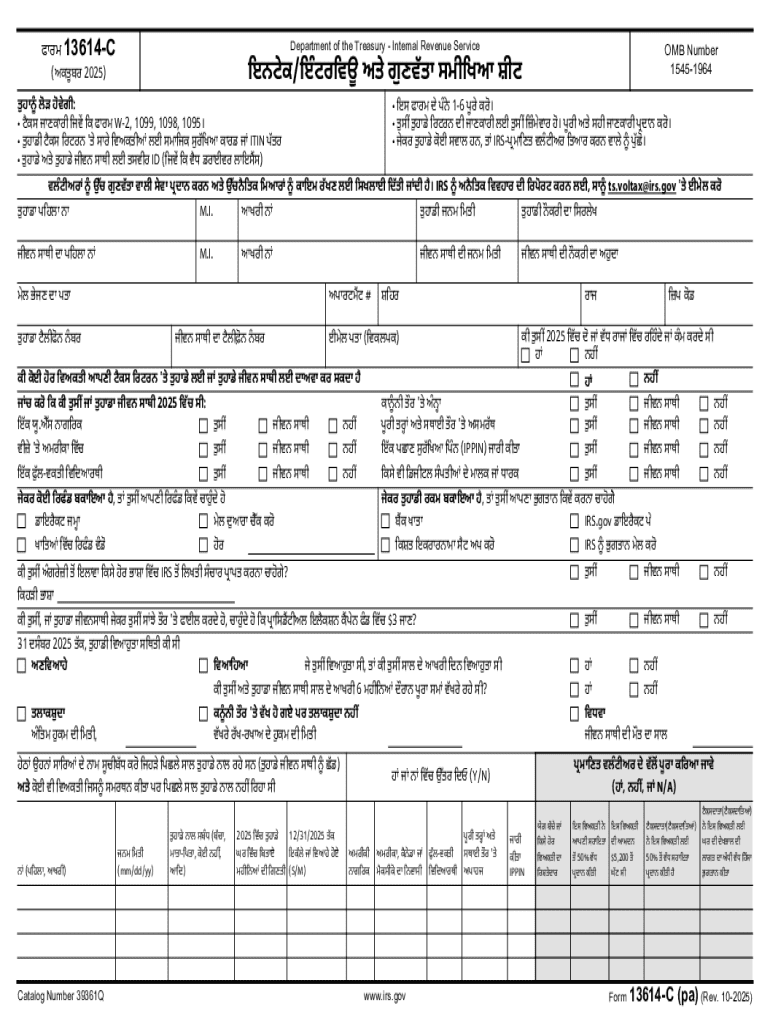

Get the free IRS Form 13614-C Intake/Interview & Quality Review Sheet

Get, Create, Make and Sign irs form 13614-c intakeinterview

How to edit irs form 13614-c intakeinterview online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 13614-c intakeinterview

How to fill out irs form 13614-c intakeinterview

Who needs irs form 13614-c intakeinterview?

Comprehensive Guide to IRS Form 13614- Intake Interview Form

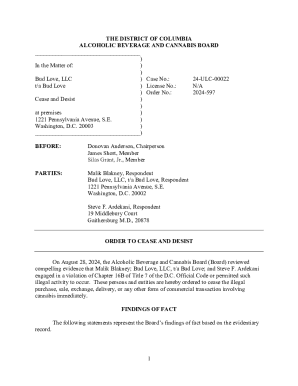

Overview of IRS Form 13614-

IRS Form 13614-C, known as the Intake Interview Form, is a key instrument in the tax filing process that aids taxpayers and volunteers in gathering essential information for accurate tax preparation. This form is crucial as it ensures that all necessary data is collected before filing, making the entire process smoother and helping individuals avoid common pitfalls associated with tax returns.

The Intake Interview Form serves multiple purposes: it assesses the taxpayer’s personal details, financial information, and specific tax situations. By using this form, taxpayers can better understand what documentation is required and what deductions and credits they may qualify for. Proper completion significantly influences the accuracy of the tax return and can lead to maximized refunds.

Preparing to Use the Form

Preparation is essential when utilizing IRS Form 13614-C. Gathering the relevant personal and financial information is crucial for accurate and complete submissions. Start by compiling your personal information, including your name, address, social security number, and filing status. Don’t forget to include details about any dependents, as this can affect your tax return significantly.

Financial information is just as vital. Collect documents outlining all sources of income, such as wages, freelance work, and investments. It's also necessary to understand potential deductions and credits that may apply to your situation, so keep track of expenses related to education, home ownership, or related financial circumstances. Awareness of unique situations like employment changes and major life events can further refine your understanding of your tax position.

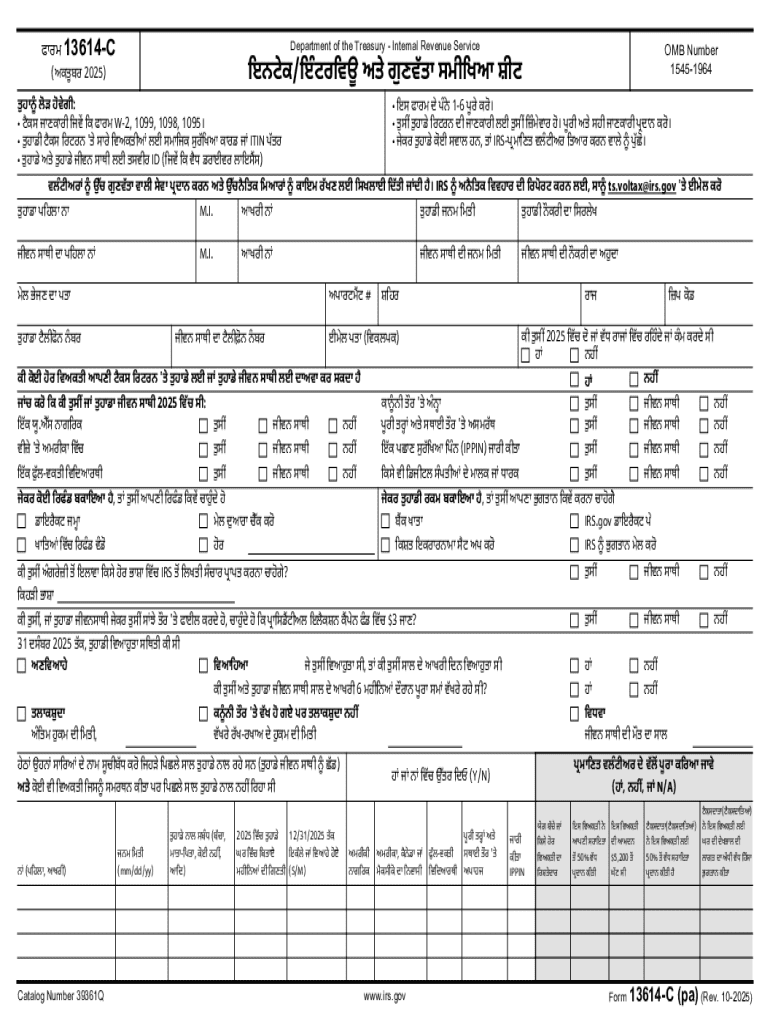

Step-by-step guide to filling out IRS Form 13614-

Filling out IRS Form 13614-C requires meticulous attention to detail. The form is divided into sections, and each segment plays a vital role in providing a complete picture of your financial situation. Start with the Personal Information section, being sure to check every entry for accuracy. Errors here can lead to delays in processing your tax return.

Moving on to the Income section, list every income source clearly. This includes wages, retirement distributions, and any rental income and must be reported accurately to avoid penalties. Finally, in the Credits and Deductions section, focus on maximizing your refunds by ensuring you claim all available credits such as the Earned Income Tax Credit (EITC) or lifetime learning credit. A comprehensive understanding of applicable deductions can significantly enhance your refund potential.

Interactive tools for completing Form 13614-

In today's digital age, multiple online tools can enhance the process of completing IRS Form 13614-C. One prominent option is pdfFiller, known for its fillable PDF features. This platform simplifies the preparation of IRS forms by allowing users to fill out, sign, and edit documents directly online. The advantages of using pdfFiller are significant, including intuitive navigation and the ability to save and share your completed forms easily.

The collaborative features offered by pdfFiller are particularly beneficial for those working with tax professionals. Users can securely share their forms, ensuring that both parties have immediate access to the most current data. This accelerates the review process, allowing for smoother communication and a quicker turnaround on filing your taxes.

eSignature and document management options

Once you’ve filled out IRS Form 13614-C, signing it electronically is a straightforward process with pdfFiller. The platform offers an easy step-by-step eSignature process that complies with all legal standards for electronic signatures. This means you can submit your form promptly without worrying about the validity of your signature. A significant benefit of eSigning is reduced processing time, allowing for rapid completion of your tax filing.

Managing your tax documents in a secure manner is crucial. With pdfFiller’s cloud-based document management, keeping track of your tax documents becomes convenient and organized. Users can categorize files, set reminders for important deadlines, and retrieve documents with ease, all while ensuring top-notch security protocols protect your sensitive data.

Frequently asked questions about IRS Form 13614-

Common inquiries regarding IRS Form 13614-C frequently arise among taxpayers. One of the primary questions is who must complete this form. Generally, individuals seeking assistance with tax preparation, especially through volunteer programs, are required to fill out this form. Moreover, it's important to understand how often this form should be updated, particularly if there are significant changes in your financial situation or family status.

Encountering challenges when filling out this form is also common. If you face difficulties, reaching out to the IRS directly for guidance can prove invaluable. They provide resources and assistance for any queries you may have to navigate the complexities related to tax filing.

Final tips for a successful tax filing process

As you approach the conclusion of your tax preparation journey using IRS Form 13614-C, keep in mind the best practices for submission. Double-check your completed form for accuracy and missing information; this vital step can save you time and hassle down the road. Understanding deadlines and submission options is equally important to ensure your return is filed on time and avoids penalties.

Leveraging comprehensive document solutions like pdfFiller can further enhance your tax filing experience. By managing all forms in one platform, you gain significant time savings and efficiency, allowing you to focus on other priorities while ensuring your tax obligations are met accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irs form 13614-c intakeinterview directly from Gmail?

How do I complete irs form 13614-c intakeinterview online?

Can I create an electronic signature for the irs form 13614-c intakeinterview in Chrome?

What is IRS Form 13614-C Intake Interview?

Who is required to file IRS Form 13614-C Intake Interview?

How to fill out IRS Form 13614-C Intake Interview?

What is the purpose of IRS Form 13614-C Intake Interview?

What information must be reported on IRS Form 13614-C Intake Interview?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.