Get the free Verify your returnInternal Revenue Service

Get, Create, Make and Sign verify your returninternal revenue

How to edit verify your returninternal revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out verify your returninternal revenue

How to fill out verify your returninternal revenue

Who needs verify your returninternal revenue?

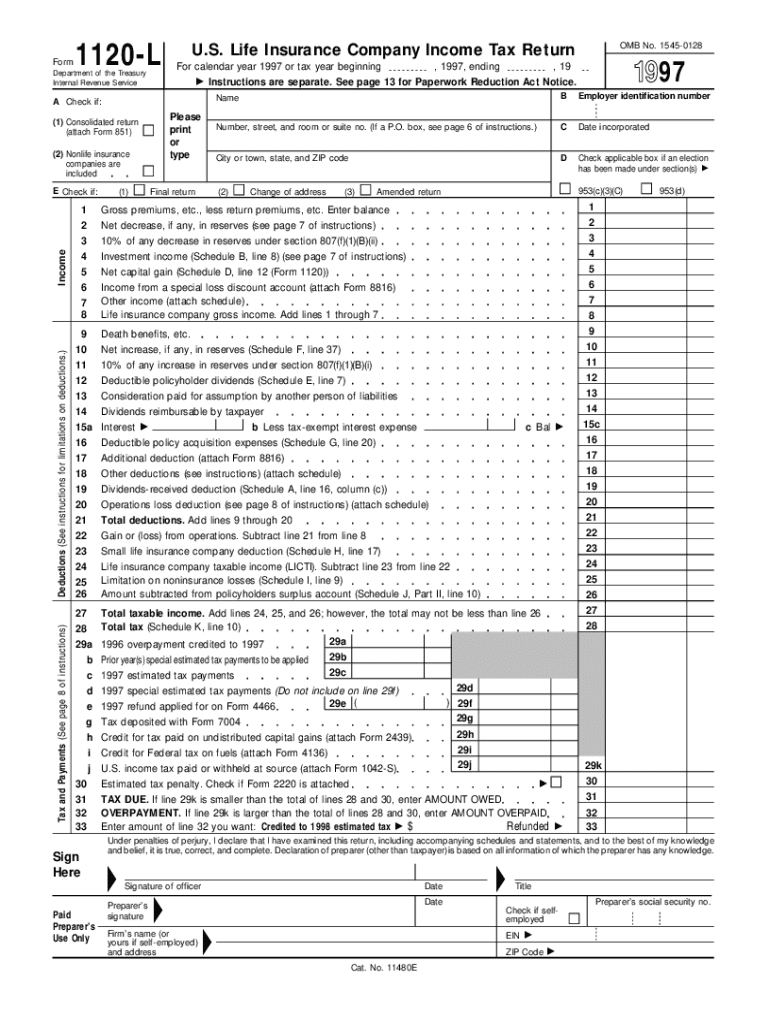

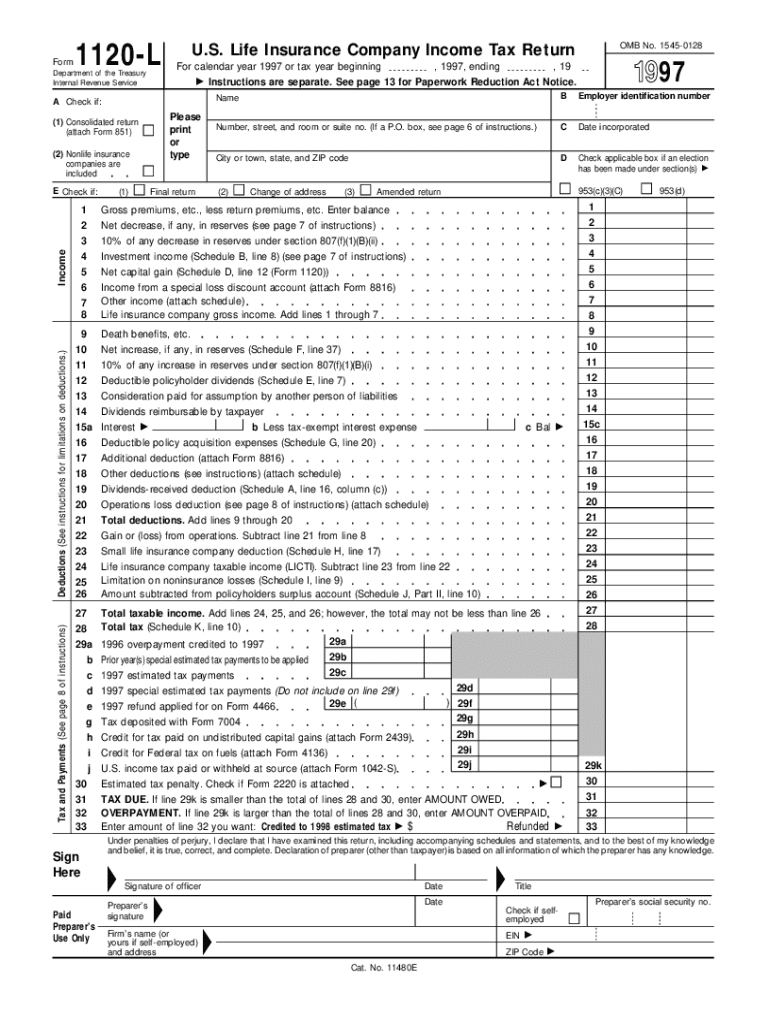

Verify Your Return Internal Revenue Form

Understanding IRS Form verification

Verifying your return means ensuring the accuracy and completeness of your income tax return before submitting it to the IRS. This process is crucial for individuals and families, including students and parents, as it can significantly affect tax compliance and financial planning. Accurate form verification ensures that you’re not only aligned with IRS regulations, but it also helps avoid potential rejections or audit complications later.

Importance of IRS form verification cannot be overstated. It establishes your credibility with the IRS and can lead to quicker processing times, especially if you are expecting a refund. Moreover, for taxpayers who might be considered nontax filers or who fall under special categories such as veterans, ensuring your information is correct is pivotal for future interactions with the IRS.

Step-by-step guide to verifying your return

Verifying your return can seem daunting, but breaking it down into manageable steps makes the process straightforward. Here’s a comprehensive guide to navigate the verification process without hassle.

Alternative options for verification

In some cases, individuals may benefit from external assistance during the verification process. Consulting with a tax professional can offer tailored support and ensure all details are thoroughly checked. This is especially helpful for those who are unfamiliar with tax regulations or handling complex forms, such as students and their parents.

The benefits of hiring an expert include deeper knowledge of tax laws, faster identification of potential errors, and guidance through any IRS communications. Additionally, utilizing document management tools such as pdfFiller can streamline the verification experience. Features like editable templates and collaborative options facilitate the document review process, ensuring you have everything ready for submission.

Common issues when verifying your return

Throughout the verification process, you may encounter various issues that could complicate things. Identifying and troubleshooting these problems early on can save you time and stress.

FAQs also help clarify what to do if your return can't be verified. If you face discrepancies, gather supporting documents and prepare your case for discussion with IRS representatives.

Understanding your rights and responsibilities

As a taxpayer, it's crucial to know your rights during the verification process. The IRS has established taxpayer rights that ensure fair treatment and the opportunity to ask questions or address concerns. You should always be treated with respect, and you have the right to complete information about your tax obligations.

Moreover, as a taxpayer, you hold responsibilities, including accurate reporting of your income and ensuring that all required forms are submitted on time. Understanding these rights and responsibilities can empower you to navigate the verification process smoothly.

Interactive tools for verification management

In today’s digital age, utilizing interactive tools for managing verification can be a game-changer. Platforms like pdfFiller offer practical, user-friendly tools that assist with editing, signing, and storing IRS forms securely.

These interactive tools allow you to save time and effort while ensuring accuracy. The seamless integration of document management simplifies your workflow and keeps you informed throughout the verification process. It streamlines collaborative efforts by allowing multiple users to connect and contribute to the document as needed.

Using pdfFiller for your IRS forms

Leveraging pdfFiller for handling your IRS forms opens up numerous benefits. The platform allows users to easily edit, annotate, and securely share IRS documents online. This is especially valuable for individuals who may need to review or correct forms from multiple locations while maintaining data integrity.

To edit and sign documents digitally, users can follow a simple process: upload the document, make necessary edits, digitally sign if required, and save. Security features built into pdfFiller ensure your sensitive information is protected every step of the way, making it a reliable choice for document management.

Real-world application and success stories

Many users have transformed their experience with tax forms through effective document management. Case studies highlight how pdfFiller's capabilities helped streamline workflows for both individuals and teams. From students managing their tax returns to parents filing for benefits, success stories illustrate the potential improvements in efficiency and accuracy.

Testimonials from satisfied users reveal significant time savings and reduced stress in navigating the IRS form landscape, showcasing how practical tools can lead to better outcomes in verification and compliance.

Important dates and deadlines

Staying informed about key dates can help manage your verification process efficiently. Tax season timelines, such as the filing deadline typically set for April 15, significantly impact verification. Always ensure that you account for potential delays when preparing to submit your forms.

Marking critical timelines and understanding how they affect your IRS interactions can prepare you for any verification needs. Missing deadlines could lead to penalties or issues with previous filings, so remain vigilant.

Contacting pdfFiller for support

If you encounter challenges while managing your IRS forms through pdfFiller, reaching out for help is easy. The platform offers robust customer support resources accessible directly from their website, ensuring you receive timely assistance.

Utilizing chat options or direct links to support articles can help you resolve form management issues quickly. Whether you’re a student, a parent, or a veteran, having reliable support can significantly enhance your overall experience with IRS-related documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send verify your returninternal revenue for eSignature?

How do I execute verify your returninternal revenue online?

Can I edit verify your returninternal revenue on an Android device?

What is verify your returninternal revenue?

Who is required to file verify your returninternal revenue?

How to fill out verify your returninternal revenue?

What is the purpose of verify your returninternal revenue?

What information must be reported on verify your returninternal revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.