Get the free New Senior Tax Exemption for School Construction Projects

Get, Create, Make and Sign new senior tax exemption

How to edit new senior tax exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new senior tax exemption

How to fill out new senior tax exemption

Who needs new senior tax exemption?

New Senior Tax Exemption Form: How-to Guide

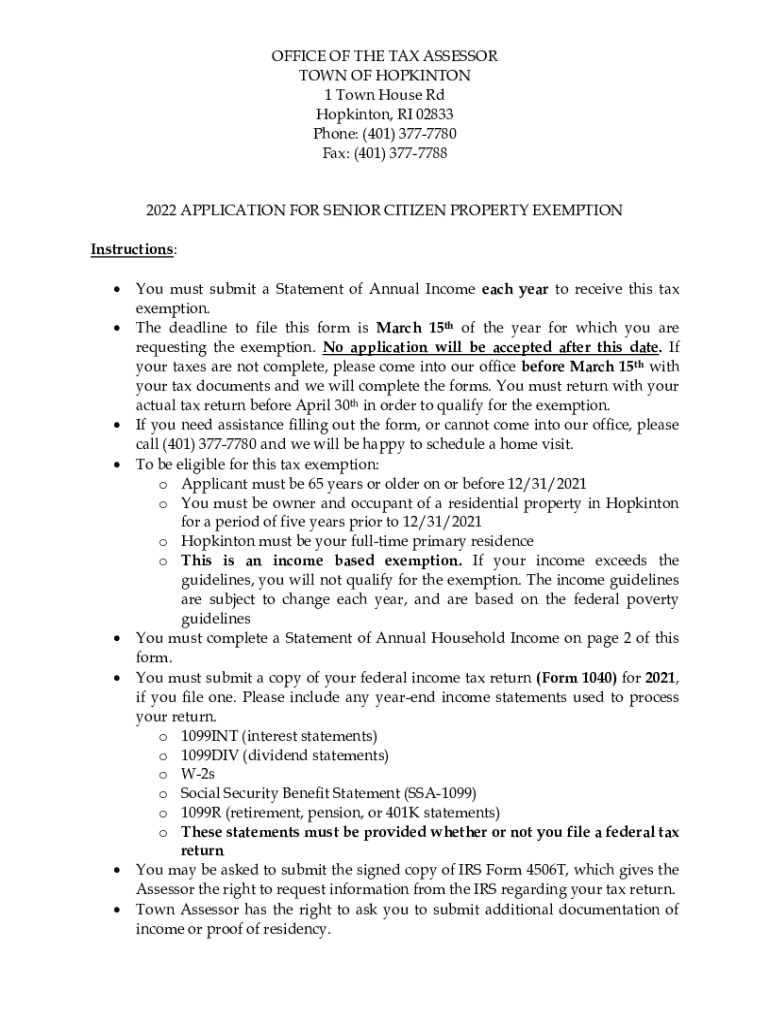

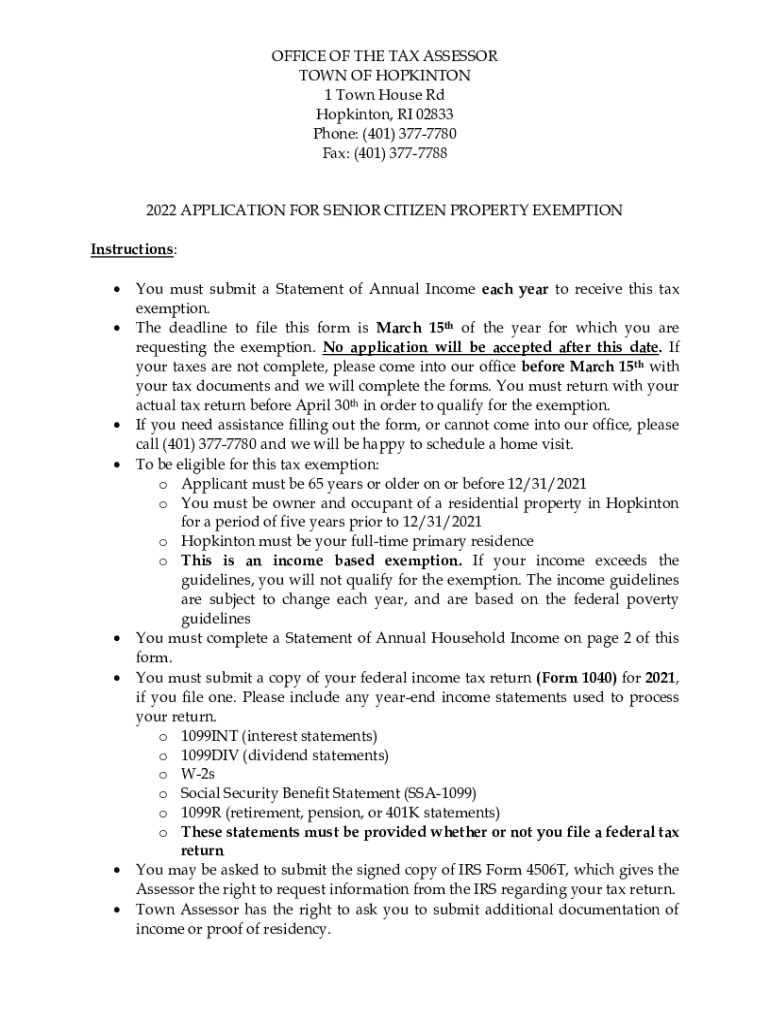

Understanding the new senior tax exemption form

The new senior tax exemption form serves as a critical document for senior citizens looking to reduce their property tax burden. In many jurisdictions, this exemption is designed to assist elderly homeowners by lowering their taxable property value, resulting in significant savings. With the current tax year, updates have been introduced to streamline the application process, making it easier than ever for seniors to qualify.

Key changes in the new form include simplified language, clarified eligibility criteria, and a more user-friendly layout. Additionally, the importance of accurately filing this form cannot be overstated. Errors or omissions can lead to delays in processing or, worse, disqualification from the exemption altogether.

Who is eligible for the senior tax exemption?

To qualify for the new senior tax exemption form, applicants must meet specific ownership and income criteria. Homeownership is a primary requirement, meaning seniors must either own the home outright or hold it in a joint tenancy. This necessitates providing documentation such as titles or mortgage agreements to verify ownership.

Income plays a crucial role in determining eligibility as well. Most jurisdictions set income limits that must not be exceeded to qualify for the exemption. These income limits often vary by region and may include various sources of income—like pensions, Social Security, and interest income—while excluding certain types like health benefits.

Requirements before filling out the form

Before diving into the new senior tax exemption form, it’s essential to gather all necessary documents and information that demonstrate eligibility. This preparation phase can save applicants time and reduce the likelihood of errors. Required documentation typically includes proof of age, property deed, and detailed income statements.

Additionally, understanding the tax assessment process is paramount. Seniors should familiarize themselves with how their property is valued by local assessors, as this information varies by jurisdiction. Knowing your home’s tax assessment can help you accurately reflect that information on the exemption form.

Step-by-step instructions for completing the new form

Completing the new senior tax exemption form can be straightforward if you follow the right steps. First, download the new senior tax exemption form directly from pdfFiller. The website boasts a plethora of resources for locating and accessing the required documents.

Once you have the form, actively fill it out section by section. Start with property information, ensuring to accurately note any relevant details such as assessed value and tax identification number. Next, provide your personal information, including your name, date of birth, and contact details.

Lastly, input your income information; make sure to include all applicable sources while adhering to local income restrictions. After filling out the form, review each section thoroughly. Common mistakes include incorrect income totals or failing to include necessary documentation.

Editing and signing the form on pdfFiller

pdfFiller makes the editing and signing process user-friendly with its robust tools. You can easily modify text fields and checkboxes directly within the PDF file. This functionality is particularly helpful for correcting any last-minute errors or when needed to adjust information based on feedback or changes in circumstance.

Inserting signatures electronically has never been simpler, ensuring that your new senior tax exemption form is not just completed, but also properly signed and dated. ESigning your form adds a layer of convenience, allowing you to submit your application without the delays associated with printing and mailing.

Submitting your new senior tax exemption form

After thoroughly completing and signing your application, the next step involves submission. It's crucial to understand the optimal methods for submitting your new senior tax exemption form, which may include mailing a paper form or using online portals, if available. Each method has its own advantages, but the online process typically expedites review times.

Moreover, keeping track of submission deadlines is vital. Most jurisdictions have strict deadlines for applications to ensure eligibility for the current tax year. Failure to meet these deadlines may mean waiting another year for possible tax relief.

Follow-up actions after submission

Once you've submitted your new senior tax exemption form, it’s prudent to follow up. Checking the status of your application can be done by contacting your local tax office, often providing an estimated processing timeframe. Typically, applicants can expect feedback on their application within a few weeks, but timelines can vary based on local caseloads.

After submission, it’s essential to be prepared for any follow-up communications from the tax office. You may receive requests for additional information or clarification, which should be addressed promptly to avoid any hitches in your exemption approval.

Additional benefits and credits related to senior tax exemption

Beyond the immediate benefits of reduced property taxes, seniors may also explore additional credits and benefits. One common area of relief is the School Tax Relief (STAR) program, which can potentially provide further reductions in school district taxes for homeowners who meet specific criteria.

In addition to STAR, many states offer various senior tax programs designed to assist aging homeowners. These can include credits based on income levels or property assessments. Staying informed about these offerings can maximize the financial benefits available to senior citizens.

Important contacts and resources

Navigating the complexities of the new senior tax exemption form can feel daunting, but help is easily accessible. Each locality maintains a tax office that can provide assistance regarding eligibility, application processes, and status inquiries. Familiarizing yourself with this contact information can streamline your experience.

In addition, numerous online resources exist to provide detailed explanations, FAQs, and forums where seniors can seek and offer advice based on their experiences with the exemption process. Utilizing these tools can enhance understanding and provide further insights into maximizing tax benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new senior tax exemption for eSignature?

Can I sign the new senior tax exemption electronically in Chrome?

Can I create an electronic signature for signing my new senior tax exemption in Gmail?

What is new senior tax exemption?

Who is required to file new senior tax exemption?

How to fill out new senior tax exemption?

What is the purpose of new senior tax exemption?

What information must be reported on new senior tax exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.