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find what is an escrow?

How do I execute what is an escrow online?

How do I complete what is an escrow on an iOS device?

What is an escrow?

Who is required to file what is an escrow?

How to fill out what is an escrow?

What is the purpose of what is an escrow?

What information must be reported on what is an escrow?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.