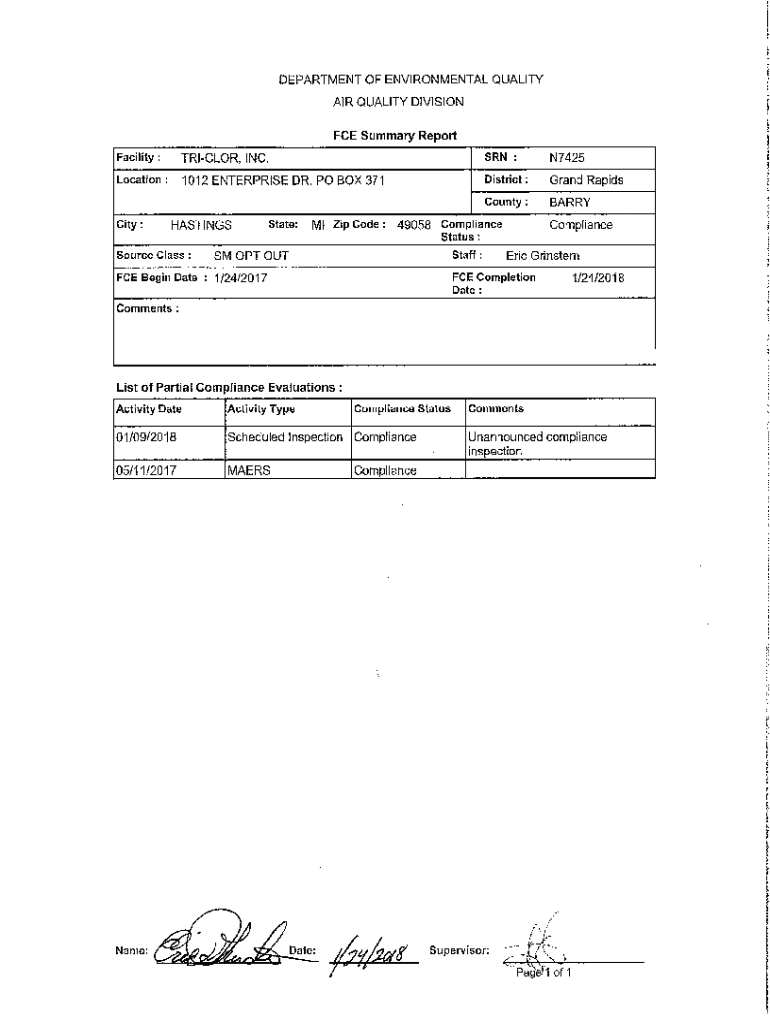

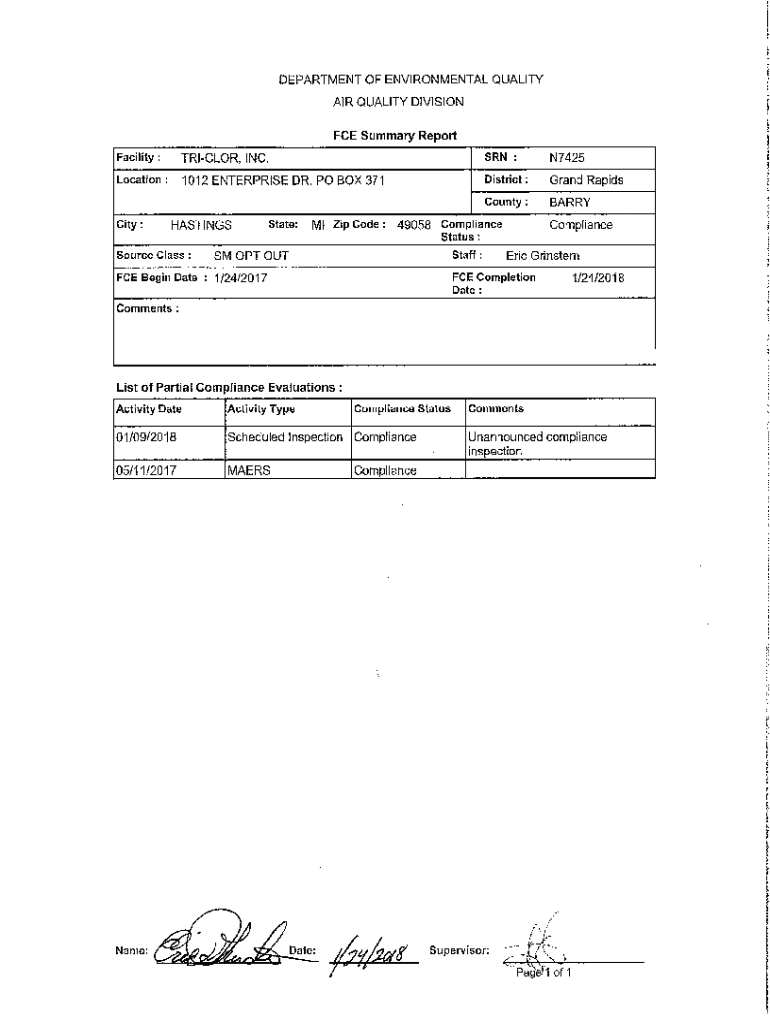

Get the free FCE for FY '014. See Inspection Report CAN742526743 ...

Get, Create, Make and Sign fce for fy 039014

How to edit fce for fy 039014 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fce for fy 039014

How to fill out fce for fy 039014

Who needs fce for fy 039014?

A comprehensive guide to the FCE for FY 039014 form

Understanding the FCE for FY 039014 form

The FCE for FY 039014 form is an essential document used in financial reporting, providing crucial insights into an organization's financial health for the fiscal year designated by the code 039014. This form is particularly relevant for agencies and companies that require accurate and standardized financial information to comply with regulations.

Its importance lies in its role as a central tool for assessing financial performance and resource allocation. Stakeholders, including management, regulatory bodies, and investors, rely on this form to make informed decisions that impact the future of the organization.

Prerequisites for filling out the FCE for FY 039014 form

Before you delve into completing the FCE for FY 039014 form, it's vital to gather the necessary documents that will support your entries. This includes previous financial statements, accounting records, and any relevant reports that might influence the current fiscal year’s data.

Understanding financial terminology is also crucial. Familiarize yourself with terms such as 'assets,' 'liabilities,' and 'equity.' This knowledge will aid in accurately interpreting and inputting data on your form.

Step-by-step instructions for completing the FCE for FY 039014 form

Completing the FCE for FY 039014 form involves a series of well-defined steps that ensure accuracy and compliance. Following these steps will help you gather the necessary information and fill out the form methodically.

Step 1: Accessing the form

Finding the FCE for FY 039014 on pdfFiller is straightforward. You can access the form by searching for the specific template within the platform. To ensure you select the correct version, check for updates or revisions that may have been made based on regulatory changes.

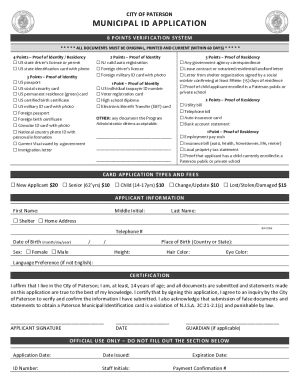

Step 2: Filling out basic information

Essential information like the organization’s name, tax ID, and address should be filled out first. It’s crucial to double-check these details, as inaccuracies could lead to complications later on.

Step 3: Inputting financial data

Entering financial figures requires careful attention. This involves compiling data regarding income, expenses, and balance sheet items directly from your financial records. Following best practices, such as verifying figures with accounting software, can prevent errors in your submissions.

Step 4: Reviewing your inputs

Conduct a thorough review of all inputs before finalizing your document. Utilize pdfFiller’s built-in correction tools and features that assist in identifying common errors or discrepancies in the provided financial data.

Step 5: Saving and exporting the form

After completing the form, you can save your work directly on pdfFiller. The platform offers various export formats suitable for different purposes, including PDF for submission and Excel for further analysis.

Editing and customizing the FCE for FY 039014 form

Utilizing pdfFiller’s editing tools enhances the quality of your FCE for FY 039014 form. You can easily modify text, adjust fields, and add or remove sections as needed. This flexibility allows you to tailor the form based on your organization's reporting requirements.

Moreover, adding comments and collaborating with team members within pdfFiller facilitates a smooth workflow. This is particularly beneficial for ensembles working on financial assessments, as it allows for real-time input and feedback, streamlining the completion process.

Advanced features like eSigning allow you to authenticate documents digitally. This ensures that all signed forms are legally binding and secure, preserving the integrity of your financial reports.

Best practices for managing your FCE documents

Efficient management of your FCE documents is vital for maintaining compliance and ensuring easy access. Organize your documents systematically, using a logical naming convention and folder structure, which aids in quickly locating past submissions.

Implementing version control is another best practice that prevents confusion over document iterations. Utilize pdfFiller’s version tracking features to monitor changes and updates, making it easier to reference previous versions when necessary.

Common questions about the FCE for FY 039014 form

As you navigate the complexities of the FCE for FY 039014 form, you might encounter questions or concerns. Common issues include confusion over specific financial terms or uncertainty about how to handle particular data fields.

Addressing these concerns is vital. Resources are available, from tailored customer support to online forums where you can connect with experienced users who’ve faced similar challenges.

Enhancing your experience with pdfFiller

pdfFiller transforms the way you create and manage documents. By providing an all-in-one platform for form editing, eSigning, and collaboration, it empowers users to handle the FCE for FY 039014 form efficiently. The interface is designed for ease of use, allowing individuals and teams to optimize their document management processes.

In comparison to traditional methods, pdfFiller offers distinctive advantages such as cloud accessibility, real-time collaboration, and the ability to integrate with various software systems. User testimonials highlight significant time savings and reduced errors as key benefits of using this platform.

Key takeaways for success with the FCE for FY 039014 form

In summary, navigating the FCE for FY 039014 form requires diligence and attention to detail. Following the outlined steps ensures not only compliance but boosts confidence in your financial submissions. Emphasizing pre-preparation, review, and using pdfFiller’s tools will enhance your overall experience.

A proactive approach to managing your documents will eliminate confusion and foster a smoother process. By embracing best practices in document management, you can ensure that your completed forms are accurate, secure, and ready for any necessary submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fce for fy 039014 to be eSigned by others?

How do I edit fce for fy 039014 straight from my smartphone?

How do I complete fce for fy 039014 on an Android device?

What is fce for fy 039014?

Who is required to file fce for fy 039014?

How to fill out fce for fy 039014?

What is the purpose of fce for fy 039014?

What information must be reported on fce for fy 039014?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.