Get the free Non-Traditional Employment Earnings Form. Use this form to report monetary earnings ...

Get, Create, Make and Sign non-traditional employment earnings form

How to edit non-traditional employment earnings form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-traditional employment earnings form

How to fill out non-traditional employment earnings form

Who needs non-traditional employment earnings form?

Understanding the Non-Traditional Employment Earnings Form

Understanding non-traditional employment earnings

Non-traditional employment encompasses various work arrangements beyond the conventional 9-to-5 job. This work model caters to the evolving job market and includes avenues such as freelancing, gig economy roles, and contract work, which provide flexible income options. For many people today, these forms of employment enable individuals to pursue their interests while earning a living.

Common sources of non-traditional earnings include freelancing, where professionals market their skills across different platforms, and gig economy jobs, which allow workers to take on short-term tasks via apps or websites. Meanwhile, contract work typically involves agreements with companies for specific projects. Furthermore, passive income streams, such as rental properties or online courses, contribute to a diversified earnings portfolio.

Why you need a non-traditional employment earnings form

A non-traditional employment earnings form serves multiple crucial functions, especially when dealing with financial institutions. Firstly, it acts as proof of income necessary for loan applications, helping applicants demonstrate their ability to repay borrowed funds. Lenders often rely on comprehensive documentation to assess risk, and documenting non-traditional earnings simplifies this process.

Additionally, the form aids individuals managing rental applications, as landlords and property managers require verifiable income to ensure tenants can meet their obligations. The importance of accurately classifying income for tax purposes cannot be overstated. Having documented non-traditional earnings helps ease the tax filing process and ensures compliance with IRS regulations. Furthermore, maintaining a clear record of income boosts financial credibility with institutions that might otherwise hesitate to lend to non-traditional earners.

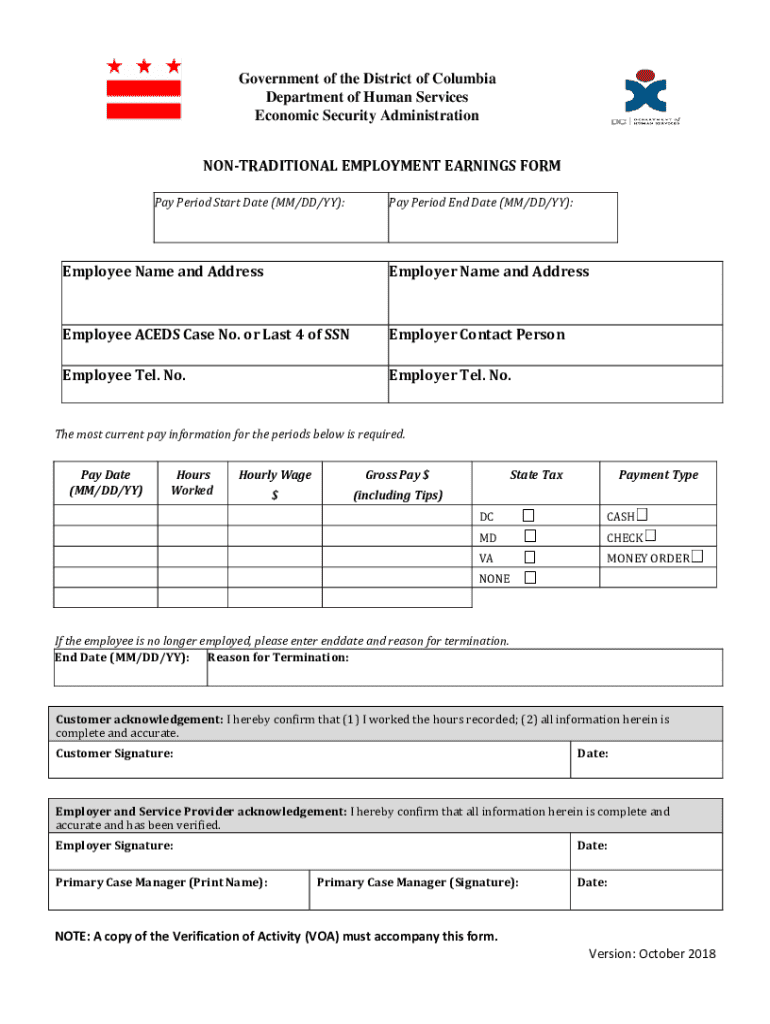

Overview of the non-traditional employment earnings form

The non-traditional employment earnings form comprises several key components designed specifically to capture varied income sources. It starts with basic personal information, where users must enter their details to establish identification. Following this, users provide extensive details on earnings, including various income streams such as freelance jobs or gig economy roles.

Another crucial aspect of the form includes tax identification numbers to ensure accountability and compliance during tax assessments. Each section functions collaboratively to represent the unique financial landscape of non-traditional earners, helping them to effectively communicate their income to lenders, landlords, or tax agencies.

Step-by-step guide to filling out the form

Filling out the non-traditional employment earnings form requires careful attention to detail. Start by gathering required documentation. This stage may involve collecting paychecks from freelance work, bank statements documenting earnings, and relevant tax returns. Having these documents on hand will streamline the process.

The next step involves completing the personal information section, ensuring all details are accurate and up-to-date. Once this is done, focus on detailing your earnings. A vital aspect of this is correctly reporting income, whether it's hourly or project-based. Always ensure that figures are accurate to present a reliable financial picture.

Finally, don’t forget to sign and date the form. Given the digital age, eSigning tools such as those offered by pdfFiller can make this process seamless. These steps collectively ensure the form is completed thoroughly and accurately, minimizing the chances of complications when submitting it.

Tips for ensuring accuracy and compliance

Accuracy in completing the non-traditional employment earnings form cannot be overstated. Common mistakes to avoid include underreporting income, which can lead to financial discrepancies and potential issues with lenders or tax authorities. Another frequent error involves inaccuracies in tax identification information, which can result in significant delays or complications.

To ensure compliance, consider utilizing resources for cross-verification, such as online calculators that help confirm your reported earnings or consulting with tax professionals who can provide guidance tailored to your situation. These strategies can significantly enhance the accuracy of your documentation, benefiting you long-term.

Editing and managing your non-traditional employment earnings form with pdfFiller

pdfFiller offers incredible features for editing your non-traditional employment earnings form conveniently. Users can quickly edit forms online, making adjustments as necessary without hassle. The platform also provides templates for efficiency, allowing users to save time and maintain consistency across multiple documents.

Moreover, collaboration is made easy through pdfFiller; team members can provide real-time feedback and share options to ensure all inputs are considered. This collaborative approach not only enhances productivity but also fosters accuracy and thoroughness in preparing vital documentation.

Common scenarios for using the form

There are various common scenarios where individuals might require the non-traditional employment earnings form. For instance, freelancers applying for personal loans will find this document essential to showcase their income credibility to lenders. When applying for loans, the clarity of income sources plays a pivotal role in securing favorable terms.

Another scenario includes renting an apartment; landlords increasingly recognize gig economy income as a valid financial source. Hence, presenting a well-documented form can significantly enhance the chances of rental approval. Furthermore, understanding IRS requirements concerning non-traditional earnings is crucial; individuals need to navigate this landscape carefully, ensuring they meet all regulatory demands while maximizing their earning potential.

FAQs about non-traditional employment earnings forms

A common question arises: what if I don't have a pay stub? In scenarios where formal pay stubs are absent, documenting income from other reliable sources remains essential. Detailed bank statements showing regular deposits and invoices for freelance work can serve as valuable alternatives.

Another frequent inquiry concerns how often one should update the form. Regular updates are advisable as income evolves; ideally, maintaining real-time documentation helps reflect accurate financial status. Additionally, users may wonder if this form can be used for multiple income sources. The answer is yes. The form is designed to capture diverse income streams, making it a versatile tool for anyone with non-traditional earnings.

Popular tools for managing your document needs

There are numerous tools available for managing document needs, but pdfFiller stands out with its comprehensive editing features. Its integration with cloud storage facilitates convenient access and storage, ensuring that your non-traditional employment earnings form is always available when needed, whether you're on the go or at home.

When compared to other document management solutions, pdfFiller offers a unique balance of usability and functionality, catering specifically to the needs of individuals navigating complex income scenarios. By utilizing such tools, you empower yourself to better manage documentation and subsequently enhance your financial standing with lenders and the IRS.

Latest trends in non-traditional employment

In recent years, there has been a growing acceptance of non-traditional income sources across multiple sectors. Financial institutions are starting to recognize the legitimacy of freelance and gig work, leading to increased opportunities for individuals in these fields. The ongoing evolution of the job market requires innovative tools that help freelancers and contract workers manage their earnings effectively.

Emerging tools designed for freelancers focus on comprehensive financial management, including budgeting and tracking income. As the landscape continues to shift, it's important to stay informed, as future implications for tax reporting and banking practices will likely favor the agility and complexities of non-traditional earnings. Recognizing these trends now equips individuals to navigate the financial world proficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non-traditional employment earnings form directly from Gmail?

How can I edit non-traditional employment earnings form from Google Drive?

How do I edit non-traditional employment earnings form in Chrome?

What is non-traditional employment earnings form?

Who is required to file non-traditional employment earnings form?

How to fill out non-traditional employment earnings form?

What is the purpose of non-traditional employment earnings form?

What information must be reported on non-traditional employment earnings form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.