Get the free Draft Assessment Roll

Get, Create, Make and Sign draft assessment roll

Editing draft assessment roll online

Uncompromising security for your PDF editing and eSignature needs

How to fill out draft assessment roll

How to fill out draft assessment roll

Who needs draft assessment roll?

Ultimate Guide to Draft Assessment Roll Form

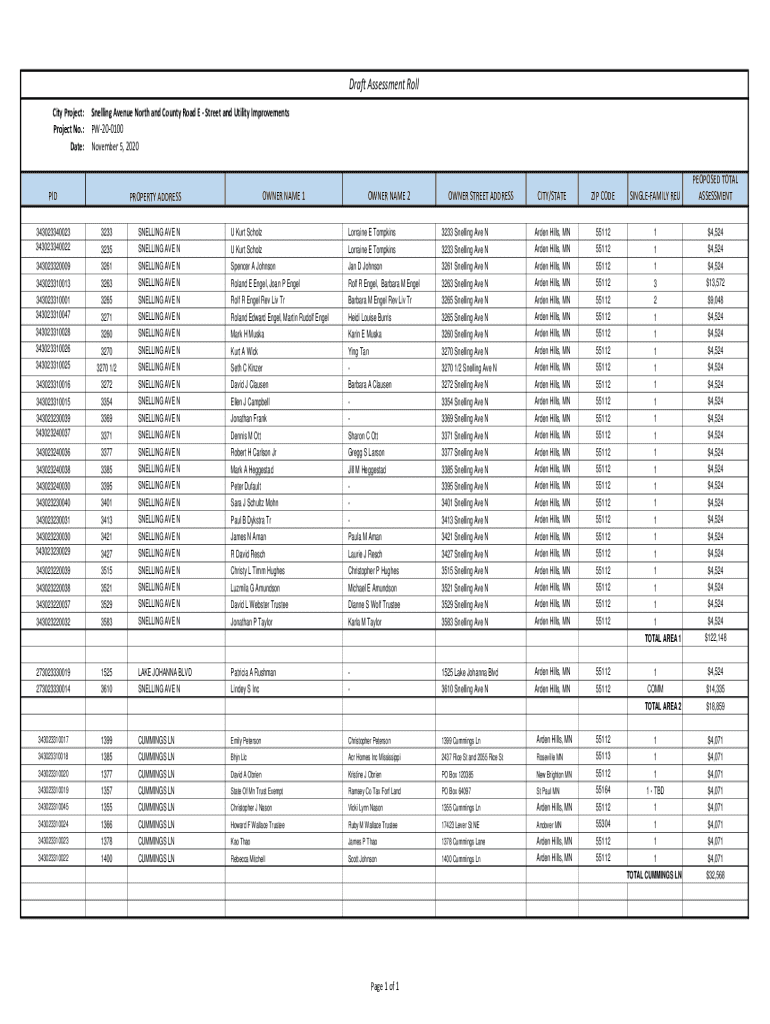

Understanding the draft assessment roll form

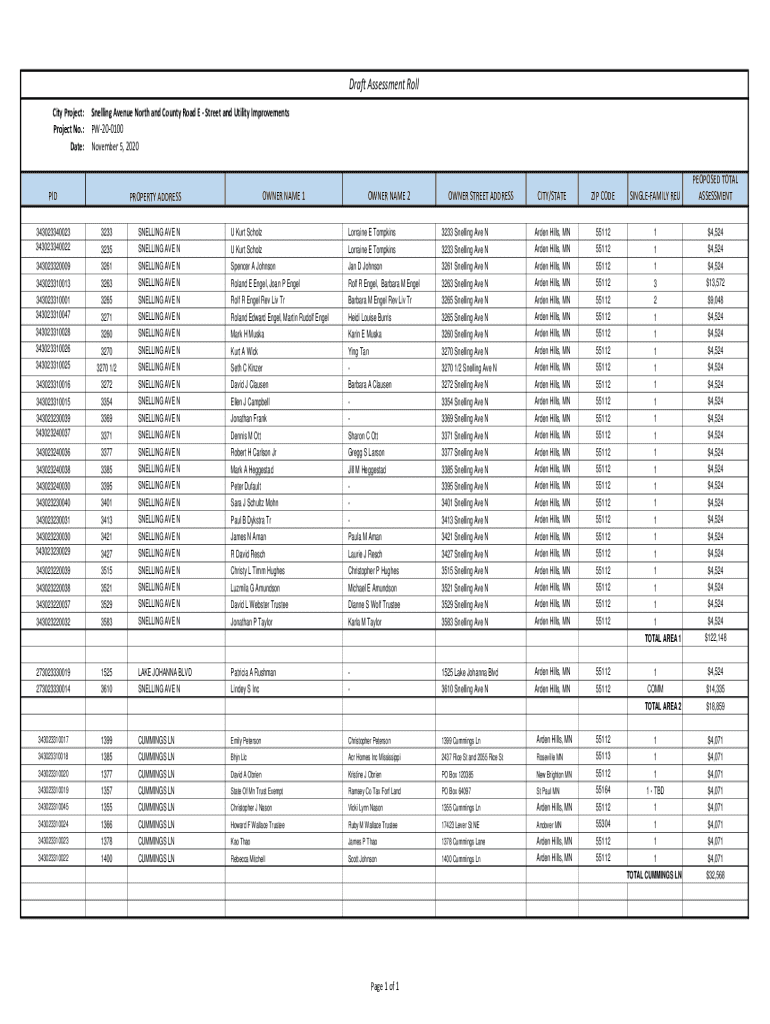

The draft assessment roll form serves as a pivotal document in the realm of property taxation. It acts as an initial draft that details properties subject to tax and their assessed values, providing both a basis for tax calculations and a reference for property owners. This form is crucial for local governments as it establishes a transparent method for determining property values, ensuring that taxation is fair and equitable.

The importance of the draft assessment roll cannot be overstated. It not only influences local revenue collection but also impacts the value and equity of properties within a jurisdiction. A well-prepared draft assessment roll aids in fostering trust among property owners, ensuring they are informed about how their taxes are calculated.

Key components of the draft assessment roll form

The draft assessment roll form comprises several key components essential for accurate property assessments. The property details required include:

Additionally, valuation information sections in the form are crucial. These include computations for:

Finally, the form must include a signature block and certification requirements. Signatures ensure that the information provided has been verified by the appropriate authority, thus adding a layer of legitimacy to the assessment.

Step-by-step instructions for completing the draft assessment roll form

Completing the draft assessment roll form can seem daunting, but breaking it down into manageable steps makes the process more straightforward. Here’s how to do it:

Interactive tools for managing your draft assessment roll form

pdfFiller offers a suite of interactive tools designed to simplify the management of your draft assessment roll form. One of the standout features includes editing tools that allow users to customize forms effortlessly.

You can collaborate with team members on property assessments in real time. This feature is particularly useful for teams handling multiple properties, as it enables seamless sharing and feedback.

Moreover, the eSignature integration streamlines the approval processes. Users can securely sign the document online, eliminating the need for physical copies and speeding up the submission process.

Frequently asked questions regarding the draft assessment roll form

Property owners often have questions about the draft assessment roll form. Here are some common queries:

Best practices for maintaining accurate property assessments

Maintaining accurate property assessments requires diligence and regular updates. Start by regularly updating property details and values to reflect current market conditions.

Annual reviews of assessment rolls should be a standard practice. This allows property owners to stay informed about their property’s value and taxation, ensuring no discrepancies.

Organizing and keeping records accessible is equally important. By creating a digital filing system or using reliable document management software like pdfFiller, users can easily retrieve necessary documents for any updates or inquiries.

Navigating common challenges

Filling out the draft assessment roll form may present certain challenges. Technical issues, such as difficulty with online submissions or form processing errors, can arise, particularly during peak submission periods.

It's vital to understand local regulations and requirements before submissions to prevent delays. Preparation is key, and being aware of changes in assessment criteria or processes helps mitigate unexpected hurdles.

For those facing recurring issues, consider reaching out to technical support services or utilizing online forums dedicated to local governance matters.

Leveraging pdfFiller to enhance your draft assessment roll experience

pdfFiller provides a range of features designed for efficient document management. From editing capabilities that allow users to easily customize their draft assessment roll forms to comprehensive storing options, pdfFiller ensures you remain organized and efficient.

The platform simplifies the editing, signing, and storing process, making it ideal for property managers or individuals who frequently manage several properties. Users report increased accuracy and reduced turnaround times for assessments by using pdfFiller.

Success stories highlight how teams have streamlined their property assessment processes through pdfFiller, allowing for better collaboration and improved response times in handling detailed property assessments.

Exploration of related forms and documents

Understanding related documents can ease the assessment process. Other important forms pertaining to property assessments include appeal forms and exemption applications. Being familiar with these documents ensures you are well-prepared for any scenario that may arise.

Accessing additional template resources available on pdfFiller can demystify the documentation process, making it easier for individuals and teams to navigate property assessments effectively. These resources often include step-by-step guides and templates customized for various jurisdictions.

Insights from local governance

Each jurisdiction may handle assessment roll submissions differently. Understanding these local nuances is crucial for compliance and accuracy. For instance, some areas might have specific requirements for submitting exemptions and amendments, while others may not.

Staying informed about local tax laws and regulations is imperative. Property owners should frequently consult their local tax authority's website or subscribe to newsletters that outline any legislative changes or updates related to property assessments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find draft assessment roll?

How do I edit draft assessment roll in Chrome?

How do I fill out the draft assessment roll form on my smartphone?

What is draft assessment roll?

Who is required to file draft assessment roll?

How to fill out draft assessment roll?

What is the purpose of draft assessment roll?

What information must be reported on draft assessment roll?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.