Get the free ApplicationsTFNB Your Bank For ...

Get, Create, Make and Sign applicationstfnb your bank for

How to edit applicationstfnb your bank for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out applicationstfnb your bank for

How to fill out applicationstfnb your bank for

Who needs applicationstfnb your bank for?

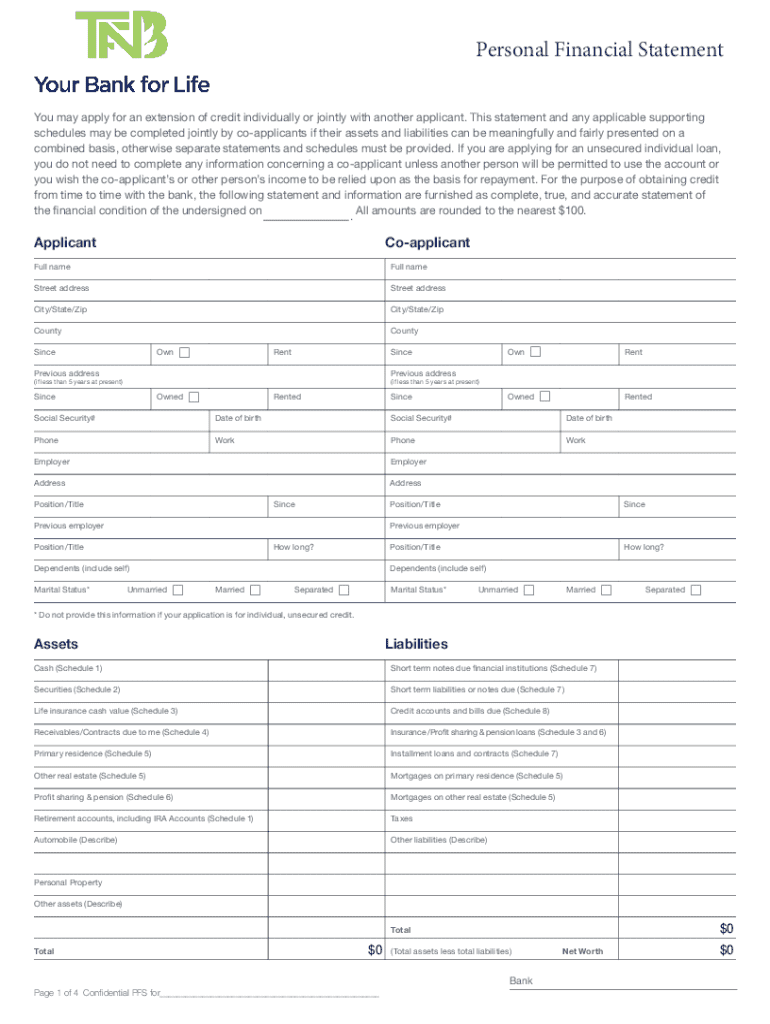

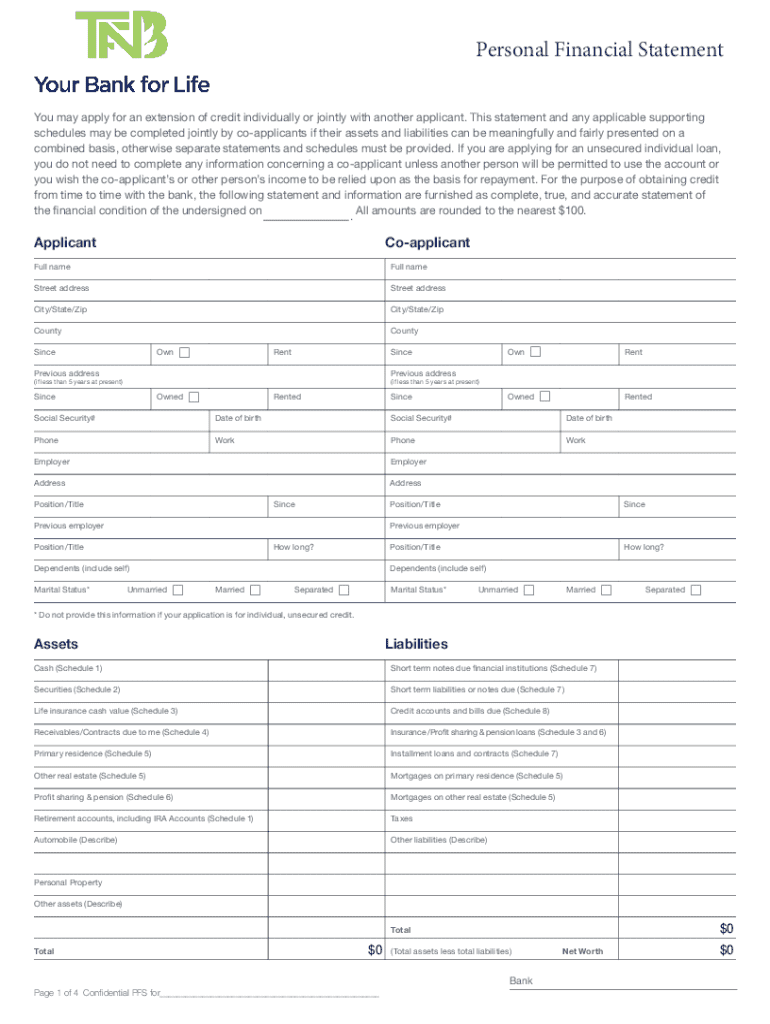

Applicationstfnb: Your Bank for Form

Understanding your bank’s application forms

Application forms serve as critical tools for individuals and businesses seeking financial services. These forms facilitate various banking processes, allowing banks to collect necessary information to either open an account, approve loans, or issue credit cards. Understanding these forms is essential for a smooth banking experience.

Accurate form submission is paramount. Missing data or inaccuracies can lead to delays or outright rejections, which can be frustrating. Thus, knowledge of what application forms are available and how to fill them correctly is crucial for effective banking.

Common types of application forms include:

Step-by-step guide to accessing applicationstfnb forms

Finding the right banking application forms online is uncomplicated with a structured approach. Start by navigating to your bank's website — in this case, Applicationstfnb.

Here are the steps to follow:

Once you’re in the forms section, choosing the right form is crucial. Identify your needs based on specific banking services or products you seek.

Utilizing filters and categories can streamline your search, ensuring you find the appropriate form quickly.

Filling out the application form

Completing your application form correctly is vital to avoid processing delays. Most forms require comprehensive personal and financial information. This typically includes:

To enhance the accuracy of your application, follow these tips:

Common mistakes include omissions of critical information or misrepresented financial data, both of which can derail your application process.

Editing and customizing your application

Utilizing pdfFiller can greatly enhance your experience when filling out Applicationstfnb forms. With this platform, you can easily modify your application forms:

Access your form through pdfFiller, and you can make necessary adjustments in a user-friendly interface. This includes modifying text and fields to suit your needs perfectly.

An essential feature is the capability to add electronic signatures. Here's how you can do it:

Submitting your application form

Effective submission of your application form can be just as crucial as completing it correctly. Here are best practices to follow before hitting send:

After you submit your application, timing for processing varies by service. It’s essential to be aware of what happens next, including tracking your application status for updates on any approvals or requests for further information.

Handling issues with your application

Despite meticulous completion, issues can arise with submissions. Here are some common problems you might encounter:

To resolve application issues, consider the following steps:

Frequently asked questions (FAQs)

Navigating application processes can raise numerous questions. Here are some common inquiries that may aid in your understanding:

Additional tools and resources from pdfFiller

pdfFiller offers robust features tailored to streamline document management for users involved in banking. This includes interactive tools to manage your forms effectively.

Collaborate easily on documents, making it simple for team members to review forms together, leave comments, and track changes, ensuring all revisions are noted.

Moreover, the benefits of using pdfFiller for your banking needs are numerous. This platform is cloud-based, ensuring that documents are accessible from anywhere and securely managed.

Success stories and case studies

Many users have benefitted from the efficiency of pdfFiller in managing their application forms. Success stories highlight remarkable improvements in application processing times when utilizing this comprehensive document management tool.

Testimonials from satisfied users showcase how they navigated Applicationstfnb forms successfully with pdfFiller, leading to positive banking experiences and expeditious approvals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get applicationstfnb your bank for?

How do I execute applicationstfnb your bank for online?

How do I make edits in applicationstfnb your bank for without leaving Chrome?

What is applicationstfnb your bank for?

Who is required to file applicationstfnb your bank for?

How to fill out applicationstfnb your bank for?

What is the purpose of applicationstfnb your bank for?

What information must be reported on applicationstfnb your bank for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.