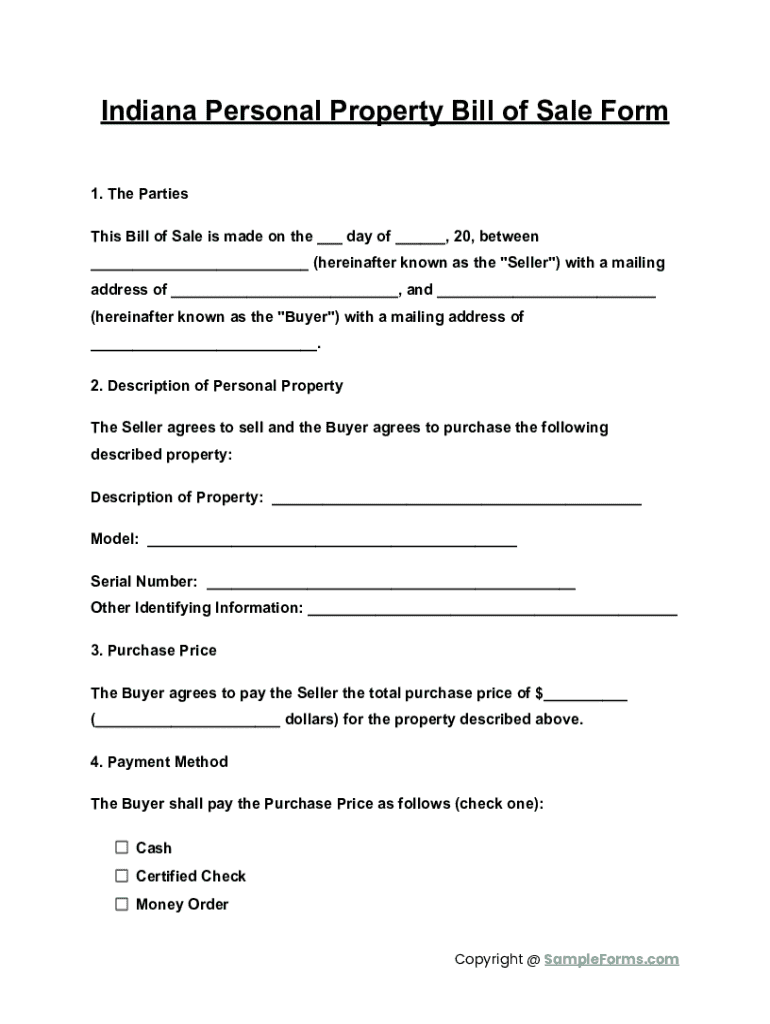

Get the free Indiana Personal Property Bill of Sale Form - Cloudfront.net

Get, Create, Make and Sign indiana personal property bill

How to edit indiana personal property bill online

Uncompromising security for your PDF editing and eSignature needs

How to fill out indiana personal property bill

How to fill out indiana personal property bill

Who needs indiana personal property bill?

Indiana Personal Property Bill Form Guide

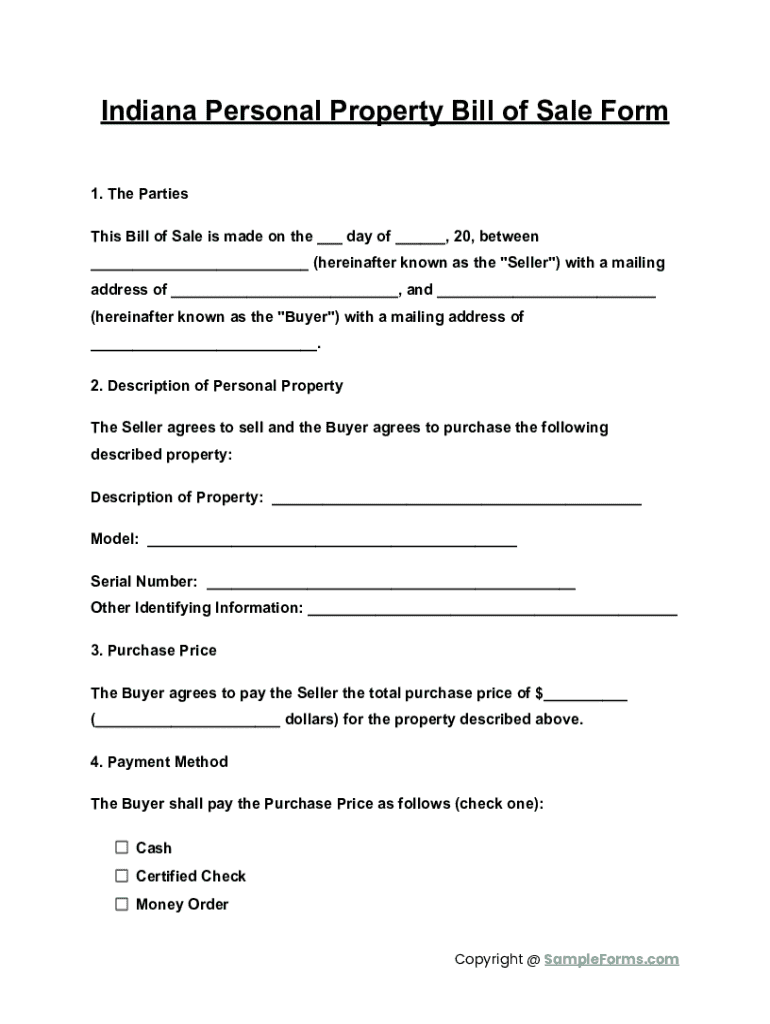

Understanding the Indiana Personal Property Bill Form

The Indiana Personal Property Bill Form plays a crucial role in the state’s property tax management system. In Indiana, personal property refers to movable items that are not attached to real estate, such as machinery, tools, and vehicles. The purpose of this form is to report such assets to the Department of Local Government Finance, ensuring accurate taxation and compliance with state laws. Failing to file this form can have serious implications for property owners and businesses, ranging from penalties to increased tax liabilities.

The form is not just a bureaucratic requirement; it provides the state with necessary information to assess and collect taxes fairly. For property owners, properly filling out this form is essential for maintaining their rights and avoiding unnecessary fines. Moreover, understanding the key deadlines and filing requirements is imperative for compliance.

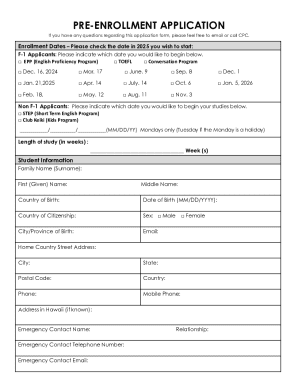

Key deadlines and filing requirements

Document features and specifications

The Indiana Personal Property Bill Form is both comprehensive and user-friendly. It is available online through the Indiana Department of Local Government Finance's website. You can access the form in various formats, primarily PDF and DOC, allowing for easy downloading and printing. The accessibility of this form is crucial for ensuring that all property owners can easily comply with state requirements.

It’s important to note that compliance with state mandates is a legal obligation for all property owners. The Indiana Code outlines specific regulations regarding personal property reporting, emphasizing thoroughness and accuracy. Any discrepancies can lead to audits, penalties, or denial of deductions, making understanding these legal obligations carefully essential.

Step-by-step guide to filling out the Indiana Personal Property Bill Form

Filling out the Indiana Personal Property Bill Form is an essential process that requires attention to detail. Here's a step-by-step guide to navigate through the form efficiently:

Tips for navigating the Indiana Personal Property Bill Form

While filling out the Indiana Personal Property Bill Form, there are several common mistakes to avoid. Many taxpayers forget to include all applicable property types or miscalculate their asset values. Ensure that you review each section carefully before submission. This kind of diligence can save you from audits or additional fees from the Department of Local Government Finance.

Additionally, best practices for accurate reporting include keeping meticulous records and receipts related to all your personal property. Utilize digital tools offered by platforms like pdfFiller that allow for easy management of your documents. This streamlined approach reduces stress and improves accuracy when managing your forms.

Interactive tools for enhanced document management

Utilizing interactive tools can significantly ease the process of filling out the Indiana Personal Property Bill Form. For instance, pdfFiller’s document editing features allow users to fill out forms digitally, saving time and reducing errors. With pdfFiller’s tools, you can add electronic signatures seamlessly, eliminating the need for printing and scanning.

Moreover, collaboration features in pdfFiller can facilitate team submissions. Sharing the form with financial advisors or accountants for feedback ensures that your filing is accurate and complete. Managing user permissions also allows for seamless collaborative editing, ensuring everyone involved can contribute effectively.

Utilizing pdfFiller for efficient form management

pdfFiller streamlines the document creation process, making the Indiana Personal Property Bill Form more manageable. To use pdfFiller effectively, navigate to their website, and select the Indiana Personal Property Bill Form template. You can fill out the form directly online, adjusting any section as needed without the hassle of physical paperwork.

Tracking and reporting submission status is another advantage of using pdfFiller. Once you submit your form through the platform, you can keep tabs on its status and any follow-up actions required. This feature ensures you stay informed about your tax obligations and can provide timely responses if needed.

Frequently asked questions (FAQs)

Many property owners have concerns regarding the Indiana Personal Property Bill Form. One common question is about response times from tax authorities after submission. Typically, you can expect to receive confirmation or a response within a few weeks, though this can vary based on local government workflows.

Another common issue arises when taxpayers realize they've made an error after submission. It’s important to contact the Department of Local Government Finance immediately to rectify any mistakes, providing details about the original submission and what needs to be corrected.

Sidebar resources and additional information

Educational resources from the Indiana Department of Local Government Finance are invaluable for those needing further assistance. Links to relevant state resources provide insights into property tax regulations and compliance requirements. Moreover, tax professionals can be instrumental in navigating complex personal property reporting.

Engaging visuals and supportive content

Visual aids can significantly enhance understanding of the Indiana Personal Property Bill Form. Consider illustrative examples of completed forms, showing how to navigate various sections and fill them out correctly. Infographics summarizing the filing process and presenting key deadline information can serve as quick references for property owners.

By utilizing these engaging materials alongside your written content, users are equipped with a holistic overview of the filing process, improving their overall experience with the Indiana Personal Property Bill Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my indiana personal property bill in Gmail?

How can I edit indiana personal property bill from Google Drive?

How do I fill out indiana personal property bill using my mobile device?

What is indiana personal property bill?

Who is required to file indiana personal property bill?

How to fill out indiana personal property bill?

What is the purpose of indiana personal property bill?

What information must be reported on indiana personal property bill?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.