Understanding and Managing the 2401 TD Application 1 Form

Understanding the 2401 TD application 1 form

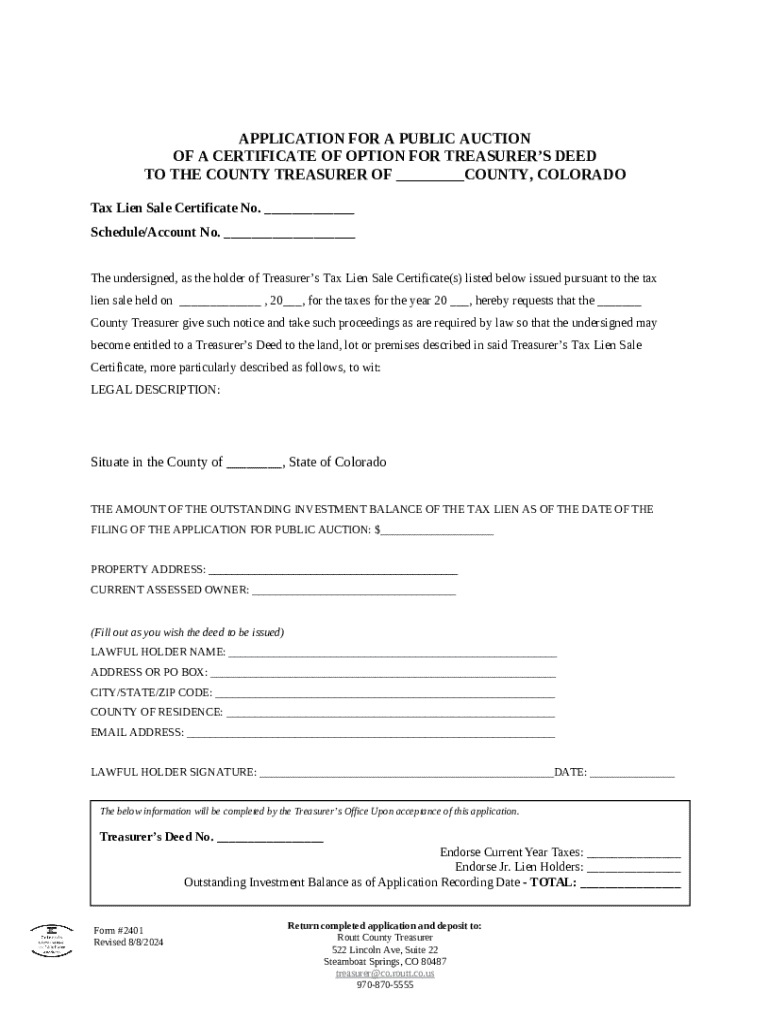

The 2401 TD Application 1 Form is a critical document utilized primarily for tax purposes, particularly in the realm of tax lien redemption. This form is essential for property owners seeking to reclaim their property after a lien has been placed due to unpaid taxes. Utilizing the correct form is incredibly important to ensure compliance with local tax statutes and to facilitate a smooth process in reclaiming ownership.

Filling out the 2401 TD Application 1 Form accurately is not just a matter of preference—it's often a legal requirement. Various scenarios may necessitate the use of this form, such as when applying for a redemption certificate, filing an affidavit concerning ownership, or responding to tax deed notices received from the treasurer's office.

Reclaiming property after a tax lien has been issued.

Applying for a tax lien redemption certificate.

Responding to notices issued regarding unpaid taxes.

Overview of the 2401 TD application 1 form structure

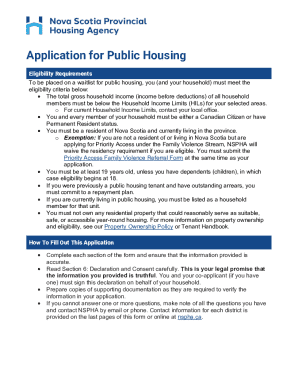

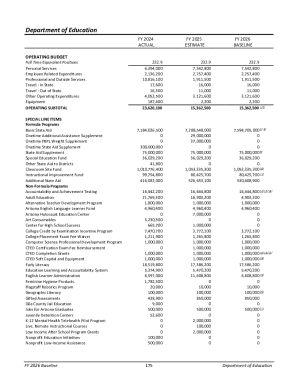

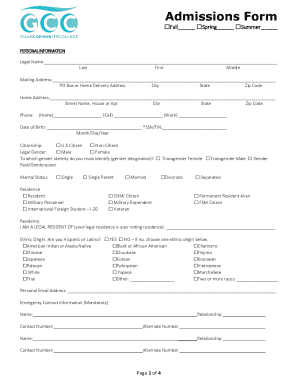

The 2401 TD Application 1 Form is structured to elicit comprehensive details from the applicant. It begins with a Personal Information Section, where essential data such as name, address, and contact information must be clearly provided. Following this, the Income Details Section requires the applicant to disclose all relevant income, which may include wages, investment earnings, or other revenue sources that demonstrate ability to pay any taxes owed.

The Deductions and Credits Section is vital as it allows the applicant to list potential deductions that can reduce their taxable income. This section may also include credits to which the applicant is entitled, thus providing a more favorable tax outcome. Finally, the Declaration and Signature Section affirms that all information provided is accurate and true under penalty of perjury.

Personal Information Section - Details about identity and contact.

Income Details Section - Report different types of income.

Deductions and Credits Section - Claim eligible deductions.

Declaration and Signature Section - Affirm accuracy and truthfulness.

Step-by-step instructions for filling out the 2401 TD application 1 form

Filling out the 2401 TD Application 1 Form can be a straightforward process if approached systematically. Start by gathering all necessary documentation that supports your claims on the form. Common documents include W-2s, 1099s, any notices from the treasurer's office regarding your tax status, and previous redemption certificates.

Once you have your documents, begin by completing the Personal Information Section. It's crucial to ensure all details are accurate, as errors here can lead to processing delays or miscommunications later. Next, move on to detailing your income. Make sure to report all types of income, including but not limited to wages, investments, and any rental income—it's important to provide comprehensive financial insights.

After detailing income, explore the Deductions and Credits Section. Familiarize yourself with common deductions you may qualify for, such as for charitable donations or mortgage interest, as well as any tax credits that can lower your overall tax burden. Finally, review all information carefully before moving on to the Review and Verification Process, where you double-check entries for any errors or omissions.

Gather documents like W-2s and 1099s.

Complete the Personal Information Section accurately.

Detail all sources of income comprehensively.

List eligible deductions and tax credits.

Carefully review all entries for errors.

Tips for editing and managing your 2401 TD application 1 form

Utilizing pdfFiller for managing your 2401 TD Application 1 Form can significantly streamline the process. This cloud-based platform offers advanced editing tools that allow you to highlight key sections, add comments, and collaborate with others seamlessly. These features can be particularly useful if you are working with a team to gather the necessary documentation or review the completed form.

Moreover, converting your completed form to different formats—such as Word or PDF—ensures that you can share it easily with advisers, or print it for mailing. Additionally, securing your application with electronic signatures not only expedites the submission process but also bolsters the authenticity of your application.

Utilize highlighting and commenting functions on pdfFiller.

Collaborate efficiently using cloud-based editing tools.

Convert forms to desired formats for easier sharing.

Electronically sign your forms for enhanced security.

Common mistakes to avoid when filling out the 2401 TD application 1 form

Filling out the 2401 TD Application 1 Form can be complex, and certain pitfalls are common among applicants. One prevalent error is leaving fields incomplete or omitting required documents. Each section is designed to capture essential information, and neglecting any part can lead to processing delays or even rejections.

Another mistake is misreporting income or deductions. It’s vital to ensure that all figures are accurate and backed by documentation. Errors can lead to complications with the tax authorities, including potential audits. Lastly, forgetting to sign the declaration can render the form invalid, so ensure you complete this final step before submission.

Leaving fields incomplete or omitting required documents.

Misreporting income or miscalculating deductions.

Forgetting to sign the declaration section.

Frequently asked questions (FAQs) regarding the 2401 TD application 1 form

If you happen to make a mistake after submitting the 2401 TD Application 1 Form, the first step is to contact the tax office where you filed your application. Depending on the circumstances, they may guide you on how to amend your submission. Processing times can vary, but you can typically expect a response within a few weeks, especially during peak tax season.

It's important to remember that you can usually amend your application if any significant changes occur in your tax situation. However, be aware that failing to submit the form by the deadline can lead to penalties, so staying organized and attentive to deadlines is paramount.

Contact the tax office for guidance on amending submissions.

Expect processing times to vary, typically a few weeks.

Amend the application for significant changes in your tax situation.

Be mindful of deadlines to avoid penalties.

Utilizing pdfFiller for seamless document management

PdfFiller is invaluable for anyone navigating the complexities of the 2401 TD Application 1 Form. The cloud-based document management software allows you to keep all your tax documents organized in one location. This is particularly beneficial for individuals or teams that need to collaborate on various tax-related tasks, as it facilitates easy access and modification of documents without the hassle of physical paper.

Moreover, pdfFiller's interface is user-friendly, making it simple to upload, edit, and eSign your forms. Enjoy the flexibility of keeping track of your tax liens, redemption certificates, and related documents, all while ensuring compliance with applicable statutes. Real success stories from users show that a standardized approach to managing the 2401 TD Application 1 Form leads to increased efficiency and reduced stress during tax season.

Keep all tax documents organized in one accessible location.

Enjoy user-friendly tools for editing and eSigning forms.

Standardize your approach for increased efficiency.

Interactive tools for the 2401 TD application 1 form

Interactive tools available through pdfFiller can significantly enhance your experience while working with the 2401 TD Application 1 Form. Accessing templates and checklists can simplify the preparation process, helping you to focus on crucial details without feeling overwhelmed. Using calculators for deductions and tax estimates allows you to easily assess what you might be eligible to claim, further optimizing your submission.

These tools are designed with user experience in mind, ensuring you can navigate easily through the complexities of filing taxes and managing your forms. By strategically utilizing these resources, you can approach the 2401 TD Application 1 Form with confidence, ensuring a smoother path toward reclaiming your property or managing your taxes effectively.

Access templates and checklists to simplify form preparation.

Utilize calculators for estimating deductions and tax credits.

Enhance your filing experience with user-friendly tools.

Keeping your records organized

Maintaining organized records is essential for any property owner navigating the complexities of tax liens and the 2401 TD Application 1 Form. Best practices include creating a systematic filing system for documents, making use of labeled folders, and backing up important documents in various formats—ideally, both cloud-based and physical copies.

Utilizing pdfFiller can greatly aid in this endeavor by providing an organized platform where you can store all forms and related documents. The software not only enhances security through electronic storage but also improves accessibility, allowing you to retrieve any document instantly whenever needed. Consequently, you can focus more on your business or personal financial goals without the added stress of misplaced documents.

Create a systematic filing system for all tax-related documents.

Use labeled folders for better organization.

Back up important documents in both cloud and physical formats.