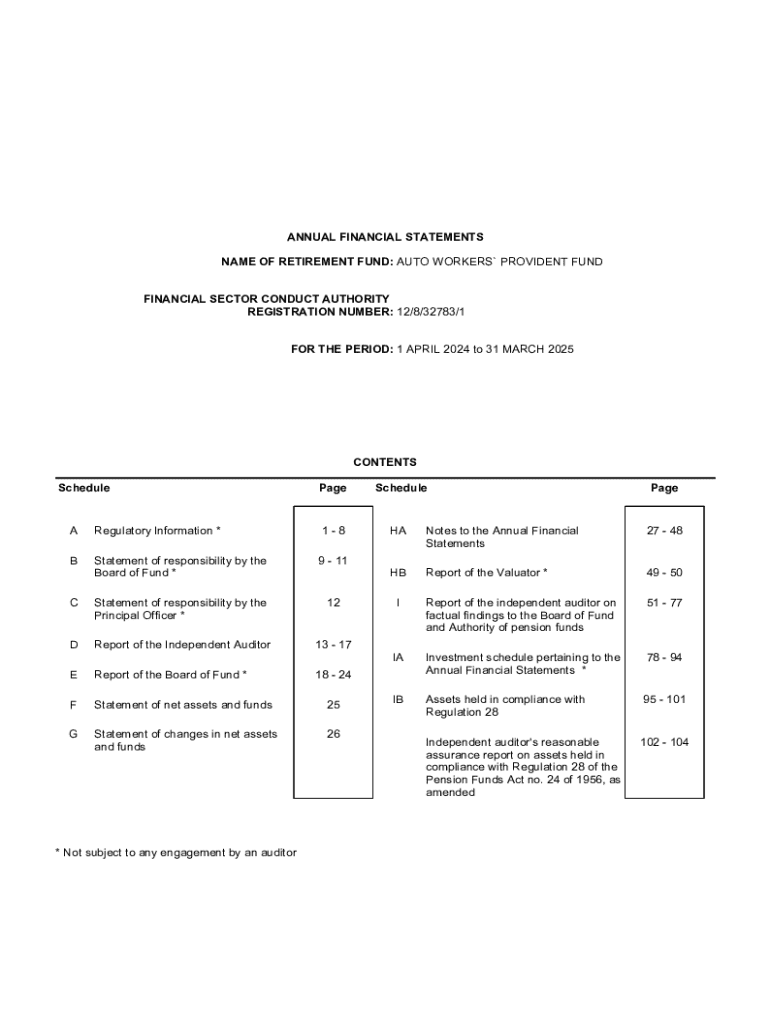

Get the free AUTO WORKERS PROVIDENT FUND FINANCIAL ...

Get, Create, Make and Sign auto workers provident fund

How to edit auto workers provident fund online

Uncompromising security for your PDF editing and eSignature needs

How to fill out auto workers provident fund

How to fill out auto workers provident fund

Who needs auto workers provident fund?

Comprehensive Guide to the Auto Workers Provident Fund Form

Understanding the auto workers provident fund

The Auto Workers Provident Fund is a crucial savings vehicle designed specifically for individuals employed in the automotive sector. As a defined contribution plan, it facilitates both employees and employers in contributing to an essential retirement fund. The primary purpose of this fund is to ensure that auto workers have a secure financial cushion when they retire, thereby offering them peace of mind during their later years. This is particularly significant in an industry known for its cyclical employment patterns, where job stability may fluctuate.

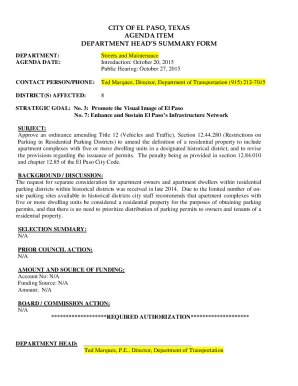

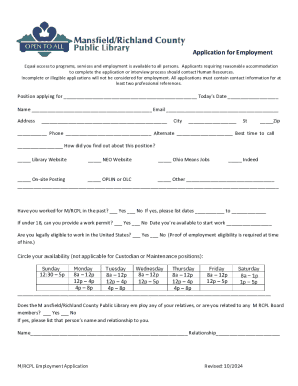

Essential information to complete the auto workers provident fund form

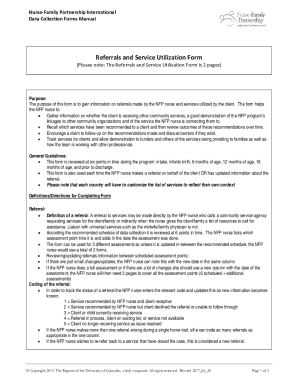

Filling out the auto workers provident fund form is vital for workers seeking to benefit from this essential retirement plan. Understanding who needs to fill out the form is the first step toward proper enrollment. Generally, all full-time employees in the automotive industry are eligible, provided they meet specific criteria set by their employers or the fund administrators. For instance, even interns or temporary workers may qualify based on their hours worked.

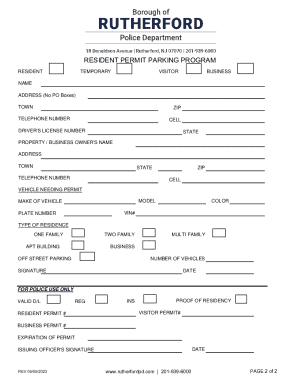

To successfully complete the form, individuals must gather essential documents. Identification documents are the first requirement, typically including a national ID or passport. Financial details such as bank account information for direct deposit should also be included. Lastly, previous employment records may be necessary if transferring from another fund or job.

Step-by-step guide to filling out the auto workers provident fund form

Accessing the auto workers provident fund form is straightforward; it can be conveniently downloaded or filled out online through pdfFiller. This quick access allows employees to begin their enrollment promptly. Navigation on pdfFiller is user-friendly, guiding individuals through each necessary step for completion.

The form typically comprises several sections. Let's break down the requirements:

Common mistakes often arise during this process, including leaving sections incomplete or failing to sign the document. Ensuring every field is filled in accurately will prevent unnecessary delays in processing.

Editing and managing your auto workers provident fund form

After filling out the auto workers provident fund form, there might be a need to edit or manage it further, especially if you're using pdfFiller. The editing tools available on this platform allow users to effortlessly adjust PDF fields. You can modify any information directly without needing to start from scratch, which is particularly useful for corrections or updates.

Additionally, pdfFiller offers collaboration features that allow you to invite others, such as your HR team, to view and edit the document. This functionality not only improves the efficiency of the completion process but also ensures that everyone involved has the necessary access to the most up-to-date information.

Signing the form legally and securely

One crucial element of submitting the auto workers provident fund form is ensuring it is signed properly. Understanding the nuances of electronic signatures is essential, as they hold the same legal validity as handwritten signatures under applicable laws. This means that your signed form can be submitted electronically just as safely as if it were signed on paper.

To eSign your document using pdfFiller, follow simple steps within the platform: Select the 'Sign' option, choose your preferred signing method, and follow the on-screen prompts to complete the process. If signatures from other individuals are needed, you can easily route the document to them for their signatures directly through the platform.

Submitting your auto workers provident fund form

Submission methods for the auto workers provident fund form can vary by employer. Most employees have the option to submit their completed forms online, which often integrates seamlessly with employer systems for swift processing. Additionally, physical submission by mail is still an option for those who prefer traditional methods.

Upon submission, applicants should expect a processing time during which their applications are reviewed. It is prudent to follow up within a few weeks if no communication has been received, as this could indicate issues with the application or a request for further information.

Keeping track of your retirement savings

Once you're enrolled in the auto workers provident fund, monitoring your account status is vital for ensuring your retirement savings are on track. Via pdfFiller, accessing your account information is simple and can be done anytime, which allows you to stay informed about your contributions and fund performance.

Additionally, updating your contribution information is crucial as your financial situation may change over time. Whether it's increasing contributions or changing funds, knowing when and how to make these changes is essential. Staying proactive in managing your fund could significantly impact your retirement planning, making it prudent to review financial statements regularly.

Amendments and updates to the fund

Staying updated with recent changes affecting the auto workers provident fund is important. Amendments to fund policies can have significant effects on both contributions and benefits. For example, alterations to the contribution limits or retirement age can directly impact your retirement strategy.

If an amendment occurs, it is essential to update your form accordingly. This may require you to fill out a revised document reflecting any new policies. Keeping abreast of these changes ensures that you are managing your retirement savings effectively and aligning your contributions with the fund's current standards.

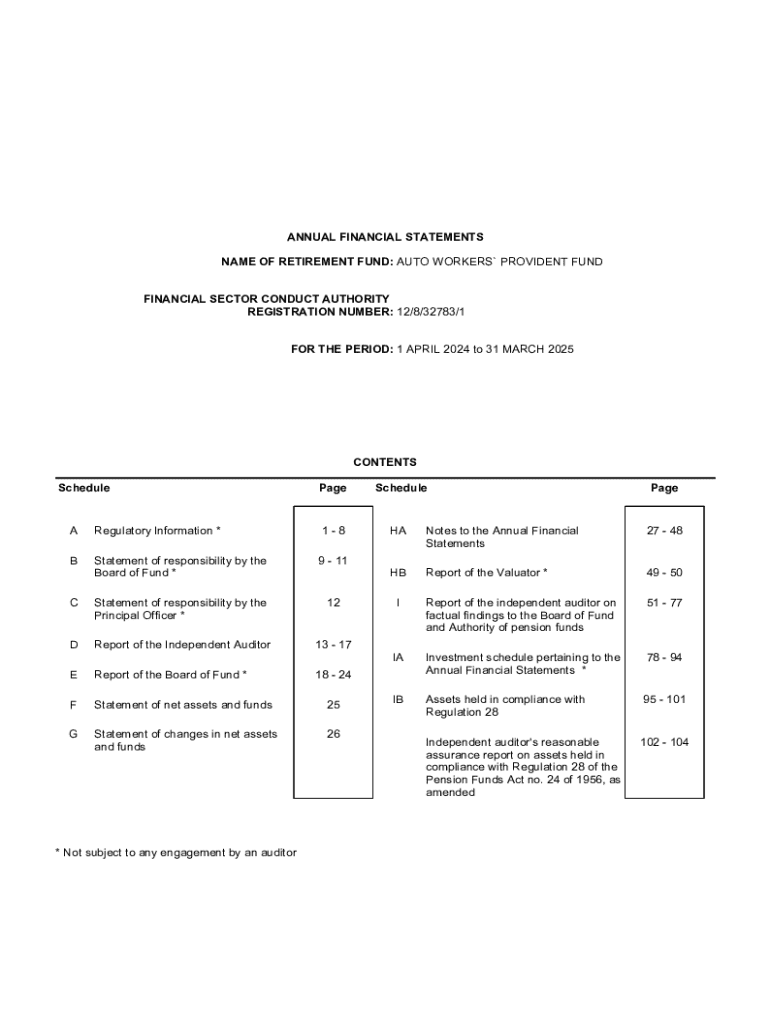

Insight into financial statements

Annual financial statements play a vital role in assessing the health and performance of the auto workers provident fund. Regular reviews of these statements help in understanding the fund's standing and trajectory. Such evaluations allow members to make informed decisions based on the fund's performance and projected growth.

Key financial reports include the actuarial valuation, which provides insights into the fund's assets versus liabilities, and the consolidated rules that guide fund functioning. Familiarity with these reports will empower members, as they can track their investment and retirement progress effectively.

Accessing historical data and trends in contributions

Reviewing historical data on contributions offers invaluable insights into how your savings have evolved over the years. Financial statements from previous years, such as those for 2022, 2023, 2024, and projections for 2025, highlight these trends. Essentially, understanding past performance not only serves as motivation but also guides future contributions.

As you analyze your contribution history, you'll identify patterns that inform decisions regarding how much to contribute or adjust for future planning. Utilizing this data effectively ensures you're prepared for a comfortable retirement, reflecting the true power of proactive financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get auto workers provident fund?

Can I sign the auto workers provident fund electronically in Chrome?

How do I complete auto workers provident fund on an iOS device?

What is auto workers provident fund?

Who is required to file auto workers provident fund?

How to fill out auto workers provident fund?

What is the purpose of auto workers provident fund?

What information must be reported on auto workers provident fund?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.