Get the free unum site pdffiller com site blog pdffiller com

Get, Create, Make and Sign unum site pdffiller com

Editing unum site pdffiller com online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unum site pdffiller com

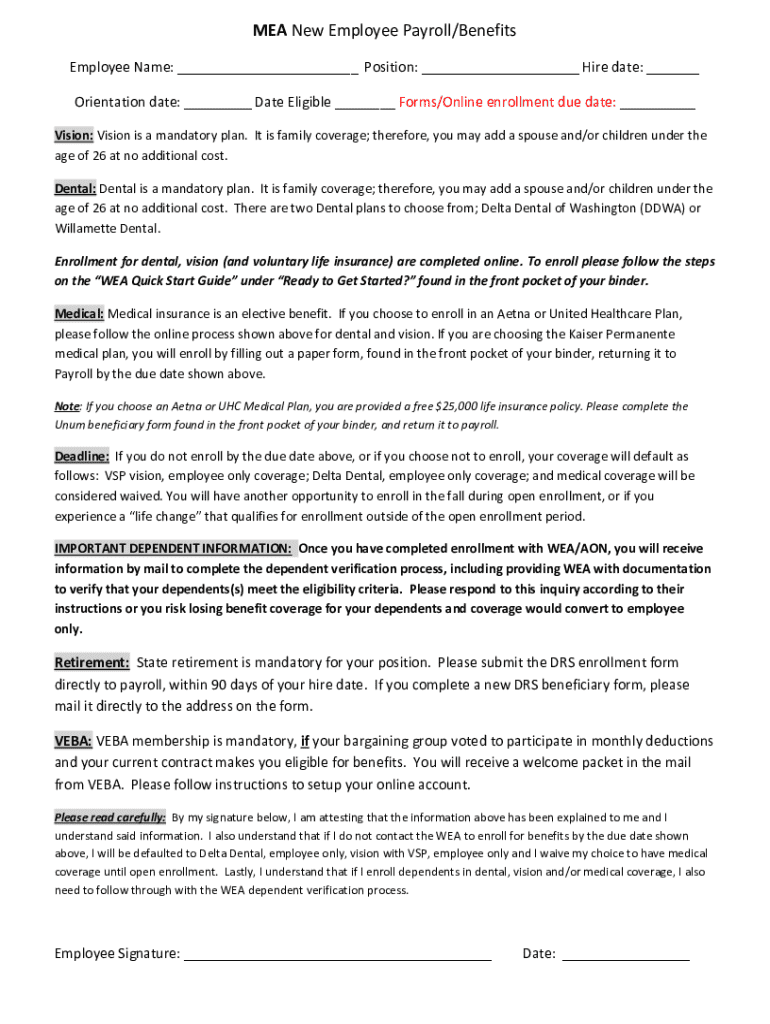

How to fill out mea new employee payrollbenefits

Who needs mea new employee payrollbenefits?

Understanding the MEA New Employee Payroll Benefits Form

Understanding the new employee payroll benefits form

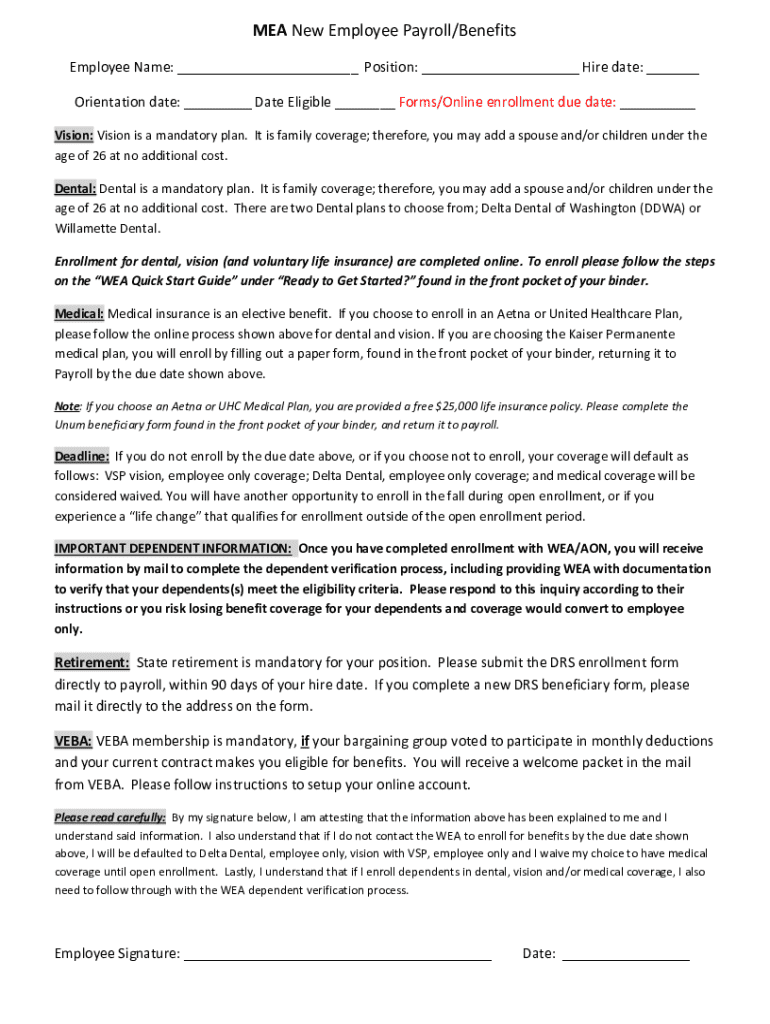

The MEA new employee payroll benefits form is a crucial document utilized by new hires to outline their compensation and benefits selection. This form not only aids in tracking payroll information but also ensures that employees receive the benefits they are entitled to from the outset of their employment. Completing this form accurately is vital as it can impact everything from tax withholdings to health insurance enrollment.

The importance of accurately filling out this form cannot be overstated. An incorrect submission might lead to miscalculations in payroll or delays in benefits activation, ultimately affecting employee satisfaction and financial planning.

Overview of the payroll benefits process

The management of payroll benefits is typically overseen by the human resources department. HR professionals hold key responsibilities, including ensuring all forms are completed correctly, maintaining up-to-date records, and communicating any changes in benefit programs to employees. They serve as the liaison between various benefit providers and the workforce, disseminating essential information regarding entitlements.

Essential information required on the form

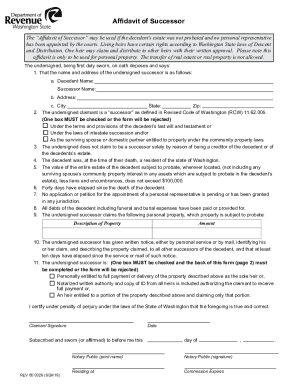

Filling out the MEA new employee payroll benefits form requires careful attention to personal information. This includes your full name, address, and contact details, ensuring your records are kept current. Additionally, providing accurate employment details such as job title, department, and start date is critical, as these factors influence benefit relevancy.

Banking information is also necessary for direct deposit setup, reducing the need for paper checks and expediting payroll processing. Most importantly, the tax information section includes the W-4 form for tax withholding specifications, where incorrect entries can lead to potential payroll issues.

Step-by-step instructions for completing the form

Completing the MEA new employee payroll benefits form can be straightforward if you follow a systematic approach. Start with gathering all the necessary documentation, including identification documents and proof of eligibility for various benefits. This will set a solid foundation for accurate form submission.

Common mistakes and how to avoid them

Even small errors in your payroll benefits form can lead to significant headaches down the line. One of the most common mistakes is overlooking mandatory fields. Ensure all required information is filled out to prevent delays in processing your payroll.

Another frequent error involves incorrect tax form submissions; ensure that you complete the W-4 accurately, reflecting your withholding preferences. Additionally, make it a habit to update personal information with HR after any significant changes, such as address moves or telephone number updates.

Tools to enhance the completion of the form

pdfFiller offers several tools to facilitate the completion of the MEA new employee payroll benefits form. With its editing features, users can customize the document and fill out required fields conveniently. This ensures that users have the most up-to-date form while allowing flexibility in response to individual circumstances.

The eSignature capabilities provide secure methods for signing documents electronically, saving time and paper. Furthermore, the collaboration features on pdfFiller allow team members and HR personnel to work together in real time, minimizing confusion and enhancing productivity.

Post-submission checklist

After submitting the MEA new employee payroll benefits form, new hires should take proactive steps to confirm that everything is in order. The first action should be to confirm enrollment in all benefits listed on the form, including health insurance and retirement contributions.

Next, understand the timeline for how and when these benefits will be integrated into the payroll system. Verify that deductions and contributions are accurately reflected in the first paycheck to ensure that everything is functioning smoothly from the onset of employment.

FAQs about the new employee payroll benefits form

New hires often have questions concerning the MEA new employee payroll benefits form. A common concern is what to do if there's a mistake after submission. It's crucial to contact HR immediately to rectify any errors as they can guide you through the necessary steps.

Another frequent inquiry pertains to how to add or alter benefits post-initial enrollment. Employees should familiarize themselves with the benefit program details found in the employee handbook, and keep communication open with HR regarding changes.

Interactive tools and features on pdfFiller

One of the advantages of using pdfFiller is access to a variety of interactive tools that can simplify document management. The platform provides form templates that help streamline the filling process, ensuring users can quickly navigate through the essential fields required for the MEA new employee payroll benefits form.

Document status tracking serves as a handy feature, allowing users to keep tabs on their submissions and ensuring they are filed correctly. Additionally, pdfFiller's robust security features offer peace of mind, shielding sensitive information from unauthorized access, a crucial consideration for any payroll-related document.

Best practices for employers supporting new employees

Employers can play a significant role in supporting new hires while navigating the MEA new employee payroll benefits form. Regular training sessions for new employees on filling out payroll benefits forms can demystify the process and reduce errors. Clear communication channels for questions should be established, fostering a supportive environment.

Utilizing technology like pdfFiller can further enhance process management, helping HR teams to streamline operations effectively. By prioritizing employee engagement and ensuring resources are readily available, employers can contribute to higher job satisfaction and reduced turnover.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my unum site pdffiller com directly from Gmail?

Can I create an eSignature for the unum site pdffiller com in Gmail?

Can I edit unum site pdffiller com on an Android device?

What is mea new employee payrollbenefits?

Who is required to file mea new employee payrollbenefits?

How to fill out mea new employee payrollbenefits?

What is the purpose of mea new employee payrollbenefits?

What information must be reported on mea new employee payrollbenefits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.