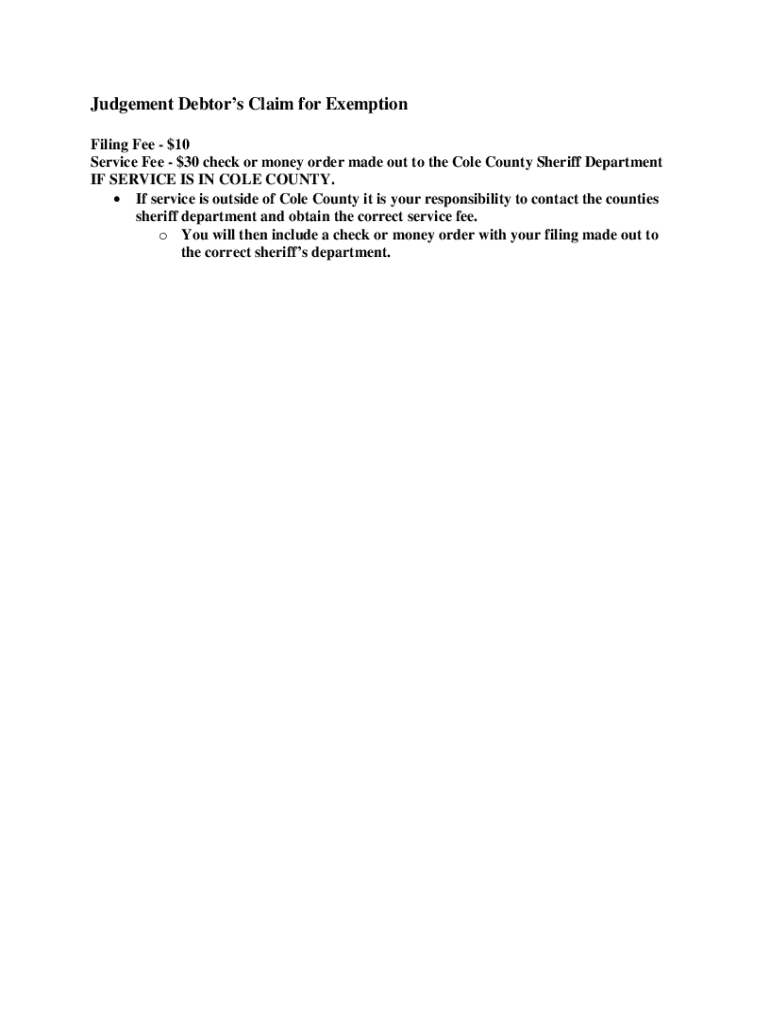

Get the free Judgement Debtor's Claim for Exemption

Get, Create, Make and Sign judgement debtor039s claim for

How to edit judgement debtor039s claim for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out judgement debtor039s claim for

How to fill out judgement debtor039s claim for

Who needs judgement debtor039s claim for?

Understanding the Judgement Debtor's Claim for Form

Understanding the judgement debtor's claim

A judgement debtor is an individual or entity that has been ordered by the court to pay a sum of money to another party, typically referred to as the creditor, as a result of a court judgment. The judgement debtor’s claim for form is an essential process through which the debtor can formally declare relevant information about their financial status, such as income and debts, to the creditor or court involved. This claim is crucial for both parties to understand the debtor’s capacity to satisfy the judgement.

Filing a judgement debtor's claim is important as it establishes transparency and can lead to a resolution of the debt more amicably. The process involves completing the claim form accurately, providing details on income, outstanding debts, and any additional pertinent information. This submission not only facilitates the creditor's understanding but also ensures the debtor is protected under applicable bankruptcy laws.

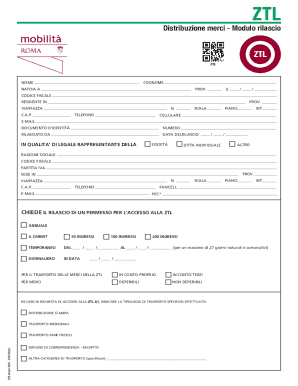

Key components of the judgement debtor's claim form

The judgement debtor's claim form is structured into several essential sections. Firstly, the Claimant Information section requires you to enter details regarding the creditor or the entity authorized to receive the judgment payment. This might include names, addresses, and relevant contact information.

Following that, the Debtor’s Information section stipulates where you enter personal details about the judgement debtor, which may include names, addresses, social security numbers, and other identification. Then, the Details of the Judgement section captures specifics about the original court judgement, including the amount owed, the date of the judgment, and the case number.

In addition to the completed form, certain attachments may be required, such as a copy of the original judgement, any prior claims, or additional financial statements that support your claim.

Step-by-step instructions for completing the form

To ensure a comprehensive submission, follow these steps diligently. In Section 1, Filling in Claimant Information, it's important to accurately fill in all requested fields. Include full names, addresses, and contact information. Remember, clarity matters, especially in legal documents.

Moving to Section 2: Debtor’s Information, pay close attention to name spellings and verification against official documents to avoid errors that could delay processing. Ensure that all personal identifiers are correct, as this section can lead to common pitfalls if overlooked.

For Section 3: Entering Details of the Judgement, ensure the information mirrors what is recorded in the court documentation. Accurate representation is critical to bolster your claim’s validity. Finally, for Section 4: Submission Guidelines, familiarize yourself with the method of submission, whether it’s electronic or via mail, and ensure that you meet all required deadlines.

FAQs related to the judgement debtor’s claim

When processing a judgement debtor's claim, it is common to wonder about timelines. Generally, processing can take anywhere from a few weeks to several months, depending on the court's workload and the complexity of the case. Can I amend a submitted claim form? Yes, amendments can be made, typically within a stipulated timeframe, but check court procedures for specific guidelines.

Additionally, what happens if my claim is disputed? There may be a follow-up hearing scheduled where both parties can present their evidence. Being prepared with documentation and possibly legal counsel can significantly aid in resolving disputes.

Importance of accuracy when filing the claim

Accuracy is paramount when filing the judgement debtor's claim as any inaccuracies or incomplete fields can lead to delayed processing or outright rejection of the claim. Misrepresentations can also lead to serious legal penalties or loss of credibility in court proceedings. Simple errors such as typos, missing signatures, or incorrect figures can complicate or derail your case.

Best practices for ensuring your form is completed accurately include double-checking all entries, consulting a legal professional if necessary, and creating a checklist based on the form’s requirements. By utilizing tools like pdfFiller, which offers users several features designed to increase efficiency and accuracy, such as editing capabilities and tracking changes, you can significantly enhance the quality of your submission.

Common mistakes to avoid when completing the claim form

First-time filers often make a variety of common errors that can undermine their claim's validity. One frequent mistake pertains to failing to provide complete and accurate debtor information, particularly full legal names and addresses, which may result in dismissal. Another is misunderstanding the specifics of the judgement, leading to inconsistencies in figures reported.

To ensure your form is error-free, establish a methodical approach where you review each section carefully before submission. Using tools like pdfFiller can aid in catching mistakes, as it provides real-time error checking and suggestions to guide you towards accurate submissions. It’s advisable to seek feedback from peers or advisors who can provide an extra set of eyes before your final submission.

Utilizing pdfFiller for document management

pdfFiller offers an array of features that facilitate not just filling out forms but also signing and managing documents securely and efficiently. The platform allows for easy edits, ensuring that your submitted documents reflect the correct information no matter where you finalize your work. Additionally, you can sign documents digitally, which expediates the entire process.

Collaboration is seamless within pdfFiller, allowing you to work on the judgement debtor's claim in teams. Team members can concurrently edit documents or provide input on different sections, enhancing the quality while ensuring compliance with requirements. This accessibility transforms document management from a tedious task into a streamlined workflow.

Useful tips for managing your judgement debtor's claim

As you embark on managing your judgement debtor's claim, keeping track of critical deadlines is essential. Set reminders or utilize project management tools to ensure no deadlines are missed. When additional information is requested by the court or creditor, respond promptly to maintain good standing and demonstrate your willingness to cooperate.

Staying organized during the process means maintaining a dedicated file for all documentation related to the claim, including copies of submitted forms, correspondence from creditors, and any records concerning the judgement itself. Establish a habit of documenting communications and responses received, as this can provide clarity should disputes arise.

Enhancing your workflow with integrated tools

pdfFiller not only assists in filling out documents but also provides integrated digital signing options, which can save you time in the submission process. E-signatures are legally recognized and can expedite the turnaround on claims and approvals, particularly when you’re managing multiple documents or working with different parties.

Moreover, using templates within pdfFiller can enhance efficiency, allowing you to pre-fill commonly used information, saving you time during the next filing. The benefits of cloud-based document editing and management are paramount, offering you access to your forms from anywhere, facilitating quick edits or reviews regardless of your location.

Success stories: Real-life applications of the judgement debtor's claim

Through effective use of the judgement debtor's claim form, many individuals have successfully resolved long-standing debts and clarified their financial status with creditors. One noteworthy case involved a small business owner who, utilizing the judgement process, was able to incorporate detailed financial disclosures that led to a negotiated settlement with their creditors, significantly alleviating their financial burden.

Testimonials from users of pdfFiller indicate the platform's effectiveness in streamlining the preparation of these claims. Many have expressed appreciation for the ease of access, collaboration features, and ability to ensure accuracy, which ultimately led to faster resolutions in their favour. These real-world applications highlight pdfFiller’s role in optimizing both individual and team workflow during the claim process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the judgement debtor039s claim for in Chrome?

Can I create an electronic signature for signing my judgement debtor039s claim for in Gmail?

How do I edit judgement debtor039s claim for on an iOS device?

What is judgement debtor's claim for?

Who is required to file judgement debtor's claim for?

How to fill out judgement debtor's claim for?

What is the purpose of judgement debtor's claim for?

What information must be reported on judgement debtor's claim for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.