Get the free 5713 instructions

Get, Create, Make and Sign 5713 instructions form

How to edit 5713 instructions form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 5713 instructions form

How to fill out 0294 form 5713 schedule

Who needs 0294 form 5713 schedule?

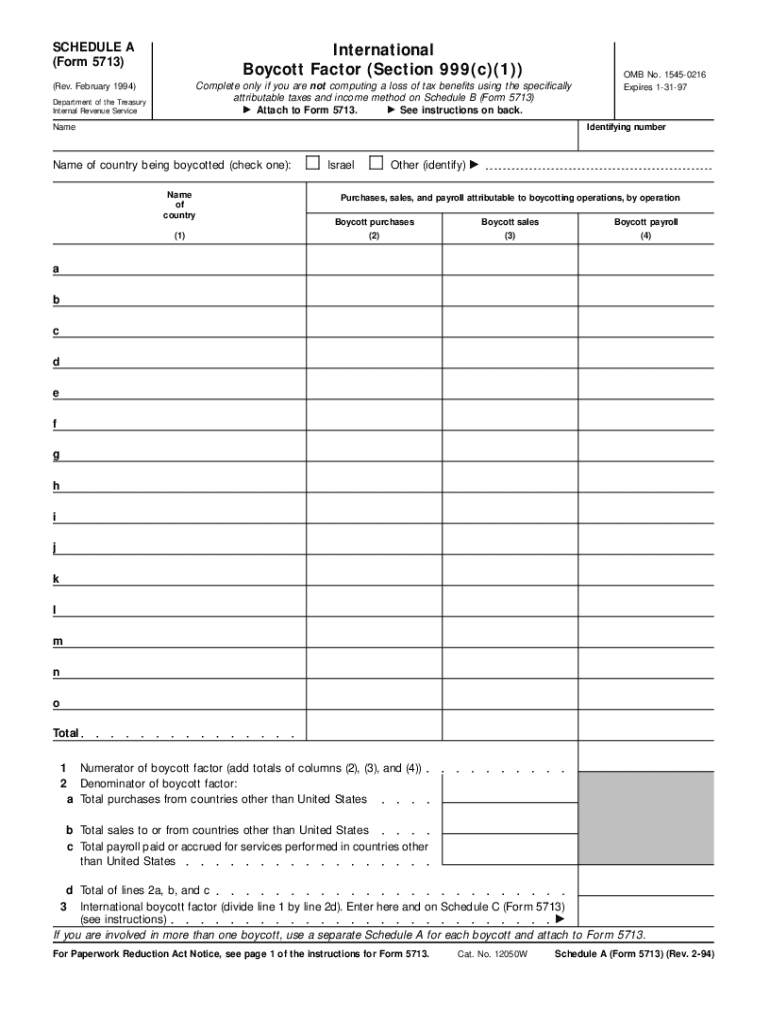

Understanding the 0294 Form 5713 Schedule Form: A Comprehensive Guide

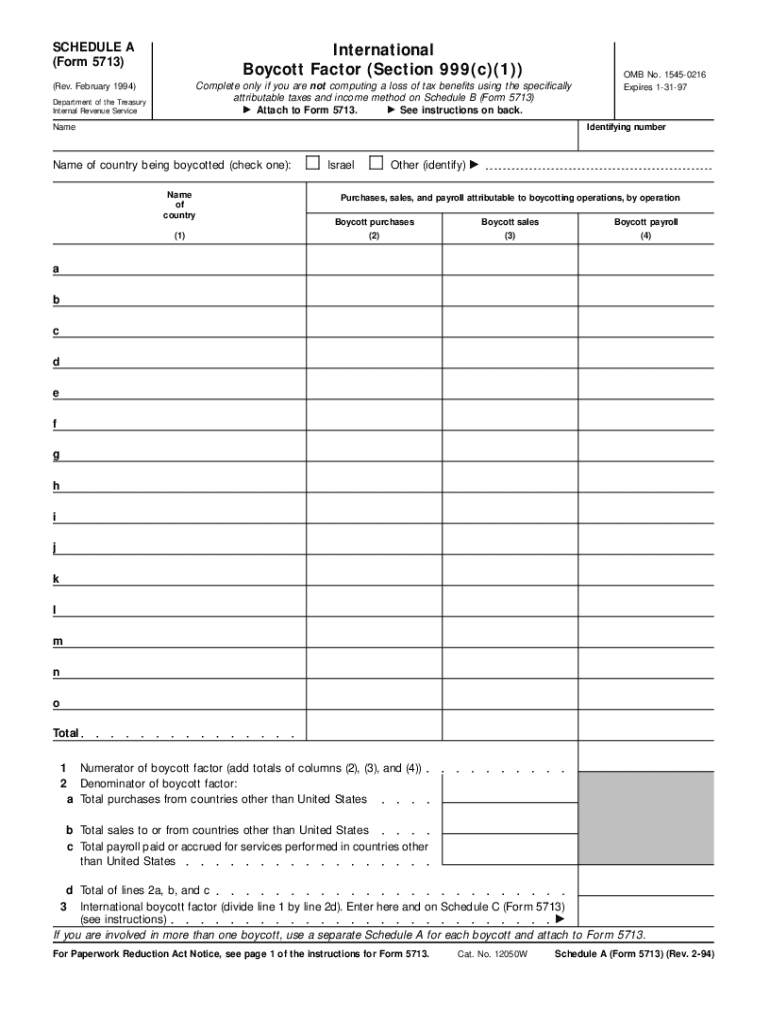

Overview of 0294 Form 5713

The 0294 Form 5713, also known as the Schedule of Income, is crucial for individuals who engage in international business or investment activities that qualify for tax benefits. Its primary purpose is to report income derived from foreign sources and ensure compliance with U.S. tax laws.

The importance of this form cannot be overstated; it not only helps taxpayers avoid penalties but also allows them to properly utilize foreign tax credits. Completing Form 5713 correctly is essential for anyone managing foreign employment income or investments.

Individuals who need to file this form include those receiving various types of income from overseas, such as salary, dividends, and interest from foreign investment accounts. If you earn more than a set threshold, it is mandatory to fill out this form.

Understanding the structure of the 0294 form

Form 5713 is structured into several key sections, making it easier for users to provide the necessary information. Each section serves a unique purpose, contributing to the overall understanding of the taxpayer's cross-border income.

Common terms that often arise while dealing with Form 5713, include 'foreign tax credit,' a credit that allows taxpayers to reduce their U.S. tax bill based on taxes paid to foreign governments, and 'tax treaty,' agreements between countries to avoid double taxation.

Step-by-step instructions for completing the 0294 form

Completing the 0294 Form 5713 requires attention to detail. Here’s a simple guide to help navigate through the process.

Interactive tools for Form 5713

Online tools are available to simplify the process of filling out Form 5713. These interactive platforms can significantly enhance user experience.

Tips for editing and managing your 0294 form

After submission, maintaining an organized document management system is essential. Here are some tips for managing your 0294 Form 5713 effectively.

Common FAQs about 0294 Form 5713

Navigating tax forms can be challenging. Here are answers to frequently asked questions regarding the 0294 Form 5713.

Differences between 0294 Form 5713 and other related forms

Understanding how Form 5713 differs from others can clarify its specific function. For example, it is distinct from Form 1040, which is the U.S. individual income tax return, as Form 5713 specifically deals with foreign income reporting.

Conclusion on utilizing pdfFiller for Form 5713

pdfFiller offers a unique digital experience for handling Form 5713. Its comprehensive document management features facilitate the form-filling process, ensuring accuracy and legal compliance.

Resources for further guidance

While using this guide provides substantial insight into the 0294 Form 5713, additional resources can extend your understanding further.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 5713 instructions form without leaving Chrome?

How do I complete 5713 instructions form on an iOS device?

How do I complete 5713 instructions form on an Android device?

What is 0294 form 5713 schedule?

Who is required to file 0294 form 5713 schedule?

How to fill out 0294 form 5713 schedule?

What is the purpose of 0294 form 5713 schedule?

What information must be reported on 0294 form 5713 schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.