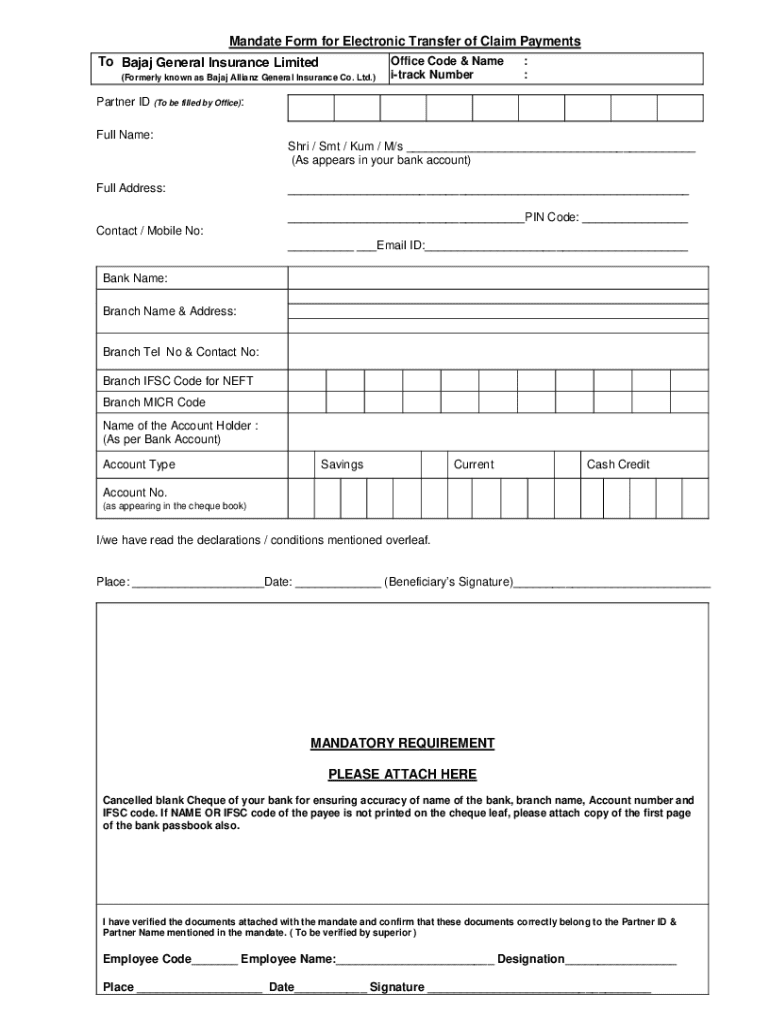

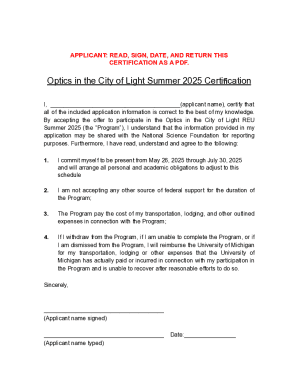

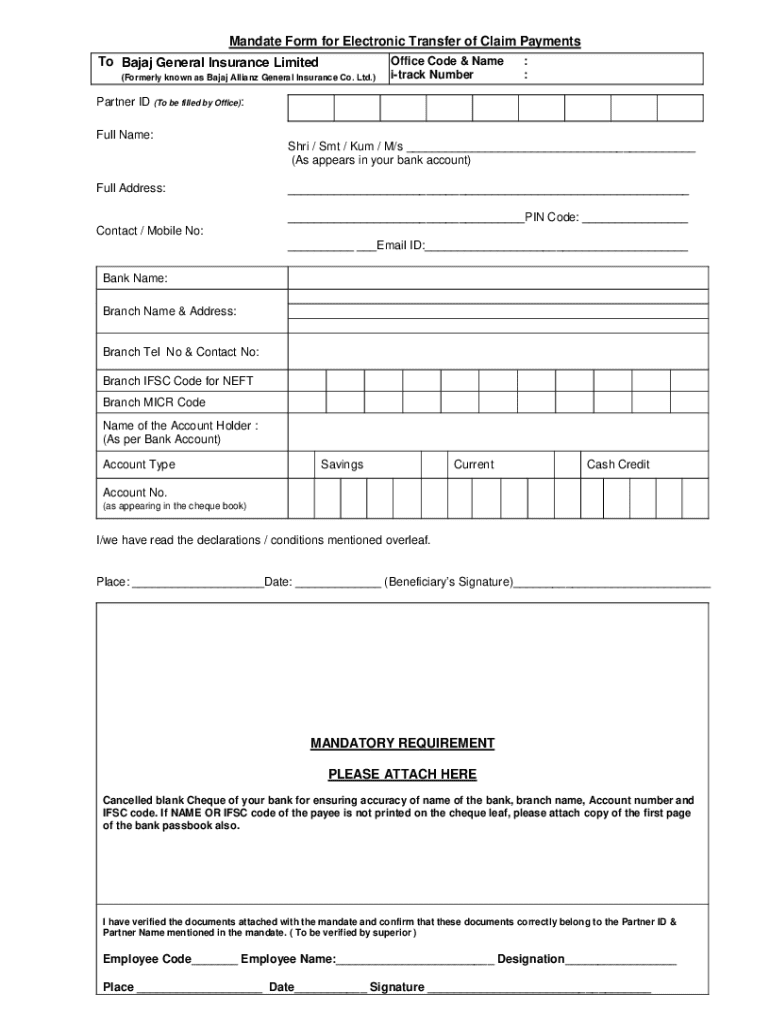

Get the free bajaj allianz health claim form

Get, Create, Make and Sign bajaj allianz health claim

How to edit bajaj allianz health claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bajaj allianz health claim

How to fill out health insurance claim form

Who needs health insurance claim form?

Health Insurance Claim Form - How-to Guide Long Read

Understanding the health insurance claim form

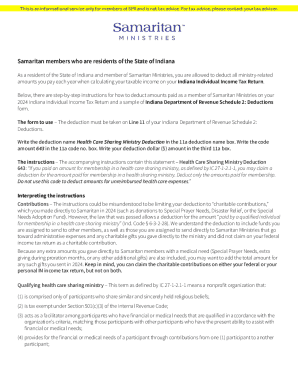

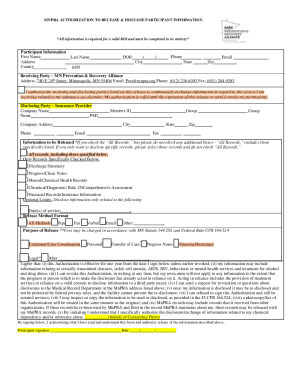

A health insurance claim form is a document used by insured individuals to request reimbursement from their health insurance company for medical expenses incurred. Each time a policyholder seeks medical care, this form is crucial for processing claims and ensuring that the healthcare provider gets paid and the insured receives coverage for eligible services. Moreover, the claim form streamlines communication between the policyholder, the insurance provider, and healthcare providers.

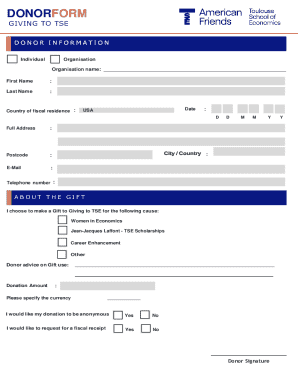

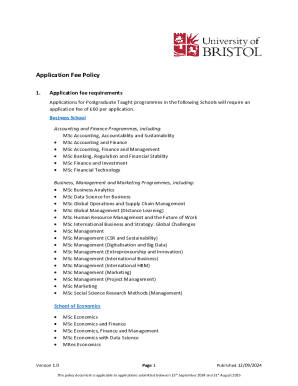

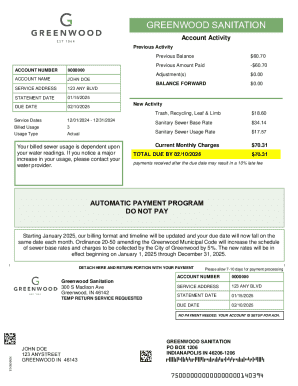

Key components of a health insurance claim form include personal information of the policyholder, details about the medical services provided, itemized billing, and any additional documentation required by the insurer. Understanding these components allows for efficient form completion and submission, which can significantly influence the claim's approval rates.

Importance of filing health insurance claim forms

Timely submission of health insurance claim forms is crucial. Most insurers have specific time frames within which claims must be submitted, often ranging from 30 to 90 days after the service is rendered. Delaying submissions can lead to rejected claims, resulting in out-of-pocket expenses for the insured, which could have been covered.

Moreover, submitting accurate claims is as important as timing. Mistakes or omissions can trigger claim denials or delays, which complicate the reimbursement process. On the other hand, accurate submissions help facilitate faster processing times and can improve the overall experience of the insured. Insurers may also value consistently accurate claim submissions, possibly leading to a more favorable relationship with the healthcare provider.

Overview of the health insurance claim process

The health insurance claim process can seem daunting, but breaking it down into clear steps makes it manageable. The first step involves gathering all necessary information and documents. This includes understanding your policy coverage to ensure services are eligible for reimbursement. Secondly, accurately completing the claim form is essential for a smooth process.

Each step in the claim process is interconnected. Missing a small detail can cause delays. Therefore, following structured steps helps not only in gathering the right information but also in presenting it correctly to the insurance provider.

How to fill out a health insurance claim form

Filling out a health insurance claim form correctly is imperative to ensure a swift processing experience. Here’s a step-by-step guide to completing the form effectively. Start with the personal information section; accurately enter your name, policy number, and contact details. Next, provide the healthcare provider's information including the name, address, and phone number.

The description of services section asks for information about the medical services provided. Be sure to describe each procedure accurately and provide the corresponding dates of service. Finally, in the itemized billing section, include the actual charges billed by the provider. Ensure every field is filled out completely; incomplete forms are a common reason for claim denial.

Common mistakes to avoid when completing the form

It’s vital to avoid several common mistakes. First, double-check the insurance policy number. A misentered number can lead to swift denial. Another critical error is neglecting to sign the form. Most insurers require an original signature to process claims. Additionally, ensuring that all relevant dates are included is essential, as missing them can cause issues.

Lastly, verifying that all information matches the healthcare provider’s invoice is crucial. Discrepancies will trigger a denial or request for additional documentation. Before submission, consider having someone else review the claim form for any potential errors you might have missed.

Health insurance claim form examples

Examples of completed health insurance claim forms can greatly aid understanding. Below is a sample completed form, followed by annotations and explanations for each section filled in correctly. A sample routine check-up claim would feature minimal services and costs, which provides a straightforward illustration, while an emergency care claim presents more complex details requiring thorough documentation.

When examining a specialty treatment claim, note the multiple service descriptions and itemized bills detailing the costs for procedures like scans or surgeries. Having multiple examples allows for insights into the variances in service details and billings that different scenarios require.

Frequently asked questions about health insurance claim forms

Understanding the intricacies of the health insurance claim process often leads to common queries. If a claim is denied, the first step is to review the denial notice carefully, which typically outlines the reason behind the denial. Next, tracking the status of a claim can frequently be accomplished online through the insurer's portal, providing real-time updates on claims processing.

In case of denial, appealing requires specific details: include the original claim number, copies of any relevant documents, and a cover letter succinctly explaining why you believe the claim should be honored. Each insurance company has its timeline for claim processing; understanding these benchmarks helps manage expectations during the waiting period.

Best practices for managing health insurance claims

Efficiently managing health insurance claims involves organizing healthcare documents meticulously. Maintain clear categories for different claims, and use tools that allow easy access and documentation updates. Platforms like pdfFiller provide secure cloud-based solutions that empower users to manage, edit, and collaborate on forms efficiently.

One of the standout features of pdfFiller is the ability to edit and customize claim forms directly. Whether you need to add or remove information or electronically sign forms, pdfFiller offers precision and convenience. The seamless collaboration tools also enable users to invite others to review and complete documents, ensuring every claim is filed impeccably.

Conclusion

Navigating through the health insurance claim submission process can empower individuals to take charge of their healthcare expenses. Through understanding the importance of the health insurance claim form, utilizing modern tools like pdfFiller for document management, and adhering to best practices for completion, users can streamline their claims. This not only enhances efficiency but also reinforces one’s position in ensuring proper healthcare reimbursement.

As the role of technology continues to evolve in simplifying claiming processes, pdfFiller stands out as a robust solution, catering to the diverse documentation needs that arise in the health insurance journey. Embracing these advancements allows for effective management of health insurance claims and fosters a proactive approach to personal healthcare management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit bajaj allianz health claim in Chrome?

How do I edit bajaj allianz health claim straight from my smartphone?

How do I complete bajaj allianz health claim on an Android device?

What is health insurance claim form?

Who is required to file health insurance claim form?

How to fill out health insurance claim form?

What is the purpose of health insurance claim form?

What information must be reported on health insurance claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.