Get the free PRE-AUTHORIZED TAX PAYMENT PLAN CANCELLATION FORM ...

Show details

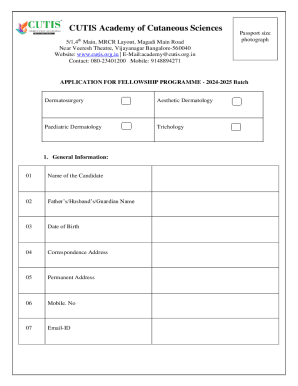

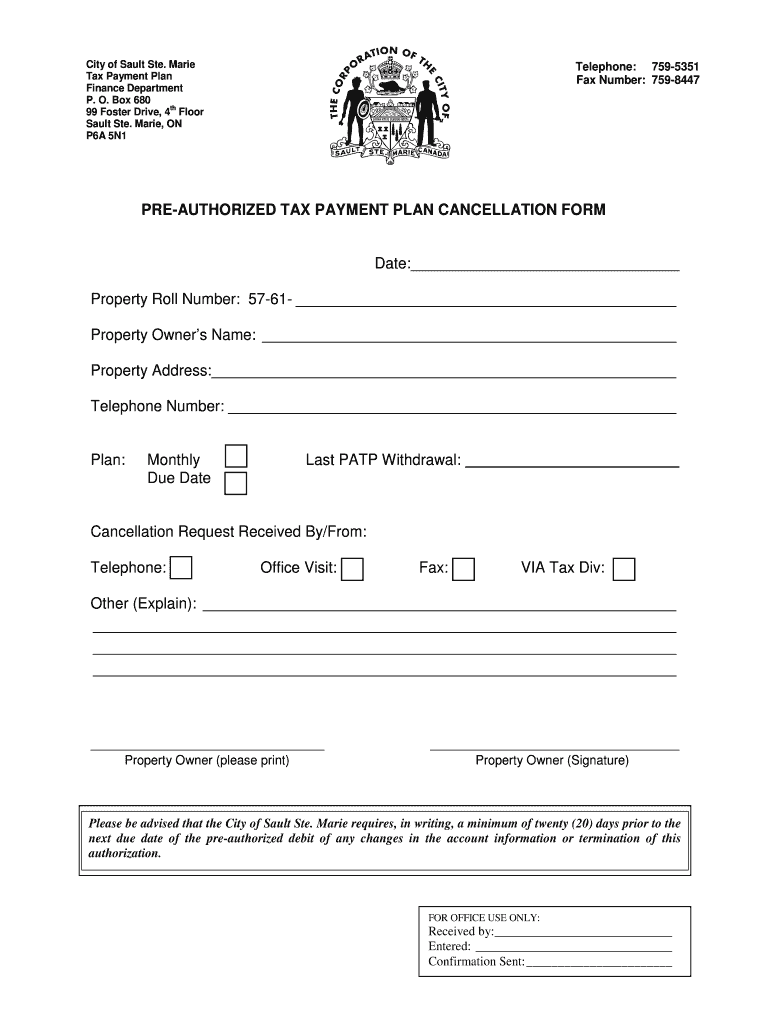

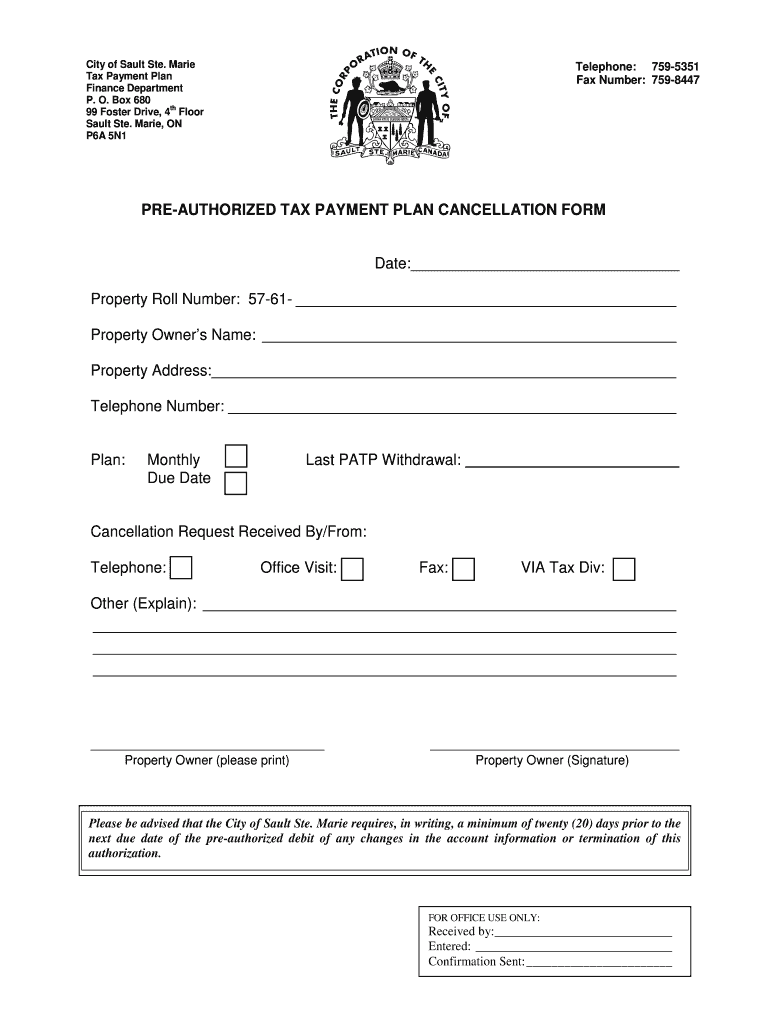

City of Salt Ste. Marie Tax Payment Plan Finance Department P. O. Box 680 99 Foster Drive, 4th Floor Salt Ste. Marie, ON P6A 5N1 Telephone: 7595351 Fax Number: 7598447 PREAUTHORIZED TAX PAYMENT PLAN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pre-authorized tax payment plan

Edit your pre-authorized tax payment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pre-authorized tax payment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pre-authorized tax payment plan online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pre-authorized tax payment plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pre-authorized tax payment plan

How to fill out a pre-authorized tax payment plan:

01

Start by gathering all the necessary information and documents related to your taxes, including your Social Security number, previous year's tax return, and any relevant tax forms.

02

Determine the amount you want to pay each month towards your taxes. This can be based on your estimated tax liability for the year or a specific amount you are comfortable with.

03

Contact the tax authority, such as the Internal Revenue Service (IRS) in the United States, to inquire about the pre-authorized tax payment plan options available. They will provide you with the necessary forms or direct you to an online portal.

04

Fill out the required forms accurately and completely. Provide your personal information, including name, address, and contact details. Include any additional information requested by the tax authority, such as your employer's name and address.

05

Indicate the amount you wish to pay each month for your tax payments and specify the account from which the funds will be debited. This is typically a checking or savings account, so have the banking information ready.

06

Review the completed forms for any errors or missing information. Ensure all calculations are accurate and the form is signed and dated where required.

07

Submit the completed forms to the appropriate tax authority. Follow the instructions provided by the tax authority for submission, whether it be online, via mail, or in-person.

Who needs a pre-authorized tax payment plan?

01

Individuals who have difficulty paying their taxes in a lump sum at tax time may benefit from a pre-authorized tax payment plan. It allows them to spread out their tax payments over a longer period of time.

02

Self-employed individuals or those with irregular income may find a pre-authorized tax payment plan helpful as it provides a more consistent and manageable way to satisfy their tax obligations.

03

Individuals who want to ensure they stay current with their tax payments and avoid penalties and interest charges may choose to set up a pre-authorized tax payment plan. It helps them stay on track and avoid any potential financial burdens.

Note: The specific eligibility criteria, terms, and conditions for pre-authorized tax payment plans may vary depending on the jurisdiction and tax authority involved. It is important to consult with the relevant tax authority or seek professional advice to determine the exact requirements and benefits of a pre-authorized tax payment plan in your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pre-authorized tax payment plan?

Pre-authorized tax payment plan is a method where individuals or businesses can set up automatic payments for their taxes to be deducted from their bank account on a regular basis.

Who is required to file pre-authorized tax payment plan?

Individuals or businesses who want to ensure regular and timely payment of their taxes may choose to file a pre-authorized tax payment plan.

How to fill out pre-authorized tax payment plan?

To fill out a pre-authorized tax payment plan, individuals or businesses need to provide their bank account information, tax details, and authorize the Canada Revenue Agency to deduct the specified amount on specific dates.

What is the purpose of pre-authorized tax payment plan?

The purpose of a pre-authorized tax payment plan is to help individuals or businesses budget for their tax payments, avoid missed payments, and ensure timely payment to avoid penalties.

What information must be reported on pre-authorized tax payment plan?

The pre-authorized tax payment plan requires individuals or businesses to report their bank account information, tax details, and the amount to be deducted on specific dates.

How do I modify my pre-authorized tax payment plan in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your pre-authorized tax payment plan as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an electronic signature for the pre-authorized tax payment plan in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your pre-authorized tax payment plan in minutes.

How do I edit pre-authorized tax payment plan on an Android device?

The pdfFiller app for Android allows you to edit PDF files like pre-authorized tax payment plan. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your pre-authorized tax payment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pre-Authorized Tax Payment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.