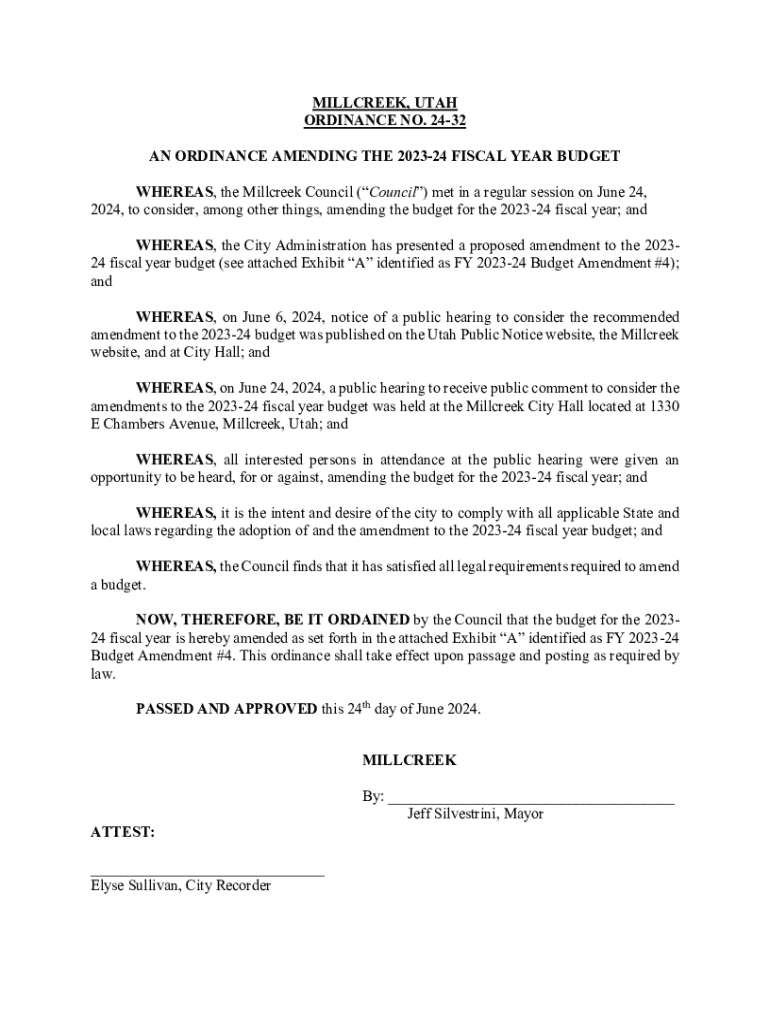

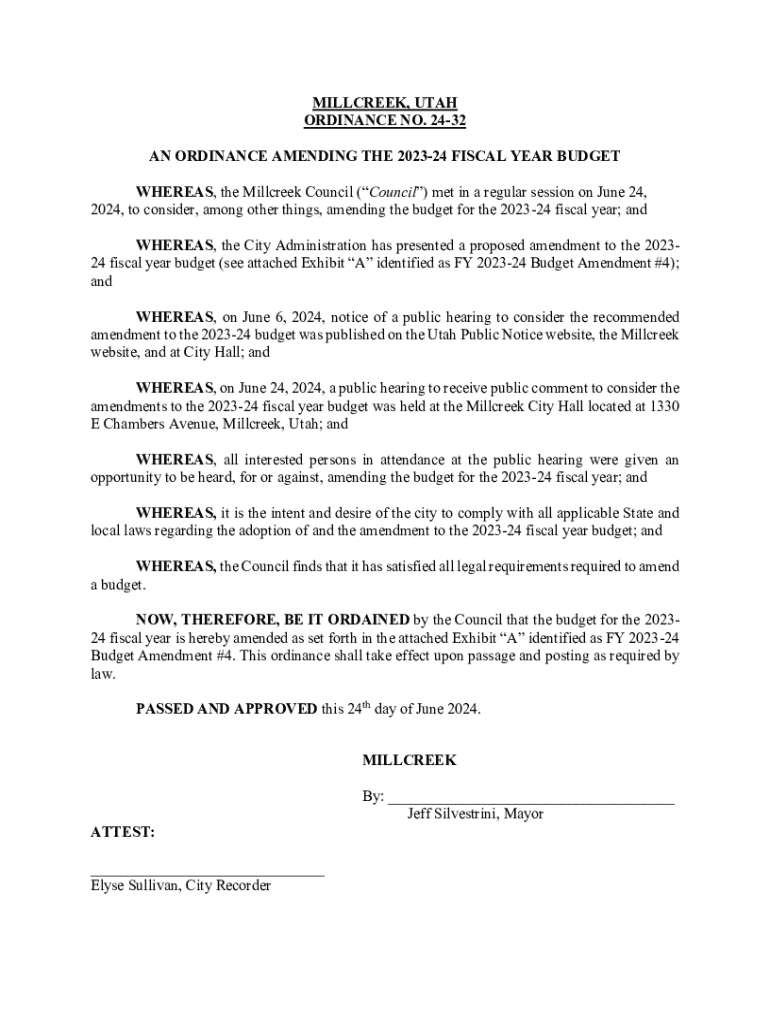

Get the free 24 fiscal year budget (see attached Exhibit "A" identified as ...

Get, Create, Make and Sign 24 fiscal year budget

How to edit 24 fiscal year budget online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 24 fiscal year budget

How to fill out 24 fiscal year budget

Who needs 24 fiscal year budget?

A Comprehensive Guide to the 24 Fiscal Year Budget Form

Understanding the 24 fiscal year budget form

The 24 fiscal year budget form is a vital document used by various government entities and organizations to outline their financial plans for the upcoming fiscal year. This form serves not only as an estimation of the revenues and expenses expected but also as a framework for strategic allocation of resources to meet organizational goals. Accurate completion of this form is essential to ensure funding requirements are met and that financial oversight is maintained.

Importance of accurate budget reporting cannot be overstated; inaccurate budget forms can lead to shortfalls, mismanagement of resources, and can even affect future funding requests. This is particularly crucial in the context of governmental operations, where public funding is involved, and mandates must be adhered to in order to prevent obstructionism in project implementations.

Preparing to complete the 24 fiscal year budget form

Before diving into the form, it's imperative to gather all necessary information, including historical financial data and projections based on your organization's activities and strategic goals. Accurate data is essential for realistic budget projections and can significantly improve the likelihood of the plan's approval by leadership or external review bodies.

Documentation required for submission may include previous fiscal year budgets, current financial statements, and forecasting reports that detail expected changes. Utilizing tools like pdfFiller can simplify the management of these documents, allowing for easy editing and sharing while ensuring compliance with required formats.

Step-by-step instructions for filling out the 24 fiscal year budget form

Section 1: Budget overview

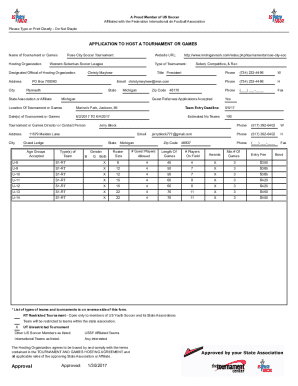

The first section of the 24 fiscal year budget form usually requires an overview that includes key figures such as total expected revenue, total expenditures, and the net balance. It's important to summarize budget goals precisely to give stakeholders a clear understanding of what the organization aims to achieve financially over the fiscal year.

Section 2: Revenue estimations

Accurate revenue estimations begin with a thorough analysis of all potential income sources. This may encompass government grants, private funding, and any earned income from operations. Calculating these expected incomes is essential to establishing a realistic budget, helping to set an achievable financial outlook.

Section 3: Expense forecasting

In this section, distinguishing between fixed and variable expenses will guide prioritization of expenditures. Fixed expenses may include salaries and rent, while variable expenses could involve project-based costs. Prioritizing expenditures helps in allocating funds effectively to ensure critical operations support initiatives essential for meeting upcoming goals.

Section 4: Comparison with previous budgets

Analyzing trends from previous budgets can provide insight into spending patterns and inform adjustments for the current budget. It not only aids in refining estimates, but also highlights areas needing attention, ensuring that the budget aligns with the organization's evolving objectives.

Section 5: Summary and approval

The final section is dedicated to providing a clear recap of the budget, outlining how it meets the predefined goals. Following completion, adhere to submission guidelines and secure the necessary approvals from relevant parties, such as department heads or financial officers to move forward without delays.

Tips for effective budgeting with the 24 fiscal year budget form

Best practices for ensuring budget accuracy include double-checking all calculations and collaborating with team members to gather diverse insights. Having more eyes on data can reduce the risk of simple errors that can derail an otherwise well-structured budget.

Common mistakes to avoid encompass overestimating revenue and underreporting expenses. It's crucial to approach estimations conservatively, particularly in economic climates where funding may be uncertain. This approach not only garners trust from supervisory parties but also encourages realistic budgeting practices across your entire organization.

Collaborating and managing your budget document

Utilizing collaboration features in pdfFiller can significantly enhance the team’s workflow during the budgeting process. Teams can share the document seamlessly for feedback, facilitating real-time edits directly or commenting on specific sections to clarify uncertain amounts or figures. This interactivity can streamline communications and produce a more polished document in the end.

The importance of e-signatures cannot be overstated, especially for official submission of the budget. Utilizing pdfFiller's secure eSigning feature allows all necessary approvals to be obtained in a compliant and efficient manner. Ensuring the budget document is signed electronically can also reinforce accountability and offer a secure method for finalizing the form.

After the budget submission

Once the budget has been submitted, it’s vital to establish a process for reviewing and evaluating budget performance. Monitoring spending relative to budgeted amounts allows the organization to make informed adjustments, enhancing strategic financial management over time. This vigilance is necessary, particularly in scenarios where economic conditions may shift unexpectedly.

Reporting requirements and compliance duties do not cease post-submission. Understanding ongoing obligations ensures transparency and accountability among stakeholders, including government entities and other funding bodies. A clear record of performance can prevent financial discrepancies and foster trust between the organization and its funders.

Frequently asked questions about the 24 fiscal year budget form

What if my financial situation changes after submission? In the event of a significant alteration in projected revenues or expenses, it's advisable to document the changes clearly and communicate them with leadership or funding agencies. Can I modify the form if necessary? While changes can often be made to the budget form, it’s crucial to follow established protocols and seek permissions where required. Where can I seek help if I encounter difficulties? Depending on the organization, there may be dedicated financial officers or external resources available for guidance during the budgeting process.

pdfFiller features enhancing your budgeting experience

Editing PDFs is straightforward with pdfFiller, allowing for customization of the 24 fiscal year budget form in a user-friendly manner. Users can easily modify field entries, adjust language, and make general tweaks to enhance clarity. This ease of use ensures that individuals and teams have the flexibility to create precise and professional budget documents.

Moreover, pdfFiller's secure cloud-based document management offers the ability to access your budget form from any device. This means financial teams can work collaboratively, making adjustments or reviewing without being tied to traditional office environments. Streamlined collaboration tools also facilitate effective teamwork, as multiple authors can contribute to the document simultaneously, resulting in a cohesive and polished final submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 24 fiscal year budget in Gmail?

How can I send 24 fiscal year budget to be eSigned by others?

How do I make changes in 24 fiscal year budget?

What is 24 fiscal year budget?

Who is required to file 24 fiscal year budget?

How to fill out 24 fiscal year budget?

What is the purpose of 24 fiscal year budget?

What information must be reported on 24 fiscal year budget?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.