Get the free ACCOUNTANTS & CONSULTANTS PROFESSIONAL ...

Get, Create, Make and Sign accountants amp consultants professional

Editing accountants amp consultants professional online

Uncompromising security for your PDF editing and eSignature needs

How to fill out accountants amp consultants professional

How to fill out accountants amp consultants professional

Who needs accountants amp consultants professional?

Accountants amp consultants professional form: A comprehensive guide

Understanding the role of accountants and consultants

Accountants and consultants provide essential services, yet their roles differ significantly. Accountants primarily focus on managing financial statements, ensuring compliance with tax regulations, and maintaining meticulous records for businesses. On the other hand, consultants offer advisory services, utilizing their expertise to solve specific business challenges, streamline operations, or develop strategies for growth. Both professions are crucial across industries, from finance to technology, contributing to informed decision-making and strategic planning.

Knowing when to use an accountant or consultant involves assessing business needs. Businesses benefit from accountants during tax season or when financial audits are required, while consultants come into play when a company seeks to enhance performance or address complex issues. Engaging with professionals ensures access to expertise, which can lead to more efficient problem resolution and informed strategic choices.

Overview of professional forms in accounting and consulting

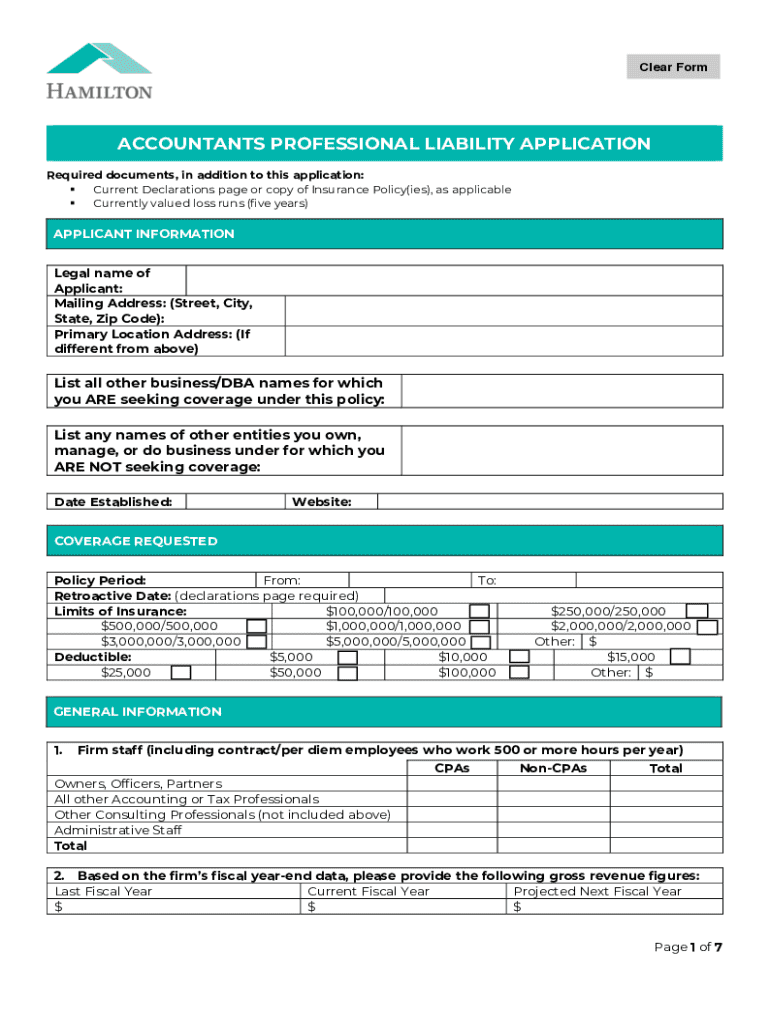

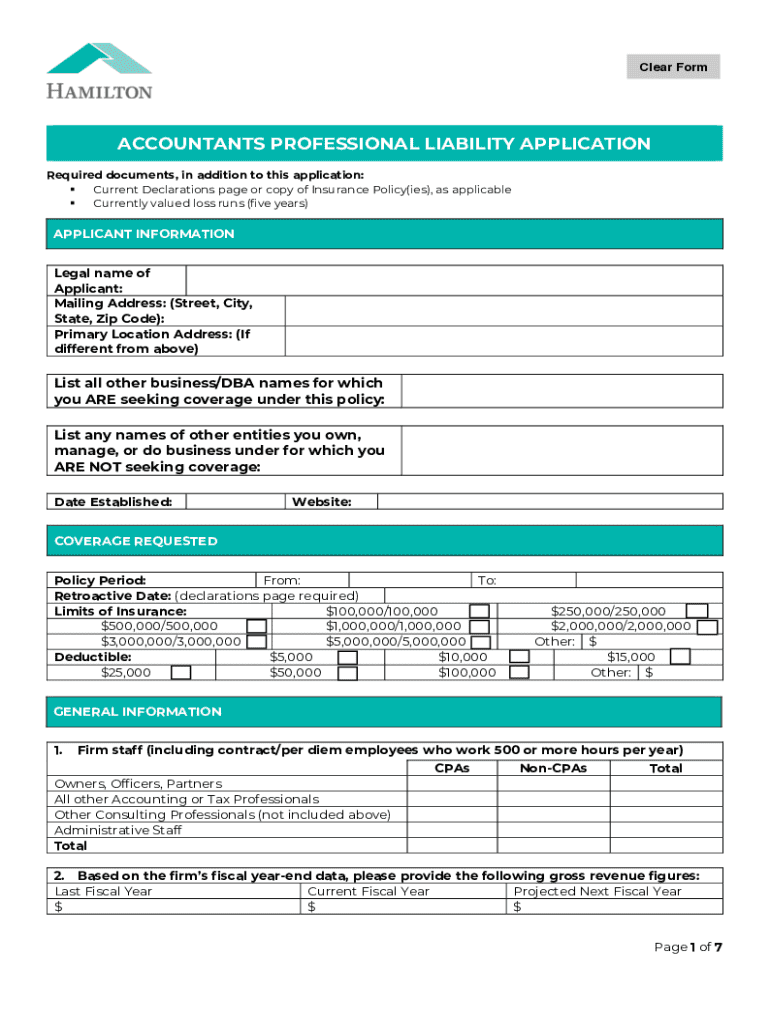

Accountants and consultants rely on various professional forms to ensure that operations run smoothly and comply with legal standards. Commonly used forms include tax forms for filing tax returns, client engagement letters to formalize the relationship and scope of work, and financial statements to present the financial health of an organization. These documents serve practical purposes, such as providing necessary information to stakeholders and facilitating accurate financial reporting.

Proper documentation is paramount in maintaining the integrity of financial transactions and client relationships. Well-prepared forms can prevent legal disputes and enhance client trust, as they demonstrate professionalism and attention to detail. The importance of accurate documentation cannot be overstated, as it lays the foundation for a robust accounting or consulting practice.

Steps to create professional forms as an accountant or consultant

Creating professional forms begins with identifying essential information specific to the type of document. For tax forms, required data includes income statements, deductible expenses, and identification numbers. Similarly, client engagement letters should contain client details, deliverables, fee structures, and timelines. Understanding the nuances of each form is crucial for accurate completion and compliance.

Another critical step is choosing the right template. Factors to consider include industry standards, specific client needs, and legal requirements. Many templates can be customized to align with branding guidelines and unique operational requirements, ensuring that each document not only serves its purpose but also resonates with reputation and professionalism.

Editing and personalizing accounting and consulting forms in pdfFiller

pdfFiller provides a suite of tools that allow accountants and consultants to edit forms seamlessly. Highlighting key editing features like drag-and-drop text boxes and form field recognition, pdfFiller allows for straightforward customization without the need for complex software. Users can modify existing documents or create new forms from scratch, ensuring that they meet all specific requirements.

Collaboration is vital in professional environments, and pdfFiller supports real-time collaboration capabilities. Teams can work together on documents, leaving comments and suggestions for enhancement. Effective management of team inputs ensures that everyone involved can contribute to the final product, facilitating a more streamlined workflow and collective ownership of documents.

Signing and managing professional forms

Electronic signatures (eSignatures) have revolutionized how professionals manage signing processes. eSignatures are legally binding in many jurisdictions, provided they comply with relevant regulations. Understanding the legality surrounding eSignatures is crucial for accountants and consultants, as it impacts the validity of signed documents and client trust.

Organizing and storing documents efficiently is key to maintaining a well-structured office. Best practices for digital storage include using document management systems that allow for easy retrieval and secure storage. Implementing a systematic approach to document management helps safeguard sensitive information while facilitating quick access to necessary forms.

Ensuring accuracy and completeness of forms

Form completion is not without its pitfalls. Common errors include overlooking required fields, miscalculating figures, or using outdated templates. Awareness of these pitfalls allows professionals to proactively address them, thereby reducing the likelihood of complications arising from incomplete or incorrect forms.

Implementing quality control measures is an effective way to ensure accuracy. Creating a checklist for validation can help accountants and consultants verify that all necessary information has been completed before submission. Additionally, utilizing proofreading tools to check for inconsistencies can enhance compliance and overall document quality.

Advanced features of pdfFiller for accountants and consultants

pdfFiller goes beyond basic form editing, offering integrations with other software commonly used in professional services. Integrating platforms streamlines processes by allowing for a unified workflow, enabling accountants and consultants to manage documents alongside their existing systems.

Leveraging analytics is another powerful feature available through pdfFiller. Understanding client engagement through analytics can provide insights into service performance and areas for improvement. Utilizing data effectively allows for enhanced services and provides a competitive edge in the accounting and consulting landscape.

FAQs: Common questions about professional forms

When a form is rejected, it’s crucial to identify the cause of rejection promptly. Reviewing the specific points raised and addressing them in a revised submission can help ensure success in subsequent attempts. Engaging directly with clients or relevant authorities may provide further clarity on necessary adjustments.

As regulations affecting forms are updated, staying informed is essential. Regularly consulting legal updates or professional associations in accounting and consulting can keep professionals aware of significant changes. Open communication with clients about how these adjustments impact documentation practices is also necessary for transparent relationships.

Case studies: Success stories using pdfFiller

Real-world examples demonstrate the impact of effective form use. A local tax consultancy service enhanced its operations by implementing pdfFiller to manage client engagement letters anonymously and securely, leading to improved client satisfaction and retention rates. Another consulting firm reported increased efficiency in document management, enabling it to navigate project deadlines more adeptly.

Lessons learned from these case studies highlight the importance of embracing technology in operational strategies. Professionals who adapt to advanced tools and methodologies witness a positive transformation in their practices, fortifying their competitive position in the industry.

Tips for staying updated with industry trends

For accountants and consultants, staying abreast of changes in practices is crucial to maintaining relevance in today’s fast-paced business environment. Regularly attending industry conferences, participating in webinars, and subscribing to relevant publications can provide insights into upcoming trends and evolving regulations.

Furthermore, investing in ongoing education and training related to document management can enhance skills and knowledge. Online courses and certification programs specifically tailored to accounting and consulting can provide the necessary expertise to navigate complexities in professional form management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify accountants amp consultants professional without leaving Google Drive?

How can I send accountants amp consultants professional for eSignature?

How do I edit accountants amp consultants professional on an iOS device?

What is accountants amp consultants professional?

Who is required to file accountants amp consultants professional?

How to fill out accountants amp consultants professional?

What is the purpose of accountants amp consultants professional?

What information must be reported on accountants amp consultants professional?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.