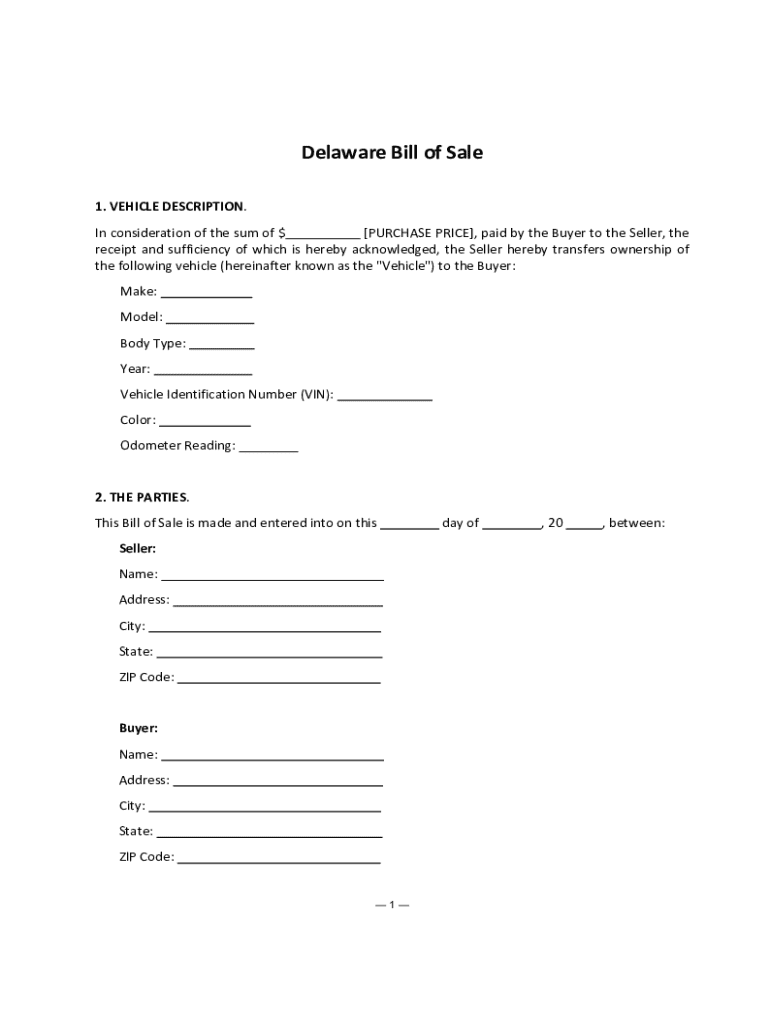

Get the free PURCHASE PRICE, paid by the Buyer to the Seller, the

Get, Create, Make and Sign purchase price paid by

How to edit purchase price paid by online

Uncompromising security for your PDF editing and eSignature needs

How to fill out purchase price paid by

How to fill out purchase price paid by

Who needs purchase price paid by?

Purchase Price Paid by Form: A Comprehensive Guide

Understanding the purchase price form

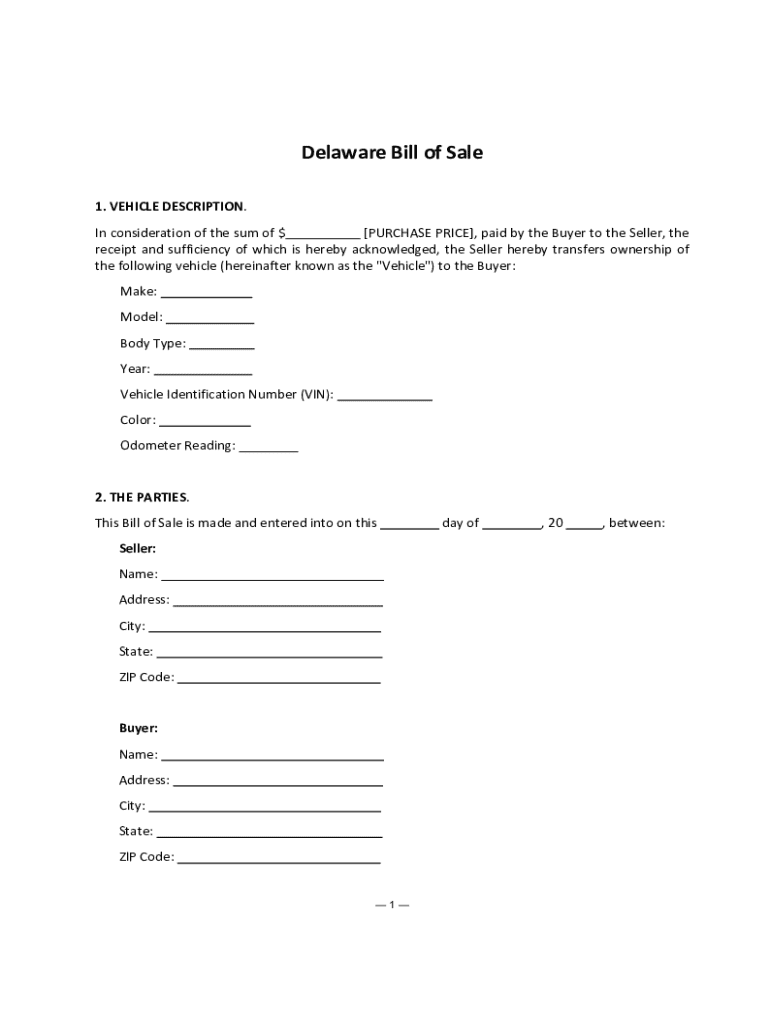

The purchase price paid by form is a critical document in various transactions, serving as an official record of the total cost involved in buying an asset. It not only outlines the purchase amount but also categorizes all included assets, ensuring transparency between buyers and sellers. This form is essential for both parties for tax compliance and financial reporting requirements, making it a vital companion in real estate transactions and other commercial dealings.

Many sectors utilize the purchase price form, including real estate, business acquisitions, and even asset transfers within corporations. Each situation demands clear documentation of the purchase price to facilitate smooth transactions, maintain accurate accounting records, and comply with regulatory requirements.

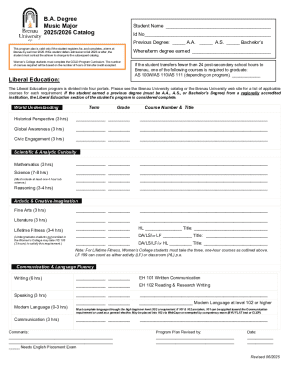

Types of purchase price forms and their applications

In real estate transactions, the purchase price form typically covers the entire scope of the deal, including property value assessments and allocation of costs associated with the sale. Common types include the Real Estate Purchase Agreement and the Purchase and Sale Agreement, which outlines both the buyer's and seller's obligations while detailing individual asset categories.

Moreover, purchase price forms are not exclusive to the real estate sector. They play a critical role in business acquisitions, where they summarize the fair market value of the company being acquired. They also apply to asset transfers between firms, ensuring that all values, whether tangible or intangible, are captured effectively to reflect the transaction's essence.

Key components of the purchase price form

A correctly filled purchase price form should encompass several key components. First, it requires basic information fields such as the names and addresses of the buyer and seller. Equally important is a detailed description of the assets included in the transaction, which aids in establishing a clear understanding of what is being purchased.

The form should also provide a breakdown of the purchase price, reflecting how each asset’s value contributes to the overall cost. Familiar terms such as 'allocation of purchase price' matter here, as this is crucial in accounting for different asset categories and their fair market values, which could impact future business valuations or tax reporting.

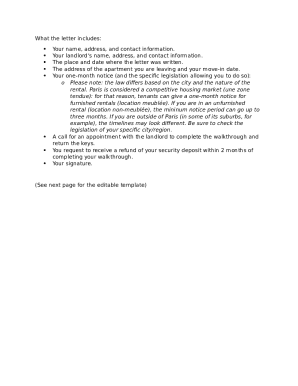

How to fill out the purchase price form

Filling out the purchase price form requires careful attention to detail. Start by gathering all necessary documentation, such as purchase agreements, tax assessments, and previous valuations for the assets involved. This foundational step ensures that you have accurate data on hand when stating the purchase price.

Next, accurately report the purchase price at the top of the form to immediately clarify the total transaction amount. Following this, classify each asset properly, ensuring that the allocations reflect their market values. Distributing costs appropriatively is vital to avoid discrepancies down the line, especially concerning tax compliance and paperwork.

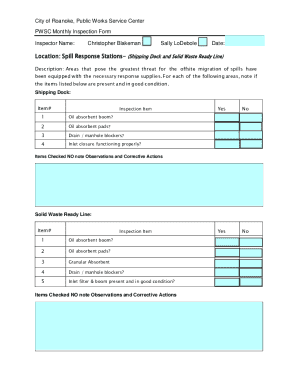

Best practices for accuracy in reporting

Maintaining accuracy in your submissions is paramount. You should double-check every entry against the original documentation and relevant financial reports. This practice helps in identifying any inconsistencies in purchase price allocations and ensures all required information has been included, which is essential for proper accounting and compliance with regulations.

Utilizing supporting documents such as invoices, property deeds, and prior sales can significantly enhance the credibility of your form. As a result, not only do you maintain transparency for all stakeholders involved, but you also safeguard against potential disputes that may arise post-transaction.

Interactive tools for completing the purchase price form

Digital solutions have transformed the process of documenting purchase price forms. Using tools like those offered by pdfFiller allows for easy editing of PDF documents, streamlining this crucial process. Such platforms often feature user-friendly interfaces that enable seamless collaboration among team members, regardless of their location.

Additional functionalities, such as eSigning capabilities and comprehensive document management systems, foster a more organized approach to handling forms. By integrating these tools into transaction workflows, users can efficiently manage the complexities of purchase price paid by form, leading to quicker conclusions to agreements and reduced likelihood of human error.

Common pitfalls in filling out the purchase price form

Errors in filling out a purchase price form can lead to significant issues down the line. Common mistakes include misallocation of costs, where costs assigned to asset categories do not accurately reflect the true fair market value. This not only complicates accounting practices but can also trigger liabilities with tax authorities.

Other pitfalls include failing to include required information such as detailed descriptions of the assets involved. To avoid these types of mistakes, it’s beneficial to have a checklist of items to review before submitting the form. Ensure that all fields are filled in, values are calculated correctly, and the form is signed where necessary.

When to seek professional help

While many can navigate filling out a purchase price form, certain situations may warrant seeking professional assistance. For instance, complex transactions involving multiple asset categories or convoluted pricing structures can lead to confusion. It’s advisable to consult with an expert when you might lack familiarity with form requirements or the implications of poor reporting.

Engaging with professionals can provide you with insights into market values and allocation strategies that can impact future business valuations. Their expertise ensures compliance with evolving tax regulations and can help avoid potential pitfalls associated with improper documentation.

Purchase price FAQs

Understanding the nuances of the purchase price paid by form can lead to crucial insights during transactions. A common concern is, 'What happens if I make a mistake on the form?' Addressing such errors promptly is essential; most jurisdictions allow for amendments, but corrections must be properly documented to maintain accuracy.

Another frequent question is whether you can use the form for multiple transactions. While a single form typically reflects one transaction, individual forms can be compiled when dealing with multiple deals to ensure clarity in reporting and accountability. Tax implications also vary based on how transactions are reported, so it’s vital to stay informed about current regulations.

Real-world examples of purchase price allocations

Case studies of successful transactions often reveal intricate details of how accurate purchase price allocations have facilitated smoother business operations. For example, a company acquiring another firm may divide the purchase price among various asset categories such as equipment, inventory, and intellectual property. Each allocation can have far-reaching effects on financial and tax reporting, ultimately enhancing clarity for stakeholders.

Conversely, organizations that have mismanaged their purchase price forms often face consequences. Errors in asset valuation could lead to public relations challenges, financial discrepancies, and costly adjustments. Learning from these real-world examples underscores the importance of precision and insight when navigating purchase price forms in any transaction.

Leveraging pdfFiller for smooth form handling

pdfFiller provides exemplary document management features tailored for managing purchase price forms seamlessly. Users can edit, eSign, and share their documents efficiently, which significantly enhances transaction workflows. This reduces the time spent on administrative tasks while increasing accuracy, thereby ensuring compliance with relevant regulations.

With tools designed for collaboration, pdfFiller empowers individuals and teams by providing real-time updates and easy access to documents from anywhere. Reviews from users indicate that these features not only simplify the management process but also foster positive engagements, transforming the often-complex nature of purchase price forms into a more navigable experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my purchase price paid by directly from Gmail?

How do I make changes in purchase price paid by?

How do I edit purchase price paid by on an Android device?

What is purchase price paid by?

Who is required to file purchase price paid by?

How to fill out purchase price paid by?

What is the purpose of purchase price paid by?

What information must be reported on purchase price paid by?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.