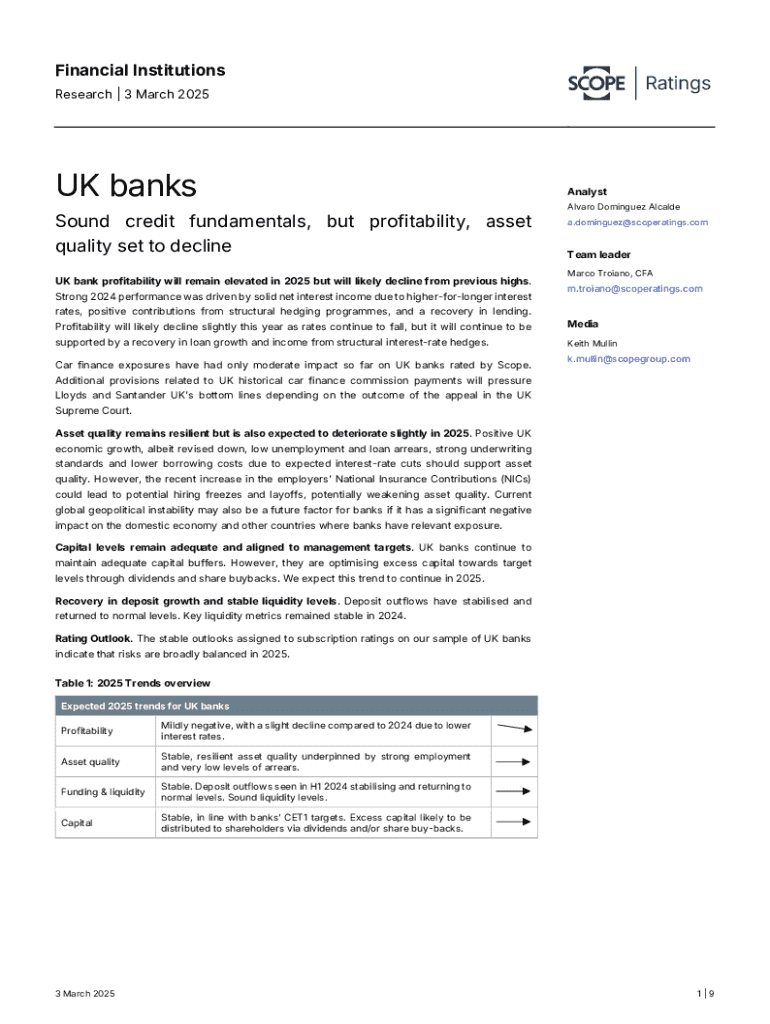

Get the free UK banks: Sound credit fundamentals, but profitability, asset quality ...

Get, Create, Make and Sign uk banks sound credit

Editing uk banks sound credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uk banks sound credit

How to fill out uk banks sound credit

Who needs uk banks sound credit?

UK Banks Sound Credit Form: A Comprehensive Guide

Understanding the sound credit form

The UK Banks Sound Credit Form is a vital document designed to assess an individual's or a business's creditworthiness. Its primary purpose is to provide banks with a standardized method to evaluate financial health, helping them make informed lending decisions. This form is essential for individuals seeking loans, mortgages, or business financing, as it reflects the financial stability and repayment ability of the applicant.

Sound credit reporting is crucial not only for borrowers but also for the banks themselves, as it enables them to minimize risks associated with lending practices. Key components of the Sound Credit Form include personal identification details, financial statements, and credit histories that detail borrowing and repayment behaviors, ensuring a comprehensive overview of the applicant's credit standing.

Eligibility criteria for submitting the sound credit form

Understanding eligibility is the first step towards a successful application for the Sound Credit Form. Individuals, including self-employed persons, and businesses may apply for the form, provided they meet specific guidelines set by financial institutions. The necessary documentation often required includes proof of identity, income verification, and previous banking relationships.

Common reasons applicants face rejections include incomplete information, poor credit histories, and discrepancies in personal financial details. Ensuring that all required documents are complete and accurate will improve the chances of successful application.

Step-by-step process to complete the sound credit form

Completing the Sound Credit Form can seem daunting, but breaking it down into manageable steps significantly eases the process. The first step is to gather all necessary information, including identification details such as your National Insurance number and financial history, which typically encompasses income sources, outstanding debts, and credit card usage.

Step 2 involves filling out the form meticulously. This includes addressing all detailed fields correctly — common sections include your employment information, monthly expenditure, and any other loans currently being serviced. It’s essential to provide as much detail as possible to present a clear financial picture.

Step 3 is reviewing your submission before sending it off. Double-checking the information helps avoid common mistakes, such as typos or incorrect numerical input, which could result in delays or rejections.

Filing the sound credit form

Once the Sound Credit Form is complete, the next step is filing it. There are options to submit online and offline, with online submission being the fastest method. For online submission, users typically navigate to their bank’s official website, fill out the form digitally, and hit submit. When opting for offline submission, the completed form must be printed and sent via post, ensuring you use a reliable mail service.

Processing times can vary, so understanding what to expect post-submission is vital. Generally, applicants can expect feedback within a few working days, but tracking the status of your application helps manage expectations and plan accordingly.

Utilizing pdfFiller for the sound credit form

pdfFiller provides a seamless solution for editing and managing the Sound Credit Form. Users can easily access and customize the form through this platform's user-friendly interface. Interactive tools streamline the editing process, allowing users to fill in information accurately and efficiently.

Digital signatures feature prominently within pdfFiller, allowing applicants to sign their forms electronically. The benefits of using eSignatures include expedited submission and enhanced security compared to traditional methods. Additionally, collaboration is made easy; users can invite partners or advisors to review the form for an extra layer of oversight.

Managing your submitted sound credit form

Once you have submitted your Sound Credit Form, it’s essential to manage it efficiently. Saving and storing your form securely in the cloud, particularly through pdfFiller, ensures you have access whenever needed. Utilize features that track modifications and versions made to your submission, contributing to better organization and record-keeping.

Post-submission, applicants should remain aware of their rights and options. Understanding how to address any concerns or discrepancies regarding the information provided fortifies one’s position and can lead to more favorable outcomes with financial institutions.

Common challenges and solutions when using the sound credit form

While submitting the Sound Credit Form is generally straightforward, various challenges can arise. Common issues faced during the completion process include ambiguity regarding specific fields or difficulty in gathering all necessary documentation. It’s beneficial to refer to resources or contact a bank representative for clarity.

Troubles with the submission process can arise, especially for those opting for offline methods. Ensuring that forms are securely packaged and sent via a reliable service can mitigate these risks. In cases where errors are identified post-submission, it's critical to contact the bank immediately to rectify these issues to reduce potential negative impacts on your credit application.

Further information and support

For any queries regarding the Sound Credit Form, it's essential to reach out to your respective UK bank directly. Most banks offer various customer support options, including phone support, online chat, and email, all tailored to assist clients throughout the application process.

Additionally, pdfFiller provides helpful customer support for users encountering challenges with their forms. Navigating frequently asked questions can provide rapid solutions while saving time and effort.

Frequently asked questions (FAQs)

One common question is, 'What happens if my application is denied?' In most cases, banks will provide feedback explaining their decision, enabling you to understand areas requiring improvement. Focusing on improving your credit score prior to applying can significantly enhance your chances — common strategies include paying down existing debts and maintaining timely payments.

Another important aspect is understanding submission deadlines. It’s critical to stay informed about any timelines involved with the Sound Credit Form application process, as this can influence the outcome efficiency and your eligibility for various financial products.

Future trends in credit reporting and form management

The banking sector is undergoing significant innovations in credit reporting and management practices. Emerging technologies are transforming how creditworthiness is assessed, with AI and digital tools enhancing accuracy and efficiency. Additionally, platforms like pdfFiller are at the forefront of this evolution, offering users an integrated approach to document management that simplifies form creation and increases overall efficiency.

Looking ahead, increased automation and real-time data utilization will likely become standard practices, shifting how both consumers and financial institutions engage in the credit assessment process. As these advancements evolve, staying informed will be paramount for individuals and businesses alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify uk banks sound credit without leaving Google Drive?

How can I fill out uk banks sound credit on an iOS device?

How do I edit uk banks sound credit on an Android device?

What is uk banks sound credit?

Who is required to file uk banks sound credit?

How to fill out uk banks sound credit?

What is the purpose of uk banks sound credit?

What information must be reported on uk banks sound credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.