Get the free Nebraska Advantage Microenterprise Tax Credit Act Claim ...

Get, Create, Make and Sign nebraska advantage microenterprise tax

Editing nebraska advantage microenterprise tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska advantage microenterprise tax

How to fill out nebraska advantage microenterprise tax

Who needs nebraska advantage microenterprise tax?

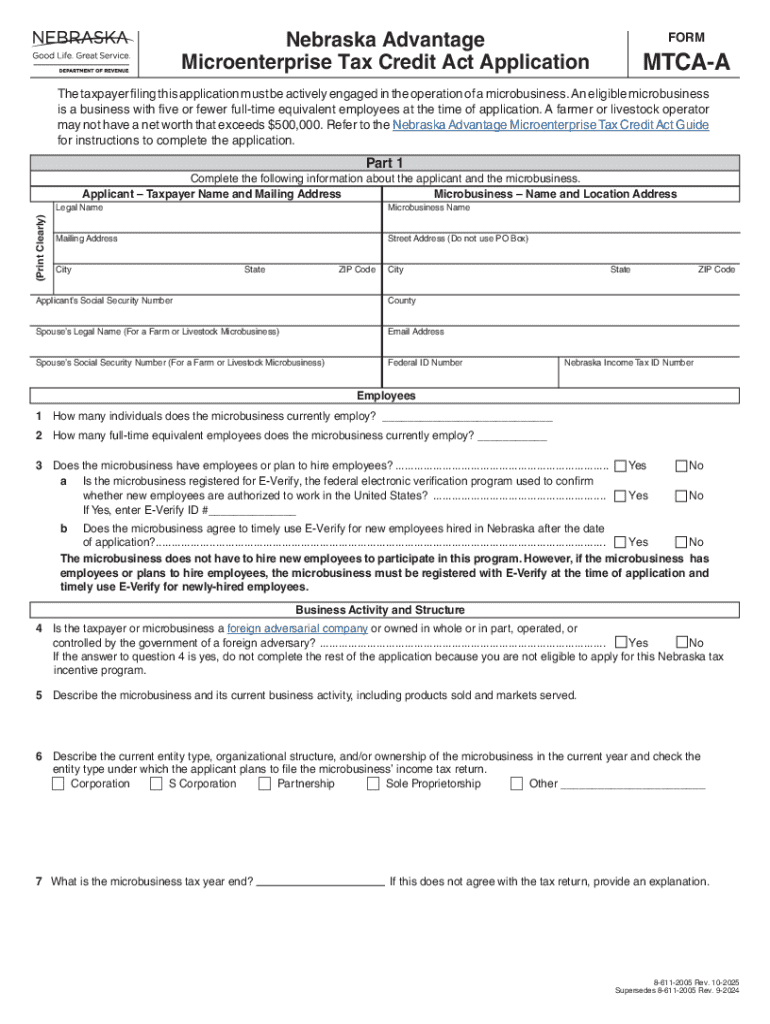

Navigating the Nebraska Advantage Microenterprise Tax Form

Understanding the Nebraska Advantage Microenterprise Tax Credit

The Nebraska Advantage Microenterprise Tax Credit serves a vital role in supporting small businesses within the state. This program incentivizes the creation and growth of microenterprises, promoting economic development by offering tax relief to eligible business owners. It is designed specifically for entrepreneurs who may not qualify for other business incentives due to the smaller scale of their operations.

To qualify for this tax credit, businesses must meet specific eligibility requirements. These include having fewer than ten employees, demonstrating a need for capital, and being registered with the Nebraska Secretary of State. Additionally, the business must be primarily engaged in the manufacture, production, or service sector. The tax benefits generally include a credit that can be applied against the business’s income tax, thereby easing the financial burden of startup costs.

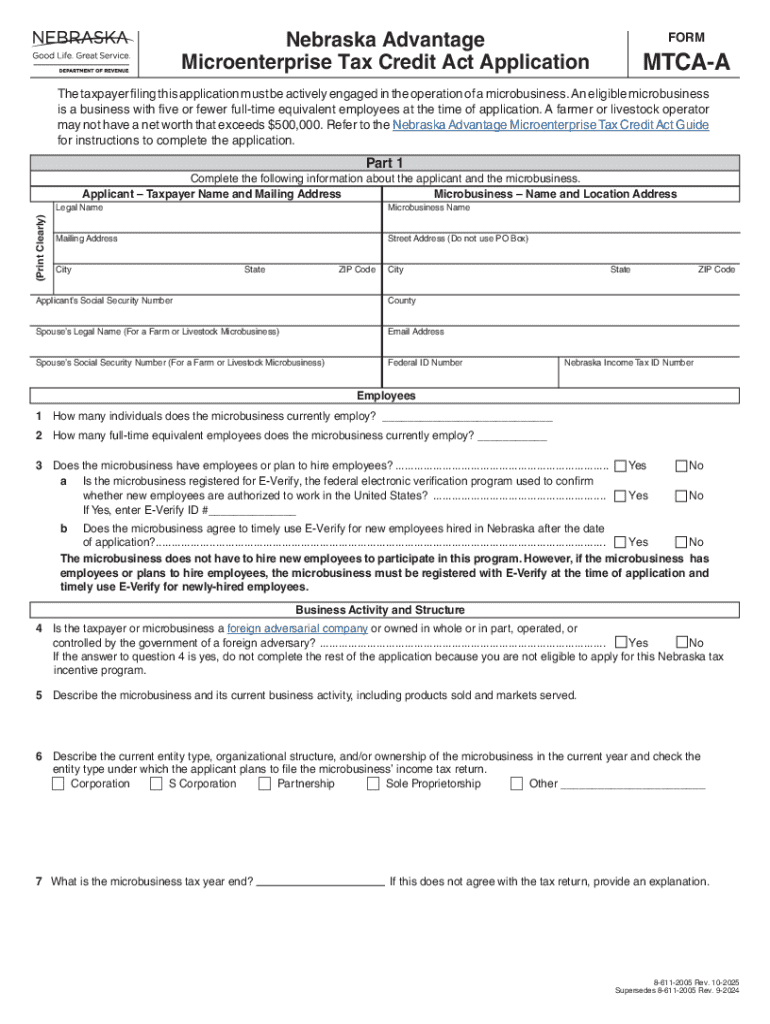

Key components of the Nebraska Advantage Microenterprise Tax Form

The Nebraska Advantage Microenterprise Tax Form comprises several critical components that you must complete accurately. Understanding the structure of the form is essential to ensure that you provide all necessary information and documentation. Typically, the form includes sections for personal information, business structure, and income reporting. Each section plays a unique role in assessing eligibility for the tax credit.

Accurate completion of the form is crucial. Incomplete or incorrect submissions can lead to delays or denial of the tax benefits. Along with the form, required documentation must be provided, including proof of income, a detailed summary of your business plan, and any other necessary attachments that showcase your business’s viability and need for assistance.

Step-by-step guide to completing the Nebraska Advantage Microenterprise Tax Form

Completing the Nebraska Advantage Microenterprise Tax Form can seem daunting, but breaking it down into manageable steps simplifies the process. Start by gathering all necessary information pertaining to your business and personal background. This includes your business name, structure, and the owner’s details, which are fundamental for identification.

Next, dive into the completion of the form itself. A thorough line-by-line breakdown entails providing accurate personal details, defining your business structure, and reporting anticipated income. It's also advisable to ensure that your estimations align with your business plan to avoid discrepancies.

After filling out the sections, take a moment to review the information you've provided. This is critical—errors or omissions can lead to complications during processing. Common mistakes include incorrect figures in the income reporting section or missing documentation. Once reviewed, you can choose your filing method, whether online for expedited results or by mailing in a paper form.

Interactive tools to aid in form completion

Utilizing interactive tools can significantly streamline the completion of the Nebraska Advantage Microenterprise Tax Form. For instance, electronic fillable options allow you to enter data directly into the form without needing to print it out. This not only saves time but also reduces the likelihood of handwriting errors. Many forms now come equipped with eSigning features, enabling you to sign your documents electronically and swiftly send them off without delay.

Collaboration tools further enhance the filing process, especially for teams. These platforms facilitate a review process, ensuring that all stakeholders can access the form and provide input before submission. Being able to share files securely and maintain version control helps in avoiding confusion and ensuring compliance with all necessary guidelines.

Frequently asked questions about the Nebraska Advantage Microenterprise Tax Form

Many users have common queries regarding the Nebraska Advantage Microenterprise Tax Form. Questions often revolve around eligibility criteria, the impact of prior tax filings, and the level of documentation required. For example, if you previously filed for the tax credit but faced rejection, understanding the reasons can clarify your next steps for improvement.

Clarifications on the filing process are also frequent. Many entrepreneurs wonder how to report income accurately or which specific documents relate to their business plan summary are necessary for submission. A detailed FAQ section can assist in addressing these concerns, guiding users to understand specific scenarios related to their tax filing.

Contact information and support

For individuals needing assistance with the Nebraska Advantage Microenterprise Tax Form, accessing help via pdfFiller is an excellent option. They offer robust customer support channels, including online chat assistance and comprehensive resources that guide users through the complexities of the form. It’s essential to utilize these services, especially when facing challenges or uncertainties during the filing process.

Online resources such as guides, video tutorials, and user forums further enhance understanding and accessibility. The Department of Revenue also has dedicated taxpayer assistance available to clarify legal questions or provide direct support related to tax filings.

Related incentives and resources

In addition to the Nebraska Advantage Microenterprise Tax Credit, various other tax credits and incentives are available to support small businesses. Familiarizing yourself with these programs can uncover additional opportunities for financial relief and business support. For instance, local resource centers often provide grants or low-interest loans aimed at microenterprises.

Networking also plays a fundamental role in a business's success. Engaging with local chambers of commerce or entrepreneurial groups offers networking opportunities that can lead to partnerships or collaboration possibilities that may not have been previously considered. Use these connections to gain insights into further resources that can help enhance your business growth.

Exploring other locations for similar programs

While the Nebraska Advantage Microenterprise Tax Form provides specific benefits within Nebraska, it's beneficial to explore similar programs in neighboring states. Many states offer tax credits designed to foster small business growth. By doing this comparative analysis, you can determine the unique benefits available elsewhere and leverage those insights to enhance your own business strategy.

For example, states like Iowa and South Dakota have their own tax incentives focusing on small business development. Some may offer higher credit amounts or different qualifying criteria that could be advantageous for businesses ranging from manufacturing to services. Understanding the landscape of available incentives helps you make informed decisions for your business’s future.

Additional tools for managing your documents with pdfFiller

Managing your documents effectively is a priority for any entrepreneur. pdfFiller offers a comprehensive suite of document management features that allow users to create, edit, and secure essential business files. Its cloud-based document solution not only facilitates easy access from anywhere but ensures that your important documents are always backed up and protected.

Moreover, collaboration tools enable seamless teamwork on documents, allowing multiple users to make edits and provide feedback without version confusion. This flexibility ensures that you can engage with team members easily, making the submission of forms like the Nebraska Advantage Microenterprise Tax Form a streamlined process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete nebraska advantage microenterprise tax on an iOS device?

How do I edit nebraska advantage microenterprise tax on an Android device?

How do I fill out nebraska advantage microenterprise tax on an Android device?

What is nebraska advantage microenterprise tax?

Who is required to file nebraska advantage microenterprise tax?

How to fill out nebraska advantage microenterprise tax?

What is the purpose of nebraska advantage microenterprise tax?

What information must be reported on nebraska advantage microenterprise tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.