Get the free TAP Tax Fund Grants - Midway City

Get, Create, Make and Sign tap tax fund grants

How to edit tap tax fund grants online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tap tax fund grants

How to fill out tap tax fund grants

Who needs tap tax fund grants?

A Comprehensive Guide to the Tap Tax Fund Grants Form

Understanding Tap Tax Fund Grants

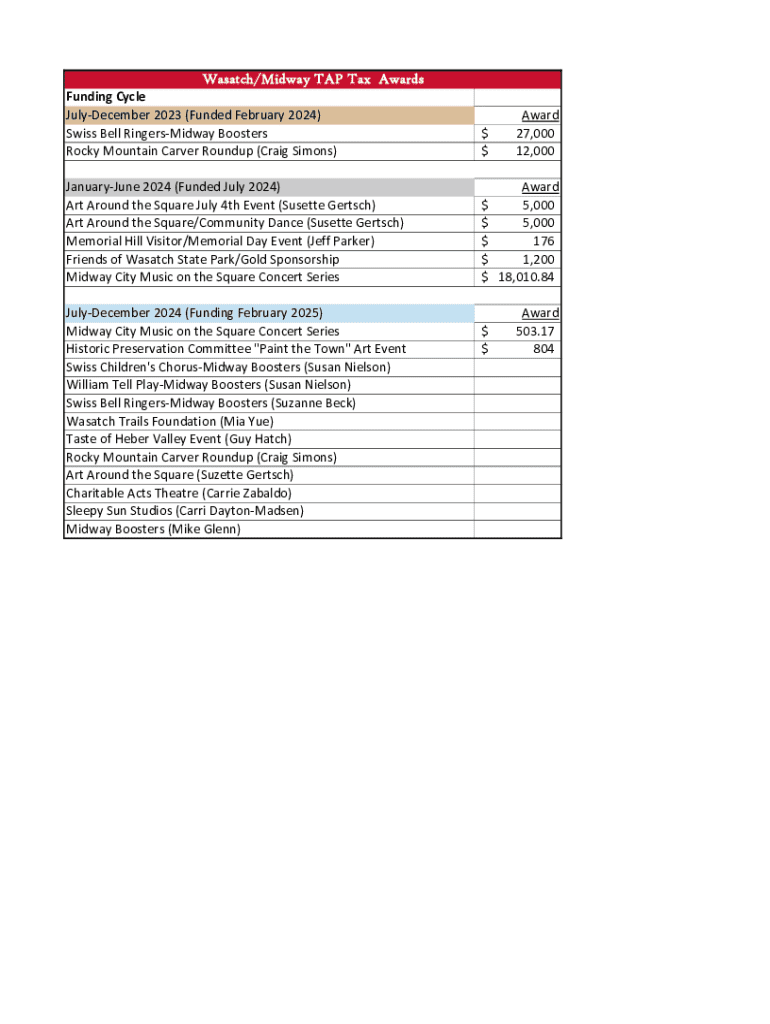

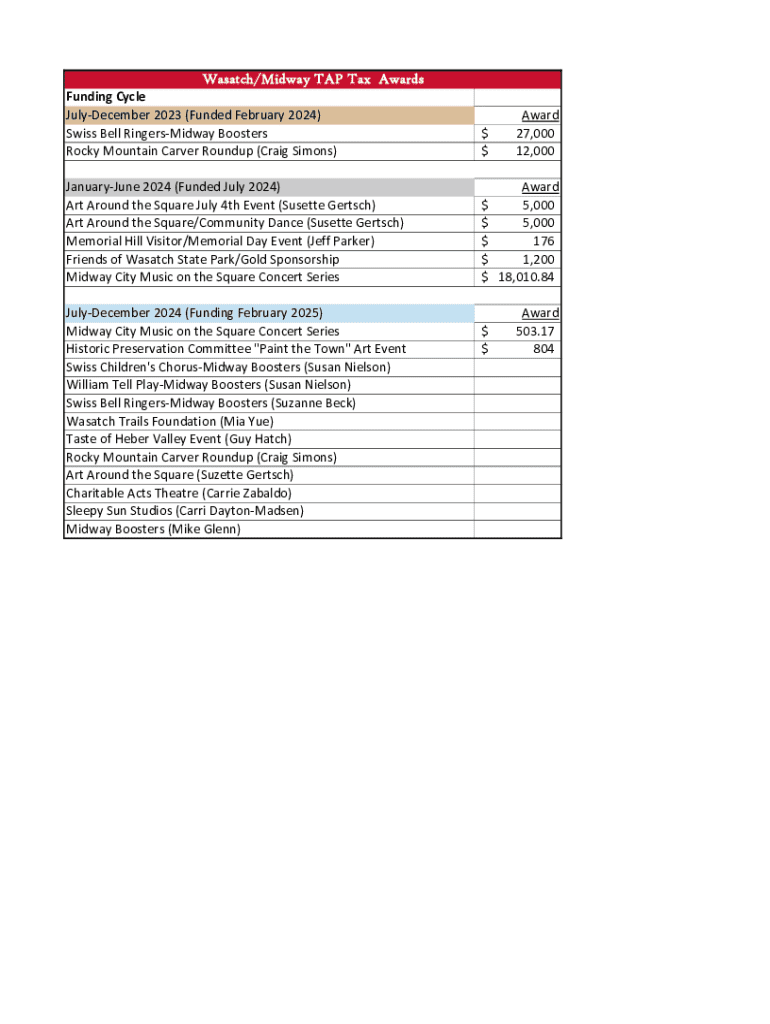

Tap Tax Fund Grants are financial awards provided by local governments or entities aimed at supporting specific projects that promote community development. These grants are primarily funded through local tax revenues, which are then redistributed to foster growth, innovation, and improvement in public services. The funds can be utilized for a wide range of initiatives, including education, infrastructure, and public health.

The purpose of these grants is to empower communities to address their unique needs, promote sustainability, and encourage local engagement. By providing financial assistance, Tap Tax Fund Grants aim to enhance quality of life, build economic resilience, and support initiatives that align with public interest.

Eligibility for Tap Tax Fund Grants typically includes non-profit organizations, local governments, schools, and community groups. However, nuances exist based on the specific funding source and the application criteria. It is essential to review the unique eligibility conditions for each grant program to maximize your chances of securing funds. Misconceptions about these grants often include the belief that only large organizations are eligible; in reality, many grants focus on grassroots efforts and community involvement.

Overview of the Tap Tax Fund Grants Form

The Tap Tax Fund Grants Form is a standardized document that applicants must complete to request funding. This form is designed to collect comprehensive information about the applicant, the proposed project, and the funding requirements. Key features often include sections for personal information, project descriptions, financial information, and required budget breakdowns.

Completing this form accurately is crucial, as any discrepancies or missing information can lead to delays or denial of the application. Fortunately, users can find the Tap Tax Fund Grants Form readily available on pdfFiller, where it can be downloaded or filled out directly online. Ensuring that all sections are completed thoughtfully will strengthen your application.

Step-by-step guide to filling out the Tap Tax Fund Grants Form

Step 1: Gather required information

Before you begin filling out the Tap Tax Fund Grants Form, it's essential to gather all necessary documentation. This may include identification, financial statements, nonprofit status verification, and any supplementary documents that relate to your proposed project. Understanding grant-specific requirements, such as specific information requested for educational initiatives versus infrastructure projects, is crucial.

Step 2: Online access and form retrieval

Accessing the Tap Tax Fund Grants Form is straightforward with pdfFiller. Start by navigating to the pdfFiller website. You can use the search function to locate the specific grant form. Ensure that you select the most recent version of the form, as outdated or incorrect forms can hinder your application process.

Step 3: Detailed instructions for each section of the form

Step 4: Reviewing your completed form

After filling out the form, reviewing it for accuracy is essential. Double-check all entries, and make sure that no crucial information is omitted. Utilize pdfFiller’s built-in review features, such as grammar checks and validation tools, to catch errors before submission.

Step 5: Submitting your form

Once you have finalized and reviewed your Tap Tax Fund Grants Form, it is time to submit it. Depending on the specific requirements set forth by the funding entity, you may submit the application either online through pdfFiller or via traditional mail. Keep in mind the submission deadlines to ensure your application is considered.

Strategies for successful grant applications

Understanding how the grant review process works can significantly enhance your application’s chances of acceptance. Grant reviewers are typically looking for alignment with their funding priorities, feasibility of the proposed project, and a well-structured budget. A compelling project narrative that connects your objectives to community needs can also set your application apart.

Additionally, key factors grant reviewers consider include clarity of your goals, the sustainability of the project after funding ends, and the capacity of your organization to execute the plan. Demonstrating strong community collaboration and alignment with local needs can also greatly enhance your standing in the selection process.

Managing your grant application with pdfFiller

pdfFiller presents engaging tools for managing your Tap Tax Fund Grants application efficiently. With eSigning capabilities, you can sign documents securely and quickly, ensuring that your application adheres to all necessary protocols. Collaboration features enable team involvement, allowing multiple contributors to refine the application.

Tracking your application status is easy with pdfFiller. You can save your progress, make revisions, and monitor your submission, providing peace of mind that your application is in good hands. This streamlines the often-daunting grant application process and fosters enhanced communication among team members.

Common issues and FAQs regarding the Tap Tax Fund Grants Form

Navigating the Tap Tax Fund Grants Form can be challenging, and common issues include missing documentation or incorrect entries. If you encounter a problem, revisiting the documentation checklist outlined earlier can help clarify what’s needed. For frequently asked questions such as eligibility standards or submission deadlines, refer to your local grant authority for tailored information.

Additional tools and resources available on pdfFiller

pdfFiller offers additional templates for various types of grant applications, enabling users to streamline their applications across funding sources. Document editing tools provided by pdfFiller make it effortless to customize applications to meet specific funder requirements, thereby enhancing clarity and focus.

Furthermore, exploring other resources on pdfFiller can uncover further funding opportunities tailored to your organization’s initiatives. The platform’s integrated approach to document management not only assists with grant applications but enhances overall operational efficiency.

Testimonials and success stories

Real-life accounts from previous beneficiaries of the Tap Tax Fund Grants illustrate the transformative impact of these funds on communities. For example, a local education nonprofit utilized its grant to launch specialized tutoring programs, resulting in significant improvements in student performance and engagement.

Other organizations have reported that securing the grant allowed them to expand their reach and influence within the community. These success stories serve as a testament to the possibilities that arise when dedicated teams pair their vision with available funding.

Encouragement for new applicants is vital, and learning from past successes can provide valuable insights into crafting effective proposals. Applicants should remember that funding bodies appreciate well-thought-out projects that clearly articulate community impact and sustainability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the tap tax fund grants form on my smartphone?

Can I edit tap tax fund grants on an iOS device?

Can I edit tap tax fund grants on an Android device?

What is tap tax fund grants?

Who is required to file tap tax fund grants?

How to fill out tap tax fund grants?

What is the purpose of tap tax fund grants?

What information must be reported on tap tax fund grants?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.