Get the free NON-INDIVIDUAL INVESTOR

Get, Create, Make and Sign non-individual investor

Editing non-individual investor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-individual investor

How to fill out non-individual investor

Who needs non-individual investor?

The Comprehensive Guide to the Non-Individual Investor Form

Understanding the non-individual investor form

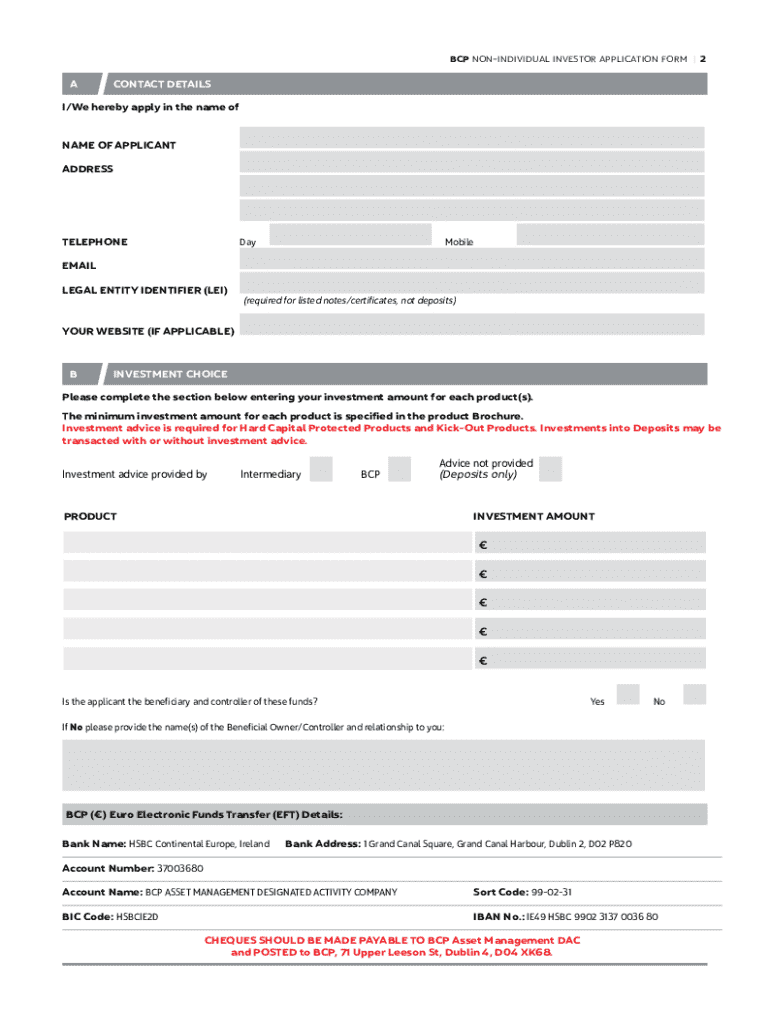

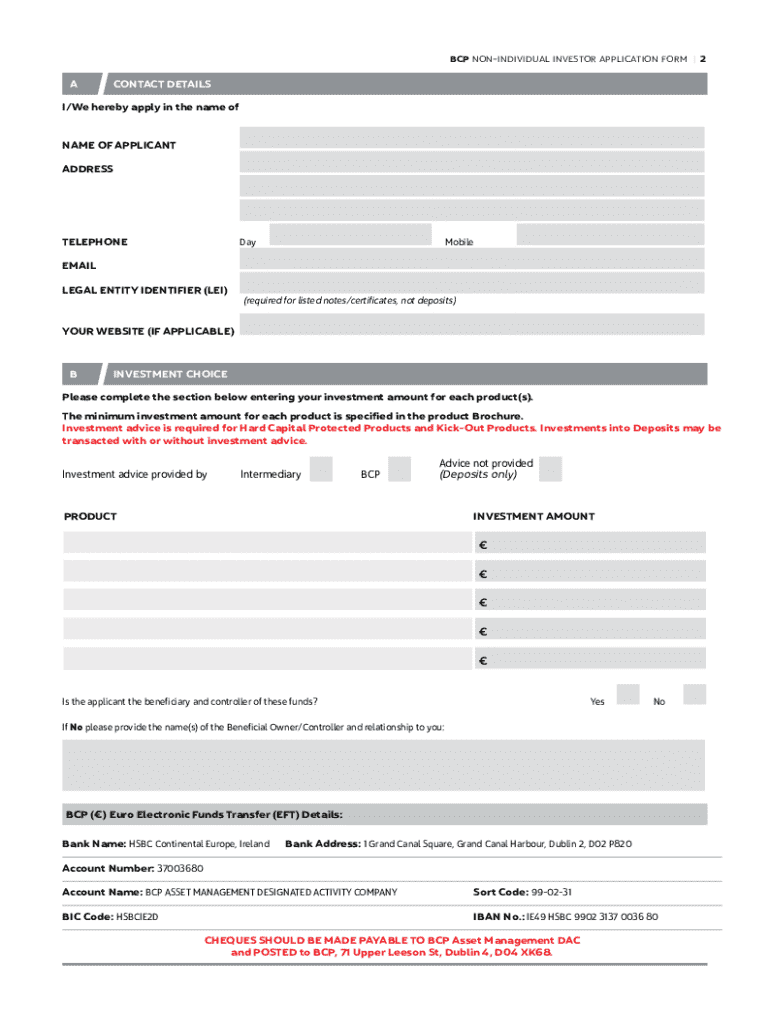

A non-individual investor form is a crucial document intended for entities such as corporations, partnerships, and trusts that are seeking to invest in various markets. This form serves to collect essential information regarding the entity's identity, investment intent, and legal representatives. Correctly completing this form is vital for compliance with regulatory requirements, safeguarding the integrity of investments, and ensuring proper accountability.

Given the intricacies of investing through an entity rather than an individual, the non-individual investor form allows the pooling of resources and expertise, which can lead to more substantial investment opportunities. Such forms are typically required by financial institutions, regulatory bodies, and investment platforms to accurately understand the ownership and control of assets.

Who should use this form?

Numerous entities benefit from using the non-individual investor form, including:

By utilizing this form, these entities can leverage collective assets, tap into diverse market opportunities, and ensure that their investments comply with legal standards. The benefits extend well beyond compliance; they include enhanced access to capital markets and increased trust from financial partners.

Key components of the non-individual investor form

The non-individual investor form typically consists of several key components essential for its proper function. Understanding these components can greatly enhance the accuracy and efficiency of completing the form.

Being thorough and precise in filling out these components is essential, as inaccuracies can lead to delays in processing or, worse, compliance issues.

Common terms explained

When dealing with the non-individual investor form, a few common terminologies emerge that are critical for understanding the format. Here’s a brief look at some of these terms:

Having a firm understanding of these terms will not only ease the completion process but also foster clarity when discussing the form with financial advisors or legal representatives.

Step-by-step guide to completing the non-individual investor form

Completing the non-individual investor form can seem daunting, but a structured approach can simplify the process. Follow this step-by-step guide to ensure accuracy and compliance.

Preparing the necessary documents

Before starting to fill out the non-individual investor form, gathering the necessary supporting documents is essential. Common documents include:

Having these documents organized will make filling out the form much more straightforward and ensure you can provide the information needed quickly.

Filling out each section of the form

Breaking down the form, let’s discuss how to fill out each specific section:

Review each section carefully before submission, as incomplete or incorrect information can lead to processing issues.

Common pitfalls to avoid

When filling out the non-individual investor form, some common pitfalls can obstruct the submission process. Be mindful of these frequent mistakes:

Avoiding these mistakes can smooth the process and facilitate faster investment approvals.

Editing and customizing the non-individual investor form with pdfFiller

Using pdfFiller can significantly enhance your experience in editing and customizing the non-individual investor form. Here’s how you can leverage the platform to your advantage.

Utilizing interactive tools

To access and use pdfFiller’s editing tools, start by uploading your non-individual investor form on the platform. The interactive features allow users to:

These features make for a smooth editing experience, ensuring you can customize the form according to your entity's needs.

Tips for collaboration

When working with a team on the non-individual investor form, pdfFiller provides an excellent collaborative environment. Here are some tips for effective teamwork:

Following these tips can make the collaboration process more effective and ensure timely completion of the form.

eSigning the document

To securely sign the non-individual investor form electronically using pdfFiller, follow these steps:

This eSigning capability is particularly useful for non-individual investors and ensures legal compliance.

Managing your non-individual investor form with pdfFiller

Proper document management is crucial for any entity. pdfFiller provides users with robust tools for storing and organizing their non-individual investor form effectively.

Storing and organizing your documents

With pdfFiller, you can create folders and sort documents by category, date, or custom names. This functionality allows users to:

Such organizational tools drastically reduce time spent searching through files and enhance overall productivity.

Tracking updates and changes

Keeping track of revisions made to the non-individual investor form is essential, particularly for compliance and audit purposes. pdfFiller allows users to easily:

This comprehensive document management capability makes pdfFiller a go-to solution for non-individual investors.

Troubleshooting and support

Challenges may arise when completing the non-individual investor form. Understanding how to troubleshoot common issues and access support is essential.

Frequently asked questions

Here are some common concerns that users may have when completing the non-individual investor form:

Having clear answers to these questions can ease the anxiety surrounding form completion.

Getting help from pdfFiller's support team

If you encounter issues while using pdfFiller or while completing the non-individual investor form, accessing their support team is straightforward. You can reach out via:

This access to expertise can help solve issues quickly and efficiently.

Conclusion

Accuracy and attention to detail in completing the non-individual investor form can significantly impact investment processes and compliance. This guide has provided insights, tools, and steps to ensure that entities can navigate this form effectively.

Furthermore, utilizing pdfFiller’s capabilities, including editing, eSigning, and document management, enhances the overall experience for non-individual investors. Embracing these tools not only simpliflies the process but positions you for future success in your investment endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my non-individual investor in Gmail?

Where do I find non-individual investor?

Can I create an eSignature for the non-individual investor in Gmail?

What is non-individual investor?

Who is required to file non-individual investor?

How to fill out non-individual investor?

What is the purpose of non-individual investor?

What information must be reported on non-individual investor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.