Get the free Guide to Completing Form 1040 for Income Tax Return

Get, Create, Make and Sign guide to completing form

Editing guide to completing form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out guide to completing form

How to fill out guide to completing form

Who needs guide to completing form?

Guide to completing form

Understanding the importance of the form

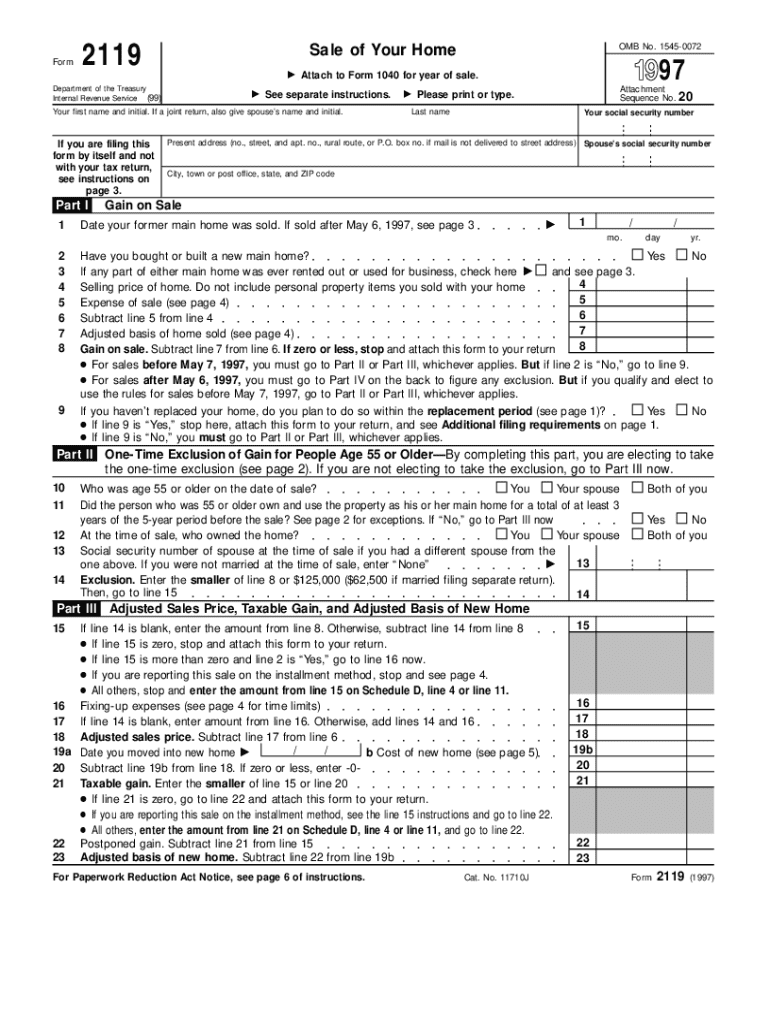

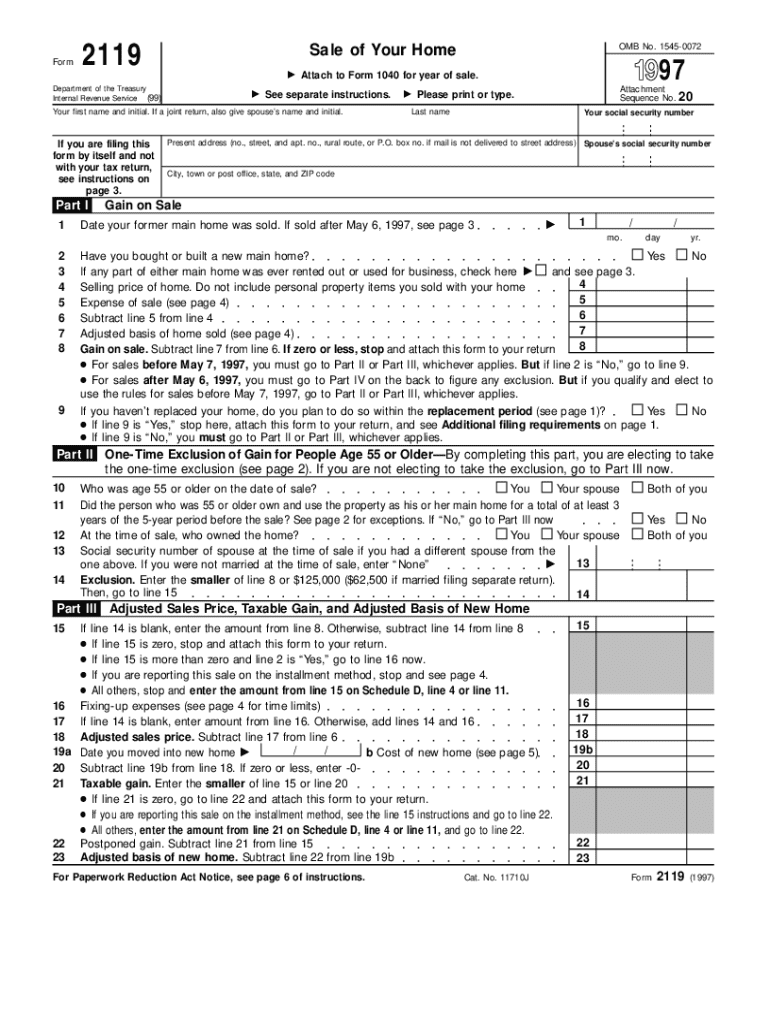

Completing forms is a crucial aspect of various processes across different sectors, such as healthcare, taxation, and employment. Each form serves a specific purpose, often linked to legal compliance or operational efficiency. Understanding the form and its intended use is the first step toward effective completion.

Whether you are a new employee needing to report your tax filing status or a team leader compiling data for a project, recognizing who is required to fill out the form is essential. This might include individuals submitting tax returns, employees reserving benefits, or even contractors providing necessary details for engagement.

Key features of the form

Forms are structured documents often comprised of multiple sections that vary based on their purpose. Key features typically include headers, instructions, sections for personal information, and places for signatures. When completing a form, pay attention to these elements to ensure accuracy and completeness.

Being aware of the most important sections—such as personal identification, tax-related questions about withholding or spouse details—will help streamline the completion process. Many forms also include frequently asked questions (FAQs) to assist users in resolving common dilemmas as they complete the document.

Step-by-step instructions for completion

Completing a form involves a systematic approach to ensure you capture all required details correctly. Here’s a step-by-step guide:

Step 1: Gathering necessary information

Before filling out any form, gather all necessary documents and information. This can include identification documents, financial statements, previous tax returns, and other specific paperwork that may be relevant to the task at hand.

Step 2: Filling out the form

Once you have all your information, proceed to fill out the form carefully. Pay attention to each section, ensuring you follow any instructions provided. Use a pen for handwritten submissions or type in clear, legible text for digital formats.

Common mistakes, such as omitting a required field or misspelling your name, can lead to delays or complications. To avoid these issues, consider utilizing tools like pdfFiller, which provide templates and hints that assist as you work through the process.

Step 3: Reviewing your form

After filling out the form, it's crucial to conduct a thorough review. Check each section against your gathered documents to ensure accuracy. You can create a checklist to ensure you haven't missed anything important.

Editing and enhancing your completed form

If changes are needed after completion, tools like pdfFiller offer excellent editing features. You can easily make adjustments to any part of the form that requires updates.

In addition to edits, the ability to add notes or highlights to key sections can help stress important information when submitting the form to your employer or team. Once your edits are made, consider converting your form into a PDF or other formats for easy sharing and archiving.

Digital signing and submission

In the age of digital documents, facilitating swift signatures is more vital than ever. With pdfFiller, you can easily eSign your completed form. This eliminates the need for printing and scanning, thereby optimizing the process.

When submitting your form online, be sure to choose secure options that comply with data protection regulations to protect your information. Ensure you receive a confirmation notice once your submission is complete, as this becomes part of your tracking process.

Post-completion management

Once your form is submitted, knowing how to save and manage it effectively is crucial. With pdfFiller, forms can be stored securely on the cloud, allowing access from anywhere and anytime.

If you collaborated with others, consider sharing access for joint reviews or follow-ups. For tracking, ensure you keep records of submission deadlines and any follow-up actions required based on your employer's or agency's responses.

Troubleshooting common issues

Throughout the form completion process, it’s possible to encounter various issues. If you find yourself facing errors during submission, don’t hesitate to seek help. Common problems often stem from incomplete fields or discrepancies in data.

With pdfFiller’s support options, assistance is readily available for resolving these technical difficulties. It's also helpful to refer to the FAQs to help mitigate potential confusion as you work through the form.

Tips for efficient form management

To manage forms efficiently over time, adopting good organizational practices is essential. Consider ways to categorize your forms based on purpose or frequency of use, allowing you to quickly locate necessary documents as needed.

Utilizing automation tools within pdfFiller can also expedite the form-filling process. Setting up templates for frequently used forms saves time and lowers the risk of errors, ensuring a smoother workflow for you and your team.

Case studies: successful form management experiences

Real-life user experiences can illuminate the benefits of effective form management. For example, one team shared how they streamlined their tax form submissions using pdfFiller, resulting in substantial time savings and reduced errors while navigating tax filing statuses for multiple employees.

Another user recounted how leveraging digital signing features helped expedite their contract agreements, eliminating delays that often accompany snail mail or in-person meetings. Such stories highlight the practicality and efficiency pdfFiller brings to form management.

Advanced features for form users

pdfFiller is not just for basic form filling; it also presents many advanced features that can take your document management to the next level. Interactive templates, custom workflows, and integrations with other platforms such as Dropbox or Google Drive enhance accessibility and organization.

Exploring these advanced capabilities enables users to tailor their approach according to specific business needs, facilitating an efficient and organized document management system.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit guide to completing form from Google Drive?

How do I make edits in guide to completing form without leaving Chrome?

How do I fill out guide to completing form using my mobile device?

What is guide to completing form?

Who is required to file guide to completing form?

How to fill out guide to completing form?

What is the purpose of guide to completing form?

What information must be reported on guide to completing form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.