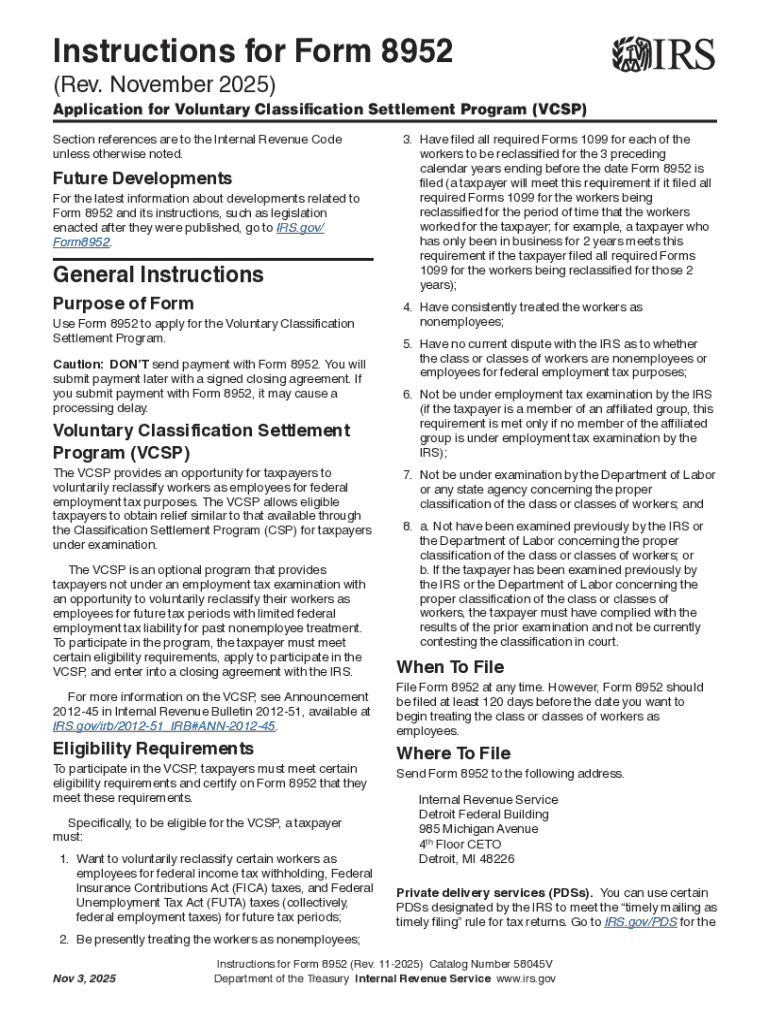

Get the free 8952 form

Get, Create, Make and Sign form 8952 instructions

Editing 8952 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 8952 form

How to fill out form 8952 - vcsp

Who needs form 8952 - vcsp?

Comprehensive Guide to Form 8952 - VCSP

Understanding Form 8952: The Voluntary Classification Settlement Program

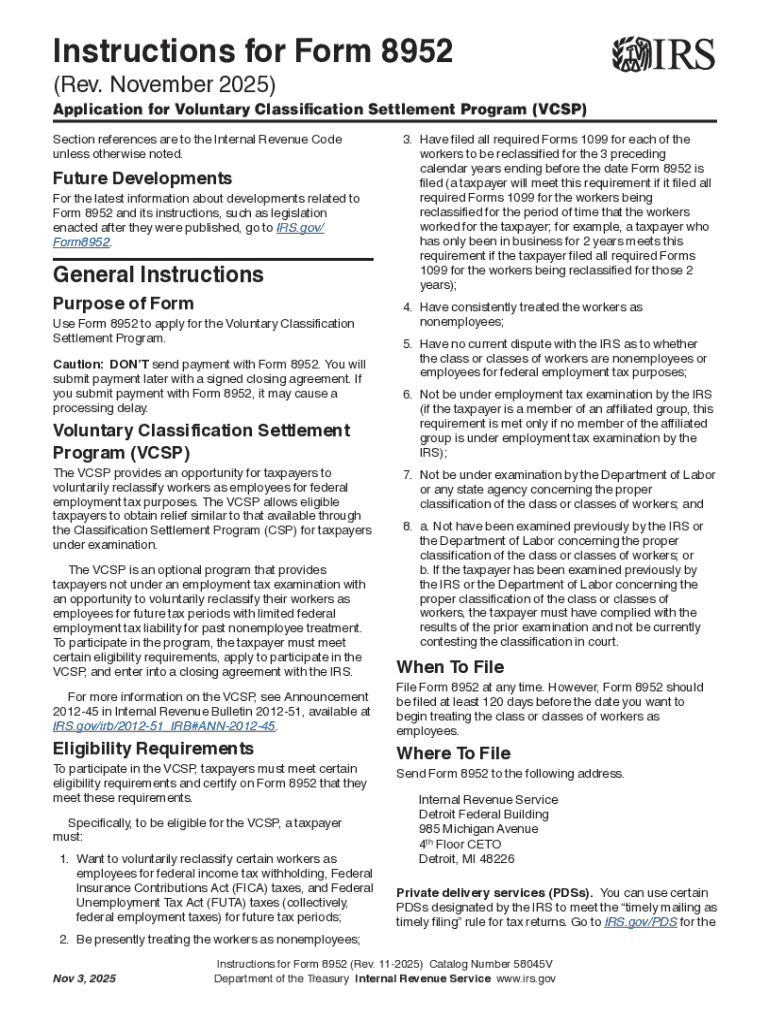

Form 8952, often a critical element for many business owners, is the official application for the Voluntary Classification Settlement Program (VCSP). This program allows employers to voluntarily reclassify their workers from independent contractors to employees, significantly impacting employment tax obligations and overall compliance with IRS regulations.

Understanding the importance of Form 8952 is essential for any organization engaging contractors. Misclassifying workers can lead to substantial tax liabilities and penalties, making this form vital for businesses wanting to ensure compliance while managing their workforce effectively.

Who should consider using Form 8952?

Eligibility for using Form 8952 generally aligns with businesses that have been misclassifying workers as independent contractors. This includes many small to medium-sized enterprises that rely on a fluctuating labor force for project-based work. Companies that wish to rectify this without facing the extensive repercussions of misclassification should consider this form.

Organizations across various sectors, from technology firms to service industries, can greatly benefit from this program. However, misconceptions abound regarding eligibility: some believe only large corporations can apply, while the reality is that any firm meeting certain criteria can take advantage of the VCSP.

Key advantages of using the Voluntary Classification Settlement Program

Employers who complete Form 8952 and utilize the VCSP can unlock numerous advantages. First, by securing employment tax relief, organizations can mitigate potential liabilities that may arise from back taxes owed to the IRS. This relief can result in a significant reduction in the employment tax amount owed.

Additionally, by voluntarily reclassifying workers, businesses reduce the risk of future audits by the IRS seeking to uncover misclassification. This proactive move not only brings peace of mind but reinforces the company’s commitment to ethical employment practices.

Costs and potential risks involved in using Form 8952

While the benefits of Form 8952 and the VCSP are significant, there are associated costs and potential risks that employers should weigh. The initial fee for participating in the VCSP depends on the number of workers being reclassified. Each employer must also consider potential legal fees that could arise from compliance efforts.

Moreover, businesses must account for the consequences of failing to comply with IRS guidelines if audits indicate ongoing misclassification after participation. Notably, even after completing Form 8952, employers may still face scrutiny if changes in operation or classification persist without clear documentation.

Step-by-step guide to completing Form 8952

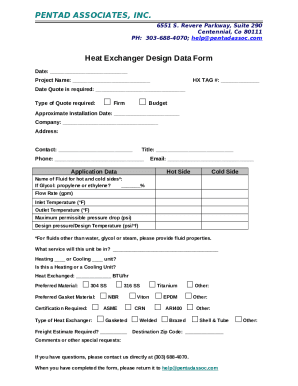

Before starting with Form 8952, preparation is crucial. Begin by gathering all necessary documentation related to the workers’ current classifications, payroll records, and tax filings. Understanding specific state regulations concerning worker classification is also key, as states may have different requirements that can influence the application process.

Next, fill out Form 8952 with accurate information. It is organized into specific sections to capture the necessary details for your application. Make sure to read the instructions thoroughly for each section, as common pitfalls can occur if details are overlooked or misentered.

Leverage pdfFiller for a seamless form completion experience

Using pdfFiller makes completing Form 8952 simple and efficient. With its user-friendly interface, users can easily fill out, edit, and sign the form. Features like PDF editing tools allow for quick adjustments, ensuring all information presented is accurate and up-to-date.

Collaboration among team members is available, enabling multiple users to work on document changes concurrently. The eSigning options ensure secure submissions while removing the burden of printing and scanning, thus streamlining the overall process.

Navigating the post-submission process

Once Form 8952 has been submitted, it is essential to know what to expect next. Typically, applicants will receive acknowledgment from the IRS regarding their application within a set time frame. Tracking the application status can be crucial for understanding any follow-up actions that may be required.

Employers should be prepared to provide additional information if requested by the IRS. Having clear records and documentation accessible is vital for responding to such inquiries efficiently.

Real-world examples of successful VCSP applicants

Many organizations have successfully navigated the complexities of Form 8952 and have shared their positive experiences. For instance, a tech start-up that classified its software developers as independent contractors transitioned to employee status under the VCSP, which resulted in significant savings on employment taxes and fostered a better working relationship among its teams.

Successful applicants often report improved morale and higher compliance confidence. Many organizations that participated in the VCSP noted a smoother operational process, demonstrating the long-term advantages of embracing the VCSP.

Frequently asked questions about Form 8952 and the VCSP

Many queries arise when dealing with Form 8952 and the VCSP, as clarity can help potential applicants navigate their next steps. Commonly asked questions include concerns about the eligibility criteria for the program, the implications of participation, and how long the process typically takes. Addressing these areas can demystify the application process and encourage more organizations to participate.

Furthermore, having a thorough understanding of the IRS guidelines surrounding the VCSP can significantly ease apprehensions. Consulting tax professionals while preparing the form can further streamline the application process, ensuring accuracy in submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 8952 form?

How do I edit 8952 form straight from my smartphone?

How can I fill out 8952 form on an iOS device?

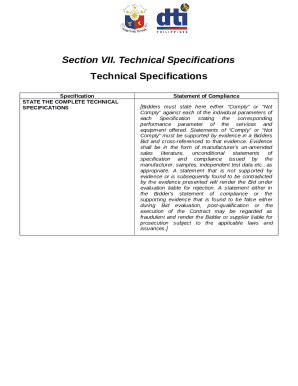

What is form 8952 - VCSP?

Who is required to file form 8952 - VCSP?

How to fill out form 8952 - VCSP?

What is the purpose of form 8952 - VCSP?

What information must be reported on form 8952 - VCSP?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.