Get the free Property Owners Mailing Address Change Request

Get, Create, Make and Sign property owners mailing address

Editing property owners mailing address online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property owners mailing address

How to fill out property owners mailing address

Who needs property owners mailing address?

Comprehensive Guide to Property Owners Mailing Address Form

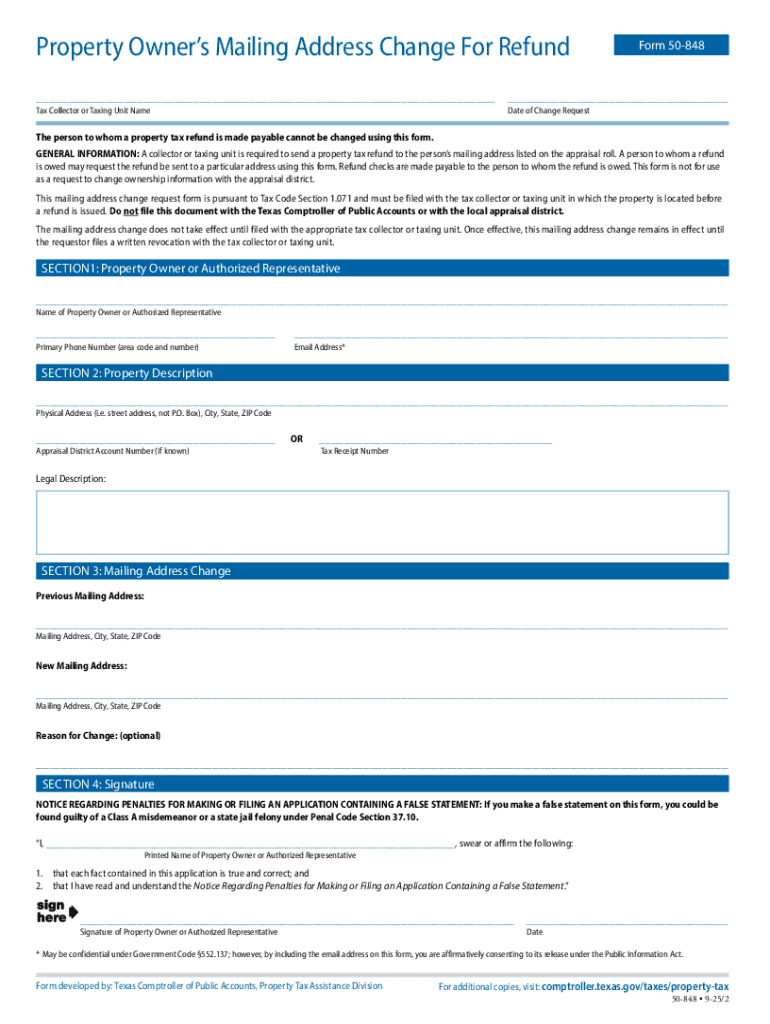

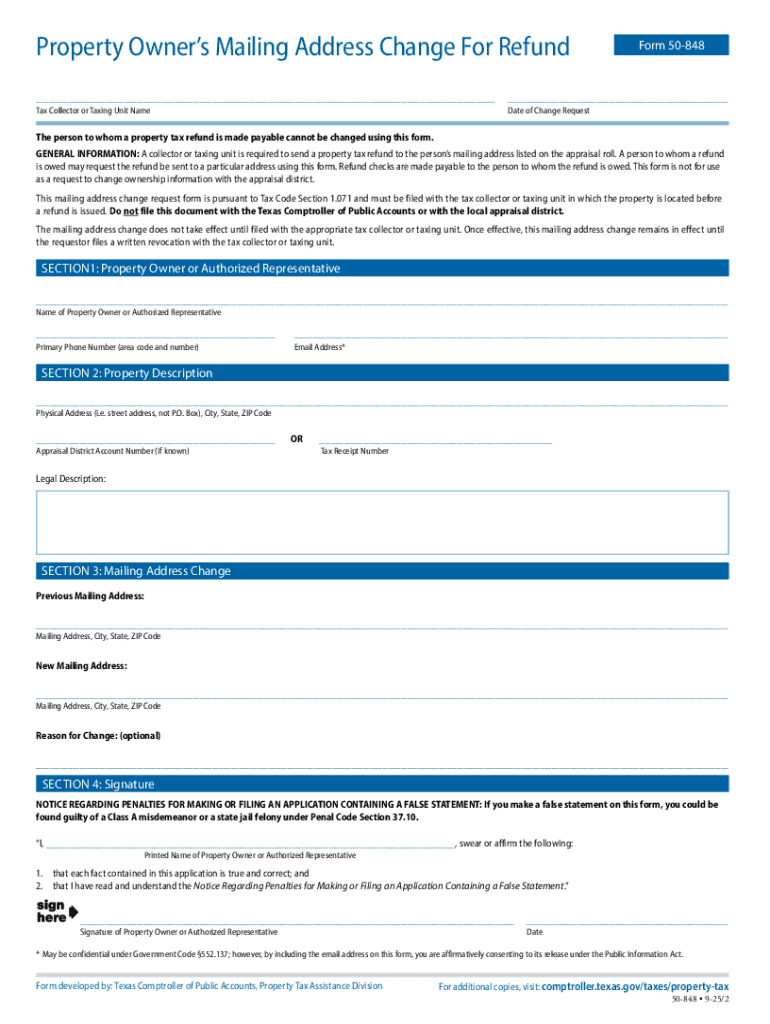

Overview of the property owners mailing address form

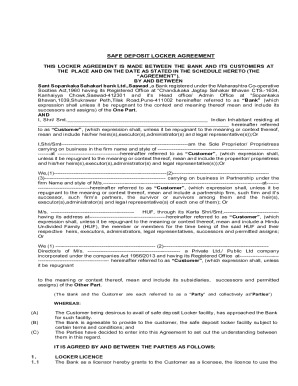

The property owners mailing address form is a crucial document for individuals and entities managing real estate. This form serves to collect and clarify the correct mailing addresses for property owners, ensuring effective communication with local authorities, tax offices, and other relevant entities.

Having accurate mailing information is vital for compliance with zoning rules, local regulations, and tax obligations. Whether it's for sending property tax bills, official notifications, or legal documents, a correct mailing address can help avoid missed communications and the subsequent problems that may arise.

Common use cases for the property owners mailing address form include updating ownership details after a property transfer, ensuring that you receive essential notices related to property assessments, and providing accurate information for abatement petitions or tax exemption applications.

Detailed breakdown of the form components

Understanding the components of the property owners mailing address form is essential for ensuring completeness and accuracy. The form is typically divided into several sections that each require specific information.

Section 1: Property owner information

The first section collects detailed information about the property owner. It generally requires full names, which should match the owner’s legal identification documents. Providing accurate contact details is also imperative. It includes a phone number and an email address, which facilitates quick communication regarding the property.

Section 2: Property details

This section focuses on the specifics of the property. You'll need to input the property's address in a recognized format, ensuring it aligns with postal standards. It's equally important to include the property identification number, also known as the tax parcel number. This can usually be found on previous tax bills or property tax documents.

Section 3: Mailing address specifications

In the final section, you specify where you want any correspondence sent. It's essential to differentiate between residential and commercial addresses. For instance, if you operate a business but reside at a different location, ensure you list both addresses accordingly. Another consideration is whether to use a P.O. Box or a physical address. If you frequently travel or are unable to check mail at a physical address, a P.O. Box may be more practical, but be aware that some governmental agencies may require a physical address.

Step-by-step instructions for completing the form

Completing the property owners mailing address form accurately is crucial, and following a systematic approach can simplify the process. Start by collecting all necessary information, including supporting documents such as previous tax bills and personal identification. This preparation helps to avoid delays and ensures that you have all details on hand.

When filling out the form, take your time to provide clear and legible information for each section. Pay particular attention to spelling names correctly, as errors can lead to significant issues later, especially when filing for tax exemptions or responding to government notices. Common mistakes to watch out for include transposed numbers in property identification or an incorrectly formatted mailing address. Use a checklist to ensure every point is addressed before submission.

Editing your property owners mailing address form

Once you've completed the form, editing it may be necessary. pdfFiller provides tools for seamless editing, ensuring that corrections can be made quickly and efficiently. To begin, upload your form to pdfFiller. The platform supports various file formats, which adds flexibility depending on your original document.

Navigating the editing tools is straightforward. Users can modify text and add new information easily. If you are collaborating with others on this document, pdfFiller allows real-time collaboration, making it simple to discuss and implement changes. When saving changes, it’s best to establish a consistent naming convention to track versions effectively, particularly if similar forms exist.

Signing the property owners mailing address form

Once the property owners mailing address form is complete and accurately reflects your information, it's time to sign it. pdfFiller offers several eSignature options, allowing you to type, draw, or upload your signature according to your preference. This digital approach is fully legally valid, making it convenient and compliant with the law.

After signing, sharing the completed form is simple. You can send it via email or generate links for cloud sharing. Tracking the submission status within pdfFiller keeps you organized and informed on whether the document has been accessed or reviewed by the intended recipients.

Managing your property owners mailing address form

A significant advantage of using pdfFiller for document management is the ability to store your forms in the cloud. This feature allows you to keep all relevant documents organized with folders and tags, ensuring easy retrieval when needed. Storing these documents electronically reduces the risk of loss and enhances accessibility.

You can access your forms from anywhere—whether on a desktop or mobile device. This cloud-based document management system means that whether you're in a meeting, on the go, or working from home, your documents are always at your fingertips. Syncing features further enhance this accessibility, making it easy to manage documents across different devices without hassle.

Additional considerations

When completing the property owners mailing address form, it's wise to consider common queries related to it. For example, many property owners often wonder about updates to their mailing address after filing a change. Keeping an updated record not only reflects well on you as a property owner but also ensures compliance with local regulations.

Another aspect to address is how to maintain up-to-date information. This could include regularly checking your address with the local tax assessor's office or using online resources. When filing for any property tax exemptions or related petitions, ensure you have the most current address to avoid issues caused by outdated information.

Related forms and resources

It’s beneficial to become familiar with other related forms, such as the address change form, business personal property forms, and senior and veteran tax exemption forms. Understanding how these forms interact can streamline the process of ensuring all your property-related documentation is correct.

Conclusion: The benefits of using pdfFiller for document management

Utilizing pdfFiller for managing your property owners mailing address form can streamline your processes significantly. Its platform consolidates editing, signing, and sharing within one cohesive system, allowing users to focus on what really matters—their properties.

By enhancing collaboration and overall efficiency with digital forms, pdfFiller empowers property owners to manage their documentation effectively and conveniently. In a world where timely communication is key, pdfFiller simplifies your document needs across various scenarios, making it an essential tool for property management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the property owners mailing address in Chrome?

Can I edit property owners mailing address on an Android device?

How do I complete property owners mailing address on an Android device?

What is property owners mailing address?

Who is required to file property owners mailing address?

How to fill out property owners mailing address?

What is the purpose of property owners mailing address?

What information must be reported on property owners mailing address?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.