Get the free Oklahoma Claim for Credit/Refund of Sales Tax

Get, Create, Make and Sign oklahoma claim for creditrefund

Editing oklahoma claim for creditrefund online

Uncompromising security for your PDF editing and eSignature needs

How to fill out oklahoma claim for creditrefund

How to fill out oklahoma claim for creditrefund

Who needs oklahoma claim for creditrefund?

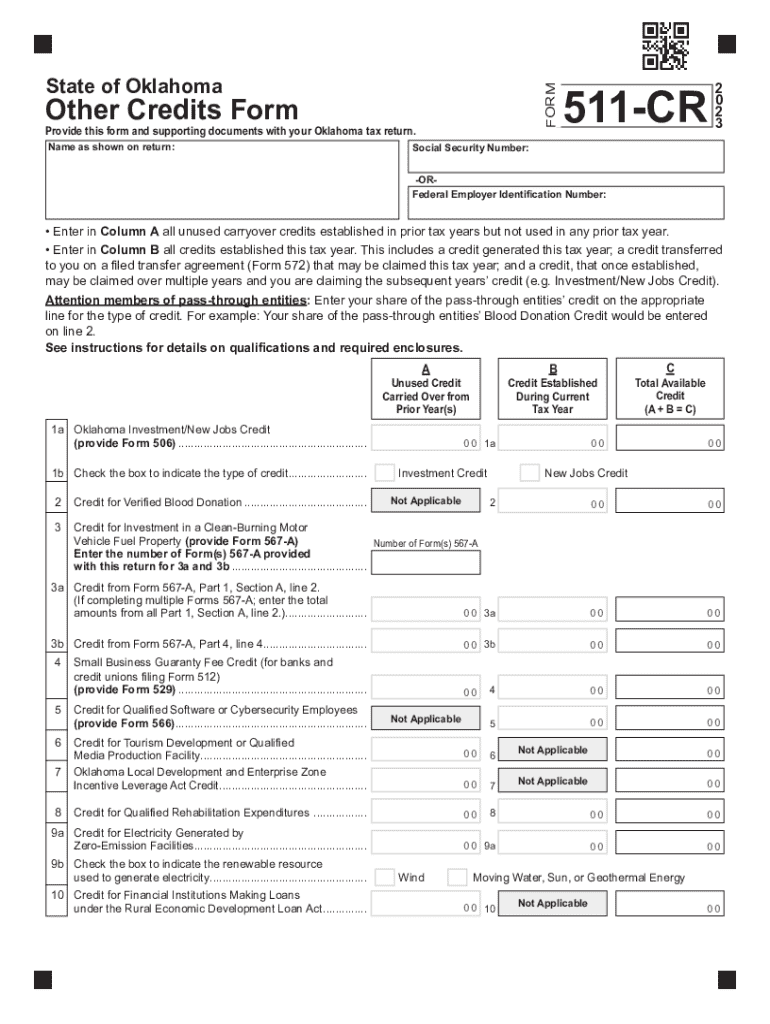

Understanding the Oklahoma Claim for Credit Refund Form

What is the Oklahoma Claim for Credit Refund Form?

The Oklahoma Claim for Credit Refund Form is a specific document utilized by taxpayers in Oklahoma to request a refund for overpaid taxes or credits claimed. This form facilitates the process of reclaiming funds from the state government, ensuring that individuals and businesses can correct errors from previous tax filings or claim eligibility for certain tax benefits that were not initially claimed.

Typically, situations necessitating the use of this form include overpayment due to mistakes in calculations, changes in tax credits eligible for claims, or errors made by the Oklahoma Tax Commission. Understanding when and how to use this form is crucial for anyone looking to manage their tax affairs effectively.

Who can use this form?

Eligibility to use the Oklahoma Claim for Credit Refund Form extends to both individuals and businesses that have paid taxes to the state of Oklahoma. This includes residents who filed taxes for personal income as well as businesses that have engaged in commercial activities within Oklahoma. To qualify for a refund, applicants must provide evidence substantiating their claim, such as tax returns or financial statements showing the overpayment.

Certain documents might differ based on whether the claim is for individual taxes or business taxes, hence it is important that applicants review their status before proceeding with the claims process.

Step-by-step guide to completing the form

Successfully completing the Oklahoma Claim for Credit Refund Form requires careful attention to detail. Begin by gathering all necessary information and documentation that supports your claim. This may include receipts for tax payments made, previous tax returns, or any additional documentation proving your entitlement to a refund.

When filling out each section of the form, follow these guidelines:

Common mistakes that could delay processing include forgetting to sign the form, incorrect amounts, or providing incomplete personal information. Always double-check your entries for accuracy before submission.

Important considerations before submitting

Before you submit your Oklahoma Claim for Credit Refund Form, it’s crucial to be aware of the deadlines for submission. Typically, the state allows a specific timeframe within which claims must be submitted following the tax year in question. Failing to submit within this timeframe may result in denial of your application.

There are various ways to submit your claim. You can submit the form online through the Oklahoma Tax Commission website, via mail, or in person at designated tax offices. Each option comes with its own set of guidelines to follow, so it's advisable to check the instructions carefully.

After submission, applicants can expect a processing time of up to several weeks, depending on the volume of claims and the complexity of each case. Keep a copy of your submission for your records and check your claim status through the Oklahoma Tax Commission’s online portal.

Resources for additional assistance

Navigating the claim process can be daunting. Therefore, having access to resources and support is invaluable. Here are some frequently asked questions that can help clarify common doubts regarding eligibility and processing timelines.

For those who require legal aid or support services, organizations that specialize in tax assistance can offer help navigating complex areas of tax law. These include local non-profits and governmental websites that provide valuable information about tax refund processes.

Interactive tools and features on pdfFiller

pdfFiller offers a range of features tailored for users completing the Oklahoma Claim for Credit Refund Form. The platform simplifies the process of filling and submission, providing an efficient way to manage your documentation online.

Key features of pdfFiller include:

These tools make it easier for individuals and teams to maintain clarity and organization while managing their claims.

User insights and success stories

Many users have shared positive experiences utilizing pdfFiller to complete their Oklahoma Claim for Credit Refund Form. Testimonials highlight the ease of use and time-saving aspects of the platform, allowing them to submit their claims confidently.

In addition, there are numerous case studies illustrating successful claims processed through thorough documentation and efficient submission methods. These stories provide motivation and guidance for new applicants looking to navigate their refund claims.

Legal considerations

Understanding your rights in the claim process is essential. Taxpayers should be informed about their rights concerning the information provided, confidentiality, and the appeal process in case of claim denial.

In the event your claim is denied, you have the right to contest the decision. It is advisable to gather any evidence or additional claims that can support your case. Engaging with a tax professional or legal advisor to navigate this process can help ensure your rights are upheld.

Conclusion of resources and next steps

Upon understanding the procedures and requirements surrounding the Oklahoma Claim for Credit Refund Form, it is imperative to navigate your tax obligations effectively. Regular consultations with tax professionals, staying updated with Oklahoma tax laws, and utilizing resources are instrumental in maintaining compliance. By fully understanding your rights and the necessary steps to manage your claims, you empower yourself to handle your tax matters efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my oklahoma claim for creditrefund directly from Gmail?

How do I edit oklahoma claim for creditrefund in Chrome?

Can I create an eSignature for the oklahoma claim for creditrefund in Gmail?

What is Oklahoma claim for credit refund?

Who is required to file Oklahoma claim for credit refund?

How to fill out Oklahoma claim for credit refund?

What is the purpose of Oklahoma claim for credit refund?

What information must be reported on Oklahoma claim for credit refund?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.