Get the free Instructions For Form Hw-6 - Employee'S Statement To ...

Get, Create, Make and Sign instructions for form hw-6

How to edit instructions for form hw-6 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form hw-6

How to fill out instructions for form hw-6

Who needs instructions for form hw-6?

Instructions for Form HW-6: Complete Guide

Understanding Form HW-6: An overview

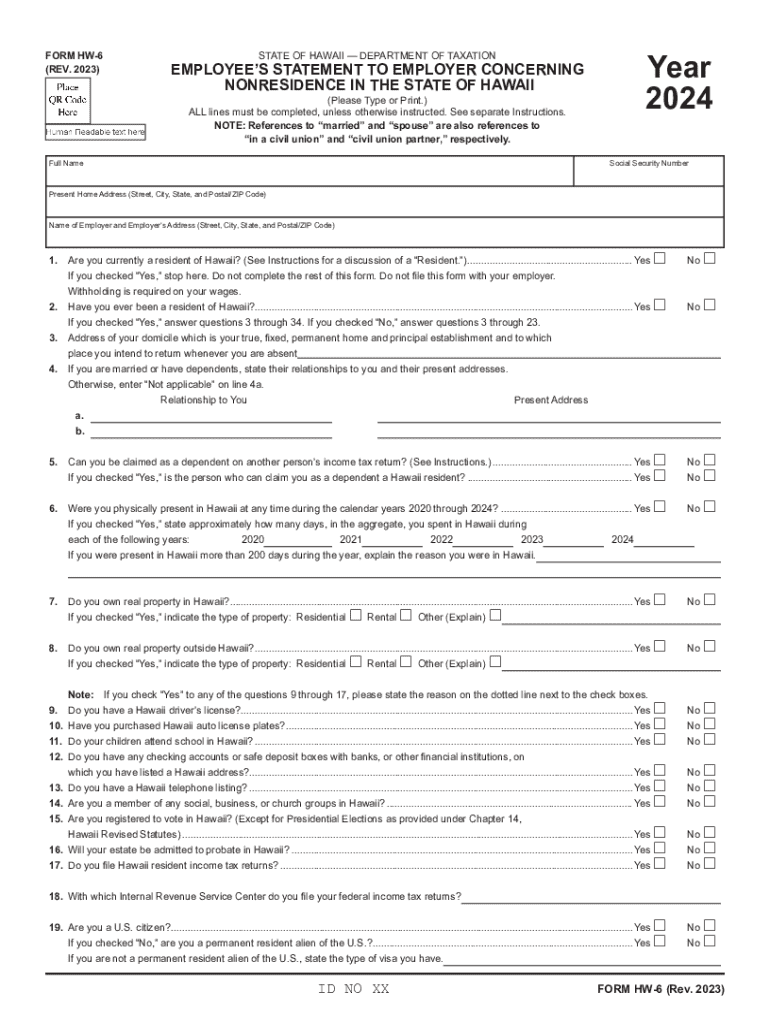

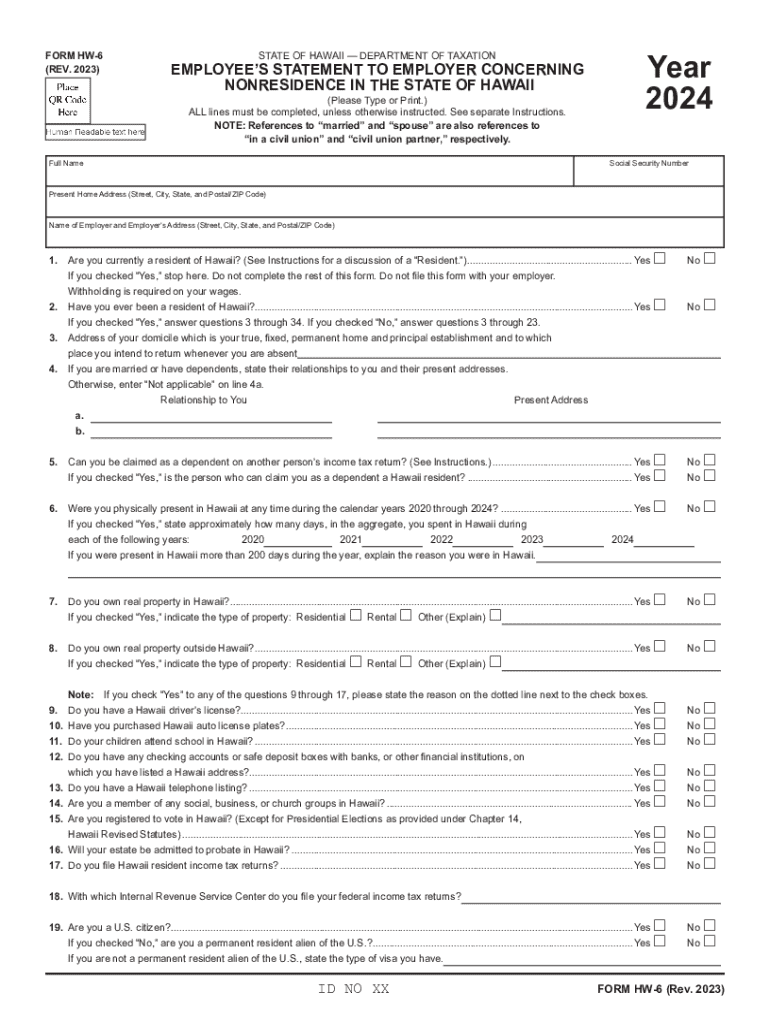

Form HW-6, officially known as the Employee's Statement to Employer Concerning Nonresidence in the State of Hawaii, serves as a crucial document for employees who wish to assert their nonresident status for tax purposes. This form helps clarify to employers why certain state taxes may not be withheld from an individual’s paycheck. Understanding the implications of this form is vital for both employees and employers to ensure compliance with Hawaii's tax regulations.

The importance of Form HW-6 cannot be understated, as it not only aids in accurate tax withholding but also protects non-resident employees from unnecessary deductions. If you're working in Hawaii but reside in another state, filling out this form correctly ensures that you aren’t taxed twice on your income. Completing Form HW-6 is essential for any employee who is classified as a nonresident under Hawaii's tax laws.

Typically, individuals need to complete Form HW-6 if they are employed in Hawaii but maintain residency in another state. This includes employees who work temporarily in the state or those who commute regularly from their actual residence. If this applies to you, the HW-6 form is necessary for ensuring proper tax protocols are followed.

When and where to file Form HW-6

Filing deadlines for Form HW-6 coincide with the commencement of employment or change in residency status. While there isn't a hard deadline, submitting the form as soon as you begin work or if your residency status changes is highly advisable. This proactive measure helps avoid issues with tax withholding. Employers should encourage employees to provide this form promptly to ensure proper tax tracking and compliance.

You have several options for submitting Form HW-6. Online submissions can be done through the Hawaii Department of Taxation's website, which may streamline the process. If you prefer or require physical documents, you can mail the completed form to the Department of Taxation at their designated addresses, which can be found on their official site. Additionally, local tax offices in Hawaii are available if you need in-person assistance.

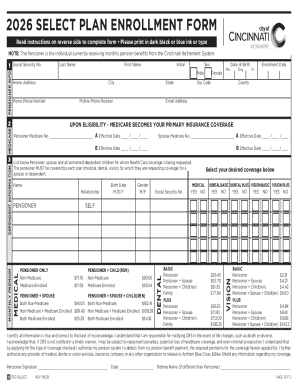

Step-by-step instructions for filling out Form HW-6

Completing Form HW-6 is straightforward if you follow the outlined sections carefully. Begin with Section 1, where you'll provide your employee information. This includes your name, address, Social Security number, and any other personal details requested. It’s crucial to double-check this information for accuracy, as discrepancies can lead to complications with your tax status and withholding.

Moving on to Section 2, you'll need to clarify your residency status. It’s important to understand the distinction between nonresidence and residency. For example, if you have established a permanent home in another state and are merely working in Hawaii temporarily, you must accurately state this status. Falsely reporting your residency could lead to tax penalties.

In Section 3, employer information is required. This includes your employer's name, address, and identification number. Correctly reporting this information helps ensure that your nonresidence claim is validated by proper authority. In Section 4, you must certify the form by signing and dating it. A valid signature is essential for proper processing and acknowledgment by the authorities.

Common mistakes to avoid when filling out Form HW-6

Completing Form HW-6 accurately is critical, but many individuals make common mistakes that can lead to processing delays or tax penalties. One of the major pitfalls is providing incomplete information. Every field on the form is there for a reason, and leaving sections blank can lead to rejection or require further clarification from tax officials.

Another frequent issue is misreporting residency status. Accurate representation is paramount; misclassifying yourself can lead to unnecessary tax deductions or legal issues. Furthermore, failing to submit the form on time can result in penalties from the State of Hawaii. It’s crucial to prioritize timely submissions and always ensure that the information you provide is complete and correct.

Editing and managing Form HW-6

Once your Form HW-6 is filled out, you may want to make edits or manage the document for future submissions. pdfFiller offers an array of tools that allow users to easily edit completed forms. Its user-friendly features enable you to make necessary changes without hassle, ensuring that your form is always up to date.

Additionally, managing your form goes beyond just editing; it involves proper storage and accessibility. By using pdfFiller, you can securely save and store your Form HW-6, facilitating easy retrieval when needed. If you’re collaborating with others – such as tax advisors or managers – the platform allows for seamless sharing and reviewing of the document.

Understanding the aftermath of your submission

Once you submit Form HW-6, it undergoes processing by your employer and the Hawaii Department of Taxation. What happens next is largely determined by the accuracy of the information you've provided. Typically, you will receive confirmation from your employer regarding the processing of your nonresident status, which should align with your employment situation.

Keeping track of the status of your submission is crucial. If you notice discrepancies or have not received confirmation, addressing these issues with your employer or tax officials is important to ensure smooth tax compliance. Regular checking can save you from last-minute complications during tax season.

Related articles and additional insights

To fully understand the implications of Form HW-6, it’s beneficial to explore related topics and additional articles. These can provide further insights into Hawaii's tax regulations, including an overview of other forms that may pertain to your employment. Expanding your knowledge through these resources can enhance your readiness for compliance.

Understanding state income tax withholding in Hawaii also provides broader context for the importance of Form HW-6. Familiarizing yourself with those processes can empower you to make more informed decisions and take better control of your tax responsibilities.

Related forms you may need

Navigating the world of taxes can bring about a need for multiple forms depending on your employment and residency status. Alongside Form HW-6, you may find it necessary to work with others like the HW-1 or HW-3 forms. Understanding the relationship between these documents is integral for comprehensive tax reporting.

Accessing and utilizing these related forms is made more manageable through platforms like pdfFiller. This service provides an interconnected ecosystem of tax documents, ensuring that users can complete and manage all requirements efficiently.

Additional categories and resources

The world of documentation extends beyond just Form HW-6. Consider exploring broader categories such as tax forms, employment documentation, and residency status claims. These categories house numerous resources that can enhance your understanding and efficiency in document management.

By utilizing platforms like pdfFiller, you can access a wealth of resources related to document management, ensuring that you're not only well-prepared for tax season but also equipped for everyday paperwork challenges.

Employer’s obligations regarding Form HW-6

Employers have a vital role in the process surrounding Form HW-6. Understanding their responsibilities is crucial, as they must ensure that the employee’s residency status is accurately reflected in tax withholdings. Failure to comply can lead to tax complications for both employees and employers, as misclassification of employee tax status can lead to inappropriate withholding.

Employers are also responsible for educating their workforce about the importance of the HW-6 form. They should inform employees of their rights and responsibilities concerning residency status, ensuring that all parties are well-informed. This proactive approach promotes compliance and helps avoid unnecessary tax liabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send instructions for form hw-6 to be eSigned by others?

How do I execute instructions for form hw-6 online?

How can I edit instructions for form hw-6 on a smartphone?

What is instructions for form hw-6?

Who is required to file instructions for form hw-6?

How to fill out instructions for form hw-6?

What is the purpose of instructions for form hw-6?

What information must be reported on instructions for form hw-6?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.