Get the free Environmental groups' financial assets and influence in the ...

Get, Create, Make and Sign environmental groups039 financial assets

How to edit environmental groups039 financial assets online

Uncompromising security for your PDF editing and eSignature needs

How to fill out environmental groups039 financial assets

How to fill out environmental groups039 financial assets

Who needs environmental groups039 financial assets?

Understanding the Environmental Groups039 Financial Assets Form

Understanding the Environmental Groups039 Financial Assets Form

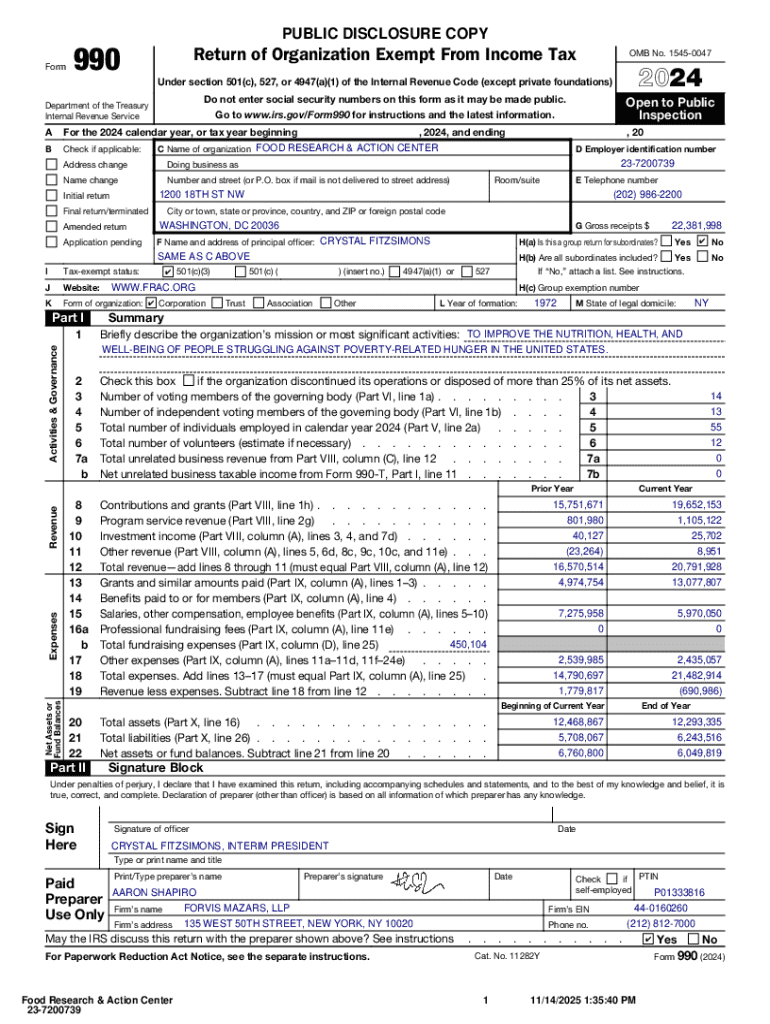

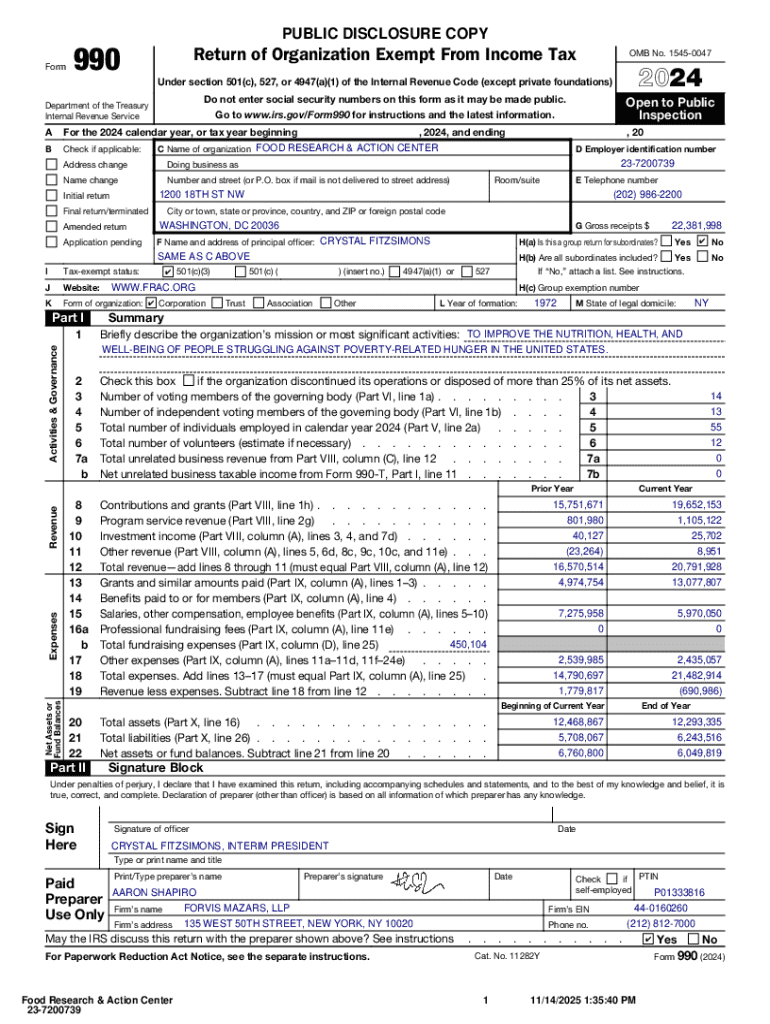

The Environmental Groups039 Financial Assets Form serves as a comprehensive statement that details a particular organization’s financial assets. It’s crucial for assessing the overall financial health and transparency of environmental organizations, and it also plays a pivotal role in ensuring compliance with regulatory standards. This form is designed specifically for nonprofits, NGOs, and charities that focus on environmental issues and aims to foster transparency in funding and resource allocation.

The importance of this form cannot be overstated. Primarily, it aids organizations in maintaining accountability to stakeholders and the public, showcasing how funds are utilized toward environmental initiatives. Additionally, accurate filing is imperative for compliance with laws governing nonprofit operations, helping to avoid the repercussions of non-compliance, which can include legal penalties or loss of funding.

Who needs to file this form?

Filing the Environmental Groups039 Financial Assets Form is pertinent for a variety of entities. Specifically, nonprofits, non-governmental organizations (NGOs), and charities that emphasize environmental conservation efforts are typically required to submit this form. These groups may include those focused on climate change, wildlife preservation, and pollution control, among others.

Certain scenarios may trigger the need for this form. For instance, organizations that receive significant funding—be it government grants, private donations, or corporate sponsorship—are often mandated to disclose their financial status. Moreover, if an organization is undergoing an audit or must adhere to particular regulatory requirements based on state or federal laws, the completion of this form becomes essential.

Detailed breakdown of the form components

The Environmental Groups039 Financial Assets Form is divided into specific sections, each focused on distinct components of a charity’s financial health. The first section usually entails financial information, wherein organizations must provide details about their income, expenses, and overall financial positioning. This encompasses comprehensive revenue streams like donations and grants, as well as operational costs associated with environmental initiatives.

Additionally, disclosures regarding assets extend beyond cash values. Organizations may need to report on property, investments, or any other significant assets that contribute to their financial health. Understanding these components is fundamental in achieving a well-rounded perspective on the organization's financial standing.

Common terminology

When dealing with the Environmental Groups039 Financial Assets Form, it is crucial to familiarize oneself with the terminology employed throughout the document. Clear comprehension of these terms ensures accurate reporting and a holistic understanding of the information being conveyed. For instance, 'net assets' refers to the total assets minus any liabilities, while 'operating reserves' indicate funds set aside for future operational needs.

Understanding these terms is paramount. They are not merely jargon but represent the foundation that supports financial transparency and accountability.

Step-by-step instructions for filling out the form

Filling out the Environmental Groups039 Financial Assets Form can seem daunting, but with proper preparation and organized documentation, the process becomes manageable. Firstly, gathering necessary documentation is crucial. Organizations should compile all relevant records, including previous financial statements, grant agreements, and any previous filings that might inform the current submission.

Once all documentation has been gathered, completing each section requires careful attention. Organizations must ensure clarity and accuracy when entering information. It is beneficial to cross-reference with past filings to avoid discrepancies. For each section, organizations can include notes or explanations of complex fund allocations or special provisions, but this is entirely based on the organization's discretion.

Interactive tools & resources

Utilizing technological tools can streamline the process of filling, editing, and managing the Environmental Groups039 Financial Assets Form. One such tool is pdfFiller, which provides an efficient platform for organizations to not only complete the form but also edit and sign it electronically. The intuitive interface allows users to input data easily, edit sections as needed, and ensure the document remains compliant with the latest standards.

Furthermore, pdfFiller enhances collaboration through its team features, enabling multiple stakeholders to review and contribute seamlessly. This is particularly beneficial for organizations involving finance teams, compliance officers, and executive boards, as they can engage in real-time discussions without needing to meet physically.

Accessibility features

In an increasingly remote working environment, having access to documents from various locations can significantly improve efficiency. pdfFiller’s accessibility features allow users to edit and manage the Environmental Groups039 Financial Assets Form from anywhere with internet access. This flexibility is invaluable for organizations with teams working in diverse geographical locations.

Additionally, the document-sharing options make collaborative efforts much smoother. Users can share forms with stakeholders and team members for feedback and approvals, streamlining communication and ensuring every voice is heard before filing the final version.

Best practices for managing the form and financial information

Establishing effective document management strategies is vital for ensuring that all financial disclosures are organized and accessible. A good starting point is to create a digital filing system that categorizes financial documents by year, project, and type of funding. Ensuring that all staff members are trained on this system fosters accountability and promotes transparency in managing financial assets.

Regular updating and reassessment of this information and the forms are advisable as regulations can change. Setting a review schedule allows organizations to stay compliant with evolving guidelines and ensures all financial records are kept current.

Understanding compliance and regulations

Organizations must be aware of the legal landscape governing their operations as they fill out the Environmental Groups039 Financial Assets Form. Various laws outline how nonprofits must report their finances, including the IRS guidelines and state-specific regulations. This emphasis on compliance not only safeguards an organization’s reputation but also enhances trust among donors and supporters.

Organizations should routinely consult legal advisors or compliance specialists to stay abreast of changes in legislation that might affect their financial reporting.

Resources for legal assistance

For organizations seeking help regarding the Environmental Groups039 Financial Assets Form, numerous resources provide access to legal counsel and advice. Various nonprofit associations readily offer guidance on filling out required forms and complying with regulations specific to the environmental sector. Additionally, online legal platforms can provide access to attorneys who specialize in nonprofit law, ensuring that the advice given is both accurate and compliant with current standards.

Engaging with local chapters of national organizations or seeking help from fellow nonprofits offers peer support that can be tremendously beneficial. Building a network within the sector not only aids in legal compliance but also fosters collaborative opportunities, maximizing resources allocation among environmental organizations.

Advantages of using pdfFiller for form management

Adopting pdfFiller for managing the Environmental Groups039 Financial Assets Form introduces several benefits. As a cloud-based platform, it allows users seamless access to forms and documentation from anywhere. This level of convenience is essential for ensuring that form completion and revisions can occur regardless of location, thereby accelerating submission processes.

These advantages position pdfFiller not just as a document management tool but as a partner in fulfilling regulatory obligations efficiently and securely.

Security and compliance

Security is a primary concern for organizations handling sensitive financial information. pdfFiller ensures that all data remains protected through robust encryption protocols and compliance with industry standards. This security is not only about protecting organizational data but also about securing the trust of donors and stakeholders who expect their contributions to be managed responsibly.

Using a platform that prioritizes these security measures allows organizations to file their Environmental Groups039 Financial Assets Form with confidence, knowing that their reported information and financial transactions will remain confidential and protected from unauthorized access.

Frequently asked questions (FAQs)

Common concerns regarding the Environmental Groups039 Financial Assets Form often revolve around filing requirements, deadlines, and data management. Questions such as whether an organization needs to submit the form annually or how to rectify errors post-filing are prevalent. Understanding these elements ensures that organizations can navigate their obligations without confusion.

Having these answers on hand can help organizations avoid common pitfalls associated with financial reporting and ensures that they remain informed and proactive in their compliance efforts.

Troubleshooting tips

While using pdfFiller for the Environmental Groups039 Financial Assets Form is straightforward, users may encounter some technical issues from time to time. Common troubleshooting tips include checking the internet connection if you experience slow loading speeds or ensuring the browser is compatible with the platform.

These tips aim to ensure that users can navigate the platform smoothly, empowering them to focus on what's essential—accurately completing and submitting the Environmental Groups039 Financial Assets Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the environmental groups039 financial assets in Gmail?

How do I complete environmental groups039 financial assets on an iOS device?

Can I edit environmental groups039 financial assets on an Android device?

What is environmental groups039 financial assets?

Who is required to file environmental groups039 financial assets?

How to fill out environmental groups039 financial assets?

What is the purpose of environmental groups039 financial assets?

What information must be reported on environmental groups039 financial assets?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.