Get the free 2025 I-0103Schedule SB - Form 1 - Subtractions from Income (fillable)

Get, Create, Make and Sign 2025 i-0103schedule sb

Editing 2025 i-0103schedule sb online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 i-0103schedule sb

How to fill out 2025 i-0103schedule sb

Who needs 2025 i-0103schedule sb?

2025 -0103 Schedule SB Form: Your Comprehensive Guide

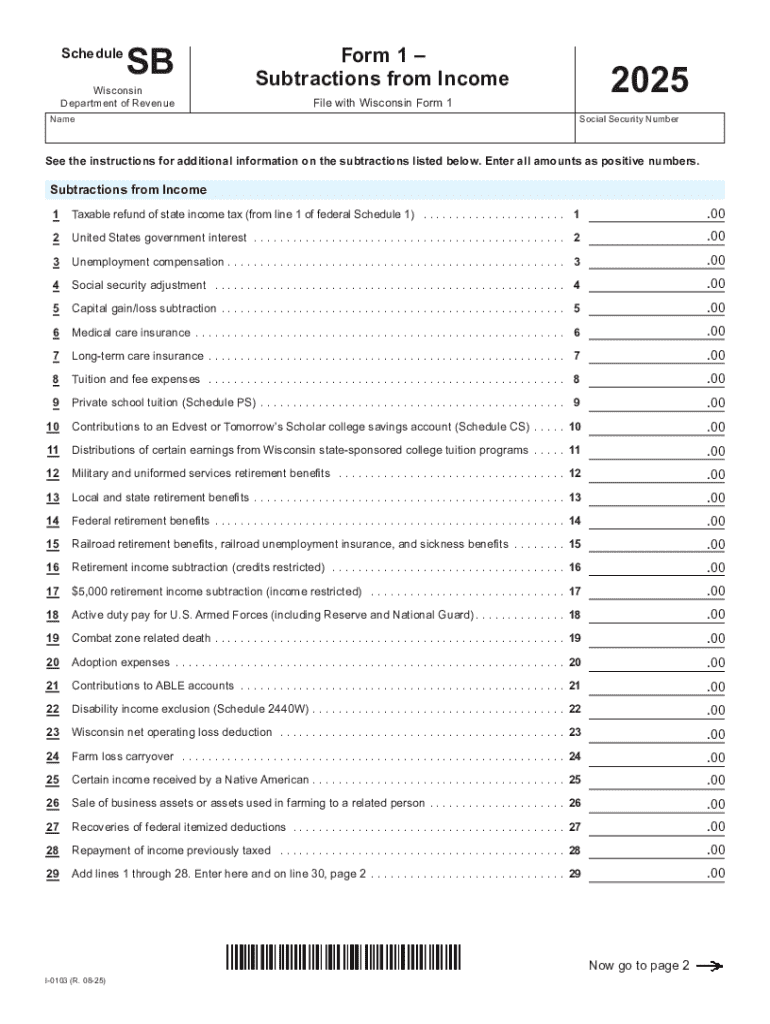

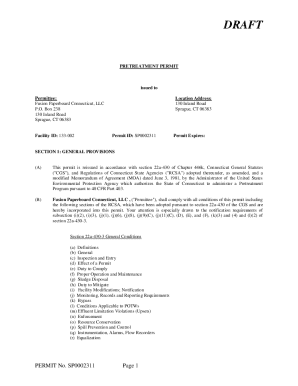

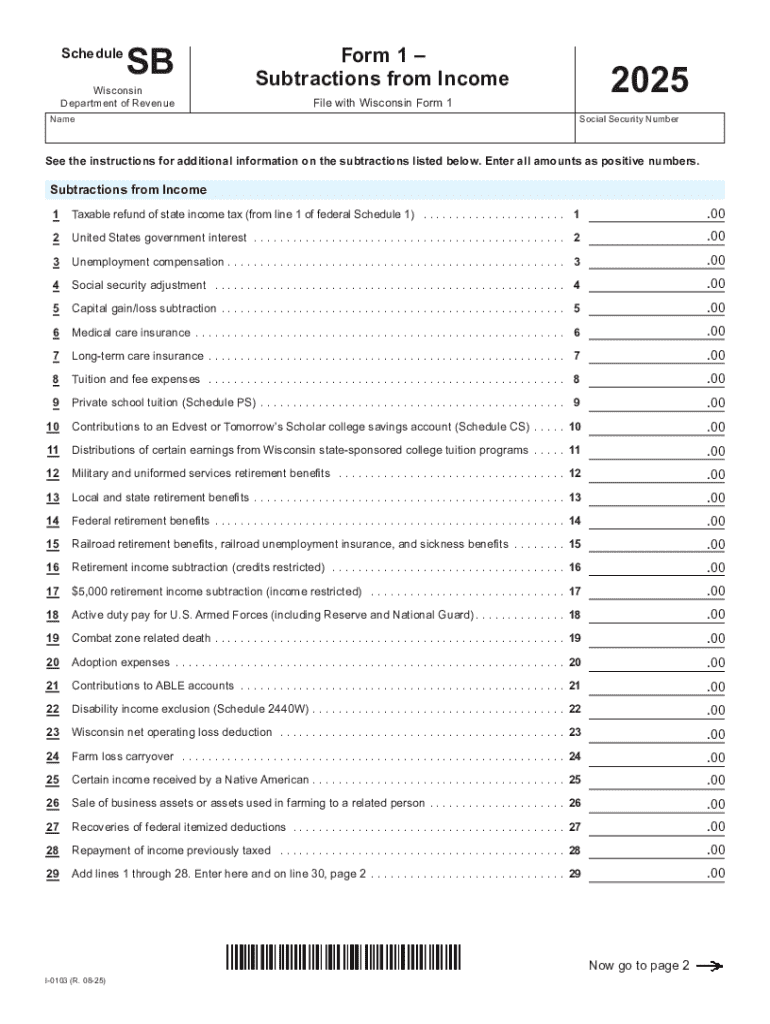

Understanding the 2025 -0103 Schedule SB Form

The 2025 i-0103 Schedule SB Form is a crucial document used for reporting specific tax information relating to small businesses and self-employed individuals. This form plays a central role in capturing relevant financial data and ensures compliance with tax regulations. Its accurate completion is essential not only for fulfilling legal requirements but also for maximizing tax benefits available to eligible taxpayers.

Aside from compliance, the form allows taxpayers to claim various deductions and credits that can significantly reduce their overall tax liability. Understanding its layout and the required information is pivotal to utilizing its full potential. Through this guide, readers will gain insights into how to efficiently complete the form and leverage resources such as pdfFiller.

The role of pdfFiller in streamlining form management

pdfFiller is an innovative platform designed to simplify the documentation process, particularly for forms like the 2025 i-0103 Schedule SB. With its cloud-based accessibility, users can modify documents anytime and from anywhere, making it a preferred choice for individuals and teams. Additionally, pdfFiller includes robust collaboration tools that enable multiple users to work on a document simultaneously, ensuring seamless teamwork.

One standout feature is its secure eSignature capabilities, which allow users to sign documents electronically without any hassle. This feature significantly speeds up the submission process, eliminating the delays associated with traditional signatures. By integrating pdfFiller into your form management routine, you leverage tools that simplify the complexities often associated with tax filing.

Step-by-step instructions to complete the 2025 -0103 Schedule SB Form

Before tackling the 2025 i-0103 Schedule SB Form, preparation is key. Begin by gathering all necessary information and documentation, such as income statements, previous tax returns, and records of deductions. Moreover, it's important to understand the eligibility criteria for certain deductions and credits as outlined for small businesses.

The form is divided into three main sections: Income Information, Deductions, and Tax Credits. Ensuring that you fill these sections accurately is crucial for the completeness of your submission.

To avoid common mistakes, double-check your figures, ensure consistency between your reports, and consult resources or professionals if in doubt.

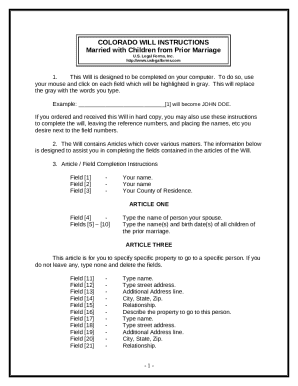

Editing and customizing the 2025 -0103 Schedule SB Form with pdfFiller

One of the primary advantages of using pdfFiller is the ability to electronically edit the 2025 i-0103 Schedule SB Form with ease. After filling out the required sections, users can insert additional information or attachments directly into the document, enhancing clarity and comprehensiveness.

Furthermore, pdfFiller provides various templates that streamline the enrollment process. These templates ensure consistent layouts and formats, making it easy to categorize and store important records. By utilizing these features, teams can efficiently manage their documentation and tailor forms specifically to their operational needs.

Signing and submitting the 2025 -0103 Schedule SB Form

Once the 2025 i-0103 Schedule SB Form is completed, the next step is signing it. Using pdfFiller, users can quickly execute the eSignature process, which ensures both authenticity and legal compliance. Before submission, it is critical to conduct necessary checks, such as verifying that all required fields are filled out and ensuring no mismatches exist in your reports.

Regarding submission methods, users have the option to choose between electronic and paper submissions. Electronic submissions tend to be faster and more secure, making them a preferred choice for many. However, understanding the guidelines for both methods is crucial to ensure compliance with the IRS or relevant tax authorities.

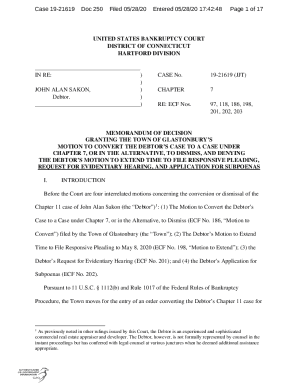

Collaboration tools for team-based form management

For teams collaborating on the 2025 i-0103 Schedule SB Form, pdfFiller offers robust features that enhance teamwork. This includes functionalities for comments, notes, and version tracking, allowing team members to provide input and ensure that everyone is on the same page throughout the process.

Real-time updates are pivotal for accountability, particularly when multiple team members are involved. These tools not only streamline the editing and reviewing process but also help prevent errors that could arise from lack of communication.

Managing and storing your completed forms with pdfFiller

Once your 2025 i-0103 Schedule SB Form is finalized and submitted, managing and storing your completed forms becomes crucial. pdfFiller offers secure storage options that keep your documents safe while also readily accessible for future reference.

Adopting best practices for backing up important documentation is essential. This includes organizing forms by year and type, ensuring there’s a structured retrieval process, and creating additional backups using cloud storage solutions. Keeping your documents organized not only aids in compliance but also provides peace of mind.

Troubleshooting common issues

Filling out the 2025 i-0103 Schedule SB Form can present various challenges. Common issues may include discrepancies between reported incomes and deductions or misunderstanding of eligibility criteria. When you encounter these problems, utilizing pdfFiller’s built-in resources can facilitate resolution.

If errors arise that you cannot resolve, consulting a tax professional is an advisable step. Having an expert review your form can provide clarity and ensure accurate reporting, which is central to avoiding potential penalties.

FAQs about the 2025 -0103 Schedule SB Form and pdfFiller

For those navigating the 2025 i-0103 Schedule SB Form, certain questions often arise. Frequently asked questions include inquiries about filing deadlines, eligibility for specific deductions, and the specific features of pdfFiller designed to streamline form completion.

Clarifications on pdfFiller functionalities, such as how to leverage templates and eSignature processes, are equally important for users seeking a more efficient form-filling experience. Understanding these resources contributes to a smoother filing process.

The importance of keeping your form updated

Timely updates to your 2025 i-0103 Schedule SB Form are crucial, particularly as tax regulations can evolve. Keeping abreast of the latest changes ensures that your submissions remain in compliance and eligible for available benefits.

Utilizing resources from pdfFiller can help users stay informed about pertinent tax regulations. Regularly checking for updates and making necessary alterations to your form submissions can provide a competitive advantage during tax seasons.

Feedback and continuous improvement

User feedback plays a significant role in enhancing the experience related to the 2025 i-0103 Schedule SB Form and its management. pdfFiller actively encourages users to share their experiences, which can provide insights into areas for improvement.

When users share suggestions, it paves the way for innovations and updates that can benefit the wider pdfFiller community, ultimately leading to more effective document management solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2025 i-0103schedule sb without leaving Google Drive?

How can I get 2025 i-0103schedule sb?

Can I edit 2025 i-0103schedule sb on an Android device?

What is 2025 i-0103schedule sb?

Who is required to file 2025 i-0103schedule sb?

How to fill out 2025 i-0103schedule sb?

What is the purpose of 2025 i-0103schedule sb?

What information must be reported on 2025 i-0103schedule sb?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.