Get the free ACH STOP PAYMENT

Get, Create, Make and Sign ach stop payment

Editing ach stop payment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ach stop payment

How to fill out ach stop payment

Who needs ach stop payment?

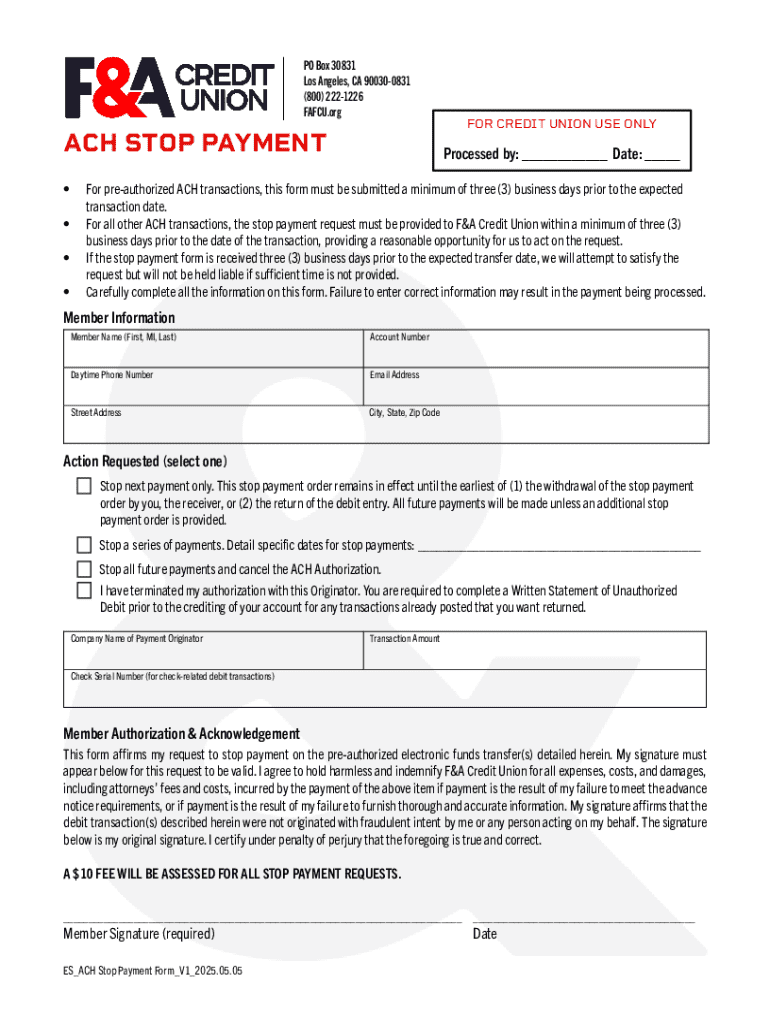

Comprehensive Guide to the ACH Stop Payment Form

Understanding ACH stop payments

An ACH transaction, or Automated Clearing House transaction, is a type of electronic funds transfer that enables individuals and businesses to move money between bank accounts. It offers a convenient and cost-effective method for processing various payments, including payroll, vendor payments, and direct debits. Understanding how ACH transactions operate is crucial, as they are significant within the financial ecosystem, streamlining payment processes across a multitude of industries.

Requesting a stop payment involves notifying your bank or financial institution to halt the processing of a specific transaction. This action is pivotal for individuals seeking to cancel an ACH payment that they did not authorize or that is related to a dispute. Unlike traditional checks, which lose validity after a period if not cashed, an ACH transaction is electronic and may require swift action to reverse or halt it. Thus, understanding the process of ACH stop payments compared to checks is essential.

Reasons for requesting an ACH stop payment

There are several scenarios where individuals may find themselves needing to request an ACH stop payment. One primary reason is unauthorized transactions, which can occur due to fraud or errors in payment processing. For instance, if you notice a charge from a merchant you do not recognize or did not authorize, you should act quickly to halt the payment. Similarly, disputes may arise from forgotten cancellations or misunderstandings about automatic debits.

Another important aspect involves managing cash flow concerns. Sometimes, individuals may realize that an unexpected ACH transaction could lead them to overdraw their account. In instances of potential fraud, requesting a stop payment can be a protective measure. By addressing these concerns proactively, individuals can maintain control over their finances and prevent undue fees or complications.

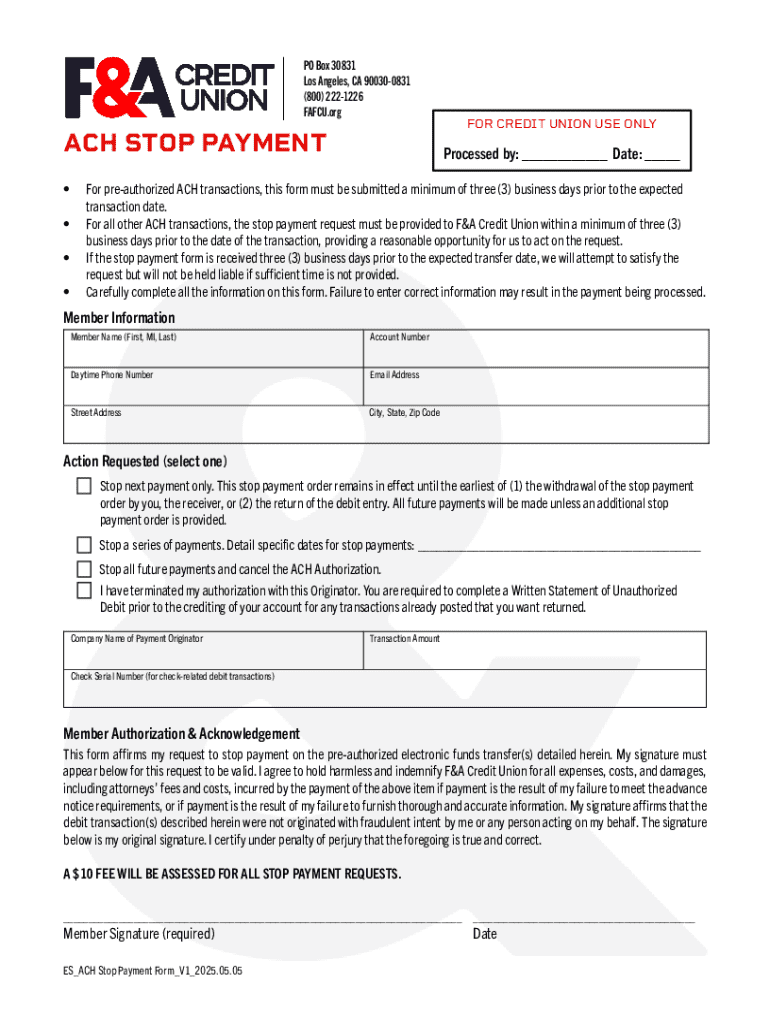

Overview of the ACH stop payment form

The ACH stop payment form is a critical document that individuals must complete to initiate the process of halting a transaction. This form serves as an official request for your bank to stop the processing of a specific ACH payment. Its significance cannot be overstated; submitting an accurate and timely form can protect your finances and help resolve disputes.

Both individuals and teams who manage accounts are eligible to use the ACH stop payment form. Individual users may need it for personal banking transactions, while teams managing business accounts might require repeated use for vendor payments or payroll processing. Understanding the context and specific needs behind the form is essential for its correct utilization.

Step-by-step instructions for completing the ACH stop payment form

Completing the ACH stop payment form is a straightforward process when followed step by step. Here’s how:

Editing and managing your ACH stop payment request

Using pdfFiller’s tools can significantly enhance your experience when handling the ACH stop payment form. If you realize you have made an error or need to provide additional information, pdfFiller allows you to edit your data in real-time, ensuring your request is accurate and effective. The platform’s e-signature capabilities allow you to authorize your request quickly, adding a layer of professionalism and immediacy to your submission.

Additionally, if you’re part of a team, pdfFiller facilitates collaboration. You can invite team members to review the form, provide feedback, or even help fill it out, ensuring that all necessary voices are heard and that the submission reflects teamwork.

After submitting your ACH stop payment request

Once you’ve submitted your ACH stop payment request, it’s essential to know what to expect next. Typically, banks process these requests promptly, and you should receive confirmation of your request. The timeline for processing may vary based on your bank’s policies, but tracking this request is vital to ensure that it’s being handled.

In the aftermath of your submission, monitor your account closely for any unexpected transactions. It’s also wise to follow up with your bank if there's any unusual activity or if you don’t receive confirmation within expected timelines. Resolving issues promptly helps maintain financial security.

FAQs about ACH stop payment requests

Addressing common questions about ACH stop payments can help users navigate this process more effectively. A frequent inquiry pertains to how long a stop payment lasts. Typically, banks enforce stop payments for a limited duration, often ranging from six months to a year, depending on their policies and the originating institution.

Another common question involves revoking a stop payment once submitted. Generally, it’s challenging to reverse a stop payment request unless the transaction is still pending. Lastly, inquiries regarding fees typically associated with stop payments are common; most banks impose nominal fees, which can vary, so consulting with your bank beforehand can provide clarity.

Leveraging pdfFiller for future document needs

Beyond just ACH stop payments, pdfFiller serves as an all-encompassing platform for document management and creation. Whether you need to draft new forms, edit existing documents, or set up templates for recurring tasks, pdfFiller equips users with the necessary tools to handle various document-related responsibilities efficiently. This versatility ensures that you have the resources to tackle your documentation needs in one place.

Additionally, integrating pdfFiller’s cloud-based features maximizes efficiency. Users have the flexibility to access their documents from anywhere and collaborate seamlessly with teams. This way, the burden of documentation management is lightened, letting individuals and teams focus on what matters most.

User tips and best practices

Preventing the need for stop payments can save time and stress. Here are a few preventative measures to consider:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ach stop payment directly from Gmail?

How can I get ach stop payment?

How do I make edits in ach stop payment without leaving Chrome?

What is ach stop payment?

Who is required to file ach stop payment?

How to fill out ach stop payment?

What is the purpose of ach stop payment?

What information must be reported on ach stop payment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.