Get the free 18002343500

Get, Create, Make and Sign 18002343500 form

Editing 18002343500 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 18002343500 form

How to fill out beneficiary designation this form

Who needs beneficiary designation this form?

Beneficiary designation this form: Your complete guide

Understanding beneficiary designation

Beneficiary designation is the legal process by which an individual identifies one or more people or entities to receive their assets upon death. This designation is crucial in financial planning, as it ensures that your assets are transferred according to your wishes without the delays associated with probate.

Many individuals misunderstand the importance of beneficiary designation forms. A frequent misconception is that a will alone is sufficient. However, assets with designated beneficiaries can pass directly to those beneficiaries, often avoiding probate altogether and thus speeding up the distribution of your estate.

Overview of the beneficiary designation process

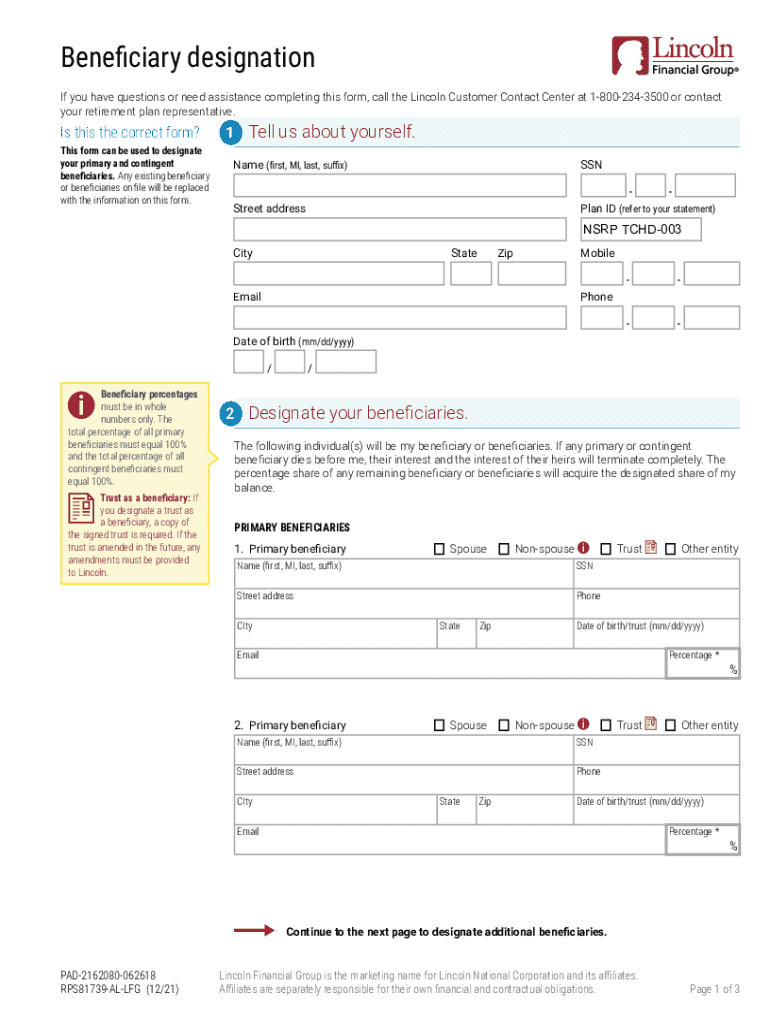

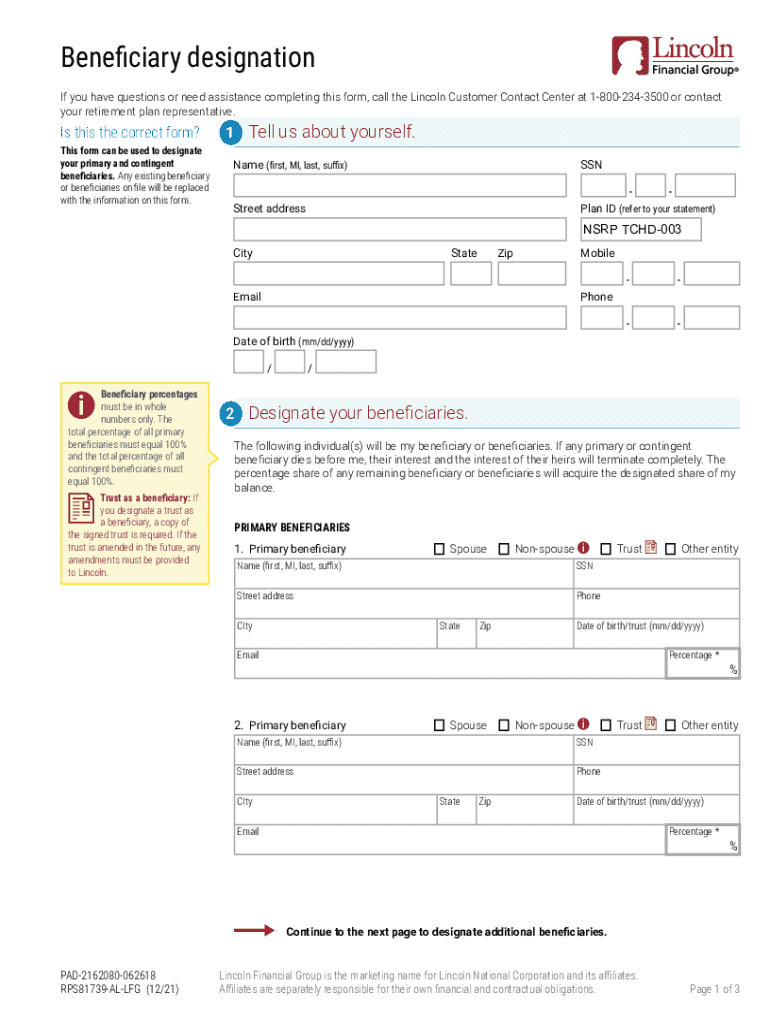

The beneficiary designation form is a critical document that allows you to outline who will receive your benefits from accounts such as retirement plans, life insurance policies, and investments. Each institution likely has its own form, and it’s vital to understand these forms to ensure your intentions are carried out.

Key components of the form include detailed information about the beneficiaries, such as their names, contact information, and social security numbers. You will also need to specify the percentage of benefits allocated to each beneficiary and include contingent beneficiaries who will receive the benefits should the primary beneficiaries be unable to.

Who should designate a beneficiary?

Designating a beneficiary is important for various individuals and organizations. For personal assets, individuals ensure their loved ones are financially secure; for families, it provides peace of mind that children or dependents are safeguarded in unforeseen circumstances.

Businesses also benefit from beneficiary designations, especially for employee benefit plans such as the Thrift Savings Plan designation of beneficiary. This helps manage employee benefits efficiently, ensuring that funds go to the intended parties without additional complications.

Step-by-step guide to filling out the beneficiary designation form

Filling out the beneficiary designation form requires careful attention to detail. Start by gathering necessary information, including your personal identification details and the information of your chosen beneficiaries. Ensure you have their full names, contact details, and social security numbers ready.

When you begin filling out the form, complete the beneficiary section first, followed by the percentage allocations. After assigning percentages, it’s critical to list any contingent beneficiaries. Once the form is complete, review all entries to ensure accuracy before submission.

Specific instructions for different scenarios

Active employees under employer-sponsored plans should be particularly vigilant about their beneficiary designations. Check with your HR department for specific requirements regarding forms and potential deadlines. For federal retirees or compensationers, unique considerations may apply regarding government benefits, which necessitate special attention to details to ensure compliance with official regulations.

Life events such as marriage, divorce, or the birth of a child can significantly impact designated beneficiaries. It is essential to review and potentially revise designations during these transitions to reflect your current situation and intentions.

Common mistakes to avoid

When filling out beneficiary designation forms, common errors can lead to unintended consequences. Incomplete or incorrect data entry can delay the transfer of benefits or result in undesired heirs receiving assets. It’s also critical not to overlook the importance of updating your designations after significant life changes, such as a divorce or remarriage.

Failing to include contingent beneficiaries can also create complications. If your primary beneficiary cannot inherit, having a contingent beneficiary is essential to ensure a smooth transition of benefits. Thoroughly reviewing your designation form can help prevent these issues.

Managing and updating your beneficiary designation

Managing your beneficiary designation is not a one-time task; it requires ongoing evaluation. It’s advisable to review your designations at least annually, and more frequently during life changes. If revisions are necessary, consider how and when to submit updates, as each institution may have different requirements for processing changes.

Keeping your designations current is crucial for ensuring that your benefits are distributed according to your current wishes. Typically, you can submit updates via online forms, through email, or by mailing paper copies, depending on the institution's policy.

Related information on beneficiary designations

Beneficiary designations can have a significant impact on your estate planning strategy. Understanding how these designations fit within your overall estate plan allows you to maximize your assets' potential for distribution. Additionally, recognizing the tax implications associated with transferring assets to beneficiaries is vital, as some benefits may be taxable while others may not.

For those looking for further guidance, consider seeking professional advice from financial planners or estate attorneys who can provide targeted strategies based on individual circumstances.

Tools and resources for beneficiary designation

Utilizing interactive tools can streamline the process of completing beneficiary designation forms. Platforms like pdfFiller feature user-friendly interfaces for filling out, editing, signing, and managing your forms from anywhere. These tools are designed to simplify what can often be a complex process.

In addition, tips for efficient eSigning and document management can help in keeping track of your beneficiary designations. Frequently asked questions about the forms can also clarify common uncertainties, guiding you toward making informed decisions.

Frequently asked questions (FAQs)

If you neglect to designate a beneficiary, your assets may be subject to probate, potentially leading to disputes among heirs or undesired distribution according to state laws. It is crucial to fill out these forms to direct asset distribution clearly.

You can change your beneficiary designation at any time, provided you follow the proper procedures outlined by the institution holding your assets. Regular reviews will help you keep your designations aligned with your life circumstances.

If a beneficiary predeceases you, the designation typically defaults to the contingent beneficiaries named on the form, or it may revert to your estate. It is vital to explicitly designate contingent beneficiaries to avoid these complications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 18002343500 form?

How do I make edits in 18002343500 form without leaving Chrome?

Can I sign the 18002343500 form electronically in Chrome?

What is beneficiary designation this form?

Who is required to file beneficiary designation this form?

How to fill out beneficiary designation this form?

What is the purpose of beneficiary designation this form?

What information must be reported on beneficiary designation this form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.