Get the free S240 Form - revenue.wi.gov

Get, Create, Make and Sign s240 form - revenuewigov

Editing s240 form - revenuewigov online

Uncompromising security for your PDF editing and eSignature needs

How to fill out s240 form - revenuewigov

How to fill out s240 form - revenuewigov

Who needs s240 form - revenuewigov?

Understanding the S240 Form - RevenueWIGov Form

Overview of the s240 form

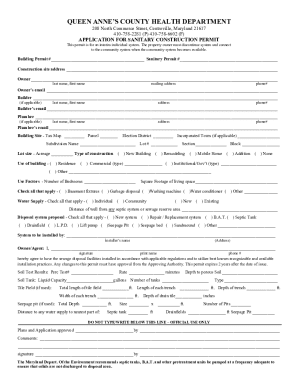

The s240 form, issued by RevenueWIGov, serves a crucial function in tax reporting and compliance within Wisconsin. This specific form helps individuals and entities to accurately report their income and facilitate a smooth interaction with tax obligations. Understanding this form is vital, as it plays a direct role in ensuring that tax data is correctly documented, thus avoiding potential legal issues stemming from inaccurate or incomplete submissions.

Accessing the s240 form

Locating the s240 form on RevenueWIGov's website is straightforward. The form can be accessed directly from their official site, which is designed for ease of navigation. Users can find the s240 form under the tax forms section, typically categorized by type of tax or filing requirements.

To download the form efficiently, ensure you have a stable internet connection and a PDF reader installed for convenient viewing. Bear in mind, you'll likely need to save the document to your local storage for filling it out or, better yet, utilize online editing tools, like those offered by pdfFiller.

Preparing to fill out the s240 form

Before diving into filling out the s240 form, it's vital to gather all necessary information and documentation. This will not only streamline the process but also ensure accuracy. Key personal identification details include your full name, address, social security number, and any pertinent deductions or credits you plan to claim.

In addition to identification details, you'll need to assemble financial information such as your income statements, W-2 forms, or any other relevant financial documentation. Having everything organized can significantly ease the process, allowing you to focus on filling out the form accurately without unnecessary interruptions.

Step-by-step instructions for filling out the s240 form

Filling out the s240 form may seem daunting, but breaking it down into sections makes it manageable. The first section focuses on entering basic information such as your name, address, and social security number. Accuracy is critical here to avoid any processing delays or issues.

Proceeding to the financial reporting section, you'll report your income. Understanding financial terms used in this section is paramount. Be sure to double-check the amounts and ensure that all reported figures correlate with your documentation.

Editing and adding information to the s240 form

After completing the initial fill-out of the s240 form, users often find the need to make edits or updates. pdfFiller provides robust editing tools, enabling users to amend fields without a hassle. This adaptability helps ensure that you can make necessary changes swiftly, allowing for a seamless filing experience.

When editing your form, it is essential to remain compliant with all regulations. Ensure that any modifications still meet the necessary requirements and keep records of changes to submit accurate information.

Reviewing and submitting the s240 form

Once you've filled out your s240 form, a thorough review is essential. Inspect each section for accuracy and completeness, ensuring no crucial information is missing. Additionally, adhere to best practices for the final review to catch any potential errors.

When it comes to submission, users can choose between online or mail-in processes. Online filing can provide immediate confirmation, while mailing might require additional processing time. Be aware of typical processing times and keep track of your submission method for effective follow-ups.

Managing your s240 form online

With tools available at pdfFiller, managing your s240 form becomes a breeze. Users can store and retrieve completed forms from anywhere with an internet connection. This kind of accessibility is invaluable for individuals juggling multiple responsibilities and needing quick access to their documents.

Moreover, pdfFiller enables you to collaborate with team members on the same document. This feature enhances the ability to streamline your workflow, ensuring that everyone involved can contribute to the document effectively.

Troubleshooting common issues with the s240 form

Despite preparation, users may encounter various issues while filling out or submitting the s240 form. Common errors include incorrect information or missed fields. If you face any challenges, it’s advisable to consult resources or reach out to support services for assistance.

Utilizing the support options available through RevenueWIGov and pdfFiller ensures you have the backing to resolve any issue that might impede your filing process.

Interactive tools and features of pdfFiller for s240 form management

The interactive capabilities of pdfFiller bring an additional layer of ease when managing the s240 form. E-signatures are notably user-friendly, allowing for secure and authenticated signing directly within the platform without the need to print or scan documents.

Moreover, pdfFiller includes collaborative tools built for teamwork, enabling multiple users to work on the s240 form smoothly. This streamlined approach saves time and enhances productivity, ensuring all team members are in sync during the form-filling process.

Additional tips for efficient document management

To maximize efficiency in managing your s240 form and other documents, setting alerts for important deadlines is crucial. These reminders can help prevent last-minute rushes and complications with submissions.

Additionally, organizing multiple forms within pdfFiller helps maintain order. Utilizing data analytics from your document management can also provide insights into your filing habits, enabling you to refine and enhance your document handling.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit s240 form - revenuewigov in Chrome?

Can I create an electronic signature for the s240 form - revenuewigov in Chrome?

How do I complete s240 form - revenuewigov on an Android device?

What is s240 form - revenuewigov?

Who is required to file s240 form - revenuewigov?

How to fill out s240 form - revenuewigov?

What is the purpose of s240 form - revenuewigov?

What information must be reported on s240 form - revenuewigov?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.