Get the free ct fcic credit

Get, Create, Make and Sign ct fcic credit form

How to edit ct fcic credit form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct fcic credit form

How to fill out form ct-1120 fcic fixed

Who needs form ct-1120 fcic fixed?

A comprehensive guide to Form CT-1120 FCIC fixed form

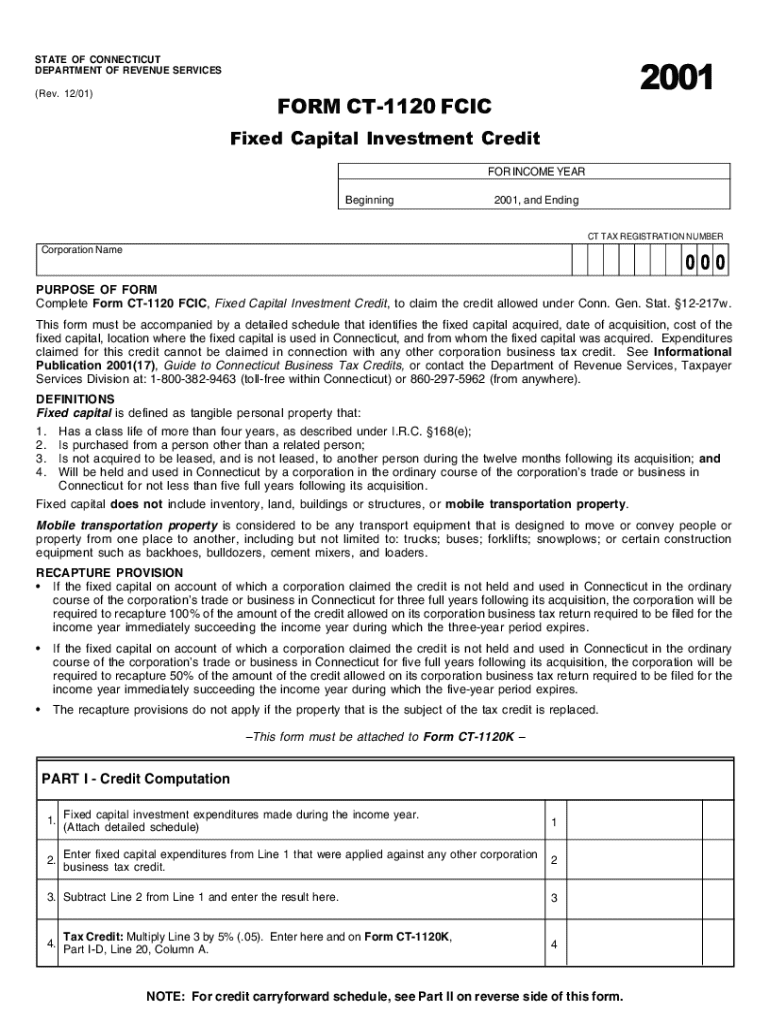

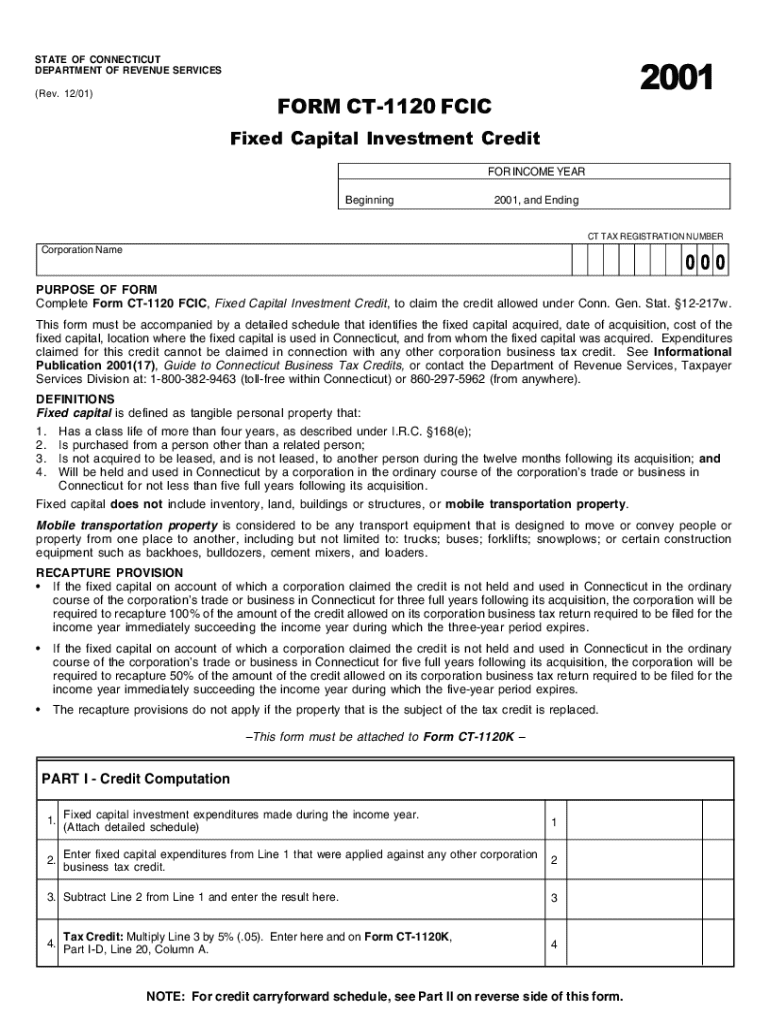

Overview of Form CT-1120 FCIC

Form CT-1120 FCIC is a crucial document used by corporations based in Connecticut to report their income, tax liability, and other financial details to the state. This fixed form allows businesses to comply with state tax laws and ensures that they accurately calculate their corporate tax obligations.

The importance of Form CT-1120 FCIC lies in its role in the state's revenue collection process. Accurate filing helps fund public services, infrastructure, and education. Furthermore, utilizing this form correctly can mitigate the risk of fines or penalties stemming from underreporting income or overestimating deductions.

To file Form CT-1120 FCIC, corporations must follow a specific procedure, which includes gathering necessary financial information, filling out the form, and submitting it by the designated deadline. This process ensures that the corporation meets its fiscal obligations and maintains good standing with state regulations.

Key features of Form CT-1120 FCIC

Form CT-1120 FCIC is designed as a comprehensive format specifically for corporation tax returns. This structured layout simplifies the filing process by guiding users through the various sections needed for accurate reporting. It incorporates fields for both basic and detailed financial information, allowing businesses to provide a complete picture of their fiscal activities.

Sections included in the form cover essential financial data such as revenue, expenses, and tax calculations. Additionally, advancements in technology mean that many corporations can integrate this form with digital tools for enhanced management. Features such as automatic calculations and reminders enable users to optimize their filing experience significantly.

The integration with digital tools enhances ease of use and ensures compliance with state regulations. This digital approach allows businesses to maintain better records, improve accuracy, and streamline the entire tax reporting process.

Step-by-step instructions for filling out Form CT-1120 FCIC

To efficiently complete Form CT-1120 FCIC, follow these step-by-step instructions.

1. Gather necessary information

Before you begin filling out the form, gather all necessary financial documents. This includes financial statements, balance sheets, and tax records from the previous year. Ensure you have the relevant deadlines marked on your calendar to avoid late submissions, as this could lead to penalties.

2. Completing each section of the form

Begin with the basic information section, which includes your corporation's name, address, and federal employer identification number (EIN). Following this, accurately input your financial data entries, detailing revenues earned during the tax year and any related expenses.

You will also need to calculate your corporation's tax liability by referencing current tax rates provided by the Connecticut Department of Revenue Services. This section is critical as errors can lead to incorrect tax payments.

3. Review and confirm your entries

Once the form is filled out, reviewing your entries is essential. Accuracy in reporting cannot be overstated as inaccuracies may result in costly ramifications. Common errors include incorrect figures and miscalculating deductions.

Interactive tools to enhance the filing process

To further aid in completing Form CT-1120 FCIC, interactive tools can significantly enhance the filing experience. Many tools allow for real-time editing and automatic error highlighting as entries are made. This immediate feedback is beneficial for ensuring that all information is correct before submission.

E-signature capabilities have also become standard; these features allow for secure digital signing of the form, which not only saves time but also ensures compliance with current e-filing regulations. Furthermore, collaboration options designed for teams facilitate document sharing for review and approval processes, enabling multiple contributors to work seamlessly together.

Filing options for CT-1120 FCIC

When it comes to submitting Form CT-1120 FCIC, corporations have two primary options: electronic filing and paper filing. Electronic submission is highly recommended as it tends to be more efficient, reducing the risk of lost documents and allows for quicker confirmation of receipt. Moreover, e-filing typically provides built-in validation checks, which can help minimize errors.

For those who prefer or need to file by paper, it is crucial to follow the specific instructions outlined by the Connecticut Department of Revenue Services. Ensure that the completed form is mailed to the correct address, postmarked by the deadline for it to be considered timely filed.

Frequently asked questions about Form CT-1120 FCIC

This section addresses some common inquiries concerning Form CT-1120 FCIC, ensuring clarity for users.

Best practices for managing business taxes with Form CT-1120 FCIC

Managing business taxes can be a complex endeavor, but implementing best practices can alleviate much of the stress. It’s vital to ensure that all tax filings are made promptly and accurately. This involves keeping detailed financial records throughout the year, rather than waiting until tax season to gather information.

Utilizing a document management tool like pdfFiller can enhance your organization by allowing access to tax forms and supporting documents from anywhere at any time. The cloud-based system aids in the efficient organization of all filing materials and supports collaboration among team members.

Updates and regulatory changes to be aware of

As tax regulations continuously evolve, staying informed on any changes to Form CT-1120 FCIC is crucial. Recent modifications have included adjustments to tax rates and filing requirements that may impact corporations filing for the 2023 tax year and beyond.

Corporations need to regularly check the Connecticut Department of Revenue Services' website for updates, ensuring they are compliant with the latest requirements. Being proactive in this regard can save corporations a considerable amount of time and potential issues down the line.

Related forms and documentation

Understanding related forms can enhance your compliance with state tax obligations. For example, the CT-1120 HCIC may be applicable for certain high-income corporations, with its own requirements and filing guidelines.

Links to additional tax resources, including instructional guides and FAQs on the Connecticut Department of Revenue Services' website, can provide further assistance and clarity as you navigate tax season.

Tips for effective document management and organization

Setting up a digital filing system is one of the most effective methods for managing tax documents efficiently. Utilize structured folders to organize forms, receipts, and financial statements. This setup not only decreases the likelihood of losing important information but also simplifies the filing process.

Employing tools like pdfFiller further streamlines document handling. The platform provides features for editing, signing, and sharing, ensuring that all necessary components of your tax documents are easily accessible when needed.

Optimizing your filing experience with pdfFiller

Leveraging the features of pdfFiller can transform the way you handle Form CT-1120 FCIC. The platform enables seamless workflows through its intuitive interface, allowing users to create, edit, and submit documents entirely online. Users can benefit from tools that aid in tracking changes, ensuring all parties are aligned on any adjustments made to the document.

Integrating pdfFiller with other business solutions adds layers of efficiency to your processes. Whether you are handling client documents, internal reporting, or compliance-related materials, having all documents on a single cloud-based platform greatly simplifies access and accountability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ct fcic credit form in Gmail?

How can I send ct fcic credit form to be eSigned by others?

Can I sign the ct fcic credit form electronically in Chrome?

What is form ct-1120 fcic fixed?

Who is required to file form ct-1120 fcic fixed?

How to fill out form ct-1120 fcic fixed?

What is the purpose of form ct-1120 fcic fixed?

What information must be reported on form ct-1120 fcic fixed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.