Get the free 18006621113

Get, Create, Make and Sign 18006621113 form

How to edit 18006621113 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 18006621113 form

How to fill out life insurance support

Who needs life insurance support?

Life Insurance Support Form - How-to Guide Long-Read

Understanding life insurance support forms

A life insurance support form is a key document that assists in managing the important aspects of a life insurance policy. Its primary purpose is to provide the necessary information needed to apply for coverage, file claims, or update existing policy details. These forms ensure that all parties involved, from beneficiaries to insurance providers, have accurate and current information to avert confusion and misunderstandings.

The importance of life insurance support forms cannot be understated. They play a critical role in securing financial protection for loved ones in times of need, such as after the death of a policyholder. Moreover, these forms streamline the process of claims filing, making it easier for beneficiaries to access entitled benefits without undue delays. Whether it’s an application form or a beneficiary designation form, each piece of paperwork is instrumental in facilitating effective policy management.

Types of life insurance support forms

Life insurance support forms come in various types, each serving a specific purpose in the management of your policy. First and foremost, application forms gather essential information required for applying for life insurance. This includes personal details, medical history, and the type of coverage desired. Understanding the different types of life insurance policies available is crucial at this point, as it influences which information you need to provide.

Claims forms are another significant category; they outline the procedure for filing a claim after the death of a policyholder. Completing these forms requires specific documentation, such as the death certificate and proof of identity of the beneficiaries. Beneficiary designation forms help policyholders specify who will receive the benefits upon their passing, making this a vital consideration for ensuring the right people are covered. Additionally, policy change request forms allow policyholders to make necessary amendments to their existing policies, such as adjusting coverage or updating personal information.

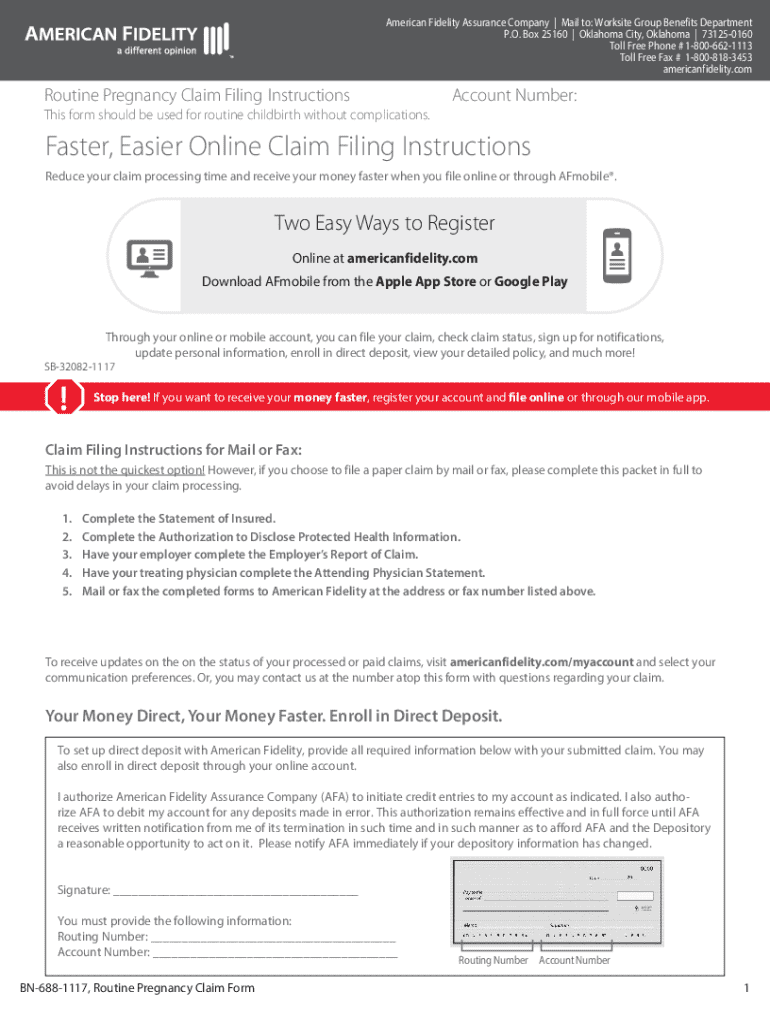

Downloading and accessing life insurance support forms

Finding the right life insurance support forms is easier than many may think. A visit to the pdfFiller website offers a wide array of templates tailored for various life insurance needs. By using their intuitive search functionality, users can quickly locate specific forms, whether it’s for an application, claim, or beneficiary designation.

Once the appropriate form is identified, downloading it is straightforward. Simply click on the download button, save it to your device, and it’s ready for use. For those who prefer cloud access, pdfFiller also provides robust storage options. Users can manage all their forms in a centralized location, making it convenient to retrieve documents as needed, anytime and from anywhere.

Filling out life insurance support forms

Completing life insurance support forms accurately is essential for smooth processing and claims handling. Begin with gathering all required information, which may include personal identification details, medical history, and any previous insurance documentation. Using pdfFiller’s interactive tools can significantly streamline this step, allowing users to fill in forms digitally without the hassle of printing and scanning.

Avoiding common mistakes can significantly enhance the effectiveness of completed forms. For instance, failing to provide required signatures or omitting necessary documentation can lead to processing delays. It’s crucial to read instructions thoroughly and ensure all fields are accurately filled.

Editing and customizing life insurance support forms

pdfFiller's editing features enable users to customize life insurance support forms as needed. This includes inserting text and images or affixing digital signatures, all of which can enhance the clarity and comprehensibility of submitted documents. Tailoring forms to suit individual needs ensures that no essential information is overlooked, increasing the likelihood of a smooth claims process.

Moreover, users can add personal notes and annotations to the forms, providing additional context that could be beneficial during the processing stage. Adding notes can significantly enhance communication with the insurance provider and improve understanding among all parties involved.

Signing life insurance support forms

The importance of electronically signing documents cannot be overstated in today’s digital age. eSigning life insurance support forms not only provides legal validity but also adds a layer of convenience and speed to the process. With pdfFiller’s eSignature tools, signing documents becomes a straightforward task, reducing the time required for traditional mail submissions.

After signing, it is essential to keep records of the completed forms. Archiving these documents in a secure manner allows you to access them easily in future inquiries or for verification of claims.

Frequently asked questions (faqs)

People often have common queries regarding life insurance support forms. A frequently asked question is, 'What happens if I make a mistake on my application form?' In most cases, minor errors can be corrected before final approval, but significant inaccuracies may require resubmission of the form. It's vital to stay informed about the specific requirements outlined by your insurance provider.

Another common question is about where to find help with filling out these forms. pdfFiller offers help resources, including tutorials and customer support, making it easy for users to find assistance whenever they encounter difficulties.

Collaborating on life insurance support forms

For teams managing life insurance policies, collaboration can increase efficiency and accuracy in form completion. pdfFiller allows multiple users to work simultaneously on a document, providing a platform for shared insights and decisions regarding form entries. This collaborative environment ensures that all team members are on the same page, minimizing the risks of miscommunication.

Sharing forms securely within a team is straightforward with pdfFiller. Documents can be shared via secure links, ensuring that sensitive information remains protected while maintaining easy accessibility for authorized users.

Managing your life insurance documents

Organizing life insurance documents is crucial for maintaining oversight and ensuring timely action in critical situations. Implementing a clear method for tracking forms, deadlines, and policy updates is essential. Utilizing file-filing systems and digital reminders can help individuals stay ahead of important dates related to their policies.

Regularly reviewing and updating your life insurance information helps keep your policy relevant and efficient. As life circumstances change, such as marriage or the birth of a child, it’s necessary to revisit beneficiary designations and coverage amounts to align them with your current needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 18006621113 form online?

How do I make changes in 18006621113 form?

How do I complete 18006621113 form on an Android device?

What is life insurance support?

Who is required to file life insurance support?

How to fill out life insurance support?

What is the purpose of life insurance support?

What information must be reported on life insurance support?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.