Get the free 11 Anunal Report.indd

Get, Create, Make and Sign 11 anunal reportindd

How to edit 11 anunal reportindd online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 11 anunal reportindd

How to fill out 11 anunal reportindd

Who needs 11 anunal reportindd?

Understanding the 11 Annual Reporting Form: A Comprehensive Guide

Overview of the 11 Annual Reporting Form

The 11 Annual Reporting Form is a crucial document mandated by the U.S. Securities and Exchange Commission (SEC) to enhance transparency and accountability in financial reporting. This form serves as a primary way for publicly traded companies to disclose their financial performance, risks, and overall business health to shareholders and potential investors. Its significance cannot be overstated, as it provides essential insights that enable stakeholders to make informed investment decisions.

Key stakeholders involved in the reporting process include company executives, financial officers, compliance teams, and external auditors. Each group plays a vital role in ensuring the accuracy and integrity of the information reported. Furthermore, investors, analysts, and regulatory bodies closely scrutinize these filings, underscoring the importance of meticulous preparation and adherence to regulations.

Understanding the regulatory framework

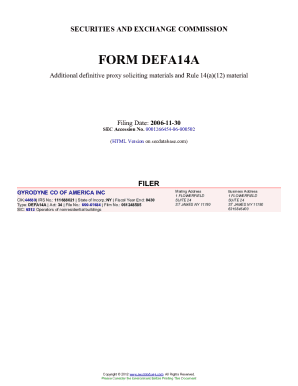

The 11 Annual Reporting Form operates within the framework established by the Securities Exchange Act of 1934, which governs securities transactions in the U.S. This act was designed to promote transparency and prevent fraudulent practices in the securities markets. Of particular relevance to the 11 Annual Reporting Form are key sections such as Sections 13, 14A, and 15(d).

Section 13 requires issuers to file annual reports, which is where the 11 Annual Reporting Form comes into play. This provision ensures that all pertinent information regarding the issuer's financial condition, operations, and management is disclosed timely. Section 14A focuses on proxy solicitation and provides rules on management's disclosure obligations during shareholder meetings. Section 15(d) stipulates that certain companies must file periodic reports even if they are not registered under Section 12 of the act. Understanding these sections aids entities in compliant reporting and reduces potential legal risks.

Compliance requirements can vary based on a company's size and public status, making it crucial for different entities to closely evaluate their obligations under these regulations.

Detailed breakdown of the 11 Annual Reporting Form

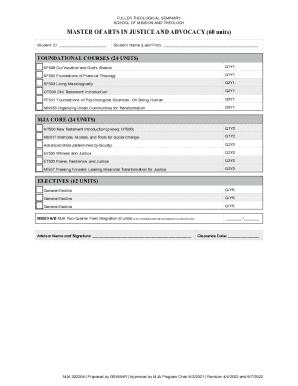

The 11 Annual Reporting Form consists of several sections that require comprehensive disclosures. Familiarity with the form's structure ensures that all necessary information is accurately reported. The main items include:

In addition to the items listed, the financial statements substantiating the company's performance—specifically the balance sheet, income statement, and cash flow statement—are critical. These documents provide insight into the company's financial health, while accompanying footnotes and disclosures offer necessary context and details that ensure complete transparency.

Steps to fill out the 11 Annual Reporting Form

Filling out the 11 Annual Reporting Form can be a complex process that demands precision and attention to detail. The first step is gathering essential information. This includes the company’s financial history, relevant statistics, and any legal and compliance documents required for accurate reporting.

Next, drafting each section should reflect an understanding of the business and its environment. Particularly, consider these tips: For the business overview, focus on clarity and succinctness; when outlining risk factors, prioritize candidness to provide a clear picture of potential downsides. After drafting, a critical phase involves review and editing for accuracy. Engaging cross-functional teams within the organization can provide additional insights and ensures that the information presented is comprehensive and accurate.

Tools for managing the 11 Annual Reporting Form

Utilizing the right tools can make the process of managing the 11 Annual Reporting Form significantly more efficient. pdfFiller offers a range of capabilities for editing and signing PDFs, which streamlines the preparation of such important documents. Its features facilitate real-time collaboration among team members, which is crucial for enhancing the quality and accuracy of the form.

Moreover, pdfFiller’s cloud-based platform allows users to access documents from anywhere, providing flexibility and ease of management. This ensures that necessary revisions or updates can be made promptly, regardless of team members' locations, which is an invaluable asset during busy reporting periods.

Common pitfalls and how to avoid them

When compiling data for the 11 Annual Reporting Form, there are several common pitfalls that organizations should be aware of. A major error involves failing to verify the accuracy of financial data, which can lead to compliance issues and legal consequences. Another common mistake is providing insufficient detail in the risk factors section, which can mislead investors.

Consequences of non-compliance or inaccuracies include costly fines, legal repercussions, and reputational damage. To avoid these pitfalls, companies should establish a clear timeline for submissions and prioritize thorough internal reviews. Additionally, regular training on compliance updates is crucial for all stakeholders involved in the reporting process.

Interactive tools and resources for further assistance

Accessing editable templates for the 11 Annual Reporting Form can significantly streamline the filling process. pdfFiller provides templates that are customizable, enabling companies to input their specific data while maintaining compliance with regulatory standards.

In addition, numerous tutorials and video guides are available, offering comprehensive instructions on effective document handling. One of the best practices in managing these documents effectively is referring to FAQs addressing common concerns and scenarios, which can provide quick resolutions to specific challenges encountered during reporting.

Final steps before submission

Before hitting 'submit,' it’s vital to complete a checklist for verification. This checklist should include confirming every section is filled accurately, all financial statements are included, and that all required signatures are in place. Understanding the submission process and its associated timelines will help in organizing these steps efficiently.

Post-filing, companies should remain vigilant for any follow-up requests from regulatory bodies, making it essential to retain proper documentation. Appropriately managing this follow-up can further solidify compliance and ensure readiness for any potential audits.

Staying informed about regulatory changes

Monitoring updates to regulations that may impact the 11 Annual Reporting Form is crucial for continuous compliance. Regulatory environments can shift, and being proactive will help avoid any non-compliance issues or the need for last-minute adjustments.

Resources such as the SEC's official website and industry-specific forums provide valuable insights and ongoing education regarding reporting standards, helping entities stay informed and prepared for any changes that might arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 11 anunal reportindd online?

How can I edit 11 anunal reportindd on a smartphone?

Can I edit 11 anunal reportindd on an iOS device?

What is 11 anunal reportindd?

Who is required to file 11 anunal reportindd?

How to fill out 11 anunal reportindd?

What is the purpose of 11 anunal reportindd?

What information must be reported on 11 anunal reportindd?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.