Get the free S-3ASR: Automatic shelf registration statement of securities of ...

Get, Create, Make and Sign s-3asr automatic shelf registration

Editing s-3asr automatic shelf registration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out s-3asr automatic shelf registration

How to fill out s-3asr automatic shelf registration

Who needs s-3asr automatic shelf registration?

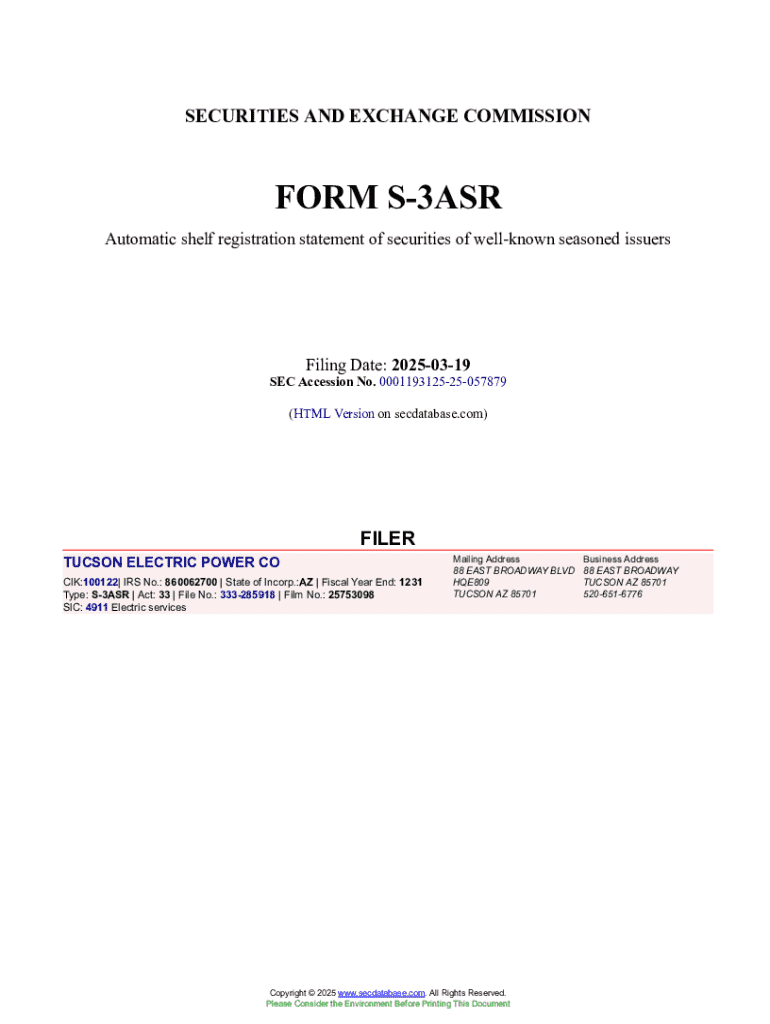

Understanding the s-3asr Automatic Shelf Registration Form

Understanding the s-3asr automatic shelf registration form

The s-3asr automatic shelf registration form is a critical tool for issuers in the securities market, allowing companies to register an assortment of securities efficiently. By enabling a streamlined approach to the registration process, the s-3asr form facilitates the quick availability of various financial instruments such as stocks or bonds to investors. This form is primarily utilized by seasoned issuers, thereby enhancing their market responsiveness and ability to raise capital swiftly.

The importance of the s-3asr form lies in its ability to distinguish between seasoned and non-seasoned issuers. For companies that meet specific conditions and are looking to maintain an effective registration for the immediate availability of securities, this form streamlines the entire process, allowing for potential offerings with minimized regulatory hurdles.

Key features of the s-3asr automatic shelf registration form

To utilize the s-3asr automatic shelf registration form, companies must meet certain eligibility criteria. This includes being a seasoned issuer, an entity that has continuously maintained a market capitalization of over $75 million. Additionally, eligible securities under this form include various instruments such as equity securities or debt securities, which allow issuers to raise capital according to market conditions.

The benefits of automatic shelf registration are significant. With an automated process, issuers can respond to favorable market conditions more rapidly, lowering barriers to timely capital fundraising. Furthermore, automating much of the regulatory compliance minimizes the time and resources spent during the offering process.

Preparing to use the s-3asr automatic shelf registration form

Preparation is key to successfully utilizing the s-3asr automatic shelf registration form. Issuers should ensure they have all essential documents ready before initiating the filing process. This includes comprehensive company details, current financial statements demonstrating eligibility, as well as compliance documents that confirm adherence to regulatory standards.

Common missteps to avoid before filing the s-3asr form include insufficient preparatory documentation, not double-checking financial disclosures, and failing to ensure up-to-date compliance records. Attention to detail in the preparation phase can prevent costly delays or denials during the filing process.

Step-by-step guide to completing the s-3asr form

Filling out the s-3asr automatic shelf registration form can be made straightforward by following a clear step-by-step process. Begin by gathering all necessary information such as company and financial details, moving on to the filing itself through an online portal.

Editing and managing your s-3asr form submissions

Managing your s-3asr form submissions is critical for maintaining compliance. Should changes be necessary post-filing, effective utilization of pdfFiller’s tools allows for efficient editing and collaboration with team members. The platform's intuitive editing interface offers features that ensure all aspects of the document are easily adjustable.

Once the s-3asr form is submitted, tracking its status becomes equally essential. Issuers can utilize the online portal to monitor their application approval stages and receive timely updates. This tracking helps companies respond to any potential issues proactively.

eSigning the s-3asr form

eSigning the s-3asr form ensures compliance and enhances security throughout the filing process. Utilizing electronic signatures allows for a faster turnaround, vital for keeping up with market demands. Choosing the right eSignature method that incorporates authentication measures is essential for maintaining a secure filing.

The step-by-step process for eSigning is straightforward. First, initiate the eSigning feature on the platform, choose your authentication method, and follow the prompts to ensure a seamless experience.

Frequently asked questions about the s-3asr automatic shelf registration form

Issuers often have common concerns and misunderstandings regarding the s-3asr automatic shelf registration form. Addressing these issues helps demystify the filing process and ensures compliance with all regulatory requirements.

Clarifications on filings and requirements can prevent setbacks. Ensuring that all documentation meets guidelines and is submitted on time is key.

Best practices for filing the s-3asr form

Implementing best practices when filing the s-3asr automatic shelf registration form can yield better outcomes. Setting a timely filing schedule ensures that your company is ready to take advantage of favorable market conditions without undue delays.

The use of a comprehensive document management tool like pdfFiller can greatly enhance the efficiency of the filing process. The combination of effective practices and advanced tools will ensure that issuers can navigate the complexities of the s-3asr automatic shelf registration form with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit s-3asr automatic shelf registration from Google Drive?

How do I complete s-3asr automatic shelf registration online?

How do I edit s-3asr automatic shelf registration on an Android device?

What is s-3asr automatic shelf registration?

Who is required to file s-3asr automatic shelf registration?

How to fill out s-3asr automatic shelf registration?

What is the purpose of s-3asr automatic shelf registration?

What information must be reported on s-3asr automatic shelf registration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.