Get the free santa-rosa-county-tax-deed-surplus- ...

Get, Create, Make and Sign santa-rosa-county-tax-deed-surplus

How to edit santa-rosa-county-tax-deed-surplus online

Uncompromising security for your PDF editing and eSignature needs

How to fill out santa-rosa-county-tax-deed-surplus

How to fill out santa-rosa-county-tax-deed-surplus

Who needs santa-rosa-county-tax-deed-surplus?

Navigating the Santa Rosa County Tax Deed Surplus Form: A Comprehensive Guide

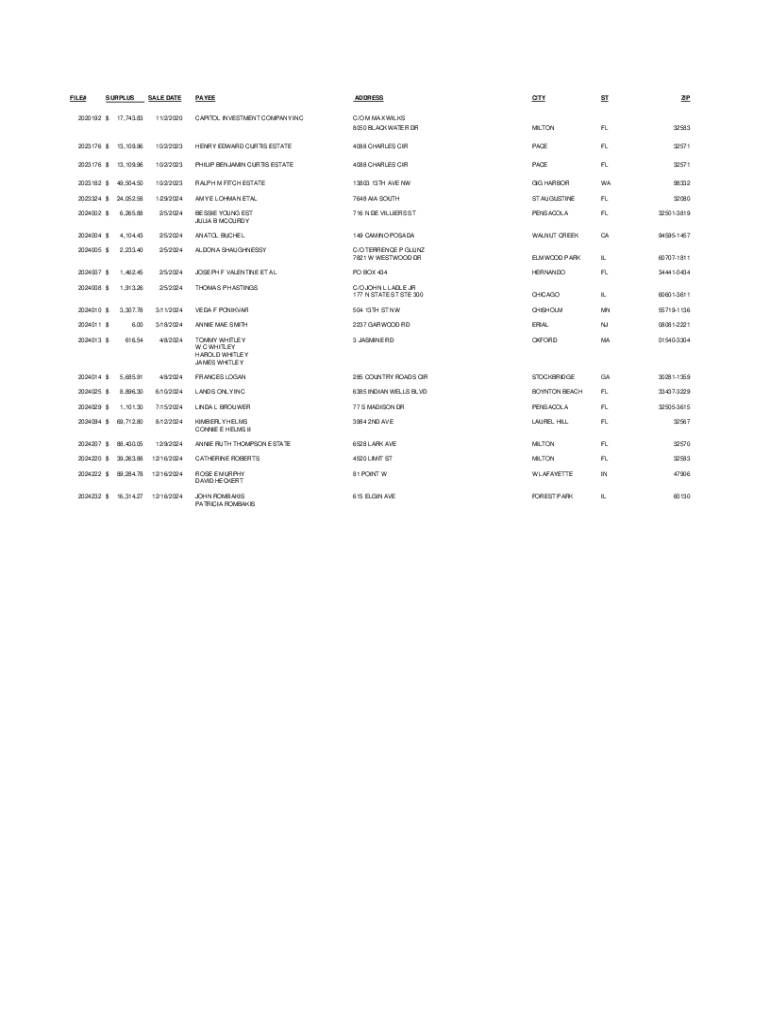

Understanding tax deed surpluses

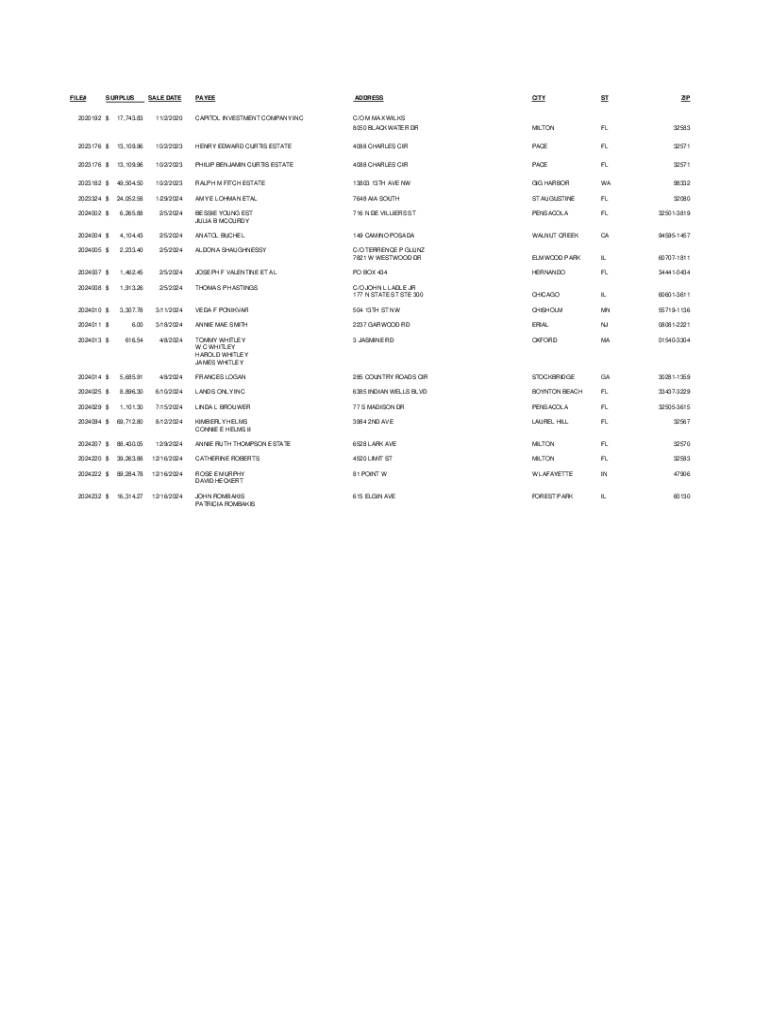

A tax deed surplus occurs when a property is sold at a tax deed auction for more than the total amount owed in delinquent taxes, fees, and costs. This surplus represents the excess funds that remain after settling the tax obligations. In Santa Rosa County, understanding tax deed surpluses is crucial for individuals involved in property tax sales, as it provides an opportunity to recover funds that may rightfully belong to previous property owners or lienholders.

The importance of tax deed surplus in Santa Rosa County cannot be overstated. Beyond the immediate financial implications, it highlights the legal responsibilities related to claims for surplus funds. Ensuring the correct processing of these claims can foster accountability and provide financial relief for individuals directly affected by property tax foreclosure actions.

Eligibility for tax deed surplus claims generally includes previous property owners, other lienholders, and parties that have a vested interest in the property. For individuals who may believe they are entitled to surplus mortgage funds or other claims resulting from the auction process, understanding the rules and requirements set forth by the Santa Rosa County Clerk's Office is essential.

The Santa Rosa County tax deed surplus process

The tax deed sale process in Santa Rosa County starts when a property’s owner fails to pay property taxes for a specified duration. This leads to a public auction where the property is sold to the highest bidder. The proceeds from this auction cover the delinquent taxes owed but may sometimes exceed the original owed amount, resulting in a surplus.

Surplus funds are generated after the sale concludes. Any money collected beyond the outstanding tax obligations and related fees, including court costs and attorney charges, creates a surplus pool. Understanding phrases like 'lis pendens’ and 'foreclosures’ is essential for those inquiring about tax deed surplus claims. Moreover, it’s important to note the role of the Clerk's office and the Department of Revenue in facilitating potential claims and distributing surplus funds.

Completing the Santa Rosa County tax deed surplus form

Filing a tax deed surplus claim requires careful attention to detail, starting with gathering necessary information before filling out the form. Individuals will need to provide property identification details, including the parcel number, as well as relevant tax deed information such as the auction date and sale information.

The form encompasses several sections that need to be completed meticulously. Section A focuses on claimant information, capturing all relevant personal data. Section B requires detailed property information needed to establish the claim, while Section C outlines the specifics of the claim itself. Accurate completion is essential to avoid delays or denials.

Interactive tools and resources for tax deed surplus

In a digital age, leveraging technology can greatly enhance the efficiency of managing tax deed surplus claims. pdfFiller offers an exceptional platform that enables users to fill out and edit documents online. Their document editor allows individuals to efficiently complete the Santa Rosa County tax deed surplus form with ease.

Besides editing, pdfFiller provides options for eSigning your completed forms, ensuring a smooth submission process without the need for printing and scanning. Collaborating with team members is also simplified through shared access features, making it easy to gather multiple signatures and input. For those concerned about tracking their submissions, tools provided by pdfFiller allow users to monitor the status of their forms, ensuring accountability and follow-up on claim processing.

Managing your tax deed surplus claim

Once you have submitted your tax deed surplus claim, understanding the review process is crucial. The Clerk’s Office will examine all submissions to confirm eligibility and accuracy. Recognizing the timelines involved can help manage expectations; typically, claims are reviewed within a designated timeframe.

After submission, applicants should expect to receive a notification regarding their claim status. If the claim is approved, further information on disbursement of funds will be provided. In some cases, should the claim be denied, an explanation will accompany that notification, presenting the opportunity for an appeal should the claimant believe the decision is unjust.

Frequently asked questions about tax deed surplus in Santa Rosa County

One frequent concern among claimants is the duration of the processing time. Processing claims can typically take anywhere from several weeks to a few months, depending on the volume of claims being reviewed and the complexity of individual submissions.

Another common question arises regarding the appeals process. If a claim is denied, claimants have the right to appeal the decision. It's important to carefully document the reasons for denial and provide substantial evidence as part of the appeal process. Lastly, failing to claim tax deed surplus money could result in the funds being retained by the county; thus, it is in the best interest of claimants to remain proactive in pursuing any surplus funds they believe they are owed.

Contacting Santa Rosa County for assistance

If further assistance or clarification is needed, claimants should reach out directly to the Santa Rosa County Clerk’s Office. Correspondence can be sent via mail or through phone inquiries. It’s crucial to have all relevant information and documentation at hand when making contact to ensure a swift resolution to inquiries.

For in-person visits, it's recommended to come prepared with required documents and to have any specific questions or details noted down. This preparation can make the visit more effective in addressing any concerns regarding the tax deed surplus process.

Links to key Santa Rosa County resources

For individuals interested in managing their tax surplus claims effectively, direct links to relevant Santa Rosa County resources are available. The Santa Rosa County Tax Collector’s Office provides extensive information regarding tax properties and payments which can be crucial for potential claimants.

Tracking down and utilizing resources available on the county site can help facilitate better understanding and awareness of property tax proceedings. Users can also find links to essential state and local tax resources that enhance knowledge and engagement with the tax deed surplus landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify santa-rosa-county-tax-deed-surplus without leaving Google Drive?

How can I get santa-rosa-county-tax-deed-surplus?

How do I fill out santa-rosa-county-tax-deed-surplus on an Android device?

What is santa-rosa-county-tax-deed-surplus?

Who is required to file santa-rosa-county-tax-deed-surplus?

How to fill out santa-rosa-county-tax-deed-surplus?

What is the purpose of santa-rosa-county-tax-deed-surplus?

What information must be reported on santa-rosa-county-tax-deed-surplus?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.