Get the free Form 13614-C Intake Interview and Quality Review Sheet ...

Get, Create, Make and Sign form 13614-c intake interview

How to edit form 13614-c intake interview online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 13614-c intake interview

How to fill out form 13614-c intake interview

Who needs form 13614-c intake interview?

Complete Guide to Form 13614- Intake Interview Form

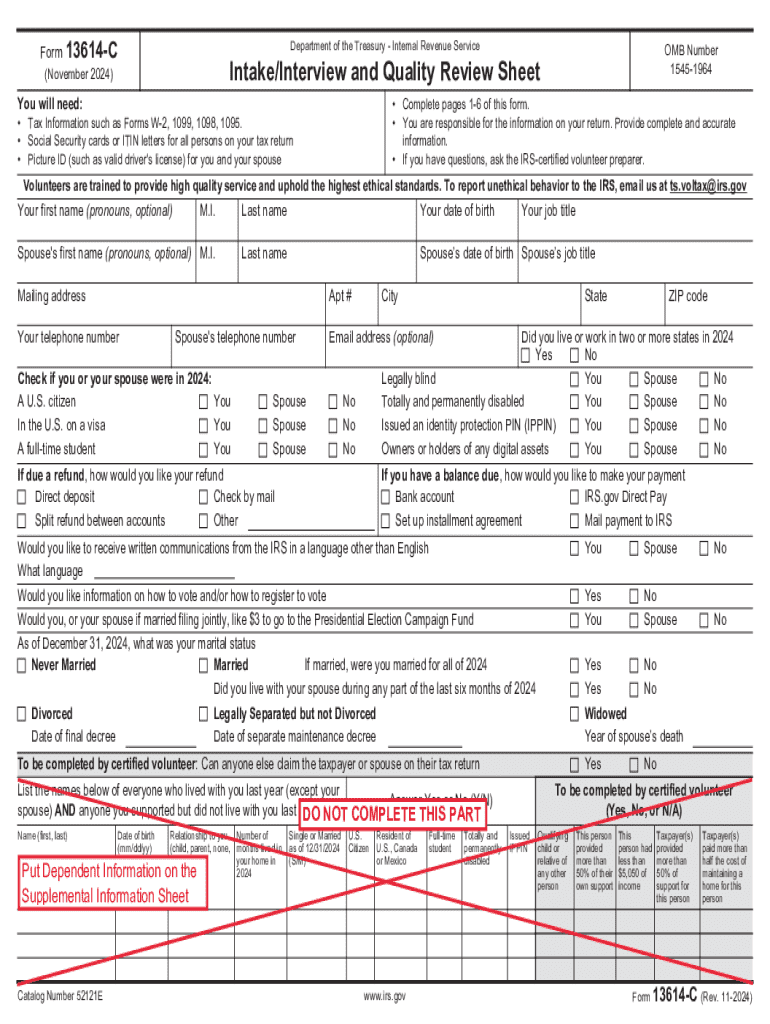

Understanding the Form 13614-

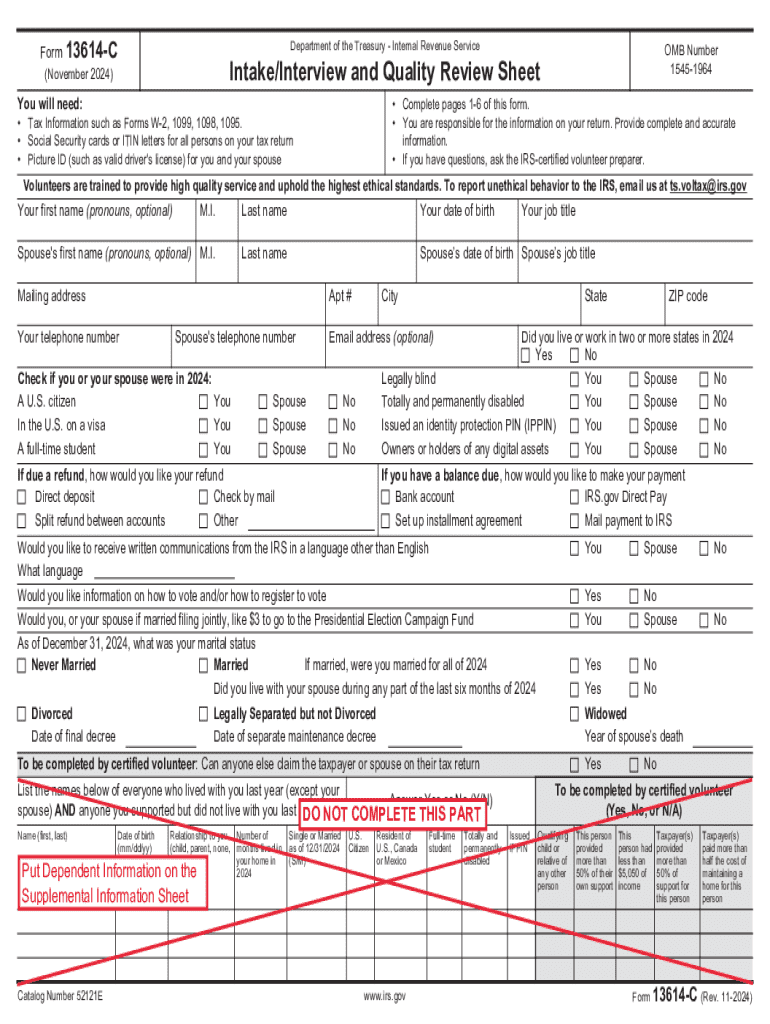

The Form 13614-C, also known as the Intake Interview Form, serves as a crucial document in the tax preparation process. This form is designed to gather essential information from taxpayers, allowing tax preparers to understand their financial situation comprehensively. By utilizing Form 13614-C, taxpayers can provide pertinent details that can effectively streamline their tax filing process.

The purpose of this form is not only to collect basic personal data but also to ensure that all necessary financial information is available for accurate tax returns. The accuracy and completeness of the information provided in this form are critical to prevent any issues during tax processing, which could lead to delays or penalties.

All taxpayers, tax preparers, and individuals filing taxes should be familiar with Form 13614-C. This form is particularly important during tax season, as it serves as the starting point for preparing returns. Taxpayers may need to complete this form if they have complicated financial situations or are filing taxes for the first time.

Key elements of the form

Form 13614-C consists of several sections that collectively help in organizing and assessing the taxpayer's financial situation. Each section has been thoughtfully arranged to ensure that no critical detail is overlooked. Users can better navigate the form by understanding its structure, which includes sections for personal information, income, deductions, and tax credits.

Completing the form accurately requires various personal details, including the taxpayer's name, Social Security number, address, and filing status. In terms of financial information, taxpayers need to provide data regarding income sources, such as W-2 wages, self-employment earnings, interest, and dividends, as well as any tax credits for which they may qualify.

Common mistakes when filling out Form 13614-C involve inaccuracies in names, incorrect Social Security numbers, and omissions of vital income or deduction sources. Taxpayers should pay special attention to detail and possibly seek a second pair of eyes during the review process to ensure accuracy.

Step-by-step guide to filling out the Form 13614-

Before filling out Form 13614-C, preparation is essential. Taxpayers should gather all necessary documents, including prior tax returns, W-2 forms, and documentation related to any deductions or credits. Creating a checklist can significantly enhance readiness and ensure no essential information is missed.

Once all necessary documents are at hand, taxpayers can begin filling out the form. The first section requires personal information, followed by details about filing status and dependents. Income sources, including wages and self-employment earnings, make up the next part, followed by deductions and credits, which can reduce tax liability.

After filling out the form, reviewing all sections for accuracy is critical. Taxpayers should confirm all requested information is accurately filled in and cross-check with source documents. A quality review ensures that inaccuracies do not lead to unnecessary complications during the tax filing process.

Utilizing pdfFiller for efficient form management

Accessing Form 13614-C is straightforward using pdfFiller. Users can quickly locate and download the form directly from the pdfFiller platform. This efficient online access streamlines the initial steps of tax preparation.

Editing the form is made simple with pdfFiller. Users can customize the document by adding text, making corrections, or even inserting digital signatures. The platform provides tools to annotate and add notes, ensuring that every detail is captured accurately.

For teams, pdfFiller offers collaborative functionalities that enable multiple users to work on the form simultaneously. This feature fosters real-time collaboration, ensuring that input from different team members is easily integrated.

Frequently asked questions (FAQs)

Taxpayers often have questions regarding Form 13614-C. For instance, if a mistake is made on the form, it's crucial to know the appropriate steps for rectification. Most errors can be amended; however, knowing the correct procedures will simplify this process.

Another common question revolves around electronic submission of Form 13614-C. Understanding whether electronic submission is acceptable improves efficiency in filing. Most importantly, if taxpayers cannot locate previous years' information, they should know how to address this issue appropriately. Fortunately, assistance is available through various channels, including tax professionals and resources indicated on the form.

Best practices for using the Form 13614-

Timing can significantly impact the efficiency of completing Form 13614-C. Taxpayers should aim to fill it out as soon as possible after gathering their documents. Early preparation allows ample time for quality review and the resolution of any unforeseen issues.

It is also vital to stay updated on any changes to tax laws that might affect the information required on Form 13614-C. Taxpayer situations vary widely, and understanding how to utilize the form in different contexts—such as for self-employed individuals or retirees—is critical for accurate tax filings.

Additional tools and resources

Using pdfFiller enhances the user's experience by offering interactive tools that assist in document management. For instance, the platform features document comparison tools to easily find discrepancies and templates for related forms, which can be a time-saver during the tax season.

Moreover, pdfFiller provides access to guides and articles that deliver further insights into tax preparation. These resources can illuminate common financial situations faced by taxpayers, providing a fuller understanding of how to navigate the complexities of tax responsibilities.

Support and contact information

If users require assistance with their Form 13614-C, pdfFiller offers robust customer support. Taxpayers can contact support directly through the platform for specific questions regarding the form. Additionally, there are comprehensive FAQs and a help center that guides users through common issues and inquiries.

Accessing help is straightforward, as pdfFiller provides multiple resources for users to navigate their concerns efficiently. This support system is a valuable asset for taxpayers looking to ensure flawless form completion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 13614-c intake interview online?

Can I create an electronic signature for the form 13614-c intake interview in Chrome?

How do I edit form 13614-c intake interview on an Android device?

What is form 13614-c intake interview?

Who is required to file form 13614-c intake interview?

How to fill out form 13614-c intake interview?

What is the purpose of form 13614-c intake interview?

What information must be reported on form 13614-c intake interview?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.