Get the free P&G 2025 Form 10-K

Get, Create, Make and Sign pampg 2025 form 10-k

How to edit pampg 2025 form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pampg 2025 form 10-k

How to fill out pampg 2025 form 10-k

Who needs pampg 2025 form 10-k?

Comprehensive Guide to the PampG 2025 Form 10-K Form

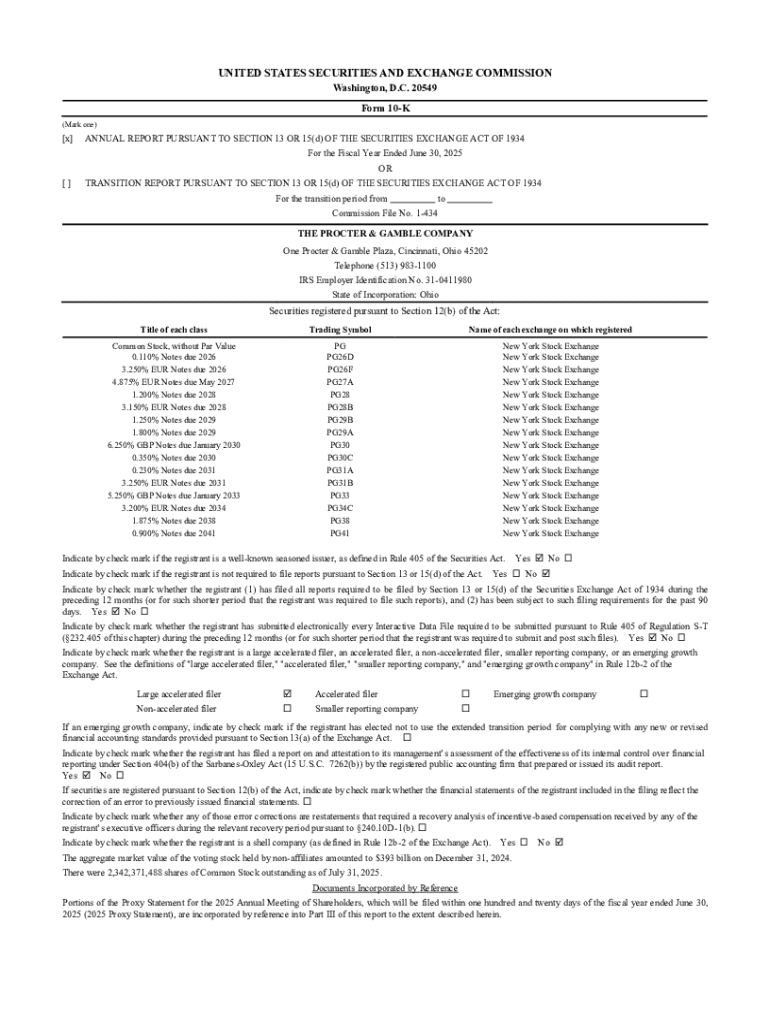

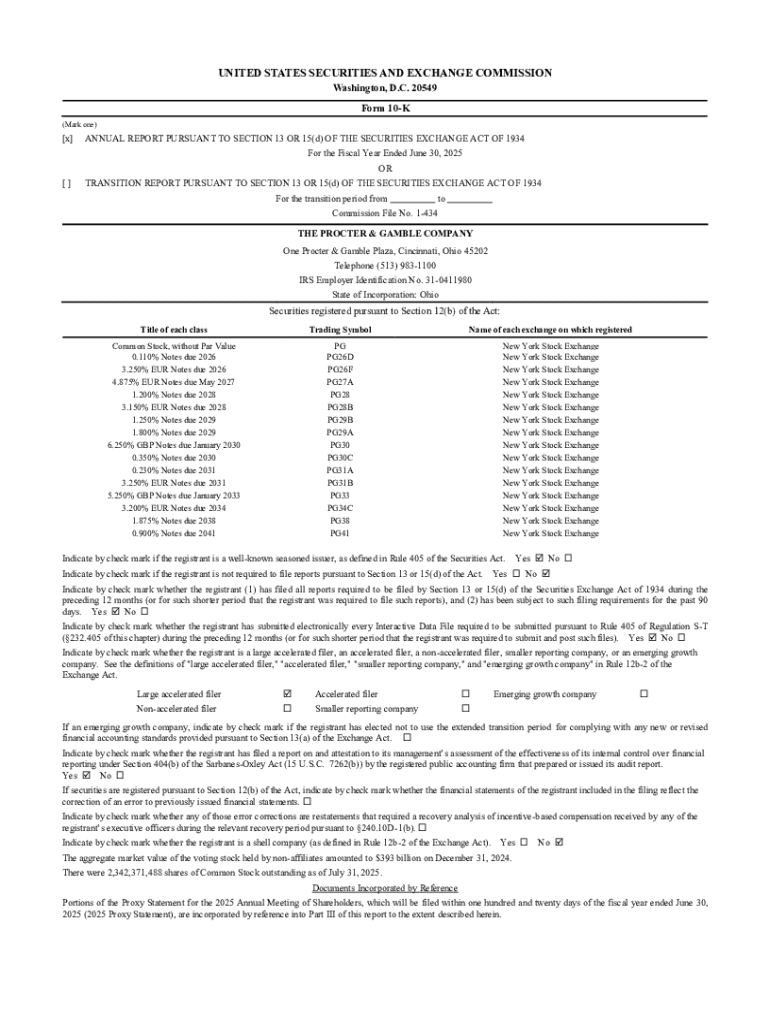

Understanding the PampG 2025 Form 10-K

The PampG 2025 Form 10-K is an essential filing that provides a comprehensive overview of Procter & Gamble's financial performance and strategic direction for the fiscal year. Form 10-K is a detailed annual report filed with the SEC, which gives investors and the general public critical insights into a company's operations, risks, and condition. For PampG, the 2025 filing encapsulates crucial data concerning its growth initiatives, financials, and overall market position.

Understanding the significance of the 2025 filing is imperative for stakeholders as it gives a window into PampG's long-term strategies and market forecasts. This reporting structure not only enhances transparency but also fosters confidence among investors. Key components of the 10-K report include annual financial statements, management discussion, risk assessment, and detailed corporate governance.

Key sections of the PampG 2025 Form 10-K

The PampG 2025 Form 10-K is laid out in structured sections, each offering specific insights into various operational aspects. The 'Business Overview' section provides a succinct description of PampG as a leading consumer goods company, outlining its market position and competitive landscape amidst evolving consumer trends. An in-depth analysis here reveals how PampG maintains its standing against competitors.

'Risk Factors' detail potential challenges that PampG foresees for 2025, ranging from supply chain vulnerabilities to regulatory changes. This is crucial for investors who need to understand potential investment risks. The 'Financial Data' section features key financial statements, including the income statement, balance sheet, and cash flow, illustrating PampG's fiscal health and year-over-year performance metrics.

Management's Discussion and Analysis (MD&A) is another vital section where PampG leaders provide context around the numbers, delve into financial performance insights, and offer commentary on market conditions that may affect future strategy. These components collectively provide a rich overview of the company's standing and future direction.

Steps for accessing PampG's 2025 Form 10-K

To access PampG's 2025 Form 10-K, one can start by navigating to the SEC's EDGAR database. This platform houses all SEC filings and provides a user-friendly interface for retrieval. Users should search for 'Procter & Gamble 10-K' along with the year to find the most relevant filing. Direct links can usually be found on PampG's own investor relations webpage as well.

Understanding filing dates is key for investors. Typically, companies have specific timelines, and 10-K reports must be submitted within a set period after the end of the fiscal year. Key dates include the filing deadline itself and subsequent earnings calls.

How to analyze the PampG 2025 Form 10-K

Analyzing PampG's 2025 Form 10-K involves identifying key financial indicators. Focus on revenue growth, profit margins, and cost management strategies. Liquidity ratios and cash flow metrics are equally important, helping investors gauge the operational efficiency and capital management practices within the company.

Evaluating the risk factors presented in the 10-K, along with management's discussion, enables analysts to assess potential impacts on future performance. Techniques for thorough evaluation include comparing these factors against industry benchmarks to comprehend the broader scope of operational challenges.

Tools for efficient document management

Utilizing tools like pdfFiller enhances the experience of working with documents like the PampG 2025 Form 10-K. Users can edit and customize PDF documents dynamically, ensuring that they can focus on the content rather than formatting concerns. The eSigning options facilitate quick approvals, streamlining collaboration and decision-making processes.

Collaboration is essential for team efforts, and pdfFiller's features support shared reviews and collaborative editing. It provides a platform for teams to store, track document versions, and maintain clarity in communication, which contributes significantly to efficient workflows.

Case studies on PampG’s 10-K usage

Examining past 10-Ks can reveal insightful investor stories. Many investment decisions are influenced by comprehensive analysis derived from historical forms that highlighted performance trends and strategic pivots. Investors who closely monitored PampG's shifts in 10-K filings often found success by aligning their strategies with reported operational changes.

Comparing the 2025 report against previous years will likely highlight evolving trends and shifts in key performance indicators. Investors and stakeholders can identify constructive patterns that may signal growth opportunities or potential risks.

Interactive tools for deep dive analysis

Beyond the 10-K report, financial dashboards and visualization platforms provide added depth for analysis. These tools enable users to dissect financial data interactively, identifying patterns and trends that may not be immediately apparent in a static report. Leveraging these resources can enhance understanding and facilitate informed investment decisions.

Custom reporting options allow users to tailor their analyses based on specific interests, drawing insights that are most relevant to their investment strategies and market needs. Such tailored approaches can significantly improve the efficacy of data-driven decision-making.

Best practices for staying updated on PampG filings

To remain informed about PampG's latest filings, investors should consider setting alerts for new submissions on the SEC's website. This can be a straightforward way to stay up-to-date with PampG's regulatory submissions, ensuring they do not miss critical updates.

Engaging with reputable financial news platforms is essential for rich discussions about PampG’s performance and filings. Staying plugged into sources that analyze and comment on PampG’s financial health can equip investors with context-rich insights that enhance their understanding.

Frequently asked questions (FAQs)

Common misconceptions about Form 10-K often stem from an unclear understanding of its purpose. Unlike quarterly reports that provide snapshots, the 10-K offers a comprehensive yearly overview. Investors may also wonder how to interpret complex financial jargon found within these filings; accessing simplified resources or guides can be incredibly helpful.

Through careful reading and contextual analysis, the insights derived from the PampG 2025 Form 10-K can significantly inform investment strategies and risk assessments, empowering investors to make sound decisions.

Expert insights and analyst predictions

Experts and analysts closely monitor PampG's filings, providing commentary that sheds light on industry expectations for 2025. Insights drawn from market dynamics and economic factors affecting consumer goods underscore the importance of strategic agility for PampG's performance trajectory.

Additionally, staying abreast of trends in reporting standards can impact how PampG communicates its financial performance. Changes in SEC requirements can necessitate adjustments in financial reporting strategies, which further underscores the dynamic nature of financial disclosures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pampg 2025 form 10-k in Gmail?

How can I get pampg 2025 form 10-k?

How do I edit pampg 2025 form 10-k on an iOS device?

What is pampg 2025 form 10-k?

Who is required to file pampg 2025 form 10-k?

How to fill out pampg 2025 form 10-k?

What is the purpose of pampg 2025 form 10-k?

What information must be reported on pampg 2025 form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.