Get the free annexure e form

Get, Create, Make and Sign annexure e form

Editing annexure e form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annexure e form

How to fill out annexure e - department

Who needs annexure e - department?

Comprehensive Guide to Annexure E - Department Form

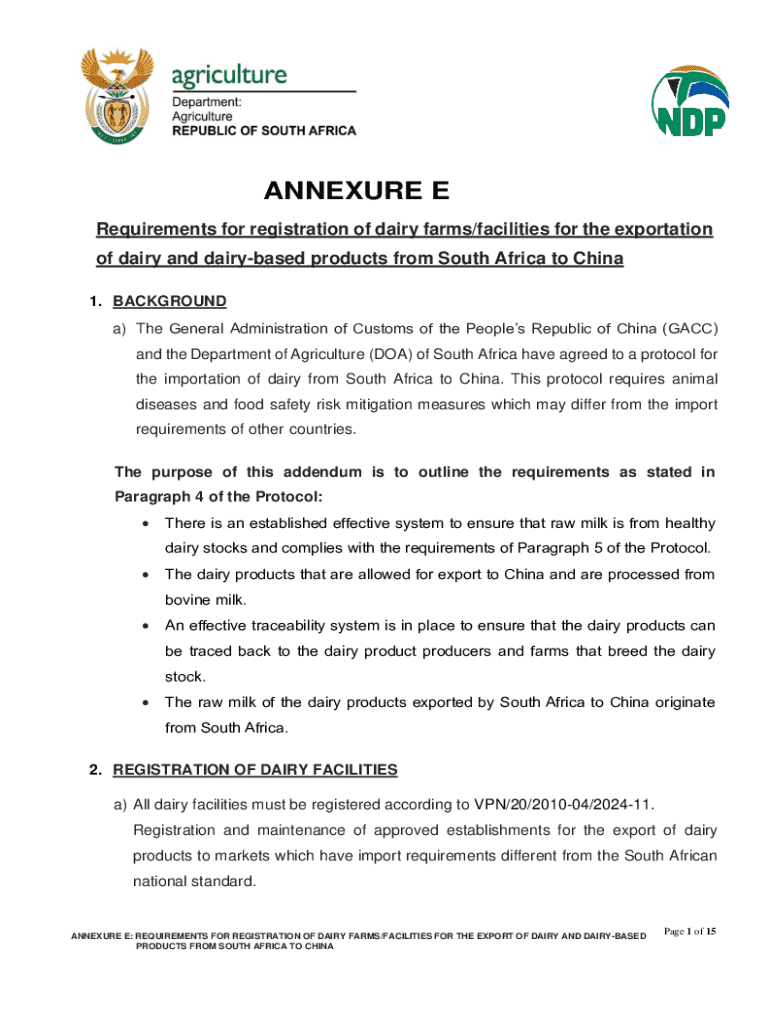

Understanding Annexure E

Annexure E refers to a specific department form that plays a crucial role in various departmental processes, particularly within governmental and administrative frameworks. It serves as a standardized document that consolidates essential information required for registration, compliance, or funding approvals. Understanding the purpose and significance of Annexure E is vital for individuals and organizations navigating bureaucratic requirements.

The importance of this form cannot be overstated. It ensures that all necessary information is documented accurately, aiding in the processing of applications and requests. For small-scale industrial units and other entities, Annexure E is often a prerequisite for obtaining a provisional registration certificate or a full registration certificate. Its use spans industries such as manufacturing, finance, and public services, where adherence to regulatory standards is mandatory.

Key components of Annexure E

Annexure E consists of several key sections that gather relevant information systematically. Each section of the form holds specific significance and must be completed accurately to ensure compliance with departmental requirements.

Section A focuses on Basic Information, collecting essential data such as the applicant's name, address, and nature of the business. Common fields include contact numbers and email addresses, with clear formatting guidelines outlined to avoid confusion.

Moving on, Section B delves into Financial Details, where applicants must provide information regarding revenue, expenses, and other financial metrics. This section often requires further documentation to substantiate the figures presented. Finally, Section C contains a Declaration that reaffirms the legitimacy of the provided information, dictating that a signatory, often the business owner or authorized representative, must endorse the submission.

Step-by-step guide to filling out Annexure E

Before diving into the form, preparation is essential. Begin by gathering all necessary documents to ensure you have supporting information handy—these may include financial statements, previous registration certificates, or other relevant administrative documents. Furthermore, become familiar with specific requirements dictated by your jurisdiction, as they may vary considerably.

Filling out each section demands careful attention to detail. In Section A, clarify personal information with precision—is it your full legal name? Under financial details in Section B, it's crucial to input accurate data. Misreporting can lead to delays or even rejection. Likewise, when reaching Section C, the declaration should reflect truthful statements. A common pitfall is assuming that all data is self-explanatory without cross-referencing against supporting documents.

Editing and customizing Annexure E

Utilizing online tools like pdfFiller to edit the Annexure E form can significantly enhance user experience. The platform offers interactive tools for customization, empowering users to add or remove sections per their specific needs. This flexibility allows teams to tailor the document efficiently while ensuring it meets departmental standards.

Advantages of online editing surpass traditional paper methods in many respects—foremost, real-time modifications can lead to a significant reduction in errors. Cloud-based features allow for easy management of different versions of Annexure E, ensuring that users always have access to the most current iteration of their documentation.

eSigning Annexure E

The significance of eSigning has grown due to its legal implications and efficiency. An eSignature validates the authenticity of the document, ensuring that submissions cannot be altered post-signature. This step is essential for ensuring compliance and securing approvals within departmental processes.

To sign Annexure E via pdfFiller, start by uploading your completed form onto the platform. Next, apply your eSignature by adding signature fields where necessary. Finally, finalize the eSignature process to secure all modifications. This streamlined approach not only saves time but guarantees that your submission adheres to legal standards.

Collaborating on Annexure E

pdfFiller offers substantial collaboration features that enhance teamwork when working on Annexure E. Users can easily share the document with colleagues or stakeholders, allowing for collective input before final submission.

When sharing, it’s critical to set appropriate permissions for each participant; this includes giving view-only access or editing rights as necessary. Moreover, pdfFiller supports real-time collaboration, enabling all participants to see updates instantaneously, which improves overall communication and minimizes chances of misunderstandings.

Tips for managing your Annexure E forms

Organizing your Annexure E forms within pdfFiller’s cloud-based platform ensures that all documents are accessible and manageable. Utilizing folders to categorize documents can save time and improve workflow efficiency, especially when multiple versions or related forms are involved.

Creating templates for recurrent use allows for expediency, as the fundamental structure of the form remains consistent. Employing best practices for digital document management—like maintaining updated files and frequently backing them up—can further streamline the process.

Frequently asked questions about Annexure E

Common inquiries surrounding Annexure E include questions about its validity and the implications of providing inaccurate information. Many users inquire about the necessary steps to rectify issues that arose during form completion or submission. It's pivotal to have contact information readily available for departmental support, ensuring any complications faced can be swiftly addressed.

Additional tools and resources for document management

Aside from Annexure E, various complementary documents may be necessary depending on the context of your application. Understanding how these documents integrate with one another can enhance clarity and efficiency in completing forms.

Integrating pdfFiller with other tools often leads to improved productivity. For instance, utilizing cloud storage in conjunction with pdfFiller can simplify document management immensely. Consider exploring available resources that provide deeper insights into document creation and management, equipping you with knowledge for effective administrative processes.

Success stories and use cases

There are numerous examples where effective handling of Annexure E led to successful submissions. For instance, small-scale industrial units in the national capital territory of Delhi have streamlined their registration processes significantly through efficient use of this form. Testimonials from users highlight how pdfFiller provided them with the tools to manage their documentation effortlessly.

Case studies illustrate that efficient document handling not only smoothens the registration process but also enhances business operations. Users consistently report benefits stemming from enhanced collaboration and reduced time spent on administrative tasks, allowing them to focus more on production and growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit annexure e form from Google Drive?

How do I execute annexure e form online?

How do I fill out annexure e form using my mobile device?

What is annexure e - department?

Who is required to file annexure e - department?

How to fill out annexure e - department?

What is the purpose of annexure e - department?

What information must be reported on annexure e - department?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.