Get the free Form RP-421-q Application for Real Property Tax Exemption ...

Get, Create, Make and Sign form rp-421-q application for

How to edit form rp-421-q application for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form rp-421-q application for

How to fill out form rp-421-q application for

Who needs form rp-421-q application for?

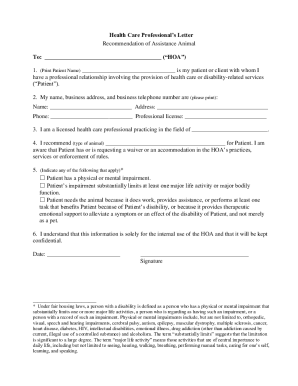

Comprehensive Guide to Form RP-421-Q Application for Form

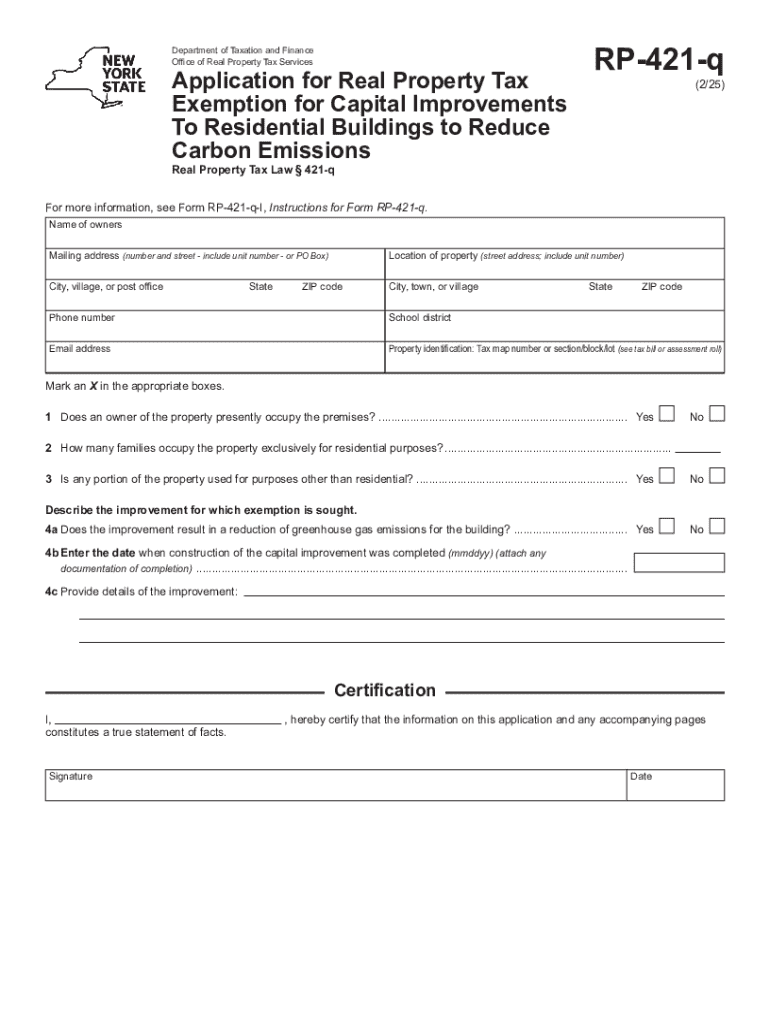

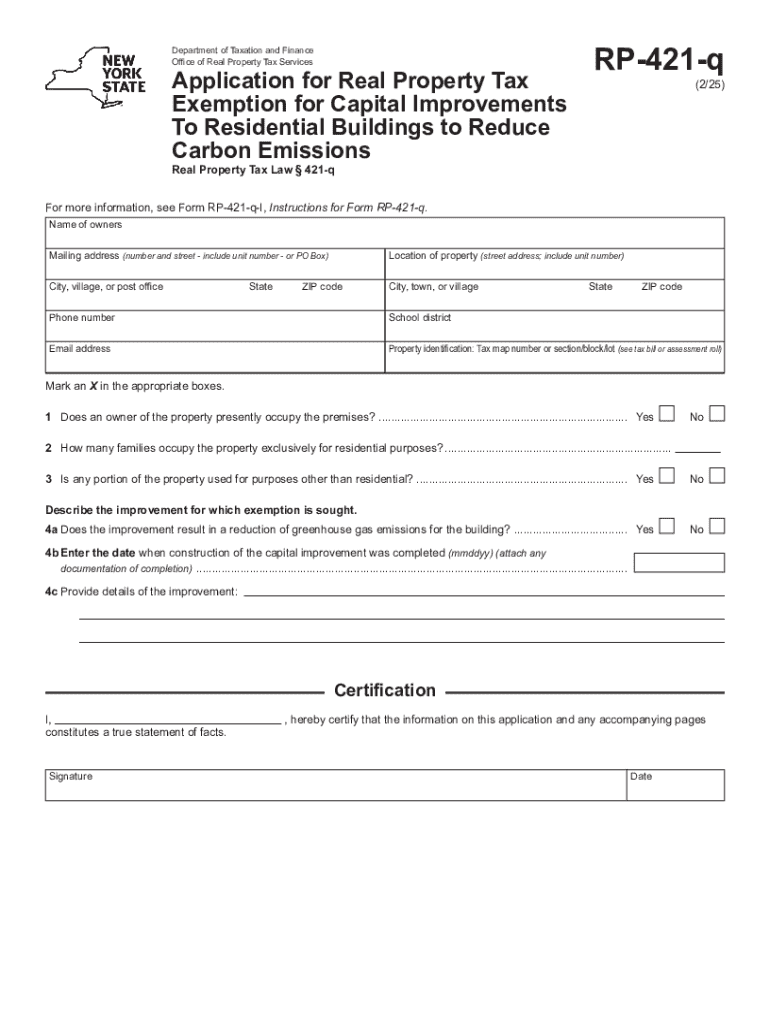

Understanding the RP-421-Q form

The RP-421-Q form is a critical document used in New York City for property tax relief applications, specifically targeting eligible property owners seeking to benefit from tax exemptions. This form is especially relevant for individuals who own properties in designated areas or who meet certain financial criteria. Its importance cannot be overstated, as it plays a significant role in property tax assessment and can lead to significant savings for homeowners.

Using the RP-421-Q form effectively can streamline the process of obtaining property tax exemptions, thereby lowering the tax burden for qualifying applicants. Eligibility criteria for using this specific form typically include requirements related to income levels, property use, and residency status. Therefore, understanding the nuances of this form is essential for anyone involved in property ownership within the relevant jurisdictions.

Detailed breakdown of form RP-421-Q

The RP-421-Q form is structured into several sections designed to elicit specific information from the applicant. Key sections include Applicant Information, Property Description, and sections for Tax Exemptions and Credits. It is crucial to differentiate between required and optional information when filling out the form, as providing unnecessary data can complicate the review process.

Common terminology associated with the RP-421-Q form includes terms such as 'tax exemption,' 'credit,' and 'property assessment.' Each of these terms has specific legal ramifications and technical meanings that can influence how the form is filled out and processed. Familiarizing yourself with these definitions is important to avoid pitfalls in your application.

Step-by-step instructions for filling out the RP-421-Q form

To complete the RP-421-Q form effectively, gather necessary documentation ahead of time. Vital supporting documents typically include proof of income, property deed, and any prior correspondence from the tax assessor's office related to the property. Not having these documents ready can delay the process considerably.

When filling out the form, ensure accuracy in each section. Start with Section 1, where you will provide Applicant Information. This may include your name, address, and contact information. Section 2 focuses on the Property Description, requiring details like the property location and type. Lastly, Section 3 addresses Tax Exemptions and Credits, where you indicate any previous claims or future expectations.

Editing and modifying your RP-421-Q form

Editing your RP-421-Q form is crucial in ensuring that all information is up-to-date and accurate before submission. Tools such as pdfFiller provide users with the ability to easily edit PDFs. With pdfFiller, you can add or remove information effortlessly, making it convenient to make changes as needed. Furthermore, if you need to incorporate signatures, pdfFiller offers both electronic and manual signing options.

Common edits to the RP-421-Q form often involve updating property details or correcting applicant information. For instance, a simple name correction or updating a tax exemption can significantly affect the outcome of your application.

Submission guidelines for the RP-421-Q form

Once your RP-421-Q form is complete, it’s time to submit it properly. You can choose between online submission through the NYS Department of Taxation and Finance website or a traditional mail-in option. Each method has its own nuances, so make sure you follow the guidelines outlined by the local tax assessor’s office.

Be mindful of deadlines. Submitting your RP-421-Q form late can lead to missed opportunities for tax relief. Familiarize yourself with specific cut-off dates relevant to your area to ensure that you are submitting well in advance.

Tracking your RP-421-Q application status

After submission, tracking the status of your RP-421-Q application is valuable for timely follow-ups. Most local tax offices provide a means to check application status online or via phone. Knowing whether your application is still under review or has been approved can inform your financial planning.

Understanding the review process is equally important. Generally, applications take several weeks for processing, but this can vary depending on the volume of submissions and regional guidelines. By staying proactive, you can ensure that any issues are addressed swiftly, paving the way for successful approval.

Assistance and resources

Frequently Asked Questions (FAQs) regarding the RP-421-Q form often revolve around eligibility, documentation requirements, and submission processes. A quick search through your local property assessor's office website can provide clarity on these queries.

For personalized assistance, contacting your local property tax assessor’s office can yield helpful information tailored to your specific situation. Additionally, online resources, including pdfFiller's offerings, make it easy for individuals to access interactive tools and guidance tailored for a comprehensive understanding of property tax forms.

Real-life scenarios and case studies

Examining successful RP-421-Q applications can provide insight into the best practices for effectively navigating the form. For example, applicants who meticulously followed guidelines and provided complete documentation often experienced smoother processes and quicker approvals. Conversely, common pitfalls include incomplete applications or failure to meet strict deadlines.

Learning from these examples can significantly benefit future applicants, helping them to avoid common mistakes that can lead to denials or delays in tax relief.

Staying informed: Updates on property tax regulations

Recent changes in property tax legislation can directly impact the RP-421-Q process. Increased property values, eligibility criteria adjustments, and changes in filing deadlines are all factors that can change each year. Keeping abreast of these developments ensures that you remain compliant and can take full advantage of available tax relief.

Staying informed can often involve subscribing to newsletters from tax assessment offices, following relevant government websites, or participating in local workshops. By doing so, you will ensure you can adapt to evolving guidelines effectively and maintain an edge in managing your property taxes.

Engaging with pdfFiller

Choosing pdfFiller for your form management simplifies the process of handling property tax forms like the RP-421-Q. The platform empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based environment. With each feature designed for efficiency, pdfFiller minimizes the stresses associated with document management.

Positive testimonials from real users emphasize the platform's ease of use and reliability, particularly when it comes to completing complex forms such as the RP-421-Q. Leveraging pdfFiller, you'll find addressing property tax issues more straightforward than ever, allowing you to concentrate on your property commitments rather than paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form rp-421-q application for?

Can I edit form rp-421-q application for on an iOS device?

How can I fill out form rp-421-q application for on an iOS device?

What is form rp-421-q application for?

Who is required to file form rp-421-q application for?

How to fill out form rp-421-q application for?

What is the purpose of form rp-421-q application for?

What information must be reported on form rp-421-q application for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.