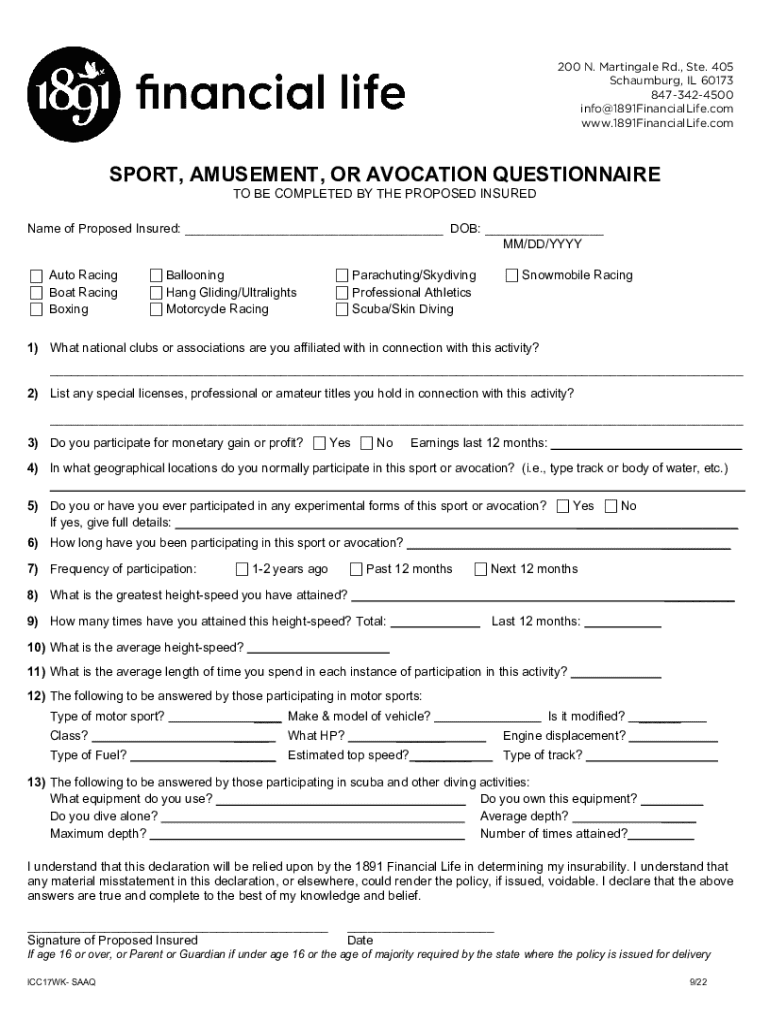

Get the free Name of Proposed Insured: DOB:

Get, Create, Make and Sign name of proposed insured

Editing name of proposed insured online

Uncompromising security for your PDF editing and eSignature needs

How to fill out name of proposed insured

How to fill out name of proposed insured

Who needs name of proposed insured?

Understanding the Proposed Insured Form: A Comprehensive Guide

Understanding the proposed insured form

The proposed insured form is a crucial document in the insurance application process, serving as a formal request for coverage for a specific individual or entity. Its significance cannot be overstated, as it establishes legal rights and obligations between the Insurance company and the proposed insured. When completing a proposed insured form, applicants must provide vital information such as their name, age, health status, and any other pertinent details that could impact the insurance policy.

The legal implications of accurately completing this form are profound. Any misinformation or omission may lead to denial of coverage, issues with claims, or even nullification of the policy. Thus, understanding the context of the proposed insured form within various insurance scenarios is essential for both individuals and businesses.

Who needs a proposed insured form?

Individuals seeking personal insurance often find themselves filling out a proposed insured form. This documentation is essential for securing protection against various risks, such as health-related expenses or untimely death in the case of life insurance. Accurately completing the form allows for proper assessment of coverage needs and potential premiums.

For businesses and organizations, the proposed insured form is equally vital. Corporate insurance often requires detailed information on multiple stakeholders. This is especially true in partnerships where multiple individuals may have a vested interest in the policy, necessitating clear designation on the proposed insured form.

How to fill out the proposed insured form

Filling out the proposed insured form efficiently is vital for a hassle-free insurance application. Begin by gathering necessary documentation, such as identification proof, medical records, and financial statements, which will be required in the form. The steps below outline the filling process:

A critical part of filling out this form is avoiding common pitfalls such as neglecting to include all dependents or misreporting health information, which could lead to coverage denial.

Utilizing interactive tools, such as fillable PDF forms available on pdfFiller, can streamline this process. These tools can assist you in making corrections, adding signatures, and securely submitting your completed form.

Managing your proposed insured form

After completing your proposed insured form, managing it effectively is essential. Here’s a guide on editing and modifying your submission if necessary. First, it’s helpful to know how to access your submissions on the pdfFiller platform. Log in to your account and navigate to the 'My Documents' section to locate the submitted form. If you need to make changes, select the document and use the editing tools to update your information.

For teams working together on insurance applications, collaboration is straightforward with tools provided by pdfFiller. Share links to your proposed insured form, allowing teammates to review and suggest changes in real-time. This ensures that all input is considered and that the final submission reflects a collective effort.

Proposed insured form variants

The proposed insured form can differ significantly based on geographic location and the entity that requires it. Each state or territory in the U.S. may have specific regulations governing insurance forms. For example, certain jurisdictions may require additional documentation, while others may have streamlined processes.

Differences also arise between organizations. Private companies may have distinct insurance requirements compared to non-profits or government bodies, which often have different obligations under the law. When completing your proposed insured form, it's vital to be mindful of these jurisdictional nuances.

On an international scale, proposed insured forms required in other countries may also differ in terms of language, required information, and even format. Always ensure that you understand the key differences to avoid potential issues during submissions.

Related terminology and definitions

Understanding terms related to the proposed insured form is crucial for navigating the insurance landscape. Terms like 'insured' refer to the person or entity covered by the insurance, while 'policy' denotes the actual contract outlining coverage terms, obligations, and commitments involved.

An additional term, 'liability,' indicates the responsibility of the insurer regarding any claims made under the policy. Familiarizing yourself with these definitions can significantly enhance your comprehension of the insurance process. A glossary can serve as a handy reference to clarify any confusion around commonly used jargon in insurance documentation.

Frequently asked questions (FAQs)

Many individuals have questions about the proposed insured form. For instance, one common query is, 'What if the proposed insured is also the policyholder?' In most cases, individuals can be both the proposed insured and policyholder but must ensure that all information is still accurately presented to avoid complications later on.

Another frequent question pertains to minors: 'Can a minor be listed as a proposed insured?' Typically, yes, but there are specific regulations that may govern this depending on the state or the type of insurance being applied for, necessitating consultation with an insurance professional.

Best practices for using the proposed insured form

To ensure the successful completion of the proposed insured form, a series of best practices can enhance accuracy and efficiency. Begin by organizing all necessary documentation ahead of time. This includes any identification materials, previous insurance policies, or medical records that could be relevant to the application.

Double-checking information for accuracy is equally important. Simple errors—like incorrect names, dates, or figures—can lead to complications or delays in securing coverage. The use of pdfFiller’s features, such as electronic signing and collaboration tools, can further streamline the process and provide a seamless document experience.

Case studies: Success stories with the proposed insured form

Numerous individuals and businesses have benefited from properly handling their proposed insured forms. For example, a couple newlyweds who accurately filled out their proposed insured form managed to secure a comprehensive health insurance plan that included both partners without any issues, showcasing the importance of correctness in such submissions.

Similarly, a startup expanded its liability coverage after careful completion of their proposed insured form, allowing them to operate confidently while minimizing risks. Gathering insights from these successful submissions highlights the value of thoroughness and attention to detail when navigating the complexities of the insurance landscape.

Conclusion: Your step towards a smooth insurance application process

Successfully managing the proposed insured form can greatly enhance your experience in the insurance application process. From understanding its significance to filling it out correctly, every step counts towards a smooth transition into coverage. Individuals and organizations are encouraged to utilize platforms like pdfFiller, which empower users to seamlessly edit PDFs, eSign, collaborate, and manage documents—all from a single, cloud-based platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit name of proposed insured from Google Drive?

How can I send name of proposed insured for eSignature?

How do I make edits in name of proposed insured without leaving Chrome?

What is name of proposed insured?

Who is required to file name of proposed insured?

How to fill out name of proposed insured?

What is the purpose of name of proposed insured?

What information must be reported on name of proposed insured?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.