Get the free Nonprofit Form 990 Deadlines and Extensions

Get, Create, Make and Sign nonprofit form 990 deadlines

How to edit nonprofit form 990 deadlines online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonprofit form 990 deadlines

How to fill out nonprofit form 990 deadlines

Who needs nonprofit form 990 deadlines?

Nonprofit Form 990 Deadlines: A Comprehensive Guide

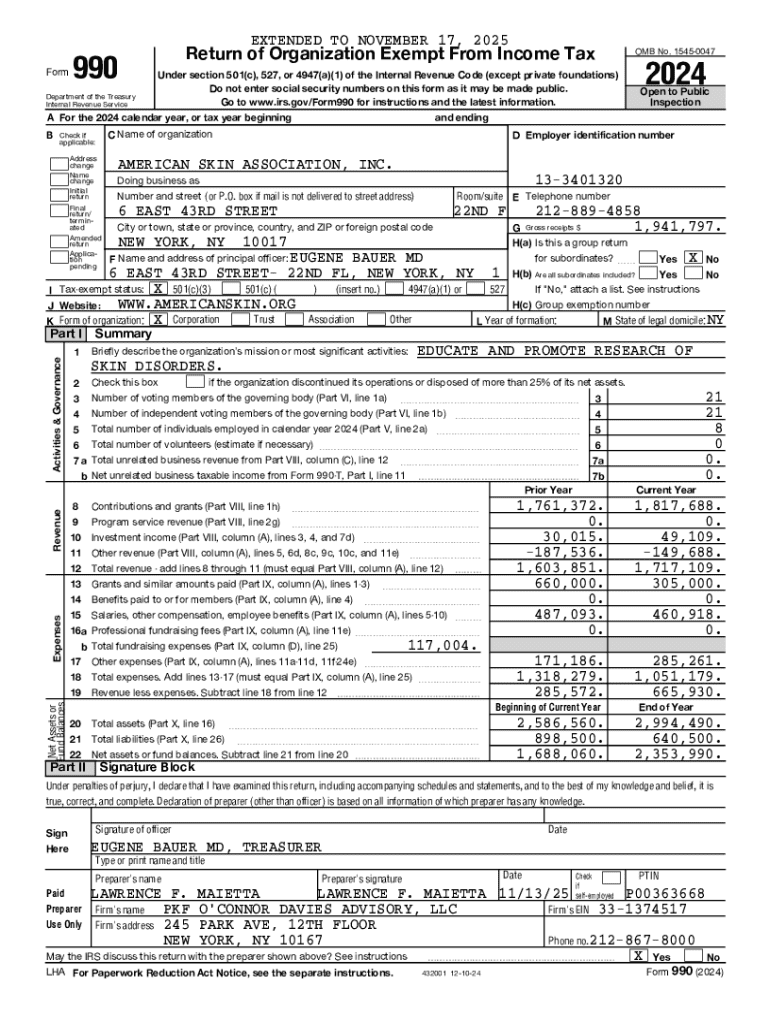

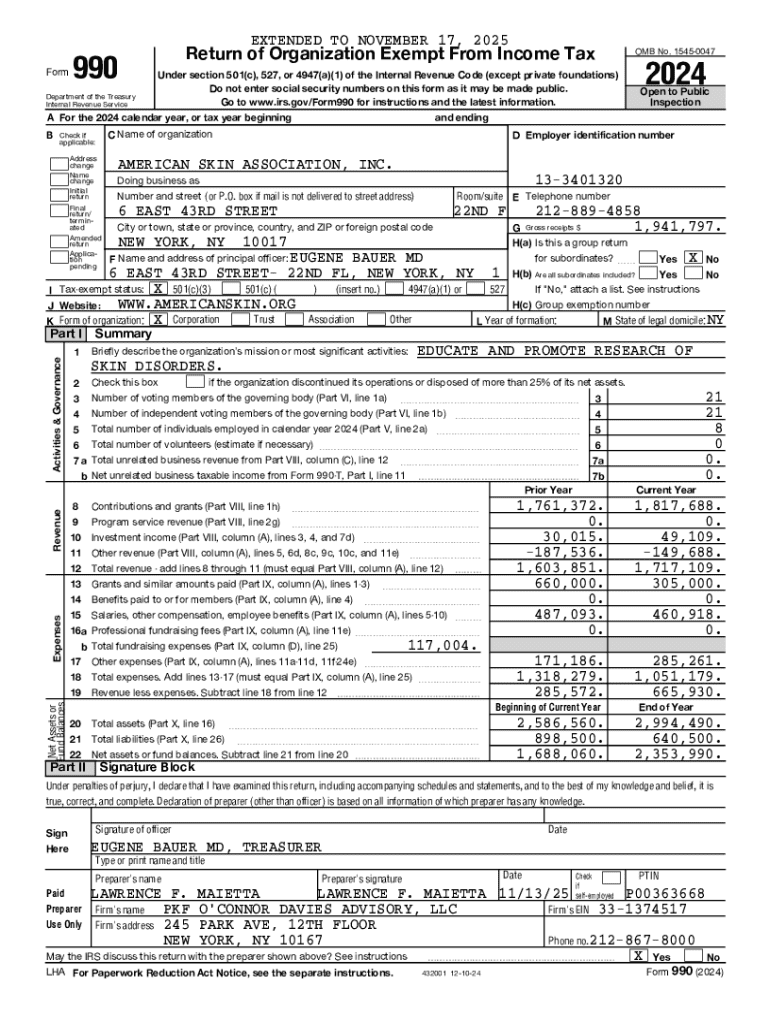

Understanding Form 990: Your key to nonprofit compliance

Form 990 is an essential information return designed by the IRS to monitor the financial activities of tax-exempt organizations in the United States. It serves to provide transparency regarding a nonprofit's revenue, expenses, governance, and charitable activities. Timely filing of Form 990 is a critical component for maintaining compliance with IRS regulations, as it ensures that nonprofits can retain their tax-exempt status and continue operating within the parameters established by law.

Failing to file Form 990, or submitting it late, can have severe consequences, including penalties, loss of tax-exempt status, and increased scrutiny from the IRS. Nonprofits need to be aware of their deadlines and ensuing obligations to ensure their ongoing compliance.

Key deadlines for nonprofit Form 990

Form 990 filing due date for 2025

The filing deadline for Form 990 for the tax year ending December 31, 2025, is May 15, 2026. Nonprofits operating on a different fiscal year schedule have their deadlines aligned according to that fiscal year end. For instance, if your organization’s fiscal year ends on June 30, your Form 990 would be due on November 15 of that same year. Hence, it is imperative to calculate your specific due date accurately and prepare in advance.

Planning your filing strategy early can help avoid last-minute issues such as loss of documents or insufficient information. Many organizations benefit from beginning their filing paperwork several months before the due date to ensure they can gather accurate financial statements and sustainability reports.

Filing extension for Form 990

If your organization requires additional time to prepare Form 990, you can apply for an extension using Form 8868. This form allows organizations to extend their filing deadline by six months, providing crucial extra time for thorough preparation. It is important to file Form 8868 by the original deadline of Form 990 to qualify for this extension.

The deadline for the extended filing for those who applied would be November 15 for calendar-year filers. Additionally, organizations need to note that while an extension can help secure more time, it does not exempt them from any penalties that may arise from late submissions of other required documentation.

Critical 2024 deadlines for nonprofits

In 2024, nonprofits must remain vigilant about their Form 990 submission deadlines. The due dates will follow the same structure: for organizations using a calendar year, the submission is due on May 15, 2024. Organizations with fiscal years ending at other times will similarly calculate their required filing dates based on their closing periods. Each variant of Form 990—990, 990-EZ, and 990-N (e-postcard for small exempt organizations)—will have specific rounds of deadlines.

It’s also critical to consider special circumstances that could arise for some organizations. For instance, if your nonprofit has experienced significant changes like mergers or name changes, additional filings may be necessary. It is crucial to check with the IRS guidelines, ensuring that all forms and any updates related to organizational changes are appropriately submitted in a timely manner.

Navigating Form 990 deadlines: Insights for nonprofits

To keep track of Form 990 deadlines, nonprofits can adopt a proactive approach. Implementing reminders is essential; digital calendars, task management apps, or dedicated accounting software can help organizations avoid missing submission deadlines. Regular meetings to review progress on Form 990 preparations can also help keep everyone in the loop.

Additionally, utilizing tools such as pdfFiller for deadline management can streamline this process significantly. The platform offers features where organizations can create, edit, sign, and collaborate on Form 990 documents. Furthermore, the ease of accessing documents anywhere and integrating e-signature capabilities means that approvals and final submissions can be handled quickly, reducing the chances of delays.

When is Form 990-T due? Additional considerations for nonprofits

Organizations that engage in unrelated business activities must also be mindful of Form 990-T, which is required to report income from such activities. Similar to Form 990, the due date for Form 990-T is aligned with the organization's fiscal year. For most nonprofits aligned with a calendar year, the Form 990-T is due on May 15, 2024.

Failure to file Form 990-T can lead to significant penalties. Nonprofits should prepare to substantiate any unrelated business income accurately, including applicable deductions, to ensure compliance. Being well-versed in these requirements will serve organizations well, especially when reporting to the IRS.

Variations of Form 990: Which one should you use?

Determining the correct Form 990 variant is crucial for nonprofits seeking compliance. The IRS outlines the following forms: the full Form 990, 990-EZ for smaller organizations, and Form 990-N (e-postcard) for organizations with gross receipts under $50,000. Each type fulfills different criteria—if your organization exceeds gross revenues of $200,000 or assets of over $500,000, you will need to file the complete Form 990.

The deadlines differ based on the form as well. Smaller organizations may have a simpler timeline, while larger ones face more extensive requirements. Understanding which form applies can ensure that nonprofits avoid complications and potential penalties related to misfiling.

Ensuring compliance: Meet your IRS-mandated filing requirements

Maintaining compliance with Form 990 requirements involves rigorous documentation practices. Organizations should keep thorough records of all financial data, including income, expenses, fundraising costs, and other operational expenses, to substantiate the claims made in Form 990. A systematic approach with proper record-keeping simplifies the auditing process considerably while minimizing risks connected to inaccuracies.

Utilizing electronic filing methods can further streamline compliance. Services like pdfFiller offer beneficial features for tax-exempt organizations, allowing them to manage records easily and access important documentation from a single platform. Engaging in regular reviews of compliance paperwork will help organizations remain proactive rather than reactive concerning their filing responsibilities.

Leveraging pdfFiller for seamless filing and document management

pdfFiller empowers nonprofits to navigate their Form 990 preparations with ease. The platform provides a seamless experience for creating and editing PDF forms, allowing users to eliminate time-consuming paperwork traditionally associated with IRS filings. Its eSignature capabilities facilitate quick approvals by stakeholders, minimizing delays typically associated with gathering signatures.

Moreover, the collaboration tools within pdfFiller enable teams to work together efficiently on Form 990 submissions, promoting a streamlined workflow and ensuring that all sections of the form are completed correctly and submitted on time. The ability to manage everything from one cloud-based platform enhances accessibility and simplifies the compilation of records needed for compliance.

FAQs about nonprofit Form 990 deadlines and filing

Nonprofits often have pressing questions about their filing timelines. Common inquiries involve the specifics of deadlines, such as: What happens if I miss the filing deadline? Can I still file if I have missed the initial submission? What are the penalties for late submissions? These questions highlight the need for diligent awareness of timelines and submission processes.

Clarifying concerns around extensions, it is vital to understand how to apply and what documents are required to ensure compliance. Many organizations benefit from establishing a routine of confirming filing requirements in advance. Doing so builds a strong foundation to avoid penalties while promoting ongoing transparency with the IRS concerning submitted claims.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the nonprofit form 990 deadlines in Chrome?

Can I create an eSignature for the nonprofit form 990 deadlines in Gmail?

How do I complete nonprofit form 990 deadlines on an Android device?

What is nonprofit form 990 deadlines?

Who is required to file nonprofit form 990 deadlines?

How to fill out nonprofit form 990 deadlines?

What is the purpose of nonprofit form 990 deadlines?

What information must be reported on nonprofit form 990 deadlines?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.