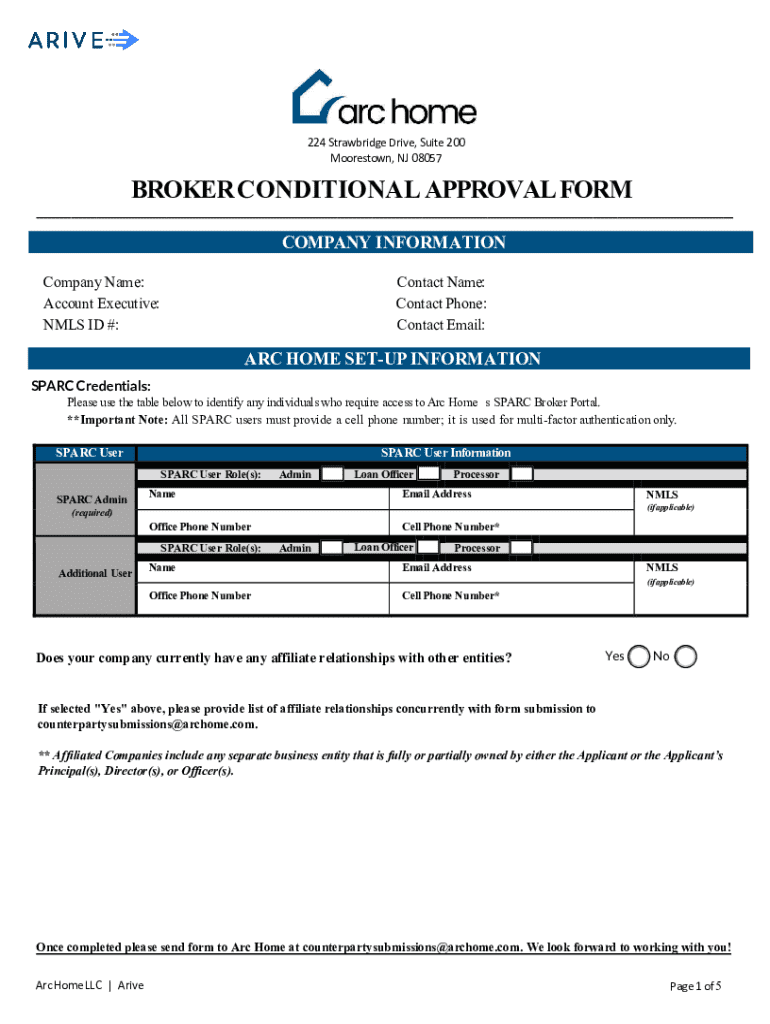

Get the free BROKER CONDITIONAL APPROVAL FORM

Get, Create, Make and Sign broker conditional approval form

Editing broker conditional approval form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out broker conditional approval form

How to fill out broker conditional approval form

Who needs broker conditional approval form?

Understanding the Broker Conditional Approval Form: A Comprehensive Guide

Understanding Broker Conditional Approval

The broker conditional approval form plays a critical role in the lending landscape. This form serves as a preliminary, unofficial approval that helps borrowers understand their eligibility for a loan before pursuing any further steps. It signifies that a lender has reviewed basic financial information and is tentatively willing to provide funding, subject to specific conditions. A strong grasp of this form is essential as it helps navigate the often confusing loan approval process.

Understanding the broker conditional approval is not just beneficial; it can be a game-changer in the home-buying journey. Knowing that you have met preliminary criteria allows you to shop for homes with greater confidence, setting a clearer financial framework for your future investment.

The role of a broker in conditional approvals

Brokers are key players in the conditional approval process. They act as intermediaries between lenders and borrowers, guiding clients through the prerequisites of the application process. By leveraging their expertise, brokers help to streamline the lender’s evaluation, ensuring that you submit a strong application that meets all criteria.

Key responsibilities of a broker include:

The conditional approval process: step-by-step

Navigating the conditional approval process involves several critical steps that set the groundwork for securing a loan. The journey begins with the initial application submission, which includes compiling various necessary documents.

Initial application submission

When submitting your application, ensure that you include essential documentation, such as income statements, tax returns, and proof of assets. Providing complete and accurate information reduces the risk of delays or denials. Common mistakes borrowers make during submission include failing to disclose all debts, inconsistent information across documents, or missing deadlines.

Evaluation of financial information

Lenders will evaluate your financial information meticulously. They assess credit scores, verify income, and calculate debt-to-income ratios to gain a comprehensive understanding of your financial health.

Issuance of conditional approval

Once the broker and lender have analyzed your application, they will issue a conditional approval. This indicates that you're a strong candidate for a loan, pending the fulfillment of certain conditions. Common conditions might include providing further documentation, undergoing a property appraisal, or meeting specific insurance requirements.

Meeting conditions for final approval

The journey doesn’t end here. Meeting the conditions set forth in your conditional approval is crucial for achieving final approval. These may range from submitting additional documentation related to your income or assets to arranging for a property appraisal. Each of these elements plays a vital role in reassuring the lender of your creditworthiness.

Timeframe for conditional approval

The timeframes associated with conditional approvals can vary significantly based on factors such as lender responsiveness, completeness of documents, and current market conditions. Typical timelines are usually between five to ten business days but can stretch longer during peak purchasing seasons.

Conditional approval vs. other approvals

When exploring financing options, understanding the distinctions between different approval types—such as pre-approval and final approval—is vital. A pre-approval means that a lender has taken cursory financial information and granted a tentative amount a borrower can afford, whereas final approval signifies a green light after all underwriting conditions are fulfilled.

Comparatively, a conditional approval falls somewhere in between these two extremes; it indicates that you are a strong candidate, but final approval hinges on satisfying specified conditions laid out by the lender.

Advantages of broker conditional approval include:

Navigating potential challenges

Despite the promising outlook provided by a conditional approval, borrowers should remain vigilant about potential pitfalls. Common reasons for denial after this stage may include fluctuations in your credit score or failure to meet conditions laid out by the lender.

To mitigate these risks, consider these helpful strategies:

By following these strategies, borrowers can navigate the conditional approval landscape with greater confidence and success.

Interactive tools and resources

As you embark on your journey to complete the broker conditional approval form, utilizing available templates can greatly enhance your experience. Having a structured template simplifies the submission process, allowing you to be thorough and organized.

Template for broker conditional approval form

pdfFiller provides an easy-to-use, downloadable template for the broker conditional approval form. This resource comes with clear instructions for accurately filling out the form, thereby minimizing the likelihood of errors. Additionally, utilizing pdfFiller's dynamic features, you can easily edit, sign, and collaborate with relevant parties right within the platform.

FAQs about broker conditional approval

It’s essential to address common inquiries related to broker conditional approvals. These include questions about the length of validity for conditional approval and whether conditions can change after initial issuance. Typically, conditional approvals are valid for 60 to 90 days, but changes in personal financial situations can prompt a reassessment of conditions.

Final thoughts on broker conditional approval

A thorough understanding of the broker conditional approval form can significantly streamline the loan approval process. By leveraging the expertise of experienced brokers and making use of tools like pdfFiller, borrowers can enhance their chances of successfully maneuvering through what can be a complex and daunting process.

Utilizing pdfFiller for your broker conditional approval form

pdfFiller is uniquely positioned to support users in their document management endeavors related to broker conditional approval forms. The platform offers features designed for editing, signing, and managing PDFs seamlessly, enhancing the overall document experience.

Editing, signing, and managing documents

With pdfFiller, you can effortlessly edit your broker conditional approval form, add electronic signatures, and collaborate with your broker or lender. This streamlining of the document workflow minimizes time spent on administrative tasks, allowing you to focus on securing your loan.

Accessing your broker conditional approval form from anywhere

Embracing a cloud-based solution like pdfFiller means you'll have remote access to critical documents wherever you are. You can manage your broker conditional approval form securely, ensuring data integrity and robust document security while remaining compliant with privacy regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit broker conditional approval form on a smartphone?

How can I fill out broker conditional approval form on an iOS device?

Can I edit broker conditional approval form on an Android device?

What is broker conditional approval form?

Who is required to file broker conditional approval form?

How to fill out broker conditional approval form?

What is the purpose of broker conditional approval form?

What information must be reported on broker conditional approval form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.