Get the free OBJECTION INCOME TAX ACT

Show details

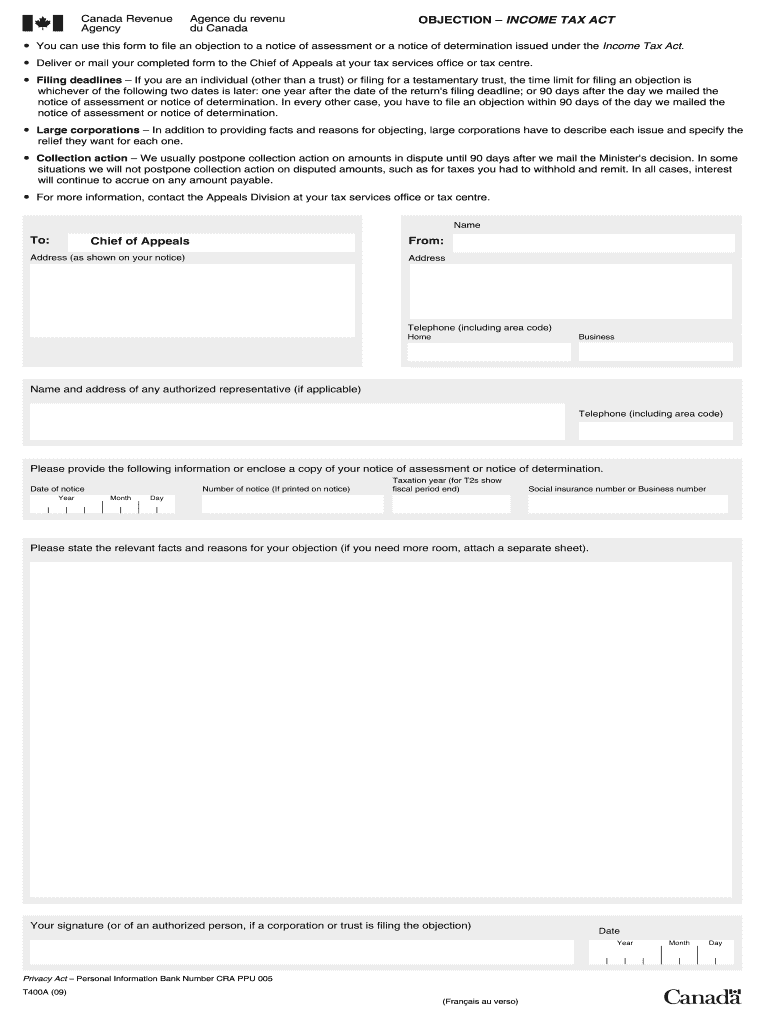

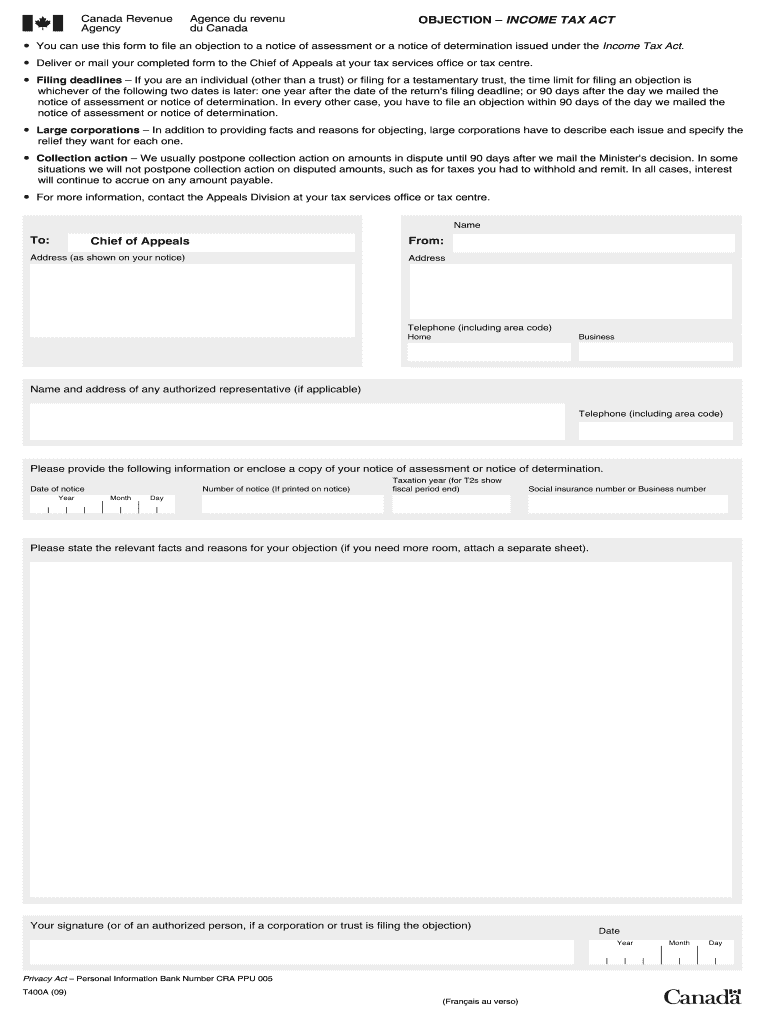

Restore OBJECTION INCOME TAX ACT Help You can use this form to file an objection to a notice of assessment or a notice of determination issued under the Income Tax Act. Deliver or mail your completed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign objection income tax act

Edit your objection income tax act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your objection income tax act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing objection income tax act online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit objection income tax act. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out objection income tax act

How to fill out an objection under the Income Tax Act:

01

Understand the grounds for objection: Before filling out the objection form, it is essential to know the specific reasons for objecting to a particular decision or assessment made by the tax authorities. Familiarize yourself with the provisions of the Income Tax Act related to your case and identify the relevant sections that support your objection.

02

Obtain the appropriate form: Contact the tax authority in your jurisdiction to obtain the correct form for filing an objection. This form is typically known as the "Notice of Objection" or "T1-ADJ" form.

03

Provide accurate personal information: Fill out the personal information section of the form, including your full name, address, social insurance number, and other relevant contact details. Ensure that all information provided is accurate and up to date.

04

Specify the tax year and type of assessment you are objecting: Indicate the specific tax year for which you are filing the objection. If you are objecting to an assessment, clearly state whether it is an original assessment, reassessment, or a Notice of Reassessment that you are challenging.

05

Clearly outline your reasons for objection: In a concise and coherent manner, explain the grounds or basis for your objection. Provide detailed information and supporting documentation to substantiate your claim. If you have engaged a tax professional or legal advisor to assist you, communicate with them to ensure all relevant details are included.

06

Submit additional supporting documents: In many cases, supporting documents such as receipts, financial statements, or other evidence may strengthen your objection. Include copies of these documents with your objection form, clearly labeling and organizing them for ease of review by the tax authorities.

07

Ensure statutory deadlines are met: Be aware of the deadline for filing your objection. Generally, objections must be sent within 90 days from the date of the Notice of Assessment or Reassessment. Failing to meet this deadline may result in your objection being rejected.

Who needs the objection under the Income Tax Act?

Individuals or entities who disagree with a specific decision or assessment made by the tax authorities may need to file an objection under the Income Tax Act. This could include situations where taxpayers believe their tax liability has been incorrectly calculated, deductions have been disallowed, or other aspects of their tax assessment are disputed. It is crucial to review the specific circumstances and consult with a tax professional to determine if lodging an objection is appropriate and necessary.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is objection income tax act?

The objection income tax act allows taxpayers to dispute decisions made by the tax authorities regarding their tax assessments.

Who is required to file objection income tax act?

Any individual or business entity who disagrees with a tax assessment made by the tax authorities is required to file an objection under the income tax act.

How to fill out objection income tax act?

To fill out an objection under the income tax act, taxpayers must provide their personal or business information, details of the tax assessment being disputed, reasons for objection, and any supporting documents.

What is the purpose of objection income tax act?

The purpose of the objection income tax act is to provide a transparent and fair process for taxpayers to challenge tax assessments they believe are incorrect or unjust.

What information must be reported on objection income tax act?

Information such as personal or business details, tax assessment being disputed, reasons for objection, and supporting documents must be reported on the objection income tax act.

How can I send objection income tax act to be eSigned by others?

Once your objection income tax act is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit objection income tax act straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing objection income tax act.

Can I edit objection income tax act on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign objection income tax act. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your objection income tax act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Objection Income Tax Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.